I absolutely hate annual fees, and it takes a lot to convince me to hang on to premium card past the sign-up bonus. That said, I pay quite a bit of $ each year to renew certain products, and regularly re-evaluate whether the benefits are still worth our hard-earned money. They better be.

But before I get to name my “keepers,” behold the most overrated (for normal people) card:

Amex Platinum ($550 fee)

First, can we just stop for a minute to reflect on the irony of paying $550 annual fee in a hobby that promises free travel? Don’t get me wrong, if you pull up a 100k sign-up offer with $3k minimum spending requirements via CardMatch tool or incognito mode, you should totally jump on it.

I’ve seen some bloggers cite the non-waived huge fee on this card (and it is huge) as a deal breaker. Hmm, at the very least, you can redeem 100k points on a $1,000 Home Depot gift card. It’s fine to question bonus value, but let’s not be ridiculous.

But what about renewing the card? If you are a middle-class person with a spouse and two kids, don’t reside in a metropolis, don’t fly somewhere every month, well… If you just paid $550 to renew Amex Platinum, may I interest you in a bridge? 🙂

Let me address three so-called selling points of the card:

1) The $200 credit on airline incidentals which works on gift cards (for now)

Update: this workaround no longer works as of July 2019.

If you’ve maxed out this credit for 2018 and have to pay the renewal fee now, what makes you so certain that the loophole will still be alive in 2019? Besides, even if it is, you are still stuck with airline gift cards which may not be easy to resell. What about using them for yourself? Wait, I’m confused, aren’t we in this hobby for free travel?

2) Unlimited Centurion lounge access, aka “Heaven on earth”

Here is the thing. Centurion lounges are nice, and I even had the privilege of visiting one during my brief ownership of Amex Platinum. It’s a pleasant refuge inside an airport, and my father-in-law was absolutely delighted by the complimentary clam chowder. He is the type of guy who still buys ramen noodles because he is cheap, so yeah, it was fun to see the grin on his face.

That said, many Centurion lounges have become victims of their own success. They are super crowded, and restrictions are being put in place to deal with zoo-like atmosphere. In addition, you can only bring two guests with you. What happens to the second kid or wife? Do you rotate Centurion lounge privileges?

One time we were connecting in Dallas and my children were running around in the free play area inside the terminal. I was planning to take a shuttle to the Centurion lounge (both me and my husband had Amex Platinum at the time), but they seemed to be having so much fun with other “commoner” kids.

My husband and I looked at each other and decided Nope. We weren’t that hungry and free massages didn’t seem all that appealing at the time. If it ain’t broke, don’t fix it. Besides, when you enter a lounge (any lounge) with little kids, other travelers look at you as if you are Satan. Doesn’t bother me, but my husband seems to care for some reason.

3) Uber credit

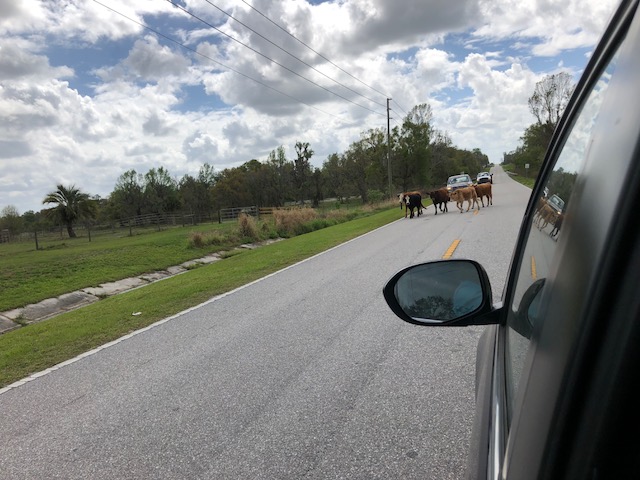

You get $15 free Uber credit per month, and $30 in December. I admit, it is a tangible benefit if you would pay cash anyway, and frequently visit the area where Uber operates. Needless to say, my county ain’t one of them:

<

p style=”text-align: center;”>Too many cows on the road may cause surge pricing

Also, while unlikely, what if Uber company folds next month? It could happen. Are you 100% sure that Amex will replace this benefit with something that is useful for your specific situation?

To be clear, I’m not saying that Amex Platinum isn’t a good fit for some people. It most certainly is! For high-wage frequent travelers who can easily maximize lounge access and all the other perks, it definitely makes sense to consider pre-paying $550. For families like mine, not so much. You can view all the benefits of Amex Platinum via this link

Got an extra $450 lying around? Look into Amex Hilton Aspire. Now that’s a premium card that is packed with value as long as you are anal-retentive. And let’s face it, who in our hobby isn’t? If you are a family of five, like to stay in Hilton resorts even once a year, and only need lounge access a few times, look into Amex Hilton Ascend.

Cards I currently renew

1) Chase IHG card X 2 (the old version with $49)

Why: free certificate upon renewal. My next cert will be valid at any IHG property, but will be capped at 40,000 points in the following years.

2) The Chase Hyatt card X 2 ($75 fee)

Why: free certificate upon renewal, valid at Category 1-4.

3) Wyndham Visa Signature card x 2 (discontinued version with $69 fee)

Why: my card gives 15,000 bonus points upon renewal. That amount will cover one night at any Wyndham property, including vacation resorts.

4) Chase Southwest Premier ($99 fee)

Why: it gives 6,000 points upon renewal, but the main reason is the ability to redeem points at 1 cent apiece towards gift cards. I will probably cancel the card next year, though. I think.

I did redeem some of my points on gift cards, but it’s painful for me. If Southwest ends up having decent prices to Hawaii, I’m hanging on to the rest of my stash. I want to take kids to Kauai and Big Island in the next few years.

Grand total: $485

In exchange, I get four nights’ worth of certificates that don’t expire for 12 months, enough points for two nights at a Wyndham resort, and 6,000 Rapid Rewards points good towards $85 in airfare or $60 Walmart gift card. I feel like I get very good value out of my hotel cards, mostly due to our central Florida location.

I have many nice nearby options for a weekend getaway, and the price per night can’t be beat. Occasionally, I even get to burn certificates on fancy hotels in expensive cities like San Francisco.

I should add that I’ve also renewed my Amex Hilton Ascend card in order to get free weekend cert, but don’t plan to hang on to it after this year. Just a reminder: the current increased offer will expire June 27th.

How hard is it to cancel cards?

This is something that makes some people really nervous. The thought of having to call to “break up” with a credit card company isn’t a pleasant one. Well, the good news is, most of the time you won’t have to. Here is a simple guide on canceling Chase, Citi, Amex and Barclays credit cards online. I was also able to cancel Wells Fargo and US Bank credit cards via message in my online profile with no issues.

You will have to call Bank of America, but it shouldn’t take more than 20 minutes, max. My sister-in-law is currently having the worst time reaching Banco Popular in order to cancel her Avianca Lifemiles credit card. That type of thing is an exception though, and I had no problem canceling my Lifemiles card via a quick phone call a few months ago.

Bottom line

If potential (reasonable) value of the card isn’t worth more than the annual fee, it’s time to let it go. It can be tempting to follow the crowd and drop $550 on Amex Platinum with a package of benefits that you would never buy a la carte. So be picky with your hard-earned money.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I know. One day somehow! As long as Delta stays in business, knock on wood!

So I kept my AmEx Biz Plat. It had a $450 AF. After the $200 on Delta gift cards (I’m from Mpls so makes sense for me); less $100 Global Entry (I fly long international flights with child and really like skipping long line); less $15

Uber (will use only once this year!); less retention bonus of MR points worth about $80…my AF if really $55.

I’ll take Centurion lounge access and Priority Pass for $55. I’m sure I’ll use those Delta gift cards one day, but I have to admit they are piling up! $550 AF night have pushed me over scale – but when I think of the money we’d spend on coffee, beer, and snacks at layovers between NZ and MSP I think I’m coming out ahead and at $550 AF I might have cut even. But still… Those Delta gift cards!!!! Ug!

@Talchinsky It sounds like you are getting a lot of value out of the card. You can always use those Delta gift cards!

My Hyatt Visa has had some good offers on it, I am at I think $60 back so far, with a $75 fee paid. And I am at $100 back on my SPG while paying one $95 annual fee. If cards continue to offer these perks that helps a ton to justify the fee.

@Kacie You know, that’s a good point. Unfortunately, it’s impossible to predict in advance whether those offers will pop up after you pay the fee. Also, I had an awful time with my Hyatt Visa. Few months ago I registered for a promo that was supposed to give me $30 back on $300 grocery purchase. I never got the credit and foolishly, I didn’t save the screenshot of registration. I did contact Chase, but no dice since I had no proof. Very annoying, but a lesson going forward.

@Flyernick I think the reason so many bloggers promote this card as a keeper is due to the fact that they happen to be well-paid business travelers. Those who do miles and Points blogging on a full-time basis also travel a lot, reviewing various airlines and properties. For many of them, $550 is a drop in a bucket and allows them to create more content. I’m sure many people enjoy Centurion lounge and fancy resorts reviews, so it’s a win-win for blogger. That’s not a dig in any way, just stating a fact. My lifestyle, aside from few trips here and there, couldn’t be more different, so I value perks differently as well.

On 100k offer on Amex Platinum. I definitely think it’s worth it, though the $550 fee stings, for sure. Try pulling it up in Chrome on various devices. It may take a few tries.

I like your take on the card fees, as it is pretty similar to mine. I can’t believe how many bloggers want to talk us into the $550 fee for the Amex Plat. (I haven’t even had it as I have a hard time even justifying it the investment for the first year and I have never gotten a 100k offer). But I’m with you on renewing IHG and Hyatt.

On another note, I have been trying without success to call the number on the back of my Avianca card. Nothing happens when I press any of the menu selections. Is that your sister-in-law’s experience as well? What to do?

@Audrey Oh, what a nightmare this card has been for her! So, she did finally get through by calling this number 787.724.3650 Even so, they wanted to give her a call back the next day, but she pitched a fit and they finally canceled it.

I don’t know if it will work, if not, try one of the numbers on this page https://www.popular.com/en/contact-us/

It is a ridiculous bank, and I need to add a warning. I had zero issues few months ago, but looks like things have changed for the worse.

So weird! Thanks Leana, I was quite puzzled.

FYI the last few times I’ve checked to notify me of new comments via email it hasn’t worked.

@Audrey Hmm, sorry about the comments issue. I’ll try to figure out what’s going on but as you know, I’m a bit IT challenged! It may have something to do with new GDPR rules on privacy. I don’t know.

Ahem. My Schwab Plat is a keeper for me in conjunction with my biz plus. 😉 It was more fun with tpm but hopefully something else will come up!

@David I’m curious if you get the annual fee waived each year? Otherwise, it seems like the fee would wipe out any gains. Maybe I’m missing an angle here, so let me know. I’m guessing TPM stands for The Plastic Merchant fiasco? Oh man, that is some crazy stuff and a reminder to be careful in this hobby of ours. I feel really bad for folks who are on the hook for thousands of dollars. I hope you didn’t lose anything.

Thank you for family focus travels/points/miles blog. Majority blog-sphere in this arena focuses on the individual which can translate (roughly) to couples / two-player mode but not well for families (i..e, more traveling members).

Being new-ish to this hobby, I have been constantly thinking about how to best accumulate and what cards to keep in two-player mode for family travel usage (there are four of us). The guest limit for Centurion lounges you stated is great example: should we (wife and I) each get a AMEX platinum card so that we can bring the whole family in or focus on sign-up bonus and cancel after a year (along with trying to maximize the “perks” to reduce the annual fee during the first year before cancel)? This is a rhetorical question; I am not looking for an answer. I am expressing what one question we have.

Our main focus right now is getting a core set of cards for everyday purchases to maximize point/mile accumulation. Once we have a core set of cards, we will focus on “keeper” cards that add value for family travel needs. Your post has helped with our thinking process.

@Rob Thanks for your kind words! I’m glad the blog has been helpful so far. Determining which cards to keep and which ones to cancel can be overwhelming, for sure. In general, I’m pretty ruthless with annual fees and frankly, looking at what I pay each year kind of gives me pause. We are a middle-class family, and here I’m dropping half a grand on fees. Yikes! But we do get to stay in very nice hotels at a deeply discounted cost, so for now, I keep on renewing.

There is no way I would renew Platinum card (or add and authorized user fee) for Centurion lounge access, but that’s just me. I do think the lounges look very nice, it’s just an extravagance I simply can’t justify. Platinum cards do have a lot of potentially lucrative perks, but I think they are designed for well-to-do frequent travelers. And that doesn’t describe my family. That said, to each his/her own, and I’m not here to tell folks how to spend their money.

As far as “keeper” cards go, you’ve probably seen this post of mine on 2-card combinations: https://milesforfamily.com/2018/02/26/best-two-card-keeper-combinations-lower-income-family/

Don’t hesitate to reach out via email as well if you ever have questions.

I understand your Amex Platinum logic but you know there is once in a life time restriction (with a few exceptions sometimes). I am trying to get all the flavors of Amex Platinum cards before that window also closes which will happen soon.

@Caveman Yeah, there is no argument from me that cycling through all the flavors of Amex Platinum makes a lot of sense as long as you actually receive the bonus. I’ve noticed a lot of data points of folks getting denied if they had the basic Platinum before. But I guess it’s YMMV type deal.