I will cut right to the Chase (see what I did there?). I got approved for Chase Sapphire Reserve! I know, I can’t believe it either. As you have guessed from the title, it did involve a trip to Chase branch which is located one hour from our house.

It was totally worth the time and trouble, though. And we even took the kids with us who just sat in the lobby playing iPads. Surprisingly, my husband was on-board with this visit and didn’t make even one complaint. I’m sure the fact that he just got a brand new Ford Mustang had nothing to do with it!

Since we had to go out of our way, I wanted to make it count. That’s why I also decided to open a couple of business checking accounts and also take advantage of promo on savings. Let me walk you through the process and share some things I’ve learned along the way.

1) Not all Chase bankers are created equal, so do your research and make an appointment beforehand.

This is especially true if you plan on opening a checking or savings account in addition to applying for a credit card. We could only go on Saturday and wouldn’t be able to leave earlier than noon. All the branches in a surrounding area close at 2 PM. Since we would have a one-hour window, I didn’t want to take any chances. That’s why I called ahead of time.

The receptionist at the first branch I called spoke to her manager and told me that they have several appointments that afternoon and wouldn’t be able to accommodate me. I called a different branch and the banker said she would be glad to make an appointment with us at 1 PM. She seemed very nice, so I happily agreed.

When the time came and I pulled out my coupons, she started laughing and told me that I was lucky we got her. She has been there for many years and knew exactly what to do. Apparently, we would be sitting there for four hours if our banker was relatively new to the job. She wasn’t trashing her co-worlkers, but simply being honest. Not all Chase bankers are created equal, it’s really no different from any other industry.

Lesson: Ask for someone with a lot of experience.

2) Just because one spouse isn’t pre-approved for CSR, doesn’t mean the other one won’t be either.

My husband wasn’t pre-approved, but I was. So, I went ahead and applied, and now I’m a proud owner of shiny CSR (though I’m currently waiting for it to come in the mail). Yay! The banker said she was shocked that Chase gave me $20,000 credit limit. In fact, she told me this was her very first CSR application. They just got all the information on it and she wasn’t sure if it’s a good card.

I gave her all the details on why it is indeed a very good card, at least in the first year. It was a bit ironic that here I was, making a pitch about CSR to Chase banker. I didn’t bother applying in my husband’s name. Due to 5/24 rule, the odds of approval were slim to none. I didn’t want to waste a credit pull.

Interestingly, the banker told me I was also pre-approved for Chase Sapphire Preferred. So, at least in theory, I might be able to get it eventually as well. It’s very clear that applying in-branch (via pre-approved offer) is a very different animal compared to doing it online. Nancy who regularly contributes posts to this site had the opposite experience from mine: she wasn’t pre-approved but her husband was. Yes, he got CSR too!

Lesson: If you do decide to go this route, find out what other cards you are pre-approved for and keep that information in mind when you are ready to apply for your next set of offers.

3) Bankers make commission if you are approved for a credit card in branch.

That’s a good thing! That means they have vested interest and are unlikely to question you on why you’ve had so many recent inquiries etc. I asked my banker if she receives commission and she sheepishly said yes. I told her: “Hey, sister, I’m glad you do!”

Unfortunately, I had to forego my own commission by not applying online, but at least I’m happy to know that a decent and competent person will get it.

4) If you have to make a separate trip, might as well make it count.

I’m referring to signing up for Chase Performance Business checking and possibly savings accounts at the same time. That’s what we did. I do have a legitimate business (this blog) and my husband occasionally sells stuff on Ebay. No problem, and once again, we weren’t questioned on revenue or any other details.

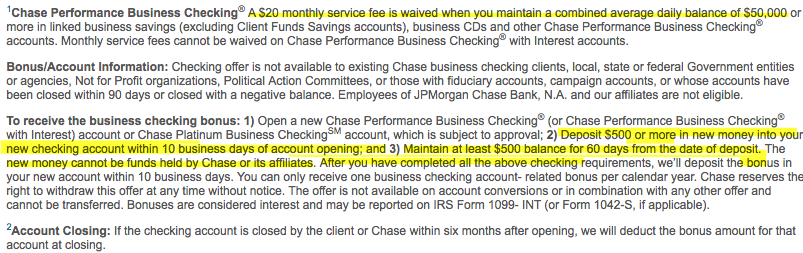

In fact, the banker told me that when I get the $500 bonus, I can call her and downgrade the account so I wouldn’t have to pay $20 monthly fee. Regular business checking account requires $1,500 average monthly balance in order to avoid fees, compared to $50,000 with Performance type. I might do that.

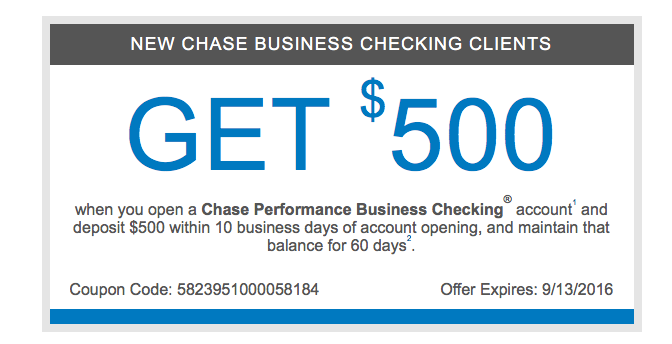

Either way, even if you end up paying $20 a few times (first two months are free), you’ll still make out like a bandit due to $500 bonus. The account has to be open for at least 6 months. You can access the coupon in your Chase profile here It will have a unique code, so each spouse will need to get their own. Print it out, this is what it looks like:

Make sure to read the terms:

Additionally, I went ahead and opened a savings account while I was there. It also required a separate coupon. I’ll have to park $5,000 for three months in order to get $100, but then I can withdraw all but $300. I can’t close the account for six months, otherwise, I would lose the bonus. DoC has a good post on this promo with all the details.

It took us about 1.5 hours to apply for CSR and open three additional accounts, which isn’t too bad. Afterwards, we went to Chick-Fil-A, where the kids played to their heart’s content.

5) If you like the banker, it’s a good idea to establish a personal relationship with that individual.

Honestly, I’m genuinely curious about people and their families, so I didn’t do it for that purpose. But we had a nice conversation: I asked her about her kids, we made jokes etc. It seemed she really enjoyed talking to me and said I can call her any time with questions.

I’m thinking if in the future I call and ask her about my credit card pre-approval offers over the phone (without having to drive an hour), she will probably oblige. No guarantees, of course, but it’s always a good idea to have an “inside” Chase man/woman.

6) If you are under 5/24 limit, going to branch is unlikely to help, but it won’t hurt.

I had to think about how to word this point in the most politically correct manner. Here is the thing. Obviously, I would much rather you use my affiliate link if 5/24 rule doesn’t apply. That said, do what works for you. If you’ll feel better about going to Chase branch and seeing “pre-approval” status, go for it. Going by data points from some of my friends and readers, I don’t believe it’s necessary, but I don’t know that with 100% certainty.

Keep in mind, just because you are pre-approved in branch, doesn’t guarantee that you’ll get the card. Nancy mentioned that her banker told her several pre-approved CSR applications went to pending status. And I saw few reports of denial in miles and points blogs. But if you are over 5/24 limit, it’s probably the only way to get CSR aside from being Chase Private Client or having a relative who has this status (rich folks).

If you want to support the blog, Chase Sapphire Reserve does pay me commission. I’ve had a lot of questions on this card via email, so expect more posts coming your way in the next few weeks. I know, I know… I think CSR will take over the internet if not the world, eventually.

Bottom line

As I’ve said in the title, this trip will potentially yield at least $2,000 in profit. And that’s a low estimate. We’ll get $1,100 from checking and savings accounts’ promos. If you factor in some fees, that’s at least $1,000 in profit. As far as CSR card goes, 100K Ultimate Rewards can be redeemed for at least $1,000 in cash. And I can always maximize $300 annual travel credit (X2) by buying Southwest gift cards. Though I’ll probably end up using it on airfare.

Not too shabby of a trip, if I say so myself!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I like what chase is doing. They have completely changed the way I look at my personal banking. I now see their branches as destinations, where before I saw anachronisms. I now want to make a relationship with my banner, instead of avoiding her.

They are brilliant. Driving traffic to their locations and driving relationship building. Good model. Other here’s should follow.

We plan on starting a business account for my wife’s etsy store there. Thanks for the tip on the bonus.

Also, more good news: my wife and her banker fixed the CSR mess we got ourselves in. We are approved, and have one headed our way. Yay!

@Cheapblackdad So happy to hear that you fixed this whole CSR mess. What a nightmare! I was thinking about emailing and asking you about it.

Yeah, definitely get that $500 bonus while you are at it. Why not? Even if you pay a few fees, you’ll still come out ahead. Plus, there is an option to downgrade after you get the bonus.

And I agree, Chase is doing something right with their branch business concept. I was surprised by how easy and, dare I say, pleasant this trip was. Very nice, helpful lady, and she even sent me a personal email thanking me for my business. I appreciate that. Nobody likes to be treated as just part of a herd (I’m looking at you, Citi!)

This is the approach I try to take with my blog as well: treat people like people.

Cha-ching! Totally worth the drive!

@Nancy High five! Very happy your husband was approved.