Note: Some of the offers in this post may have changed. See our Best Credit Card Deals for the latest offers.

I don’t just write about credit cards that earn miles and points for free travel. My family actually “plays the game” in 2-player mode (meaning both my husband and I apply for credit cards). I don’t use a big corporate expense account to fund “free” travel and then write about how readers can do the same thing through credit card bonuses. I practice what I preach.

While my family was on vacation this past week, a few more great credit card offers came out from Chase. The Southwest personal credit cards (the Plus, Premier and Priority cards) now offer 65,000 bonus points after spending $2000 in the first three months. See this blog post for more details. In addition, the Chase IHG card increased its bonus to 150,000!

But those cards don’t fit my family’s future travel goals. I had another card in mind.

United Quest Card

My family hopes to travel to Europe in 2022 and 2023, so I’ve had my eye on cards that would help get us there. The Chase United Quest card fits the bill. It currently has a bonus of up to 100,000 United miles. You get 80,000 bonus miles after spending $5000 in the first three months, and an additional 20,000 miles after spending another $5000 within the first six months. The annual fee is $250. I wrote about this card a few months ago. See the details here. This elevated launch offer expires TODAY.

Why this card? My husband and I both already have the United MileagePlus Explorer card (which I recommend getting first). We have five people in our family, so we need a lot of miles and points to get us all to Europe. The bonus from one or two cards isn’t going to cut it for us. We have to keep stacking bonuses on top of bonuses over a period of a few years. That’s just the reality of how to get free travel for a large family.

I’m confident that we will be able to put $10,000 of spending on the card within the first six months. That’s less than $2000 per month. We charge all of our groceries, gas and other bills on our credit cards and pay them off every month. Plus, we have a couple of large purchases we’ve been saving up for that will easily put us over the top of the bonus spending requirement.

I admit, the $250 annual fee does give me pause. We usually don’t apply for cards with fees that high. However, the card comes with a $125 credit on United purchases. Since we will have to pay award taxes for our international flights, we can easily use the credit for that.

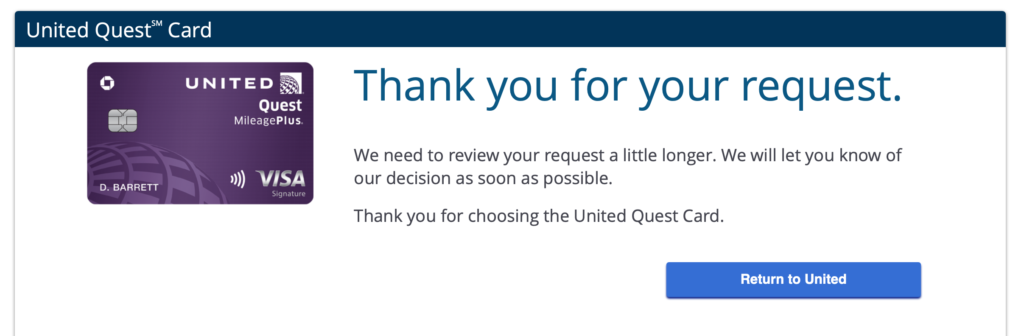

My husband applied for the card last night. Unfortunately, his application wasn’t instantly approved. His application status is pending.

I plan to wait a few days to see if the application is approved before calling the reconsideration line. I’ll keep you updated.

Note: Before applying for any credit cards, please review the bank rules and restrictions to increase your chances of getting approved. Click here to see more credit card options.

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

Leave a Reply