There is no question that this hobby has seen its share of negative changes over the last few years. It looks all but certain that 5/24 rule has recently expanded to all of Chase credit cards, yet another blow for miles and points enthusiasts.

But does it mean that there are no longer any options out there for “parasites” like myself? Not at all. As I’ve detailed in my post Is miles and points hobby truly dead for old-timers?, lucrative opportunities are still out there. You just have to adjust your expectations and work harder in order to find them. Enter Terps Visa, aka my latest conquest.

Non-affiliate application link

Why I applied

This card was mentioned on DoC blog few months ago, though somehow I missed it. Well, the other day I was browsing the internet and came across Terps Visa. Terps what?! Quick Google search yielded this result:

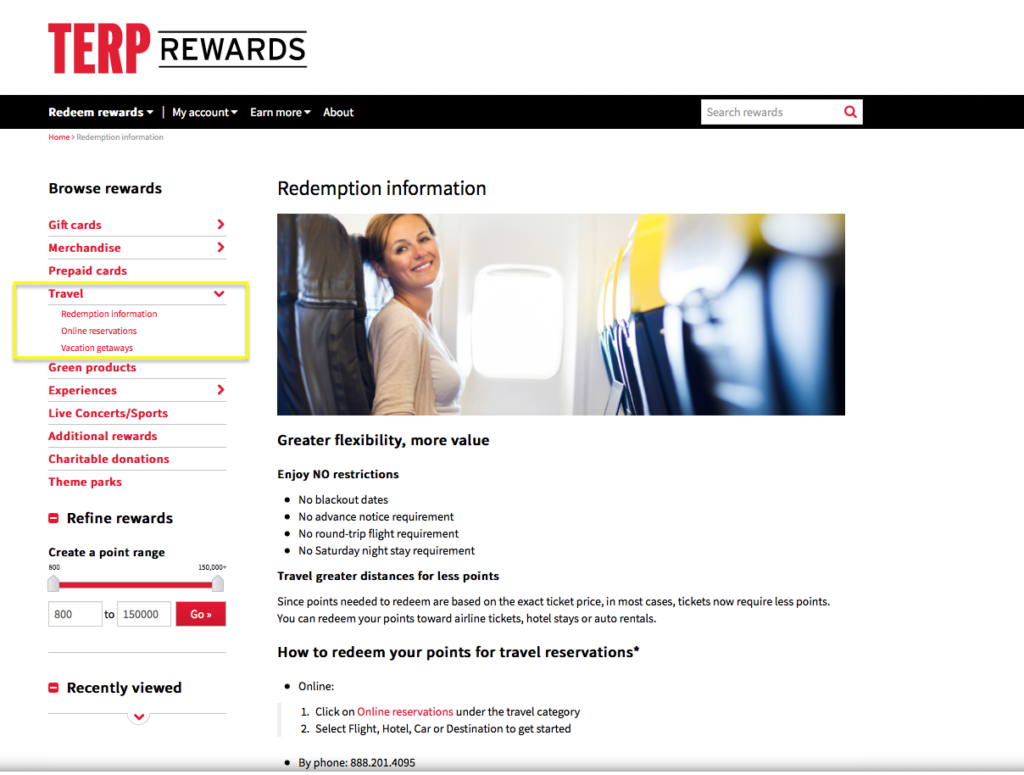

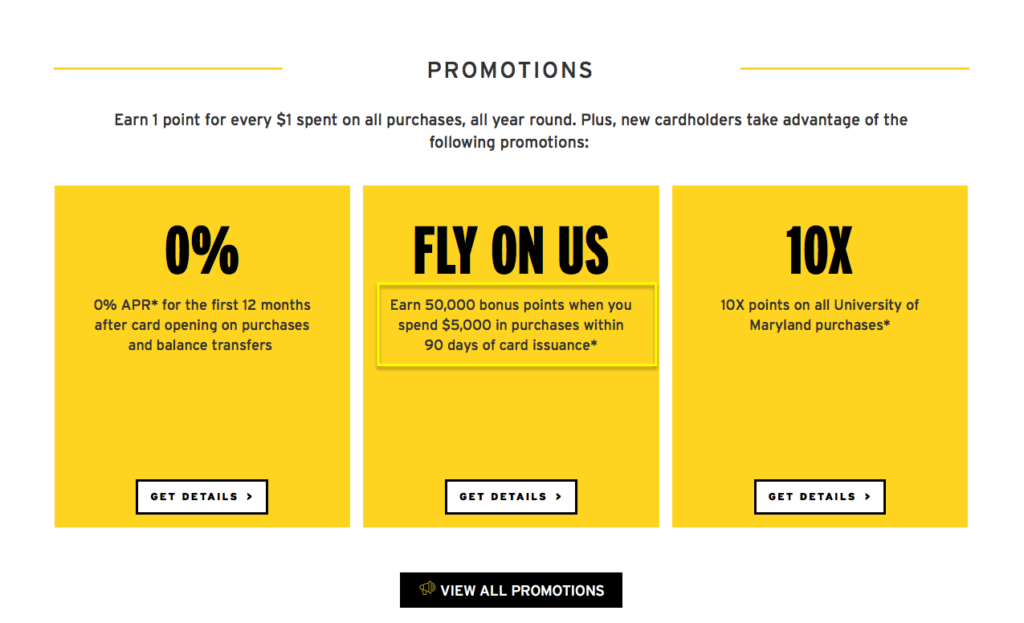

Hmm, are rewards given in marijuana supplies? If so, I’m not interested. Fortunately, the card has a totally benign rewards structure, and “terps” is a short name for University of Maryland alumni. But anyone can apply, and no credit union membership is necessary. The application page specifically says “for UoM graduates and fans”. And I’m certainly a fan of getting 50,000 points in exchange for one credit pull. There is also no annual fee, so no need to cancel the card down the road.

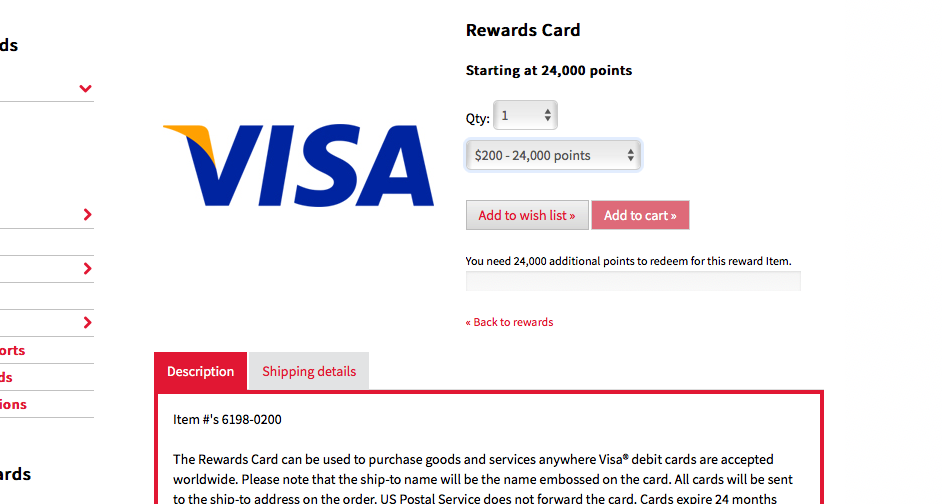

But how much are the points worth exactly? Fortunately, quite a bit. If you spend $5,000, you will have a total of 55,000 points. As DoC post brings out, you can redeem 48,000 points towards two $200 Visa gift cards.

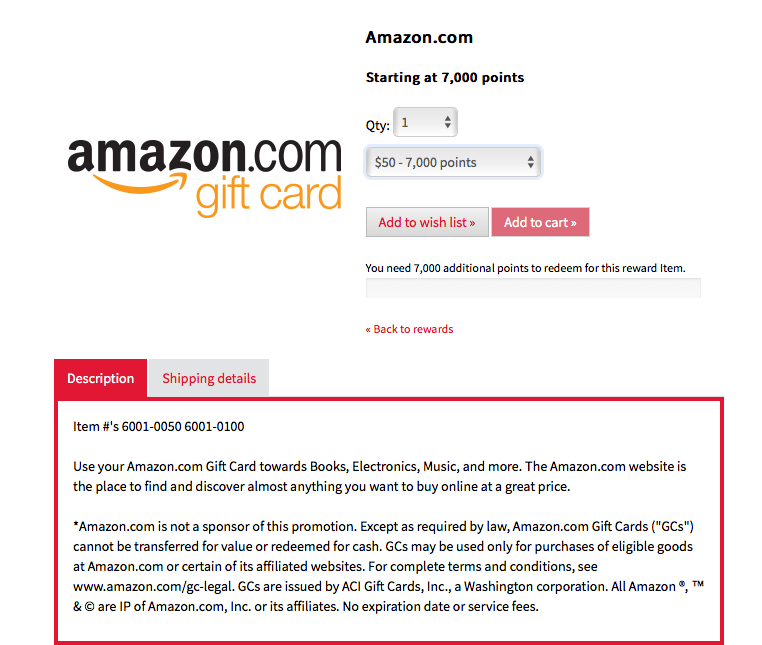

The remaining 8,000 points can be used on a $50 Amazon gift card:

The credit card earns 10x points on all University of Maryland purchases and 1x point on everything else. If you factor in lost opportunity cost of $100 earnings on a 2% card like Citi Double Cash, it means getting a profit of $350. I’m definitely interested. I went ahead and applied, but got a pending status.

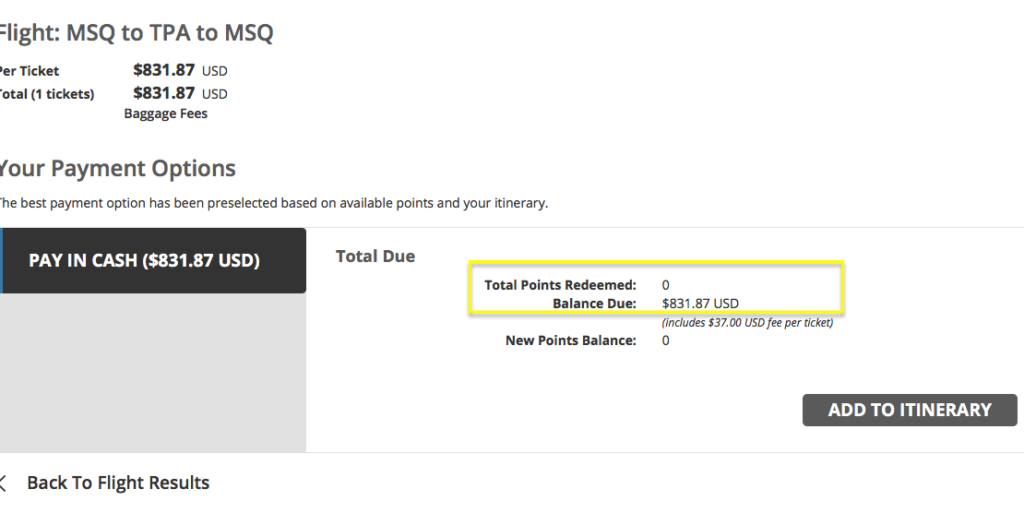

After a few days I got notification that the card was approved. Obviously, YMMV. But bottom line is: if I can get approved, your chances are probably excellent as well. And getting $350 profit is nothing to sneeze at these days. But apparently it gets better. One of DoC commenters has mentioned that the points are worth around 1.1 cents towards flights after you deduct the booking fee of $37.

I can’t vouch for that because I currently don’t have any points in my account. I’m looking to cover my parents’ tickets from Belarus to US, and they usually run at $700-$850 per person. What I’m mostly interested in is whether they will let me use points towards a partial payment and credit card for the rest. It appears the answer is yes, but I’m not 100% sure.

I can’t vouch for that because I currently don’t have any points in my account. I’m looking to cover my parents’ tickets from Belarus to US, and they usually run at $700-$850 per person. What I’m mostly interested in is whether they will let me use points towards a partial payment and credit card for the rest. It appears the answer is yes, but I’m not 100% sure.

If all goes well, perhaps I can redeem 55,000 points towards $600 or so in airfare, and use credit card for the remainder of the cost. This would be preferable to getting $450 in gift cards. Originally, I was looking at converting Chase Freedom to Chase Sapphire Preferred in order to transfer UR points to United. But Terps Visa bonus may be a better way to go about covering my dad’s flights.

It appears that you can also use points toward hotels, car rentals and even cruises. Again, I’m not 100% certain whether you will get an uplift on points just like you do on flights. I imagine you do.

So, the worst case scenario, I will get $450 in valuable gift cards. Best case scenario: I will be able to mostly cover my dad’s ticket from Belarus to Florida.

I do have to spend $5,000 in 3 months, which is a significant amount. It doesn’t help that they took their sweet time mailing the card. Still, all in all, this is a pretty nice return on spending. Plus, beggars can’t be choosers. If I have to, I will simply prepay my power bill in order to reach the threshold.

You should have seen my husband’s face when I handed him the card. It has a turtle on it, and says “University of Maryland” at the top. He was shaking his head and rolling his eyes at the same time. But he did put it in his wallet as he was trained to do a long time ago. 🙂

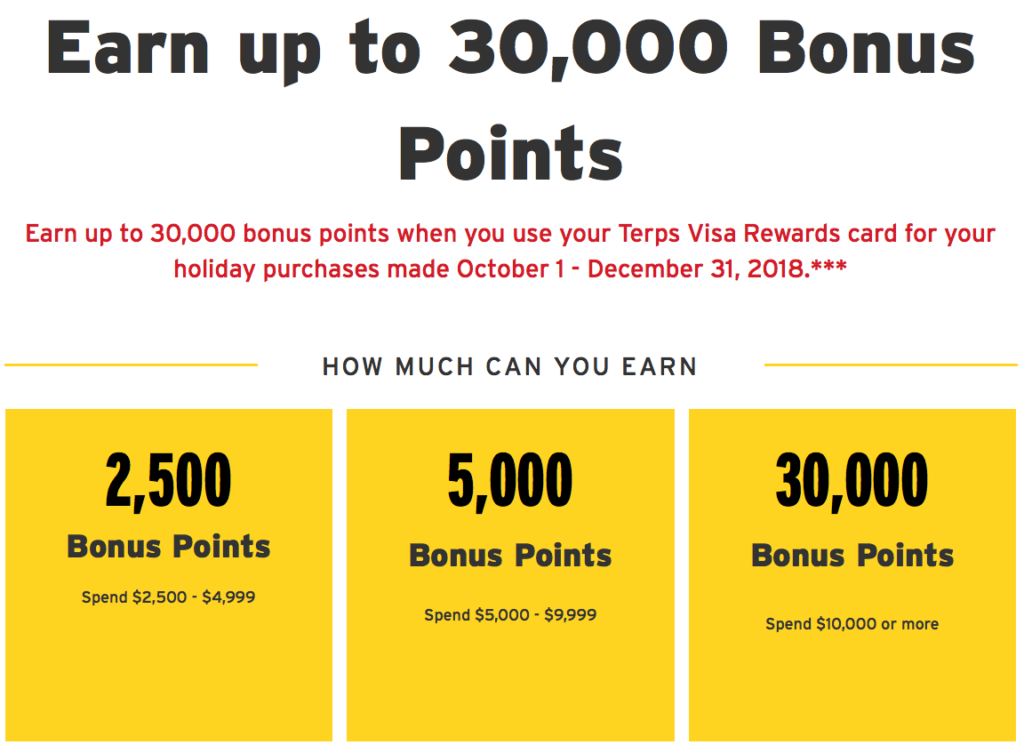

Incidentally, there is currently a promotion that may sweeten the deal further:

I might be able to get the extra 2,500 points bonus. Not a game changer, but it’s something.

Non-affiliate application link

Other obscure offers to consider:

1) Wells Fargo Propel World: worth $500, factoring in $100 airline incidentals credit. Related post

2) PNC Traveler Premier card: worth $300 in travel rebates. Only available to residents of certain states. Related post

3) Star Trek Visa (oh yes, it’s real): worth $300, though the bonus was higher in the past. Non-affiliate link

Aaand more, so keep digging.

Bottom line

If you are relatively new to miles and points hobby, your best bet is to focus on Chase cards first. Seriously, forget other issuers (for now). This is especially important due to recent 5/24 rule expansion. I also recommend not just focusing on the sign-up bonus, but giving some thought to what Chase cards you want to hang onto in the long run.

Once you are “done” with Chase, move on to other major banks like Capital One, Amex, Citi and Barclays. When they no longer want you, it’s time to apply for a turtle or Star Trek credit card. Live long and prosper!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Hi Leana,

How long did it take for the 50k pts to show up once you met the spend and the statement closed?

Thanks

@Bill The Points showed up on the following statement, so it took about a month and a half after meeting the spend for me to get the bonus.

Thanks Leana!

I think I just became a fan of the University of Maryland! LOL I will put this on our list of “maybes” for future applications.

@Nancy It’s definitely a decent offer as long as they don’t devalue redemptions.

Hmmm. I’ll have to think hard about this one! I was planning to try and sign up for the Capital One Savor this week, but to be able to get almost the same return ($450 v. $500) with a hard pull on only one agency as opposed to all 3 is very attractive!

@Doug This is a tough one. Here are my 2 cents, whatever they are worth. If you can get approved for Savor card, I would pick that offer over Terps Visa. And I’m not just saying it because it pays us commission.

There are several factors in play here. First, as you said, the bonus on Savor card is richer because you are getting $500, plus the points earned from minimum spending. Speaking of, the minimum spend is lower ($3,000 vs. $5,000 on Terps card) and there are bonus categories. Terps card will earn you only 1 point per dollar, unless it’s UoM purchases.

Yes, there are 3 hard pulls to take into account. But unless you are like me, as in apply for cards constantly, it’s not as big of a factor. Most banks these days mostly look at the number of opened accounts, with Chase starting the whole trend.

Capital One will not approve me, and I’ve tried multiple times. If I felt there was a chance, I would probably pick Savor card. Better yet, I would go for 75k points offer on Venture Rewards. As always, it’s your call. Capital One is a tough nut to crack, so if they are willing to approve you, I would go for it.

Hilarious!

@Talchinsky Glad you enjoyed!

@Leana. Oh yes! Especially this line: “I’m certainly a fan of getting 50,000 points” Well I guess you qualify! Hahaha!

Thought about this but have read mixed reports of approvals. How many new accounts do you have in the last 12 months?

@Projectx This may sound crazy, but I’m not sure. I’m at LOL/24, that I know. They pulled Transunion, which doesn’t get a lot of action in my state. As I always say, the only way to know for sure is to actually apply. Only you can decide if it’s worth an extra ding on your credit. It was for me.

The bonus is certainly worth the ding on my CR. Just a matter of whether or not it will be approved. I hate denials.

That’s completely understandable. I saw that quite a few people got denied. Not sure what the criteria is, but they can’t be too picky if I got approved.

Finally applied… Approved! 6/12, 8 hard pulls in the same time frame.

Here’s a similar card to consider from UofI

https://uoficreditunion.org/uic-credit-card-promotions/

Congrats!

Wow – this is a fantastic tip!! Thank you 😉

@Army Glad it was helpful! This isn’t the most lucrative offer, obviously, but nothing to sneeze at either.

$400 in Visa cards are awesome – especially for us since we are currently in Da Nang, Vietnam and our monthly “rent” at a hotel (w/all utilities included) is around $500. *thumbs up!!*

Ha ha, Leana! Great post.

Happy holidays!

@Audrey Thanks for reading!