As I’m sure you’ve heard by now, Amex has recently decided to revamp their personal Gold credit card and make some enhancements. Don’t get me wrong, the changes are most definitely positive. But once again, American Express has decided to take convoluted approach, rather than simplify and streamline the benefits.

Sure, miles and points enthusiasts will find a way to squeeze as much value as possible out of recent enhancements. A regular person will take one look at the current structure and move on to Chase Sapphire Preferred or Reserve. People are busy and don’t have time to figure out all the loopholes, err… benefits.

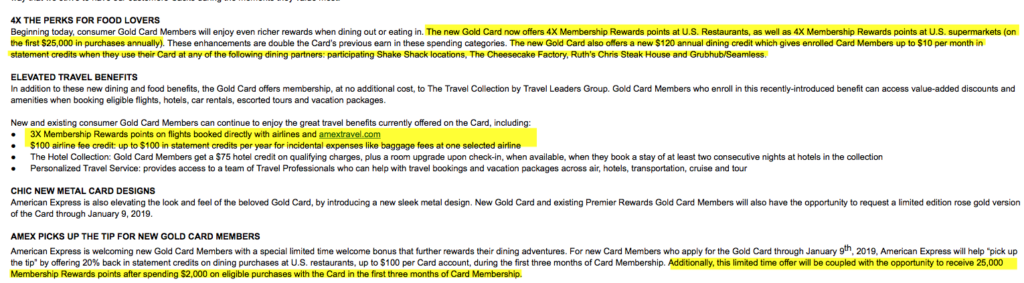

Here is a screenshot of the email I got from Amex rep, touting recent changes (click on it if you want to make it larger):

<

p dir=”ltr”>The new Gold Card now has an annual fee of $250, up from the Premier Reward Gold Card’s previous fee of $195. The new fee will go into effect for current Premier Rewards Gold Card Members beginning April 1, 2019 on their account renewal date.

The $55 difference appears to be more than justified when you look at the added perks. And I have no doubt that those who do manufactured spending can benefit greatly from 4X points on grocery stores, as long as they can buy Visa gift cards in-store and liquidate them later. For the rest of us “renew vs. cancel” question isn’t as easy to answer.

Earlier in the year my husband was approved for 50k points offer on the old version of Amex Rewards Gold. We will have to either renew or cancel this card by the end of February of 2019. When I applied, there was no question in my mind that the card will be axed before renewal fee posts, and this new development hasn’t changed anything.

Here is why:

1) Getting 4 points on restaurants and groceries is nice. However, most of my spending goes towards new sign-up bonuses. In addition, I have several cards that already offer 5 points in these categories at certain times of year. There is Chase Freedom, US Bank Cash Plus and Discover IT. For the most part, this benefit is redundant, at least for me.

Also, I tend to buy restaurant and grocery store gift cards from third-party resellers. I stick to small amounts, of course, and usually get them at 6-10% off. I also use the cards where I have to meet minimum spending requirements, thereby killing two birds with one stone. Read my post Here is why 5% bonus categories are overrated for more on this topic.

I’ve said before that if you are a low-spender and don’t engage in MS, the rewards you will earn via everyday spending will probably amount to peanuts. Not always, of course, but as a general rule.

2) We don’t live near Cheesecake Factory or any other restaurants where you will get $10 per month credit. There is a possibility to buy a gift card inside if we are in the vicinity, I suppose, but I seriously doubt I would take advantage of this benefit a whole lot. If you eat at those places on a regular basis, it’s a different story. YMMV

3) You can order this card in pretty rose color. And?!

So, to summarize, this will be an exciting product for MSers, perk maximizers and those who love rose color. The $100 airline incidentals calendar year credit stays, and for now can be used for airline gift cards. Can one potentially turn a profit on Amex Gold, even when factoring the annual fee? Absolutely. Will an average person bother to jump through all the hoops? I doubt it.

What Amex should have done instead

As I’ve said, a certain segment of population is very excited about the changes and for a good reason. But Amex will not make profit on those folks, I can guarantee it. Our brethren will eat out at a Cheesecake Factory once a month, spending exactly $10. They will also make sure to buy $100 in airline gift cards each year. Last but not least, they will spend exactly $25,000 each year on Visa gift cards in grocery stores in order to replenish their Membership Rewards balance.

What Amex should have done instead was make Gold product into a CSP/CSR hybrid. The biggest problem with Chase Sapphire Reserve is its huge $450 annual fee, a turn-off for regular folks. The problem with Chase Sapphire Preferred, on the other hand, is lack of travel benefits like Priority Pass access.

I would do three things to make Gold card more appealing to general population:

1) Add a meaningful travel insurance. Getting 3 MR points on airfare is pretty good, but people will probably pick Chase Sapphire Reserve or Preferred when given a choice. It’s about simplicity, and having one card that rules them all.

2) Add 12 Priority Pass entries, similar to what’s offered on Hilton Ascend card. Adding an unlimited number of entries would probably cannibalize the benefit on Platinum card, so this would be a decent compromise. Most families of four who fly once or twice per year will only need 12 passes to cover their needs.

Another thing they should have considered is adding a few passes to Centurion lounges. Now that would be intriguing to those who are put off by Platinum annual fee.

3) Keep the fee at $195 and make $100 incidentals credit valid for any travel related expenses.

If they did all that and offer 3 points on travel, groceries and restaurants (instead of 4), I believe it would make the card compelling enough to stand out from the competition. Then again, I’m sure Amex folks have done tons of research and decided that bribing people with Cheesecake Factory credit is the way to go. Time will tell, I guess.

Should you apply for Amex Gold card if you’ve never had it before?

If you can pull up a 50k points offer with a waived fee, sure. That’s the one I’ve applied for back in February. Try it in incognito mode and check CardMatch tool (your credit will not be pulled). . My personal referral link

If you do apply, you will have a whole year to decide whether to renew this card. Membership Rewards points are extremely valuable, as well as versatile, no doubt about that. But I don’t think Amex will get the desired result from this particular overhaul.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I’ve heard a fewer others suggest the Cheesecake Factory GC. Amex can pull Level 3 Data (itemized receipt).

But under the “learn more” button on your dashboard:

Good to Know

This benefit doesn’t offer statement credits for gift card or merchandise purchases.

Eligible purchases made by both the Basic and any Additional Card Members are covered. However, statement credits for eligible purchases can’t exceed $10 on the Card Account per month, for a total of $120 per calendar year.

Read below for other important terms and conditions.

@Youno Me That’s a good point. I imagine that in reality the credit will post without issues anyway. However, there is always a chance of clawbacks, and I wouldn’t put it past Amex to be petty enough to go after ten bucks! 🙂

My complaint is that these bonus categories are limited to the US. Why bother advertising no FX fees if you can’t get bonus spend on foreign restaurants? That’s just silly.

@Clegmir I agree! That’s the thing with Amex. They make improvements, but don’t go quite far enough.