See our Advertiser Disclosure here.

As soon as Chase has instituted the infamous 5/24 rule for most of its cards, I thought that was the end of my love affair with that bank. Sure, I would go out of my way to maximize 5x categories on Chase Freedom Flex. But I figured my only pathway into transferrable Ultimate Rewards universe would be via card conversion. And that was fine because I wasn’t about to stop applying for juicy sign-up bonuses from other banks.

Alas, a few years later things have changed and I didn’t even notice. To be honest, I pretty much stopped checking mine and my husband’s 5/24 status because it seemed pointless. In fact, I even tried applying for one of Amex Delta cards recently, but thankfully got the dreaded pop-up saying my husband wasn’t eligible.

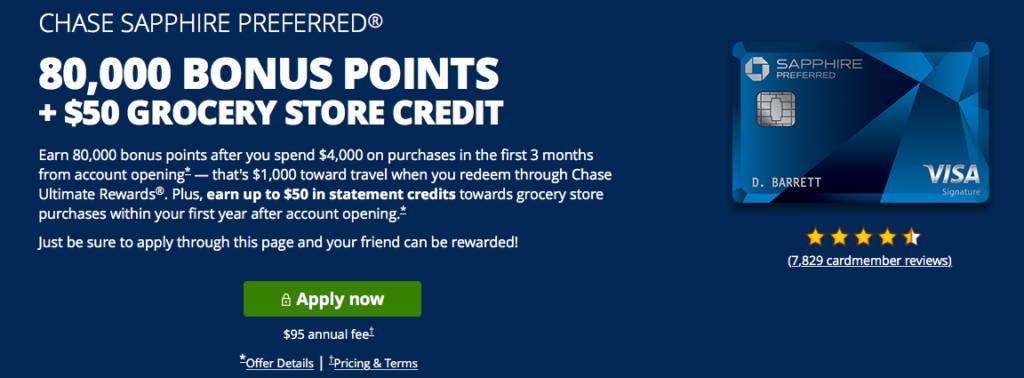

I say “thankfully” because as it turns out, he would be under 5/24 as of April 1st. I only checked his free annual credit report because my cousin-in-law asked about Chase Sapphire Preferred offer. So, I was pleasantly surprised, to say the least. It didn’t hurt that the bonus on Chase Sapphire Preferred was recently increased to 80k UR points+$50 grocery credit. Talk about a fortuitous turn of events.

Apply in branch or online?

I saw some reports and the reader has also mentioned that it may be possible to apply in branch and get a waived $95 annual fee. Unfortunately, we live almost an hour from the nearest Chase bank and the application would be in my husband’s name. He hates anything hobby related, so reluctantly, I decided to scrap the idea. Ironically, we had to go to that area for an unrelated chore a few days later, so we could have stopped by the branch. Don’t you just hate that?

Anyway, I applied online and he was approved. If you intend to get the card, I absolutely recommend you call your nearest Chase branch because potentially saving $95 is certainly worth some inconvenience. If you plan to apply online, I hope you consider using my husband’s referral link, which will support yours truly. Make sure you read the terms to see if you qualify to receive the bonus.

This is a great deal, and an offer I wholeheartedly recommend. At the minimum it’s worth $850 in cash, so hard to argue with the value proposition here. I personally plan to use it for Hyatt stays and transfer to United.

As it turns out, I will be under 5/24 on August 1st, so will avoid any new credit card applications in my name between now and then. Even if the offer is reduced to 60k points (likely), I still plan to apply and use my husband’s referral link, which will give us an extra 15k points. Close enough.

A Citi Premier shocker

We have several large bills coming our way in the next few months, so I also decided to get Citi Premier in my husband’s name. It’s been 24 months since he canceled his previous card, so I was sure he would have no issues getting the bonus.

I did see some recent online reports that Citi will not approve you if you had more than 3 credit inquiries in the last 6 months. My husband had 2, so I wasn’t worried. Alas, he was denied, the application didn’t even go to pending status. That was a surprise, but it just goes to show that you can’t take things for granted in the miles and points hobby.

Fortunately, I don’t take this sort of thing personally. Plus, I was thrilled with Chase Sapphire Preferred approval. However, I did want to try applying for one more card. But which one? I thought about Capital One Venture Rewards, but we never have any success with that bank. If Citi didn’t deem my husband to be worthy, the chances of success here would be slim. I sure don’t want to collect 3 inquiries just to be told to go pound sand.

The other two options I was looking at were Bank of America Premium Rewards Visa and 50k miles offer on Alaska Mileage Plan BoA product. Normally, I prefer cash or flexible points, but now that Alaska Air has joined OneWorld, I decided to go with the latter. And it was approved. I’m not sure when I will use the miles, but I will eventually. It looks like the offer has changed since yesterday, and you will now get 40k miles+$100 credit. Non-affiliate link

About that “ unexpected” IHG devaluation

By now you’ve probably seen a few posts on massive IHG devaluation that seemingly came out of nowhere. Or did it?

IHG has announced last year that it will be switching to dynamic award pricing. In simple language, it means going forward the customer would have to pay what the website tells him to pay. No award chart to speak of.

So unless you are new to this hobby, the best course of action would have been to burn most of your IHG points…. a year ago. And to stop collecting them, of course, unless you are OK with the risks.

I’m absolutely not defending IHG here. It’s a schizophrenic program and always has been. The latest development is their modus operandi. Years ago IHG ran ridiculously lucrative promotions where you often could get a ton of points after just one night stay. There was also a PointBreaks program, basically a yard sale for unloved/unknown hotels which sometimes provided spectacular value.

On the other hand, IHG is too cheap to even provide free breakfast and guaranteed upgrades to its most prized members. On top of it, customer service is a complete mess. That, plus lack of promotions and recent move to dynamic pricing made me finally give up on it. If you want predictability in a hotel program, Hyatt is probably your best bet, but you will have to deal with a limited footprint. You win some and you lose some, and no hotel program is perfect.

But one thing I’m not giving up is my Chase IHG credit card with a grandfathered $49 annual fee. As usual, I see people gnashing their teeth saying they will cancel it. Go right ahead. I’m sure IHG executives will be crying over it.

Again, it’s a ridiculous program that often spits in customer’s face. All the more reason not to give it any business. But there is still value to be had, people, especially at $49 per night all-in. And if you are willing to travel during off-season, you can even occasionally score a beachfront hotel.

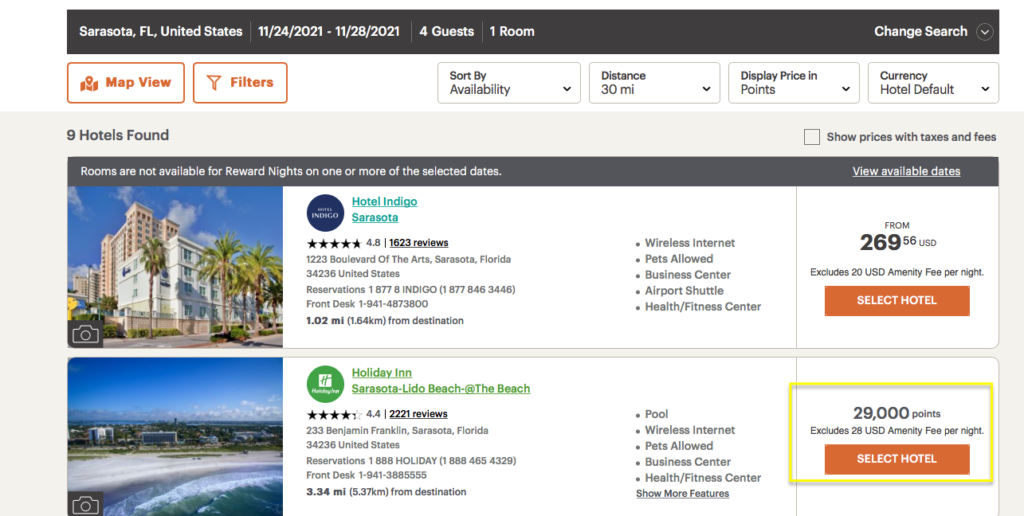

For example, you can get this Holiday Inn Lido Beach for $49 during Thanksgiving week, when hurricanes usually aren’t a threat. Sure, there is a stupid $28 resort fee, but it’s still a very good deal, all things considered.

Want to stay in a 2-bedroom rental near Disney, that also has an amazing waterpark? This place costs 40k points per night on all the dates I checked, so your certificate will work here (for now).

And of course, there are tons of decent airport hotels where you can still burn it. So my advice is to hang on to the card and don’t dwell on the good ole’ days.

If you find that you are not getting acceptable value for your $49, you can always reconsider and cancel the card later. Just don’t do it in an emotional state because you want to teach IHG a lesson. Trust me, they don’t care.

The beauty of low expectations

This goes contrary to very strong aspirational angle that is often pushed in the miles and points blogs, but I encourage you to set low expectations. That way you will never be disappointed.

Reaching for the “stars” can be a double-edged sword.

If something doesn’t go quite the way you planned it, it can lead to stress and frustration. Yes, it stinks to apply for a card only to see the value drop in half right after you get the bonus. And of course, companies should be held accountable when they break their promises.

But otherwise, I think it’s good to have plan B and C, but be aware that things still may not work out. Just look at the last year and what Covid-19 pandemic did to all of our travel plans.

Well, I’m off to work on my minimum spending for Chase Sapphire Preferred. I’m sure my kids will be thrilled to stay in their favorite Hyatt resort after pandemic is over.

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Thank you. I will keep an eye out on which program has the best sign up offer. For now, I’ll keep our four IHG cards as the annual fee is still less than paying out of pocket for a night.

@Michelle Sure thing! I think the biggest devaluation threat is to very popular leisure destinations, not necessarily a college town in Georgia. I believe going forward you will be able to justify annual fees on your IHG cards, especially when traveling during off season. Plus, according to some blogs, it looks like IHG has backtracked somewhat.

I’m a little heartbroken over the IHG devaluation. We have four cards and I use them to get back and forth to my son’s college a few times a year. I’ve had SPG/Marriott about four years ago. I have never had a Hyatt or Hilton card. Any suggestions? I don’t use the points for anything more than a place to stay while traveling to/from GA or while visiting my son in Georgia. Thanks.

@Michelle I can definitely understand your disappointment. I think IHG is being very short-sighted, and will lose paying customers as a result. I don’t think it will hurt to reach out on Twitter or Facebook to politely voice your concern. Though realistically speaking, I doubt it will accomplish anything.

As far as Hilton vs. Hyatt, it will depend on what type of hotels are in the area you are interested in. I recommend doing a search to see where things stand in that part of Georgia. Obviously, Hilton has a much bigger footprint compared to Hyatt, but it’s usually moot point in a relatively big city. Personally, I prefer Hyatt points, but only because my kids love one specific resort in Florida. I promised to take them there, and would prefer to use points rather than cash. During road trips when I just need a place to sleep, any large chain will do. Though Marriott would probably be my first choice, specifically Residence Inn. So, my long-winded point is that either chain will probably work, so I recommend you focus on the current sign-up offer.

@Agnes That’s pretty neat! I didn’t even know they have a room with a jetted tub, and we’ve stayed there 5 or 6 times. It seems like they did charge us the resort fee once or twice, but it’s YMMV kind of thing. It’s not a fancy hotel and certainly not a resort, but you can’t beat the location.

Whoops, it flew off before signing my name 🙂

Hi Leana, we just stayed at IHG Lido last weekend. It is a do over vacay because we didn’t make it last Christmas. Had to changed room but got a nice 7th floor with jet tub and floor to ceiling rayban glass. They didn’t charge me the resort fee for whatever reason. Hey, and cycling Chase Sapphire cc.

Billndc, thanks for stopping by! Yeah, I tread carefully with my husband too. He is extremely busy at work, and thinking about miles and points isn’t his cup of tea. That’s my job and something I happen to enjoy. That said, I was able to drag him into Chase branch a few years ago, but we walked away with Chase Sapphire Reserve, plus several savings account bonuses that could only be done in person. So reluctantly, he agreed. I probably could have convinced him to do it this time with Preferred card, but I try to save this sort of thing for a special occasion. 🙂 I would do it for 50k AA miles, though.

What an interesting tip on Capital One. I’ve also read that this bank likes it when folks carry balances. Since I don’t, I didn’t give it much thought. But yeah, if you have a 0% promo you plan to use anyway, it could potentially help. Capital One is one nut I haven’t been able to crack. But someday!