As most of you know, Marriott’s takeover of SPG brand brought a number of new changes to the program as well as to lineup of SPG co-branded credit cards. For those of you who don’t follow major blogs, here is an email from Amex rep, outlining the latest enhancements:

<

p dir=”ltr”>”New Card Names – Starting February 13, 2019

-

The Starwood Preferred Guest® American Express Luxury Card will now be called the Marriott Bonvoy Brilliant™ American Express® Card.

-

The Starwood Preferred Guest® Credit Card from American Express will now be called the Marriott Bonvoy™ American Express® Card.

-

The Starwood Preferred Guest® Business Credit Card from American Express will now be called the Marriott Bonvoy Business™ American Express® Card.

New Card Benefits

In addition to the current benefits, more benefits will be rolled out this year to further reward and enhance Card Members’ travel experiences:

-

Elite Night Credits: As of January 1, 2019, all Cards within the Marriott Bonvoy American Express cobrand Card portfolio will offer Card Members 15 Elite Night credits per year to help reach the next level of Marriott Bonvoy status even faster.

-

Limit one 15 Elite Night Credit per Marriott Bonvoy member account; benefit is not exclusive to Cards offered by American Express

-

-

$100 Property Credit: Starting March 28, 2019, Marriott Bonvoy Brilliant™ American Express® Card Members can get up to $100 in property credits per stay when they use their Card and a special rate code to book 2+ night stays at The Ritz-Carlton® or St. Regis®.

-

Additional Free Night Award: Starting March 28, 2019, Marriott Bonvoy Business™ American Express® Card Members can get an additional free night award (valued at up to 35,000 points) when they spend $60,000 or more annually on the Card. With the new enhancements to the Marriott Bonvoy Business™ American Express® Card, the Card’s annual fee will increase from $95 to $125 starting on March 28, 2019.

New Rich Offers

In celebration of the refreshed Marriott Bonvoy™ American Express® Card portfolio, we will be introducing rich offers for both new and existing Card Members.

-

100K welcome offers for Marriott Bonvoy Brilliant and Marriott Bonvoy Business Cards

-

Starting February 13, 2019 through April 24, 2019, eligible new Card Members who sign up for the Marriott Bonvoy Brilliant™ American Express® Card or Marriott Bonvoy Business™ American Express® Card can receive 100,000 points after they spend $5,000 in the first three months of Card Membership.

-

-

Points offer for existing Marriott Bonvoy Card Members

-

Starting on February 24, 2019, eligible existing Marriott Bonvoy™ American Express® Card Members can register to earn 25,000 points for every $25,000 in eligible purchases on the Card, up to four times for a maximum of 100,000 bonus points, based on the total amount of purchases starting from when the Card Member registers through the end of the year. Eligible Card Members will soon receive more information about this offer and how to register their Card.”

- See full press release here

-

My quick take on the announcement

I currently don’t have any SPG cards, so none of this affects me personally. But I’ve highlighted the parts that relate to travelers who don’t fall into “road warrior” or “high spender” category. So, obviously, the fact that the fee on business version of Amex SPG will go up to $125 is a bummer. I would be tempted to cancel the card.

At $95 it’s still somewhat compelling because you are getting an annual certificate good for any Marriott property that costs 35,000 points or less. Even a decent airport hotel will run you more than that when you factor in tax. With Marriott’s excellent footprint, it would be relatively easy to recoup the fee for those who take a few trips per year. But $125 is just too rich for my blood.

I always assume the worst when it comes to renewal certificates. As in, if my original plan doesn’t materialize and I have to burn the cert on a nearby property before it expires, would I be happy paying $125? I don’t think I would be, and I live in central Florida, with plethora of options just a short drive away. Obviously, those who travel constantly are in excellent position to maximize the certificate.

As far as Amex/Marriott justifying the increase in fee because they will now let you earn a second certificate after you spend $60k per year. To quote Ariana Grande: “Thank u, next.”

For those thinking about signing up for business version of Amex SPG, the best time to do so would be between February 13th and March 27th, even if the fee is initially waived. That way, you would have some leverage during the time of renewal. Perhaps you can get extra points as a retention benefit. This bonus is only available to those who never had the card before, and who Amex finds worthy based on their own proprietary formula.

Last call for personal version of Starwood Preferred Guest (SPG) Amex card

This, in my opinion, is the most important news item of all. After February 12th, personal version of Amex SPG will no longer be available to new applicants. If you’ve been in this hobby for a few years, you probably already had or currently have this card. Reportedly, Amex “forgets” that you previously had it after 7 years or so, but you can’t count on it.

If you never had it before, I definitely think you should consider picking it up while you still can. Why? There are two reasons:

1. The sign-up bonus

This is the case of “use it or lose it”. Any time a card will be discontinued or no longer available for new applications, it’s prudent to at least look into it. It doesn’t mean that you should jump on every card out there, but Amex SPG isn’t just any card. Sure, the bonus was higher in the past but once again, it’s not like you have a choice unless you invent a time machine.

Here is the current bonus structure:

- Earn 75,000 Bonus Points after you use your new Card to make $3,000 in purchases within the first 3 months.

- Earn 6 points for each dollar of eligible purchases at participating SPG® and Marriott Rewards® hotels and 2 points on all other eligible purchases.

- No Foreign Transaction Fees on International purchases.

- Receive 1 Free Night Award every year after your Card account anniversary. Award can be used for one night (redemption level at or under 35,000 points) at a participating hotel. Select hotels have resort fees.

- Enjoy complimentary, unlimited Boingo Wi-Fi on up to four devices at more than 1,000,000 Boingo hotspots worldwide. Enrollment required.

- $0 introductory annual fee for the first year, then $95.

I speculatively value Marriott points at 0.5 cents apiece, and would pay more under unique circumstances. So, using that logic, the bonus is worth at least $375 and that’s a very conservative number. What can you do with Marriott points? Redeem them on Marriott hotels, of course, and there are quite a few out there. Marriott points will come in handy during road trips due to excellent footprint.

You can also transfer Marriott points to miles via 3:1 ratio, plus you get an extra 5,000 miles for each 60,000 points transfer. Points transfer to Alaska and American programs, something that is unique to Marriott. Keep in mind that transfer can take weeks, so it’s only a good option for topping off account when you have a specific award in mind. Not too long ago there was a promo where you could transfer Marriott points to United program and get 0.6 miles per point. That’s a great deal and I personally would be tempted to take advantage of it.

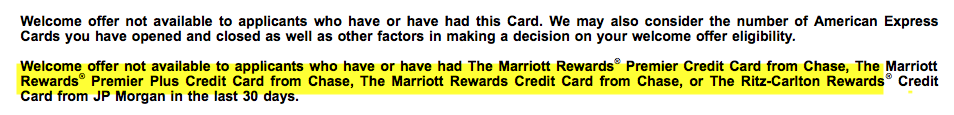

My point is, Marriott currency is valuable enough to collect speculatively. So even if you don’t have any plans for it right now, you shouldn’t automatically dismiss the offer. Do keep in mind this restriction:

2. Renewal certificate

At each renewal, you will get a certificate good for any property that costs up to 35k points per night. It expires in 12 months. Personally, I wouldn’t sign up for the card just for this benefit alone unless I was running out of options. To me, it’s a nice extra, not a game changer. Plus, as I’ve said earlier, there is always a risk of not maximizing this perk the way you originally intended. You may get more than $95 in value but you may not, especially if you don’t travel frequently.

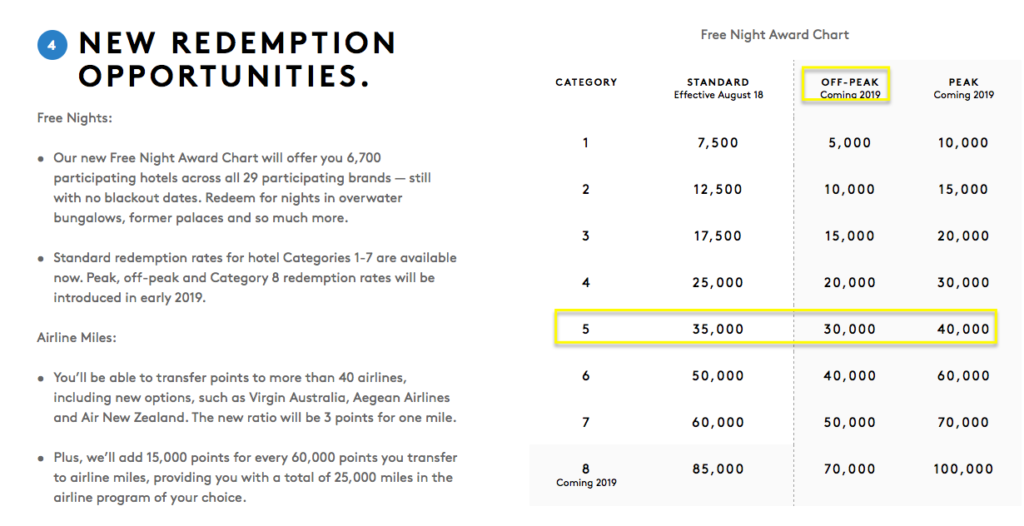

Categories shift each year, so it’s hard to predict how valuable this perk will be in the future. Plus, keep in mind that starting sometime in March, you will only be able to use it during off-peak dates:

Marriott has made it difficult to see award rates sorted by category, but you can find prices for individual hotels on this page

Right now, there are quite a few nice properties that are eligible for renewal certificate. Sheraton Sand Key (costs 35,000 points per night) is just one example. Nancy and her family vacationed here during spring break, and everyone enjoyed it. See her trip report At $95 per night all-in, it’s definitely hard to beat, even during low season. If you are heading to Clearwater area in the spring, this is a good place to use points as well.

When it comes to annual certificate benefit, I would say the closest competitors are IHG Rewards Club Premier credit card and The Hyatt credit card. You can see full details on this page

IHG card vs. SPG card:

Similar footprint, the same annual fee, but Marriott is more consistent when it comes to quality. Due to latest IHG devaluations, the SPG certificate will probably get you a better property.

Hyatt card vs. SPG card:

Due to merger with Marriott, Hyatt pales in comparison when it comes to footprint; the annual fee on Hyatt card is the same; Category 4 Hyatt will most likely be preferable to Category 5 Marriott for most folks.

I think comparing the cards is sort of like comparing apples and oranges. It really depends on your preferences and travel patterns. I have the old version of IHG card that comes with $49 annual fee, so that would be the one I would hang on to.

So, the bottom line is: it’s a nice perk that may pay off in the future, but it shouldn’t be the primary reason for getting Amex SPG card.

Bottom line

The earth won’t stop spinning if you don’t apply for this card before February 12th. That said, Marriott points are very valuable and someday you may regret not jumping at this opportunity. As always, the choice is yours. If you do decide to apply, I hope you consider using one of our personal referral links.

My referral link for personal version of Amex SPG

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Hi Leana. I’m playing catch up again. My husband’s AmEx Biz SPG/Bonvoy just came up for renewal and I was surprised that they only billed us $95, as opposed to $125. But this post says fee was increasing on March 28th? Have there been updated terms? I’m sure I’ll stumble upon the answer as I read, but thought I’d mention in case I misunderstood something.

@Talchinsky I believe it only affects the cards that were approved after March 28th. That’s why you got a $95 fee. Next year it will be $125.

Turns out it didn’t matter, I have never had a SPG or marriott card. Got the dreaded Amex pop-up that I would not get the bonus based on past history of bonuses. Too bad, guess I’ll just see how long that lasts and try again months from now.

@Jason I’m sorry to hear it! Amex is picky with some of their cards. You may want to consider getting a business version of Chase Marriott Card if you have a side gig of some sort. This card will also be discontinued soon. I saw a recent report on Doctor of Credit blog that it may not be subject to 5/25 restriction. No guarantees, of course.

Thanks for the suggestion. I did get an approval on that, it was a painful 45 min call to recon, where they nitpicked my income numbers and generally looked for any reason to deny it, I’m 9/24, so it definitely isn’t subject (in my experience).

P.S. See this post https://rapidtravelchai.boardingarea.com/last-call-chase-marriott-business-credit-card/

I hate to get caught up in the lemming category, but… All the blogs are screaming about last chance. I sat out the Ritz card. Our family has two IHG and Hyatt cards (so four free nights).

One of us has never had the SPG or any of the Marriott cards. Is getting the SPG personal card right now of any benefit? By that I mean, am I missing out if we wait for a higher bonus?

From my understanding, if I get the SPG it is not possible to get another SPG or Marriott bonus for 7+ years from Amex.

@Jason First, let me say that I completely understand your skepticism. I rarely do “last chance” posts unless, well, it’s really last chance. I’ve done it for Merrill+ card when it was being discontinued, and it didn’t pay me a cent in commission. Ditto for Ritz card. I don’t play games with readers.

To address your question. As I’ve said in the post, I absolutely would not apply for personal SPG card just for the certificate. You already get four certs each year, so the value would be marginal at best unless you are on the road constantly. The main reason for applying is to get the sign-up bonus while you still can. I’m sure you are familiar with Marriott currency and are aware that it’s quite valuable. Is it the most valuable out there? Well, no. But the fact that Marriott has a large footprint and points transfer to miles via favorable ratio would motivate me to apply. Alas, both me and my husband got this card a few years ago.

As far as getting a bonus on Chase Marriott card, you are correct, there will be some restrictions. But the fact remains that you should be able to get the bonus on it eventually. Not so with personal Amex SPG.

Also, here are the terms on Chase Marriott card:

“Eligibility for the new cardmember bonus: The bonus is not available to you if you:

are a current cardmember, or were a previous cardmember within the last 30 days, of The Starwood Preferred Guest® Credit Card from American Express;

are a current or previous cardmember of either The Starwood Preferred Guest® Business Credit Card from American Express or the Starwood Preferred Guest® American Express Luxury Card, and received a new cardmember bonus or upgrade bonus in the last 24 months; or

applied and were approved for The Starwood Preferred Guest® Business Credit Card from American Express or the Starwood Preferred Guest® American Express Luxury Card within the last 90 days.”

So, if you cancel your Amex SPG card, you will presumably be eligible for bonus after 30 days. It should not preclude you from getting a bonus on Amex Bonvoy cards. There is no “family” restriction right now, though they may implement one in the future.

There is opportunity cost in applying for Amex SPG, but there is a cost in NOT applying as well. Like I said at the end of the post, if you don’t get it, it’s certainly not the end of the world.

Thank you for your very thoughtful reply. Since I’m over 5/24 my thought was to grab the 75k points while I can My hesitation was in regards to being ineligible for future marriott bonuses. It sounds like that won’t be an issue. Thank you for clearing that up for me.

You are certainly correct in regards to the four certificates, we took an unwanted trip last year to use the Hyatt certificates, so we didn’t lose the $.

Thank you. That’s what I thought but I wasn’t sure!

Forgive me for being slow today. I’m just not processing this news. My husband and I have both had the Amex SPG card. I still have mine. With this announcement, could we now get the new cards with new sign up bonuses when they come out?

@Michelle You are not slow at all! 😉 The short answer: most likely not. This is a refresh of the existing SPG products. Basically a new name, fee goes up on business card and so on. Most likely, the terms will indicate this restriction. Of course, anything is possible.