I’m sure most of you know that March 31st is the last day when transfers from hotel programs to Southwest will count towards Companion Pass. It essentially allows you to get a 2-for-1 deal on flights for close to two years. And that is precisely why Southwest has closed the backdoor on January 1st, only to cave in due to all the bad publicity. Thumbs up, Southwest for doing the right thing!

Aside from signing up for Southwest co-branded cards, transfer form SPG (and topping off the account via Ultimate Rewards or Membership Rewards programs) is the easiest path towards Companion Pass. So, this is what we will be focusing on here. You may also want to read my post for details on SPG/Marriott merger.

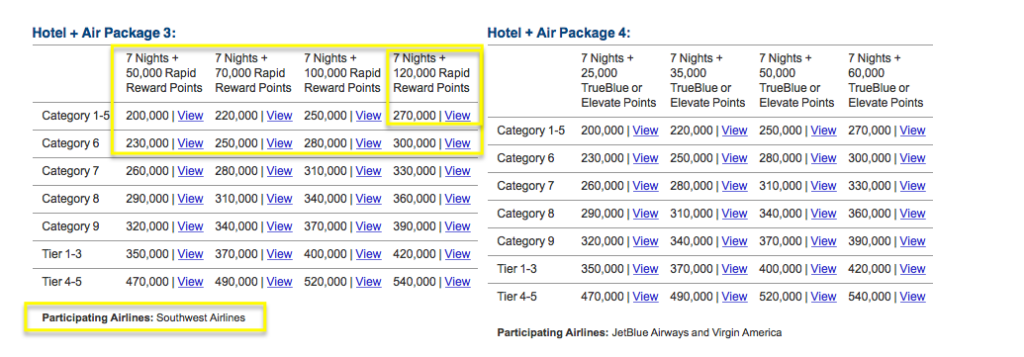

Basically, you need 110,000 Rapid Rewards in order to receive Companion Pass. Most lucrative option is to convert 90,000 SPG points to Marriott (1:3 ratio). This will give you 270,000 Marriott points needed for 7 nights at a category 1-5 property, plus 120,000 Rapid Rewards points, plus Companion Pass. If you have a boatload of SPG points, you can always consider getting a more expensive package.

.

You can combine SPG points with members of your household for free, but it will take a few days for transfer to go through. Not enough SPG points? You can top off the account via transfer from Ultimate Rewards to Marriott (1:1 ratio). Normally, it’s not a good deal, but this is an exception if you only need 20,000 or 30,000 points.

You can also transfer Membership Rewards to SPG (1,000:333 ratio) and then convert them to Marriott points. I would do the latter because UR points are more valuable to me. If you don’t have transferrable Ultimate Rewards or Membership Rewards, you can consider purchasing SPG points at 3.5 cents apiece, then transferring them to Marriott. Yes, they are overpriced, but if you only need a small amount, it could be worth it.

You can also consider signing up for one of Southwest cards (find application links here) if you are under 5/24 limit. If you are able to meet your minimum spending quickly, the bonus points will count towards Companion Pass when combined with your transfer form SPG. You can also consider getting Chase Marriott Premier Visa Personal version is subject to 5/24 rule, business version is not.

But you only have till March 31st, so I would try to meet minimum spending during the first billing cycle. See this post for some ideas on how to prepay certain expenses.

When this deal is a no-brainer

Well, relatively speaking. But assuming you have enough or almost enough points to pull it off, you may want to strongly consider it if:

1) You fly Southwest at least few times per year and take someone with you every single time. Obviously, this describes families who happen to be leisure travelers. Let’s say you’ll be able to fly four times between now and the end of 2018. Assuming each roundtrip ticket costs you around 15,000 Rapid Rewards, you will save 60,000 points total.

If you are used to transferring points from Ultimate Rewards, this amount represents at least $600 in cash, or opportunity cost of transferring to another program like Hyatt. Those 60,000 Hyatt points can pay for 4 nights at Hyatt Regency Coconut Point Resort and Spa, not too shabby!

2) Southwest is almost always the best deal for your chosen destination and has the most convenient routing from your home airport. Of course, it always pays to check regardless.

3) You are mostly interested in flights within Lower 48 States and trips to Caribbean, Mexico and Central America. You know for a fact that you won’t be going to Europe or Hawaii within the next two years.

4) You don’t really like SPG hotels and rarely find them to be a good deal on points. You like Marriott brand, especially properties that provide free breakfast.

5) You’ve had SPG points for few years and haven’t found a good use for them yet. You keep hearing how valuable they are, but so far, they’ve done squat to reduce your travel expenses.

6) You are way over 5/24 and have no way of replenishing your UR stash aside from everyday spending.

7) You happen to have Chase Southwest Rapid Rewards credit card and plan on renewing it. Why is it important? It unlocks the possibility of redeeming Rapid Rewards on gift cards to places like Walmart and Target, and you can also use points towards paid flights on other airlines at 1 cent per point.

So, let’s say you are a bit hesitant about this transfer because you are not sure if you’ll be flying Southwest all that much. If you exchange your 90K SPG points for Marriott Package, you will be getting 120K Rapid Rewards plus 7-night hotel stay (has to be used consecutively, valid for 12 months).

You can redeem 120K Rapid Rewards for $1,200 Walmart gift cards. Even if you value this amount at 5% less, it’s $1140. Let’s say you won’t be able to stay the entire 7 nights at a Marriott property, but only maybe 3 nights. And it won’t be a very fancy hotel, but just a place to crash while visiting relatives. A decent Residence Inn with breakfast rarely costs less than $100 per night all-in. So, I think it’s fair to say that this package is worth at least $300. So, we have a total value of $1440 ($1140+$300).

Obviously, I assume that Rapid Rewards program will keep offering Walmart redemption option to those with co-branded credit card. So, basically, you will be selling 90K SPG points for $1440, or getting a value of 1.6 cents per SPG point. That’s not a bad deal, all things considered. And remember, this is worst case scenario. If you end up staying at a nice Marriott property for 7 nights and utilize your Companion Pass, you’ll make out like a bandit.

Marriott hotels you may want to consider for your family vacation

See all Category 5 Marriott hotels here While you are not going to find a spectacular, all-inclusive beachfront property on the list, I think it’s fair to say that most will save you at least $100 per night. A few that caught my eye:

Residence Inn Colorado Springs South Beautiful area which I recommend you visit if you like outdoors. Roomy suites and breakfast is included.

Courtyard St. Augustine Beach Not right on the beach, but just a block away (you can walk to it). I love St. Augustine area and highly recommend it as a family-friendly destination.

Residence Inn Orlando Lake Buena Vista Visiting Disney? Consider staying at this property and enjoy complimentary hot breakfast.

Residence Inn Buffalo Galleria Mall A possible base for visiting Niagara Falls.

<

p style=”text-align: center;”>Witnessing this natural wonder up close in 2014

Courtyard San Antonio SeaWorld®/Westover Hills Self-explanatory.

Courtyard Newark Downtown Good access to New York City.

TownePlace Suites Anaheim Maingate Near Angel Stadium Always wanted to visit Disneyland? Here is your chance.

Of course, there are many other options and I recommend you check lower categories as well. As long as you can save money, that’s all that matters. I’ve read comments saying that you can extend hotel package for another year, but I wouldn’t count on it. I’ve also seen reports of some giving these hotel packages away to relatives, but once again, YMMV If you absolutely can’t find any use for your hotel package, call and request a refund of 45K Marriott points.

Why you may want to pass on this deal

1) You don’t travel all that often and rarely fly Southwest.

2) You don’t have a Southwest co-branded credit card and have no way of getting it for the foreseeable future, so redeeming Rapid Rewards on gift cards will not be an option.

3) You like SPG properties and prefer to use your points on them.

4) You are planning on flying to a destination not served by Southwest and are pretty certain that you will need to convert SPG points to traditional miles.

5) You like to squeeze as much value as possible out of traditional miles, even if it means foregoing flexibility. A good example is Alaska program (partners only with SPG), that has generous routing rules. Of course, you will need a lot of SPG points if you plan on redeeming miles on four tickets. Fortunately, Bank of America is quite generous when it comes to Alaska co-branded credit cards. So, your SPG stash may come in handy for topping off Alaska account.

6) You want to see what other opportunities will open up when/if SPG program is discontinued due to merger with Marriott. I doubt there will be any fantastic last-minute developments, but you never know.

7) You are extremely concerned that Southwest will gut their program in a near future. Honestly, I wouldn’t stress too much because I’m fairly confident that the points will be worth at least 1 cent towards flights. In fact, I’m certain they will always be worth more than that. Why? Because Southwest sells its points to Chase.

They will have a tough time convincing people to accumulate Rapid Rewards instead of cash back via everyday spending. So my prediction is that Southwest currency will never be worth less than 1.25 cents, to match what you can get via UR point with premium cards like Chase Sapphire Preferred. I could be wrong now, but I don’t think so (hat tip to show “Monk”)

Bottom line

SPG points are extremely valuable, but they are NOT priceless. If you did the math and feel fairly confident that you will do well by trading them for Marriott travel package, go for it. Personally, I would do it sooner rather than later. After all, Marriott may devalue travel package redemption option without notice. Programs can do that, you know. You may also want to read Milestomemories post for Shawn’s experience in transferring SPG points in order to take advantage of this deal.

Readers, who is considering this option? Why/Why not?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

TLDR: but did you consider buying Marriott points if you are within 50,000 points of the package? I need to do the math but it might be a good option.

Haley, I think it could definitely make sense for some. Though unless you’ve exceeded the yearly limit, buying SPG points is a bit cheaper. You can get 1,000 SPG points for $35 and then convert them 1:3 to Marriott. Marriott charges $12.50 per 1000 points.

But yeah, it really depends on one’s situation. If you plan on flying Southwest many times in the next few years, buying points to reach the needed amount can make all kinds of sense. For infrequent flyers like myself the upside is iffy. YMMV