Last week I wrote a post about my “adventures” booking award tickets to Europe while using Avianca Lifemiles program. It appears that they finally fixed the browser issue, and search is now working for everyone, not just those who were crafty enough to download Firefox on their desktop. Well, at least until another weird problem pops up. This nonsense has lasted for several weeks, with Lifemiles agents usually blaming the members.

Anyway, all is well that ends well, I guess. And here is the crazy thing. Despite my rants, we’ll probably end up transferring flexible points to Lifemiles program again. Though not from my account, as I currently don’t have any points to spare. But I’ll be the one booking the tickets and “babysitting” reservations afterwards. Am I a masochist? Not really.

Fool me thrice…

The reason we keep circling back to Lifemiles is simple: it’s usually much cheaper than other Star alliance programs, and it doesn’t impose fuel surcharges. It’s also easier to justify investing in Lifemiles (again) if you already have some points in your account. That’s the case with us. After booking our tickets from JFK to Brussels I have 6k miles left and my husband has 16k miles. It’s not a lot, but it would be a shame to lose them, right?

It doesn’t help that the miles didn’t just land in my lap. I’ve acquired them via transfer from Amex, and my sister-in-law bought some as well. At the time we were booking three award tickets for 2020 summer trip to Japan, and Avianca seemed like the best option for San Francisco-Osaka flight. You can guess what happened to that plan.

It took me four years to finally find a decent use for the miles. During that time I had to make sure to transfer 1k Amex MR points to mine and my husband’s accounts once a year in order to avoid losing our stash. Lifemiles requires you to have earning activity every 12 months, another “delightful” quirk. But lo and behold, they came in handy at last.

I was telling my sister-in-law about my redemption and she mentioned that her new husband will actually need to fly to Brussels on business next year. She was planning to fly with him, and they would need to cover her ticket, as the company would only reimburse his. I’ve mentioned my leftover stash and told her she is welcome to use it, since she technically paid for some of it. In fact, I offered other currencies as well. She said she actually forgot about these miles, and didn’t really feel like I owe her anything. But of course, I disagree.

Anyway, since one-way ticket costs 22k Avianca miles, she would need to transfer flexible points or buy miles. Fortunately, she has a small MR stash (16k points), which would take care of one ticket. I’m listed as an authorized user on her Amex card.

For her return ticket she would need to use my husband’s account, and top it off by purchasing miles at a discount or use cash+miles option. The only issue is that they live in Detroit and this price is from JFK. However, she said they will simply have a long NYC layover both ways. They love the city, so it’s not a problem. And for her flights to/from NYC I will use my leftover Delta stash.

This isn’t an ideal solution, but let’s look at the alternatives. Nonstop flights from JFK to Brussels run at $1,500 in the summer, and around the same amount from Detroit (with one stop). Sure, there are cheaper options in Europe, especially if you utilize a low-cost carrier. But in this case they actually have to be in Brussels for work.

Her other option is to transfer Chase Ultimate Rewards to United and start from scratch. United Mileage Plus is a better overall choice. The website is usually not schizophrenic and you can cancel award tickets and re-deposit miles for free. My sister-in-law also likes United and finds the program easy to navigate. Plus, United doesn’t charge $25 booking fee. But you will pay dearly for all these advantages, to the tune of almost 44k miles instead of 22k miles Avianca charges one-way. Sure, it might be possible to book a ticket from Detroit for the same price, which would make it more compelling. But saver space on United is scarce these days.

Plus, since I have some Lifemiles already, it would be a shame not to put them to good use for something my SIL actually needs. This is a point where I would roll the dice… again. I did explain to her all the nuances of dealing with Lifemiles, and ultimately the decision is hers. But since she is good at math (being an accountant helps), she reluctantly agreed with me. Plus, she is saving her Chase Ultimate Rewards points for a possible trip to Australia, something her new husband is very excited about.

So, despite some serious drawbacks, I have to admit that Lifemiles currency has its uses. If you find saver availability on United, you can pay as little as 6k Avianca miles on certain routes in the United States. That’s really good, especially if you have to fly last-minute. The ability to deal with frustrating frequent flyer programs is a pre-requisite to being a successful traveler. But I still reserve the right to rant about them on the blog.

Will I go out of my way to invest in Lifemiles? Not a chance. I would never consider speculatively buying these miles and I don’t recommend you do it either. They could add fuel surcharges to award tickets with no warning, rendering some lucrative redemptions obsolete. But does it mean that you should totally ignore it? Not really, especially if you have to buy tickets last-minute.

How you can mitigate the risks

I’ve mentioned before that your best bet is to stick to nonstop itineraries. The less complicated you make it, the better. Of course, if you want to squeeze more value, it’s your call. Just be aware that there is more potential for things to go wrong in case of a schedule change.

I also recommend making sure you have a ticketed reservation with the operating carrier, and monitoring it regularly. After burning my miles, I went to Brussels Airlines website and put in my record locator to check if everything is in order. It was. I did discover an unpleasant surprise: apparently, the airline charges for seat assignments. Oh well, it is what it is. At least that’s not something I can blame on Lifemiles.

I’m hoping that we won’t have any nasty surprises, but at this point we are committed. We have flights to/from Europe on specific dates, and canceling them now will cost a small fortune. Speaking of, Avianca charges $200 per person for award ticket cancellations. That’s $800 for my family of four.

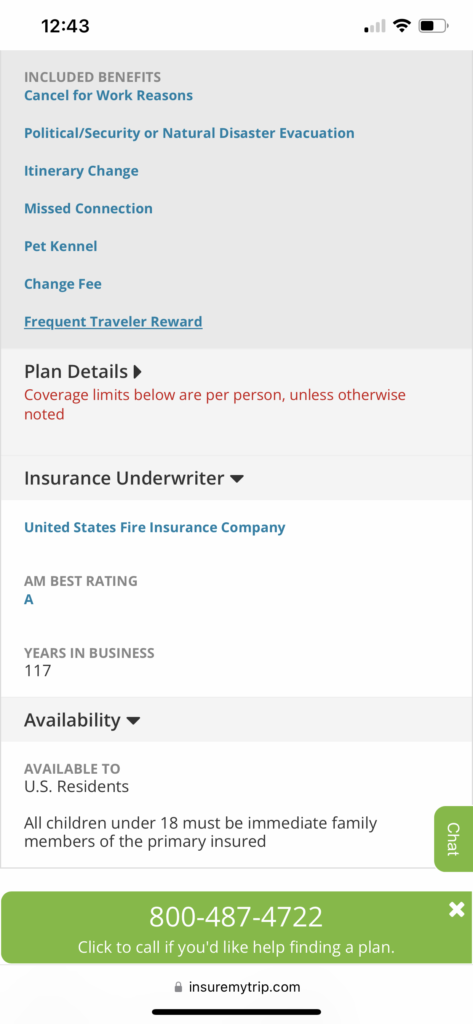

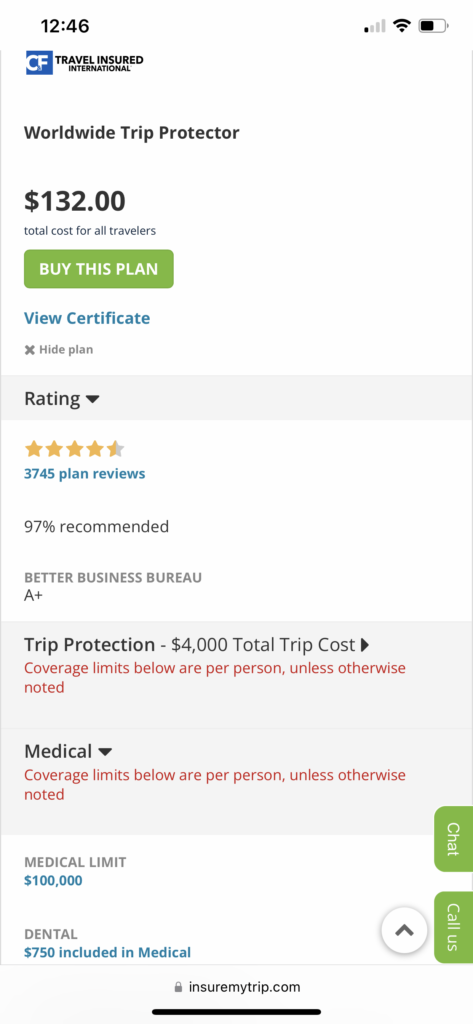

When you have two kids in public school and an elderly mother-in-law, your travel plans are iffy at best. That’s why I bought a standalone travel insurance. This is one of those times where credit card insurance is unlikely to rescue you. When I looked at the terms of most premium credit cards, I didn’t see anything about mileage re-deposit fees being covered. Another thing not covered? Canceling for work reasons.

So, buying a policy for $132 (total for four of us) seems like a good investment. It covers $4k in non-refundable travel costs, $100k in medical insurance and specifically mentions award re-deposit fees:

I like to use insuremytrip.com (we don’t have any affiliate relationship with them), but there are other websites offering this service. It can be a pain to file a claim, but it gives me peace of mind to know that I won’t be on the hook for $800 in fees in case of an emergency. Honestly, at that price I would probably just let the miles go, unless I had an immediate use for them.

The best way to acquire Avianca miles is by not buying them, but by collecting flexible points via cards like Capital One Venture X card (our affiliate link). That way, you can transfer as needed. Just make sure the juice is truly worth the squeeze.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Is your travel policy primary coverage? Secondary coverage is kind of worthless if you have regular health insurance. My agent said that when the ACA passed it specifically required certain things including coverage while traveling. I would very strongly suggest you call your insurance provider to check this but it may save money on part of a travel policy in the future.

@Christian Yes, the policy includes primary medical coverage. That’s always my preference.

I did hear from relatives that their regular insurance told them they would be covered in Ireland for any medical emergency. I didn’t realize it was part of ACA. That said, we have a very high deductible ($5k per person), so buying a cheap medical policy for a trip seems prudent. And in this case, I mainly needed to insure against a potential cancellation, and medical coverage was part of the package.