As Nancy recently covered in her post, many folks are being targeted by Chase for pre-qualified credit card offers that sometimes bypass 5/24 restriction. They certainly don’t guarantee an approval, but they do seem to increase your chances.

In the past, only “offers for you” section would bypass 5/24, but at the moment pre-qualified offers in “credit cards” section seem to also do the trick. In order to find those, click here:

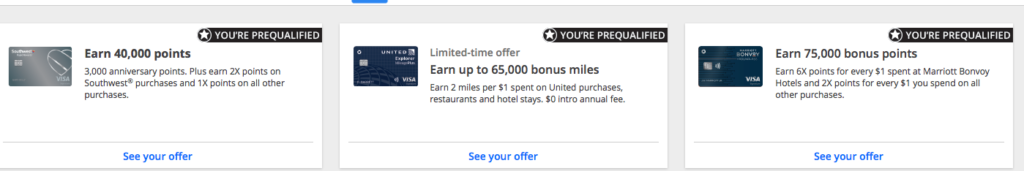

Then look for a black star next to a credit card and make sure “T and C” shows fixed APR. This is what I recently saw in my husband’s Chase profile:

I got the usual, as in nada. Out of the three offers, United card was the most appealing one. The first annual fee is waived, and 40k miles after spending $2k is nothing to sneeze at. I speculatively value the offer at $400 minimum. Of course, there is an option to get an additional 25k miles after spending $10k instead of $2k.

I might do that or I may not. The deal is worth it, regardless. If I decided to go for the whole thing, I would have to prepay some bills via Plastiq (my referral link ) and possibly use PayPal (3% fee).

I went ahead and looked up my husband’s United Mileage Plus number and applied via his online profile. Approved! I then saw something extremely strange. The new card showed up in my Chase online profile instead of my husband’s.

I honestly have no explanation for this, so maybe some IT savvy person can solve this puzzle. I did have tabs for both of our Chase online profiles opened simultaneously. But the pre-qualified offer was definitely in my husband’s profile, not mine. No, my delicate female brain did NOT get temporarily confused!

So, I started thinking. What if I apply again and this time have only one tab opened? Would my husband get approved so we could get the second United bonus? I hesitated because I really don’t want to draw any attention from Chase. However, the first approval was clearly in my name.

I pulled the trigger and voila, the second card was approved as well. It promptly showed up in my husband’s online Chase profile. I’m very puzzled by this whole thing, but hopeful that in a few months we will be at least 84k United miles richer. I’ll have to call and change the United number for my card once I get it in the mail. Fingers crossed, there won’t be any issues.

As it stands, I have semi-definite plans for United miles within the next seven months. We are hoping to go to Quebec City in summer of 2021, and redeeming United miles on Air Canada (no fuel surcharges) will be ideal.

<

p style=”text-align: center;”> Photo by Rich Martello on Unsplash

Photo by Rich Martello on Unsplash

Of course, if things don’t work out, I can always use them for a flight to Europe to visit my family.

When it rains, it pours

This was a totally unexpected win, assuming Chase doesn’t shut us down. It just goes to show that waiting until you are under 5/24 isn’t always the best course of action. Obviously, the decision is yours, and I’m not trying to persuade you one way or another.

For me personally, applying for lucrative offers rather than waiting for Chase to finally welcome me with open arms has been the right strategy. And as you can see, I got to have my cake and eat it too. That’s the hope at least. As they say, don’t count your chickens (miles in my case) before they hatch.

After many recent denials, I was leery to apply for any new cards because it seemed like a hopeless case. But just a week ago (before I saw pre-qualified United offer) I threw caution to the wind and applied for Citi Expedia Rewards Voyager card. I learned about it on LazyTravelers blog and instantly saw the potential. I won’t rehash the whole thing and recommend you read the linked post.

In a nutshell, if all goes well, I will be able to get around $700 in hotel value out of that thing if I book a VIP Access hotel (search listings via this link). By the way, VIP Access doesn’t necessarily mean the hotel is super expensive. This is honestly the only reason to apply for the card, since value for regular hotels is reduced in half.

Speaking of Quebec City, there are quite a few central VIP Access hotels listed, so that made the decision to apply a no-brainer. Of course, there is always a chance that Expedia devalues the program, but that’s the nature of the game we play. Some have reported that buying airline gets cards triggered $100 incidentals reimbursement, but you shouldn’t count on that.

If we don’t end up using points on hotels in Quebec City, I will redeem them on South Seas Island Resort in Captiva, Florida during off-season. I’ve wanted to stay there for a long time, but don’t like paying cash.

My application was approved, and my husband’s is still pending. Non-Affiliate application link for the card (look for 70k points offer with $95 annual fee, valid until December 2nd)

If you are relatively new to this hobby, I don’t recommend this card or United offer, for that matter. Instead, focus on flexible points earning cards or lucrative cashback products first. See Nancy’s post for more details.

Bottom line

I hesitated a little before applying for both United cards. Now I have to juggle three offers, possibly four if my husband’s Citi Expedia Voyager card gets approved by some miracle. But the payoff to me is worth it.

Pre-qualified offers in my husband’s profile have since disappeared, and who knows when I will see them again. I believe in seizing the moment when it comes to opportunities like this one.

If all goes well, my bonus haul will mostly cover award tickets to Canada as well as hotels. No, the trip won’t be free. But here is the thing. I would pay for airline tickets and lodging out-of-pocket since I really want to visit Quebec City. Thanks to this hobby I don’t have to agonize over the decision for fear of jeopardizing our limited family savings.

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Leana you are in trouble. Many many many people having their Chase accounts shut down for this exact same thing. Reddit has all the details – only a matter of time.

I’d use all those miles before they are confiscated.

@Mommy4trips Thanks for the warning! I’ll look it up on Reddit. I didn’t really use any special codes or nefarious methods to apply, it was a pre-approved offer in my husband’s account. I know there was some recent controversy about code manipulation, this wasn’t anything like it. A shutdown could absolutely happen, and Chase has the right to do whatever they want. I don’t currently have any miles, though my husband has some UR points. For now, I will sit tight. Thanks for the warning, though.

Who are the 2 ill-mannered newbies who have the audacity to comment on such a friendly blog? I hope they go away; it’s easy to be a bully online. Idiots!

When I click your link for the citi expedia card, it doesn’t go to the 50k offer. I do see a 20k offer further down. Wonder if they took it down? Thanks for the idea!

@Lynn Thanks for reading! I think I know what the problem is. I believe you will have to first join Expedia Rewards program (free) and then the credit card offer will show up. https://www.expedia.com/rewards/howitworks Let me know how it goes.

When I click the application link, I did see it, so it still works AFAIK. It is a decent offer IF Expedia doesn’t gut the program. I wouldn’t hang on to the points for more than a year, tops.

Thanks, I see it and just read on Doc that it has gone up to 70K. You could try for a match.

@Lynn Ugh, just saw that on FM blog! I called Citi, but they won’t match it. Oh well. You win some, you lose some in this hobby. The 70k offer is hot.

I think Johnny and RC83 are a-holes! Ignore them

I liked the article! Keep ‘em comin! I check your blog almost daily because I find it interesting and relevant. Posts are also not a rehash of everything everyone else has already blogged about or filled with credit card referrals.

@Tammie Thanks! I try to write when I can, though I will be starting a new job soon. But I definitely plan to keep posting, and appreciate the encouragement.

As far as those comments go, they honestly don’t bother me. I did laugh at the guy who suggested I made the whole thing up. A head scratcher, for sure. Everyone is entitled to their opinion. Goodness, if I was afraid to embarrass myself, I would have deleted this blog a long time ago. 🙂 I have published my share of foolish posts over the years. I don’t hold back, and record the good, the bad and the ugly.

And posting the real life person is why your followers appreciate your blog! I will never make enough money or points for some of these huge expensive trips I read about. I just want to be able to afford a vacation once a year and the points and miles have done the trick. And when you have the “guts” to post about a mistake you make you should not get hate. Because often we read about these mistakes and learn from them to not make the same mistake! The wealthy travelers that have done the hobby for many years can be so negative and hateful. I have stopped following several blog sites due to the spiteful comments. You are appreciated! Thank you for all you do!

@Clyn6 I appreciate your comment very much! Nancy and I do try to keep it real. Not everything we post will appeal to everyone, we simply write about our adventures in this hobby ( and life in general!)

I can completely relate to the challenge of affording travel on a limited budget. We are in better shape than many folks, to be sure, but many things I see others do are simply not an option for us. No matter! I’m super grateful for what we CAN afford, and sometimes pinch myself thinking of the adventures I’ve had over the years. As a poor kid growing up in Soviet Union, all of it seemed out of realm of possibility back in the day.

Probably some cookie confusion (yum!).

Ignore the haters. Bunch of losers who have nothing better to do but project their own insecurities in the form of anger and hate.

@Dabblebabble Sorry, your post went to SPAM.

It sure sounds like cookie confusion! Is that a real IT term? LOL

This never happened to me before, and I figured that my husband’s SSN would be attached to the offer. Very strange! I sure hope I don’t get shut down by Chase as a result.

Wait so you’re a blog that gives out advice and you don’t know how tabs work in a browser? This is embarrassing you should delete this article.

@RC83 Well, as I’ve said in the post, my IT knowledge is somewhat limited. I honestly thought that if I clicked through my husband’s profile, the application would be made in his name. In fact, I actually forgot that the other tab was even opened at the time. I figured that was the only explanation. Anyway, I just thought it was interesting and wanted to share. This isn’t an IT blog, but family travel blog.

@RC83 Not sure why you hang around here, with those of us who really appreciate Leana??

Yea sounds like you used the leaked links and trying to cover your ass. Nobody falling for this lol.

@Johnny Nope. Why would I have to cover anything? I could simply skip writing this post altogether. That’s just silly! 🙂 I don’t have to reveal every detail of my life, you know.

@ Johnny- Are you really serious?