One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

Few weeks ago I wrote a post on my miles and points accumulation strategy In it I’ve mentioned that I try to focus on short-term goals first and foremost. That means if I have a choice between 50,000 miles in a program I’m unlikely to utilize for few years and $500, I will probably choose the latter.

Few months ago I was looking for ways to offset some upcoming travel expenses. I have a Wyndham stay coming up in March which I reserved via Cash+Points rate. Unfortunately, I wasn’t presented with many options. Barclaycard Arrival Plus World Elite MasterCard is out of the picture due to new 6/24 rule. I gave up on Capital One because getting approved is a hopeless case. Most cash back/travel rebate cards had a bonus of $200, a bit low by my standards.

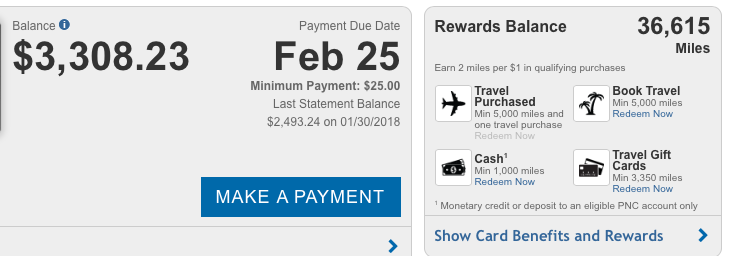

We meet again, PNC Premier Traveler Signature Visa

But what about $300? That’s still kind of low, but enough to entice me. One card I kept coming back to was PNC Premier Traveler Signature Visa. You get 30,000 points after spending $3,000 in 3 months, first annual fee is waived. Note that the terms say “billing cycles” instead of months. You also earn 2 points per dollar on everything. The bonus is good towards a $300 rebate against travel purchases. Redemption starts at 5,000 points and equals $50.

The card is only available to residents of these states: Alabama, Delaware, Florida, Georgia, Illinois, Indiana, Kentucky, Maryland, Michigan, Missouri, North Carolina, New Jersey, Ohio, Pennsylvania, South Carolina, Virginia, Wisconsin, West Virginia and Washington D.C.

Direct link (pays no commission)

I’ve had this card before and canceled it in July of 2017. I looked at the terms and there was nothing there indicating that you can’t get the bonus again. I couldn’t find any data points, but decided to take a chance anyway. Score! The bonus just posted.

I view it as a $330 offer, actually, because the card earns 2 points per dollar on everything. Many of the cards I sign-up for earn just 1 cent/point. I was debating on whether to apply for this offer in my husband’s name, but wanted to take a look at other options. As always, I went to my own page on the blog that lists the best current credit card bonuses.

Full disclaimer: I don’t pretend that the list covers every deal under the sun. There are many offers that are targeted, state-specific or can be found via certain browsers. I want to keep things simple by listing only 10-12 cards that 99% of US population will be eligible for.

Sadly, I fall into 1% of US population. Not when it comes to my income, but the ability to get approved for many lucrative cards. But it doesn’t mean the situation is hopeless…yet.

Should I go for 50,000 Avios or $330?

One card that has been on my radar for a long time is Chase British Airways Visa Signature. It’s not currently subject to 5/24 rule. If you are new to this hobby, make sure to read my post on why you may want to start with Chase products.

The bonus on Chase British Airways Visa Signature Card is nothing to sneeze at. Here are the details:

- 50,000 bonus Avios after you spend $3,000 on purchases within the first 3 months from account opening.

- Earn an additional 25,000 bonus Avios after you spend $10,000 total on purchases within your first year from account opening for a total of 75,000 bonus Avios.

- Every calendar year you make $30,000 in purchases on your British Airways Visa card, you’ll earn a Travel Together Ticket good for two years.

- In addition to the bonus Avios, you will also get 3 Avios for every $1 spent on British Airways purchases and 1 Avios for every $1 spent on all other purchases.

- Pay no foreign transaction fees when you travel abroad.

- Chip Technology allows you to use your card for chip based purchases in Europe & beyond, while still giving you the ability to use your card as you do today at home.

- The annual fee of $95 is not waived.

I would stop at 50,000 Avios because my everyday spending can yield better ROI if I’m pursuing new sign-up bonuses. The $95 is not waived, which is a bummer. Still, 50,000 Avios can be incredibly useful under the right circumstances. You can read my post for more details on the program. This card currently pays us commission.

I just drained my Avios stash on tickets from New Zealand to Australia where I got around 1.9 CPM, a great deal. That said, I don’t see any scenario where I would utilize these miles for at least 3-4 years. My hope is to someday take my kids to Hawaii. Non-stop one-way flights on Alaska Air and American from West coast to Hawaiian islands cost only 12,500 Avios. That’s a pretty sweet deal, but only if you can find low-level availability. Plus, who knows how things will be in 3-4 years. Avios program may be revenue-based by then.

This is where it gets difficult. Let’s say I speculatively value Avios at 0.9 cents apiece. After deducting the annual fee of $95, we get a total of $355. It’s not that much more than $330 on PNC card. Plus, unlike Avios, I could utilize that $330 RIGHT NOW. On the other hand, Chase British Airways Visa Signature Card may be subject to 5/24 rule in a near future. You see how this hobby can totally mess with your head?

A forgotten third option

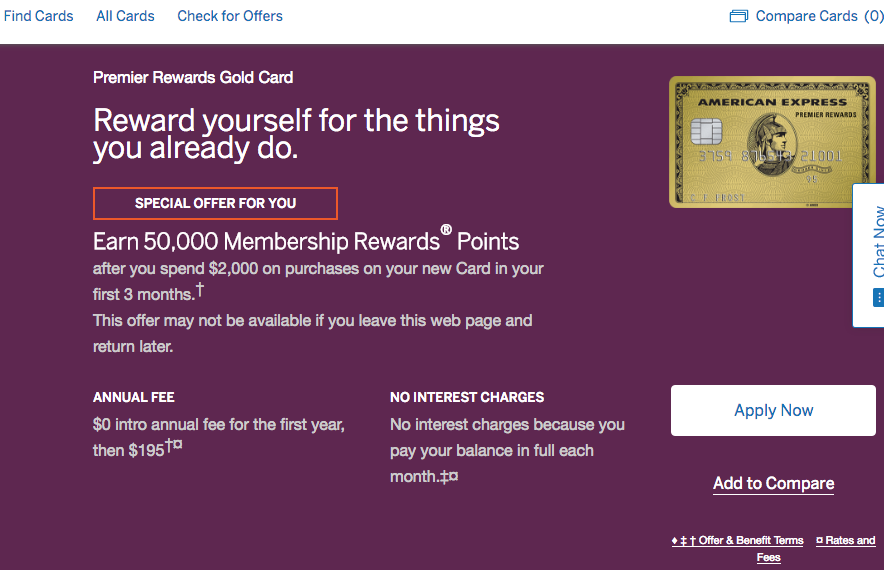

I was seriously thinking about applying for Chase BA Visa, but then I remembered something. My husband never had Amex Premier Rewards Gold card. I’ve tried to get the 50,000 offer to come up in various browsers, but never had any luck. Not this time. I checked in Chrome mode after finding public application link on American Express website, and voila:

Approved! The standard bonus is only 25,000 points, so obviously, this is a great deal. If you are relatively new to this hobby, you can probably pull up 50k offer via CardMatch Getting it to come up in Chrome is not a guarantee, unfortunately. My cousin-in-law tried and could only see the 25,000 points offer. YMMV

There was no contest. This deal is way better than Chase BA Visa or PNC card. I love flexible points because you are not locked into just one mileage program. Plus, there is always an option to drain MR currency on valuable gift cards like Home Depot. I’ve mentioned awhile back that as much as I love UR program, the annual fee on Chase premium cards kills the deal.

You can keep your MR points alive by holding no-annual-fee Amex Everyday or Amex Blue Business card (both products pay us commission). So, in twelve months I plan to apply for Amex Everyday in my husband’s name before canceling his Gold card in order to avoid paying a $195 annual fee.

I’ve been battered by all the recent negative hobby changes but as you can see, I’m still in business.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Glad to hear you were approved for your cashback card. Just heard that I was approved for my Capital One Venture card…can’t wait to start using it. Question – we used to have the AMEX Gold years and years ago…how do I find out which one of us was the primary? And was it once per lifetime years ago? I think we signed up for it back in 2002. We really could use Membership Reward points to round out our stash. Thanks!

@Stephanie Congrats on your Venture Rewards Card approval! I wish I could get one myself, so I’m a little jealous of you. 🙂

On Amex Gold, your best best is to do an online chat with a rep. They should be able to see it. If they don’t, then it’s probably not in the system. You could also try calling. The lifetime rule does apply regardless of when you got the card. However, according to reports, you can get the bonus again in 7-10 years. I would never suggest this strategy to someone, but it’s a matter of conscience. I personally don’t feel comfortable doing it, but it’s a grey area, I suppose.

Also note that Amex Gold and Amex Premier Rewards Gold are two different products, you are eligible for signup bonuses on each once per “lifetime”.

@WR That’s true. If I remember correctly, regular Gold card usually has a low sign-up bonus. But it is something to keep in mind, for sure.

Do you still have any ultimate rewards premium cards?

Nope, I do not. I have Freedom and Freedom Unlimited, though. So, if opportunity presents itself, I could always upgrade to CSP or CSR. But I only have 10k UR points at the moment, so the annual fee would wipe out any potential value when it comes to airline or hotel transfers. My focus right now is on MR program. I just hope we can get Amex Everyday for my husband next year.