This post is geared to newbies or people unfamiliar with the miles and points hobby. This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products.

Last week, Nancy wrote a post on how you can potentially turn your increased end-of-year spending into a boatload of miles and points. Obviously, this hobby isn’t for everyone, which is why she also made sure to highlight risks and caveats.

But there is no question that applying for new bonuses is the easiest path to deeply discounted travel. In my household, we have to cover hefty property taxes and car insurance bills this time of year. Even though there is a fee on the former, it’s often worth paying it for the purpose of receiving a new credit card bonus.

There are cards that are easy to recommend to everyone. That’s why Nancy specifically mentioned Chase Sapphire Preferred as the best overall offer. You will get 60,000 bonus points (currently, worth $750 towards travel). It really is a great card for beginners. You can transfer the points to several travel partners 1:1 (Southwest, United, Hyatt) or redeem them for travel through Chase travel portal. I totally agree with her recommendation.

That said, I also wanted to highlight another Chase option that for some people will be a better overall fit.

Upcoming Southwest Companion Pass changes

Until now, Southwest Companion Pass required earning 110k Rapid Rewards points within one calendar year. That will change on January 1st 2020. Starting on that day, you will have to earn 125k points.

While a dealbreaker for some, it’s important to note the silver lining. I’m referring to the fact that points earned from Southwest credit card will still count towards the pass.  This is huge and to be honest, I’m somewhat surprised that Southwest has kept this deal alive. My guess is that they want to get folks hooked on their “kool-aid” and hope they will stick around even after the pass runs out. Plus, having this perk will surely steer people towards Southwest-operated flights.

This is huge and to be honest, I’m somewhat surprised that Southwest has kept this deal alive. My guess is that they want to get folks hooked on their “kool-aid” and hope they will stick around even after the pass runs out. Plus, having this perk will surely steer people towards Southwest-operated flights.

You qualify for free Companion Pass in the calendar year you earn 125k Rapid Rewards points, plus the entire following year.

How Companion Pass works

It’s very simple. You can book an award or paid ticket and take a companion for free. Well, you will still have to pay taxes. Obviously, this is only a hot deal when Southwest happens to have the best price to begin with. This will depend on the route as well as time of the year you plan to fly. During holidays it will be much harder to score a bargain, but that goes for all airlines, really.

I’ve had a pretty good success with Southwest so far. Rapid Rewards points are worth approximately 1.4 cents apiece towards Wanna Get Away fares, sometimes more on international flights. In the past we’ve flown to Jamaica and Niagara Falls for 5k points per person one-way.

I paid 10k points for Spokane-Orlando flight, and consider it a very good deal. I’ve seen some low fares on their new Hawaiian routes, so if you live on the west coast, definitely look into Southwest. To reiterate again, whether you find a good deal or not will depend on your individual circumstances.

I paid 10k points for Spokane-Orlando flight, and consider it a very good deal. I’ve seen some low fares on their new Hawaiian routes, so if you live on the west coast, definitely look into Southwest. To reiterate again, whether you find a good deal or not will depend on your individual circumstances.

Southwest has been having some issues lately related to MAX planes, but hopefully they will be resolved soon.

The path to 125k points

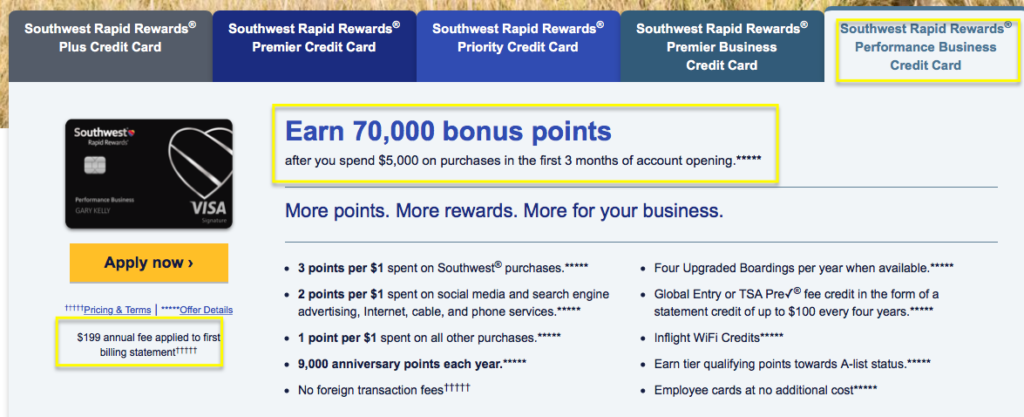

Do you have a legitimate business? Are you under 5/24 limit? I recommend you consider applying for Southwest Business Rewards Performance credit card right now.

Of course, make sure you can handle minimum spending requirements. Be aware, the bonus on this card was 80k points when it was first launched. I have no idea if it will ever come back, but you can ask Chase for a match via secure message if they increase it within the next few months. Again, the idea is to position yourself for Companion Pass.

Once you meet minimum spending, you will have at least 75k points. Oh, and make sure you don’t spend the full $5k before December 31st. That way the points will hit your account in 2020.

Once you are done with your business Southwest card, its time to apply for personal version. Right now the bonus on all personal versions is reduced to 40k points, but I’m fairly certain that Chase will increase it to 50k-60k points within the next few months.

Pursuing Companion Pass does require a leap of faith and some extra planning. But the rewards for many families will be well worth it. No, this deal isn’t for everyone, but it’s hard to argue with getting 250k Rapid Rewards points in value in exchange for applying for just two credit cards.

If you plan to apply for any Southwest credit cards, I hope you consider using my personal referral link (I will get 10k points per approval). Thanks in advance!

Bottom line

If you are relatively new to this hobby, it’s important to keep in mind that it’s not one-size-fits-all. Something that is a hot deal for one person will be merely a lukewarm deal for another. Companion Pass is one of those things. If you don’t live near an airport served by Southwest and if you don’t fly often, then it’s probably not worth pursuing.

However, if you do, definitely look into it. Feel free to reach out with questions.

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Leave a Reply