One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

Reposting this information since the annual fee on Barclaycard Arrival Plus World Elite MasterCard is now waived and the bonus is 70,000 points. I imagine this was done in response to the increased 75,000 points offer on Capital One Venture Rewards Card (find non-affiliate link in our Hot Deals page). If you’ve recently signed up for Arrival Plus card, make sure to contact Barclays and request that they match it.

Here are the key details on this product:

1) Get 70,000 bonus miles after spending $5,000 within the first ninety (90) days of account open date.

2) The card earns 2 miles (points) per dollar.

3) Miles can not be transferred to airline programs.

4) You can redeem 70,000 points towards $700 in travel expenses.

5) You have to redeem at least 10,000 points at a time, so the travel purchase has to be $100 or more. You can redeem miles toward statement credit, but value is cut in half, so you want to avoid that option if at all possible.

6) You still get 5% rebate on redemptions.

7) The annual fee of $89 is now waived.

The card pays us commission. Thanks if you choose to support the blog! (See How This Blog Makes Money)

Is the card worth getting?

Absolutely! You can basically get a profit of $700, assuming you plan to pay cash for travel anyway. And I’m not even taking into account the 5% rebate which will sweeten the deal further. The minimum spending requirement is a bit high (it used to be $3,000), but it’s definitely within reach of most normal families. I know that between groceries, power bill, gas and everything else, we can easily put $1,666 on credit cards each month.

For majority of folks, this card will not be worth renewing. You’ll have to charge a small fortune on it each year to justify $89 fee, when taking into account 5% rebate on redemptions. Most folks will do better with Citi Double Cash or one of my other “keepers” on the list

How easy is it to get approved?

Not easy at all if you are like me. Barclays is usually pretty tough on approvals, especially for those who like to switch cards on a regular basis. All the recent data suggests that Barclays has now implemented an unofficial 6/24 rule. It works the same way as Chase 5/24 rule.

What it means is if you got 6 or more new cards from any bank in the last 24 months, you will be automatically denied. The rule is not set in stone, but latest data points suggest that it recently started affecting co-branded cards like Wyndham Visa Signature I wrote about yesterday.

Will you get the bonus if you had Arrival Plus before?

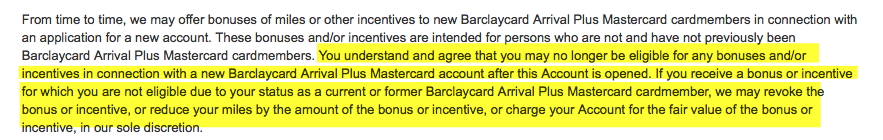

In the past you could receive the sign-up bonus multiple times without any restrictions (aside from 6/24 rule). However, take a look at this new verbiage on Arrival Plus application:

I don’t remember seeing it before and I’m not aware of any other blog mentioning it. Basically, it means that Barclays may claw back the bonus AFTER you receive it or may even charge you for it after you redeem the points. This is a new development and a sign that like American Express, Barclays is on a mission to weed out the deadbeats.

I’ve had Arrival Plus before (few times actually), so this new verbiage gives me pause. I think I’m going to sit this one out.

How to increase your chances of approval

We don’t know the exact criteria Barclays uses, aside from the fact that they don’t like to see multiple recent inquiries and accounts. However, we do know that putting a lot of spending on your existing Barclay cards before applying for new one seems to increase your odds of approval.

Also, reducing your existing credit lines may be prudent because Barclays is a conservative bank and doesn’t like to extend too much credit. I also think that closing all of your existing Barclay cards first can improve your chances. I’ve been following this thread on Reddit and it seems that most “6/24” people who got approved for Arrival Plus are those who didn’t have any opened Barclays accounts at the time.

Perhaps it’s a coincidence, but I doubt it. I truly believe that having existing accounts invites more scrutiny, as in “fresh meat” is likely to slip through the cracks. But once again, nobody knows for sure, so the only thing you can do is try.

Bottom line

This isn’t the most lucrative bonus on the market, but it’s nothing to sneeze at either. I do think that folks who are new to miles and points hobby will do better to concentrate on certain Chase cards first.

If you’ve already applied for those, then Arrival Plus is worth considering, especially if you don’t currently have any Barclay cards in your wallet. Just keep in mind the fact that you may not get the bonus (or get it clawed back) if you had this card before.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

[…] cash and erase the expense with points from cards like the Capital One Venture Rewards card or the Barclaycard Arrival Plus. See our Hot Deals page for more information on these […]