Note: We make a commission on some of the credit cards mentioned below if you apply through our affiliate links. See How This Blog Makes Money.

Earlier this week, I decided to apply for a new credit card. I have a couple of large expenses coming up, including a new laptop I want to buy for writing. My last credit card application was back in January for the Citi Premier.

Since some of these upcoming purchases are business-related and I’m considering dropping below 5/24 for future Chase card applications, it made sense to look at small business cards. My top three choices were the Capital One Spark Miles for Business (50k bonus), Marriott Bonvoy Business Amex (100k bonus) and the Hilton Honors Amex Business (125k bonus).

I eliminated the Capital One Spark Miles for Business card because it will show up on my personal credit report and affect my 5/24 status. Between the other two cards, I decided to apply for the Marriott Bonvoy Business Amex card. I never had the Amex SPG business card, so I was eligible for the bonus. Plus, I could use the Marriott points for either hotel stays or AA flights.

Once I made my choice, I filled out the application. After I hit submit, I got the dreaded Amex pop-up box. Oh, no!

What Is the Amex Pop-up Box?

Last summer, Amex started warning customers with a pop-up message if they were ineligible for a sign-up bonus because of Amex’s once-per-lifetime bonus rule. Very handy, right? I would want to know before I waste a credit inquiry if I wasn’t going to get the bonus.

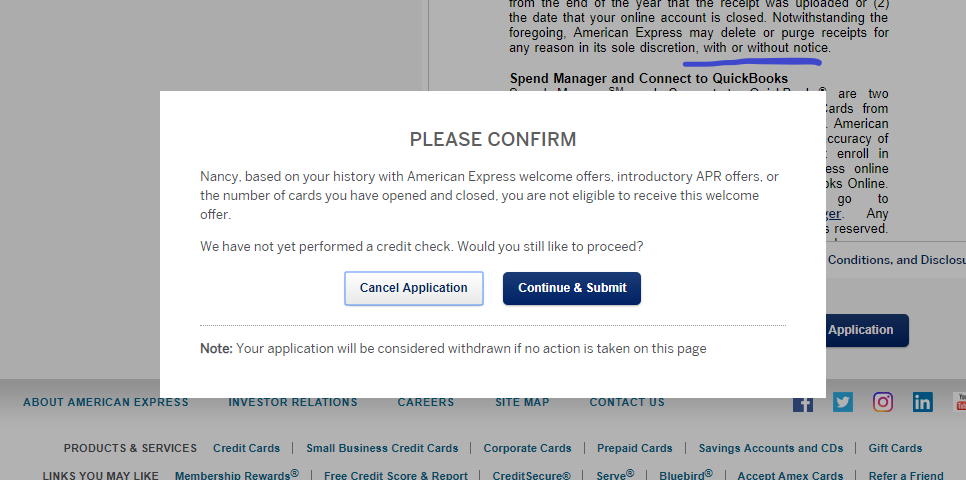

Amex then added a second pop-up box to warn other folks that they were also ineligible for the sign-up bonus due to abusing the award system or opening too many cards. It looks like this:

I can hardly blame Amex for doing this. I’m not a profitable customer for Amex or any credit card company. I always pay my balance off every month, so I don’t pay interest or fees. Plus, I cancel some cards after a year or two if they don’t make sense to have as “keeper” cards.

The frustrating thing about this second pop-up box message is that, unlike Chase’s 5/24 rule, nobody has figured out the exact number of credit card openings that trigger Amex’s denial message. Some people report that putting spending on existing Amex credit cards helps prevent the pop-up box. I had put some recent spending on a current Amex card, but it wasn’t enough.

Today’s miles and points credit card atmosphere is so different from just a few years ago. I still remember the days of reading miles and points blogs when bloggers would apply for several cards on the same day, and then repeat that every three months. Those days are long gone!

Other Business Credit Cards to Consider

Amex isn’t the only business credit card gig in town. I have other options. Sort-of.

Obviously, Chase business cards are out since I can’t get approved since I’m over 5/24. I am avoiding Capital One business cards since they will show up on my personal credit report and hurt my progress on getting under 5/24. I’m not eligible to get the bonus on the CitiBusiness/AAdvantage Platinum Select World Mastercard because I just had it last year. Too bad, because the public bonus is now 70,000 miles!

I could apply for the Alaska Airlines Business Visa credit card. It currently has a bonus of 40,000 miles and comes with a $99 companion certificate. I’ve never had either of the Alaska Airlines cards. However, I’ve read several accounts of sole proprietorships having difficulty getting approved due to some strict business paperwork requirements.

Another card I would consider due to the high sign-up bonus is the Radisson Rewards Business Visa Card (non-affiliate link) by US Bank. It comes with 85,000 bonus points after spending $2500 in the first 90 days, annual fee of $60. However, I don’t have a use for these points in the next year.

Go-Forward Strategy

Not counting business cards, I’m at 11/24. Most of those cards are from 2017 and the first half of 2018. If I can wait until June of next year, I could get under 5/24 and be eligible for Chase cards again. I am strongly considering this path and sticking with business cards over the next year.

For now, I’m going to put a little more daily spend on my Amex cards and see if I can get that Amex pop-up box to disappear next month. I’m also going to keep looking at business card sign-up bonus offers to see if any others compel me to apply.

How are your credit card apps going? Have you been the victim of Amex’s pop-up box on a new card application?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

@Nancy Have you been able to get out of the Amex penalty box?

If so, how much spend did it take? And did you place that spend across all your cards or just some cards?

Not sure whether to put spend on my Amex cards and applying in the fall or just focus on applying to business cards from other issuers until I get under 5/24 by early 2020.

@H I’m actually not sure if I’m out of the penalty box because I haven’t applied for any new Amex cards. I put a couple hundred dollars of spend on one card (I only have 2 Amex cards right now). Just a few days ago I was invited to upgrade one of my Hilton cards to Aspire for 150k bonus. I’m not sure if this means I’m out of the doghouse or not. If you really want an Amex card, I would try charging a few hundred dollars on a current card and then waiting a couple of months. I wish we could better predict Amex’s approvals. Good luck!

My wife has had a BCE for a few years, and I got the ED (the card, not uhh… yeah) a few months ago. I added her as an AU.

Now, a few months later, she checked her pre-qualified offers and found the ED listed there as well. I tried to refer her, and she tried 3 different applications – ED, EDP, and Cash Magnet. Pop-up on all. Then she tried clicking through to the pre-qualified offer (no referral) and still got the pop-up. In the end, we said “screw it” and she opened the Gold instead (targeted 50k offer). She has a respectable (for an Amex quasi-charge card) 20.24% APR on the Gold, with a 700 credit score. My ED APR is 22.24%, with a 740 credit score, lower credit utilization, and the same number of inquiries (2) on my report.

It could be that she charged a lot to the BCE in the 0% APR period, then paid half off and transferred the rest out at the end of that. Or that since then, she has been using it only sporadically to take advantage of an Amex Offer here and there (and always paying the balance in full). Or that she has an 18k limit on it, more than double the limit on any of her other cards.

@Nancy

Your right it is a tough enviornment, all the rules and restrictions…I had an Amex Gold and Delta Gold in the past. I beleive the reason I am getting the popup is I didnt wait for the annual fee to post before cancelling years back. Now all I have is the Green Biz card. I have put $1K of organic spend over the last 3 months with still no success. Not sure what else I can do, I dont like to use the Amex card as its only 1x on my purchases where I can use other cards that are much better… Amex…

@msturg29 Yeah, I wouldn’t put too much on your Green business card. I think all you can do is slow down and wait at this point.

@Nancy

This is a great post. I am in a similar situation, but have 20 months until either me or P2 go under 5/24. I get the dreaded Amex Pop-up for any good Amex card and was recently denied the green card…. Amex doesnt like me….

I have been pretty agressive myself with 9 cards since January and 4 within the last 30 days. I am getting instant denials, so probably need to slow down… but as you all know its addictive.

I am trying to decide if I want to slow down and in 6 months go for biz only every 6 months until I get under 5/24 or slow down and get whatever is the best SUB not worrying about 5/24.

Some of the biz cards I have been eyeing is Amex (if I can avoid the popup ever), more Citi AA (Mailer if I can find em with no 24 mo language), BoA has some good cashback and Alaska Airline biz cards, and now the US Bank Biz that I wasnt aware of….

Any advice for me?

Let me know if you have any questions as Ill share what I know.

@msturg29 This is a tough decision. 20 months is a long time to wait to go below 5/24. If I were you, I would definitely slow down and try to get on Amex’s good side again IF there are several good Amex cards you haven’t already have. Do you have any Amex cards right now? Try putting more spending on those. Even BoA and US Bank are sensitive to a lot of recent inquiries. Citi seems to be the most lenient for approvals right now. My last new card was through a Citi snail mail targeted offer. I would wait 2-3 months before applying again for any card, and then try testing the waters. It’s such a tough approval environment right now, unfortunately. Keep me posted!

Thank you @Nancy and @project. After a year of Ink Business Preferred could I downgrade to the Business Cash? or should I just try to apply later for the Business Cash to get the bonus when I’m under 5/24 again?

@Stephanie You could downgrade it to the Business Cash after a year with a phone call. As long as you still have the CSR, you can transfer the “cash” points to UR. Or, you could apply for the Business Cash for the bonus at another time when you’re under 5/24 since it’s considered a different product from the Business Preferred. Oh, I wish I was under 5/24!

I didn’t realize I was close to being under 5/24 until I read this. Question — I have a large purchase coming up this summer…should I apply for the Chase Ink Business Preferred? I’m not really interested in the benefits as I have the CSR…I would benefit from the Ink Business Cash credit card’s categories but it’s only 50,000 points. Just need a 2nd opinion. Thanks!

Why not the Ink Business Preferred? $95 annual fee, but the bonus is 80k UR points. That’s worth at minimum $700 more than the Ink Cash bonus

Whoops… read your post too fast. Yes, I’d get the Biz Preferred.

@Stephanie I would get the Business Preferred over the Business Cash because of the 80k points. The only way the Business Cash would be better is if you plan to keep it a long time and do manufactured spending (or heavy real spending) in those 5X categories. But even then, it would take awhile to earn the difference back from the lower sign-up bonus, and the Business Preferred still has 3X in those categories.