See our Advertiser Disclosure here.

As many of our readers know, my main strategy for accumulating miles and points involves constantly switching credit cards. I apply for new bonus, collect it, cancel the card, rinse and repeat.

I’m convinced that for a normal family who spends $2-3K each month, this is the easiest/most efficient way of getting the miles and points to cover travel. Obviously, paying off credit card balances in full each month is key. If you can’t do that, this strategy is not for you.

Unfortunately, banks have become much smarter in recent years, hence the introduction of various official (and unofficial) restrictions. See this page for all the latest info That doesn’t mean, of course, that all hope is lost. Occasionally, banks provide a workaround, as was the case with Chase “Offers for you” trick, which allowed me to apply for United card X2 last November.

And when it comes to some conservative banks, often the only way to know for sure is to actually apply. Rules change, and you never know when you may get lucky.

A low-hanging fruit that is out of my reach

One of the easiest cards to recommend to just about everyone is AAdvantage Aviator Red World Elite Mastercard. Even if you hate AA miles, it’s too good of a deal to pass up. Basically, you pay $99 annual fee, buy a pack of gum and voila, the 60k AAdvantage miles are yours. Non-Affiliate link to apply

Even if you decide to redeem the miles on hotels or car rentals, this card is a total no-brainer.We don’t make commission on it, so there is no incentive to push it whatsoever.

That’s why every six months for the last three years or so, like clockwork, I’ve been applying in mine and my husband’s names. And like clockwork, Barclays bank has been denying the applications. And so it was a few days ago. I got two letters saying we have had too many recently added accounts. It was totally expected, but it won’t stop me from trying again in 6-8 months.

Sixth time is a charm

Three years ago, I applied for US Bank Altitude Reserve (as soon as it was introduced) and was shocked to get an approval. This is an extremely conservative bank. Since then, I’ve been trying to get one for my husband, to no avail. Five times total, to be exact. Well, I tried again a few days ago, and it went into pending status. I was convinced that we would get a denial letter, so much so, that I almost tried applying for another card.

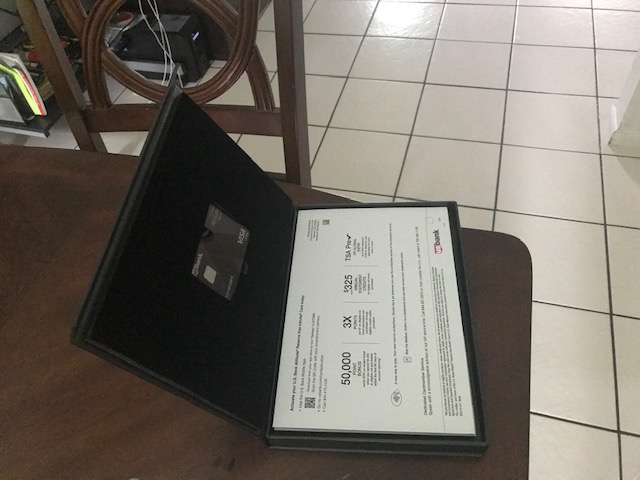

But to my total amazement, he got approved. Check out the fancy box the card came in!

My husband was impressed by the looks of the card and said he actually likes it better than Chase Sapphire Reserve (his second favorite). Here are some details on the sign-up offer:

- Earn 50,000 bonus points worth $750 in travel when you spend $4,500 in eligible net purchases within the first 90 days. Points do not expire.

- 3X points per $1 for eligible net travel purchases.

- 3X points per $1 for eligible net mobile wallet purchases.

- Up to $325 in statement credits annually for eligible net travel purchases.

- TSA Pre√® or Global Entry — up to $100 statement credit to reimburse you for your application fee — whichever program you apply for first.

- Relax with airport lounge access and stay connected with 12 Gogo Inflight Wi-Fi passes per year.

- Redeem points instantly with Real-Time Mobile Rewards Redemption.

- Elevated service levels with dedicated Concierge and Cardmember Service advisors.

- Annual fee is $400, not waived. Additional authorized user card is $75.

- Non-affiliate application link

You have to have an existing relationship with US Bank in order to apply. An eligible U.S. Bank account relationship is defined as: Checking or Savings account, Certificate of Deposit, Mortgage, Home Equity Loan, Home Equity Line of Credit, Auto/Boat/RV Loan, Personal Loans and Lines, Private Banking account or Consumer Credit Card issued by U.S. Bank.

About 1.5 years ago, US Bank has also introduced a neat feature. You can now redeem the points toward travel purchases via mobile app, so no need to go through US Bank shopping portal. This is a potentially useful option, though I haven’t had a chance to try it yet. Keep in mind that there are various restrictions. For example, you have to have enough points in the accounts to cover the whole charge.

According to Frequent Miler, US Bank is allowing customers to redeem $325 travel credit towards dining through the end of this year. I wasn’t aware of this when I applied, but this makes the deal even sweeter.

As far as how I plan to spend the points, I will most likely burn them toward flights by booking through US Bank travel portal. Let’s say I value $325 travel/dining credit at $300. It would mean a profit of $650 once you deduct the annual fee. Not too shabby, if I say so myself.

Spending $4,500 in 3 months is a bit of a challenge, but certainly nothing I can’t overcome. I can always prepay our power bill and my husband’s car via Plastiq if needed. The prize (aka sign-up bonus) is most definitely worth the effort.

This isn’t as easy of a deal as Aviator card I’ve mentioned earlier, but beggars can’t be choosers. I don’t think I will renew US Bank Altitude Reserve card, but I can see why many would. Getting 3X points per dollar on ALL eligible mobile wallet purchases is certainly an attractive option. Getting Gogo passes and few entries to Priority Pass lounge could also come in handy for some. But for me personally, the bonus is what it’s all about.

What’s next

Once we meet the minimum spending on Altitude Reserve, I will see what’s available at the time. Obscure lucrative cards tend to pop up out of nowhere, and Amex has been offering some decent upgrade options lately. Eventually, I would love to apply for Chase Sapphire Preferred and collect the initial 60k UR points bonus. Unfortunately, with ten new accounts in the last two years, this won’t be an option for a long time.

I absolutely love Ultimate Rewards points, but not enough to stop applying for other cards in the meantime. There is more than one way to skin a cat, and Altitude Reserve lets you redeem points at 1.5 cents towards travel, which matches Chase Sapphire Reserve.

I do make sure to take advantage of 5X categories on Chase Freedom (my referral link that lets you earn 20k points) and occasionally convert it to a premium card in order to take advantage of partner transfers.

I really believe every family should have Chase Freedom on hand. There is no annual fee, and you can collect points until a decent UR transfer opportunity presents itself. There are things you can only accomplish with UR points. See this post if you are a beginner

But I don’t generally hang on to premium cards because I feel my energy and money are better spent elsewhere. It’s true that chasing after new sign-up bonuses isn’t what it used to be, but opportunities still present themselves on occasion. And you bet I’m there to take advantage of them.

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Russ Nice! Yeah, it’s a super easy bonus, so why not? I’m hoping to get approved myself one of these days. Barclays is a tough nut to crack, but I’ll find a way. 🙂

Thanks Leana, you’ve jogged my memory! I’d lost track of the Aviator Red card. I recently canceled my card but applied in my wife’s name after reading your blog. Ca-ching! 60,000 points! :>)