I think we can all agree that one of the most valuable perks of certain premium cards is built-in travel insurance. I’ve seen more than one person say it’s the main reason they keep renewing Chase Sapphire Reserve or Chase Sapphire Preferred.

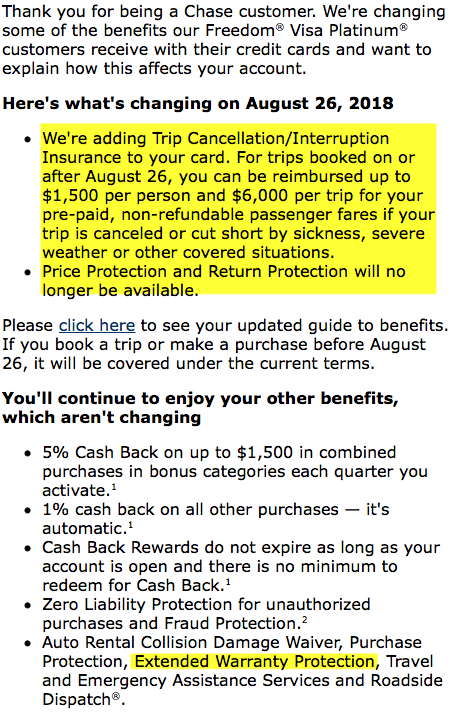

Even though I’m a bit paranoid about relying on credit cards for my travel insurance, I recognize how it can be a huge perk for those who travel often, and who book relatively simple trips. Well, it appears that Chase has decided to improve the benefits on Chase Freedom ($0 annual fee), as stated in this message I received few days ago:

It looks like they are removing price and return protection, and I know that many savvy folks have taken advantage of it over the years (hence the loss, I guess). But I never did, so it’s not important to me. In exchange though, Chase Freedom will come with built-in travel insurance. Also, I found out that apparently Chase Freedom already offers extended warranty, something I wasn’t aware of before!

You can view full list of Chase Freedom benefits via this link

Dissecting trip cancellation/interruption insurance benefit

I don’t know about you, but I never book trips that cost more than $6,000, so this amount works for me. I was mainly interested in whether the card provides coverage when you make a partial payment. According to Page 17, it appears that it does:

It also looks like change and re-deposit fees will be covered, which is obviously important to those who redeem miles:

All the standard exclusions (like pre-existing conditions etc.) apply, so I recommend you carefully read the benefits guide before choosing to rely on Chase Freedom for your travel insurance. And of course, it goes without saying that purchasing a separate medical policy may be prudent, depending on where you plan to go.

Is it time to cut ties with a premium Chase card?

Only you can decide. As nice as Chase Freedom is, it doesn’t pay 2/3 points per dollar on travel and dining all year long. It also doesn’t allow transfers to airline and hotel partners. And if you rely on airline lounge access via Chase Sapphire Reserve, you will have to say goodbye to that perk. Just keep in mind that very soon you will only be able to bring two guests anyway. If you are a family of four, this is a problem.

Long-time readers know that I don’t renew credit cards unless they provide a benefit upfront (a post coming up), which is why I have converted Chase Sapphire Preferred as well as Reserve to no-fee cards. But I also realize that I’m an anomaly in this respect.

I do urge you to do the math and decide if paying $95/$150 on CSP or CSR cards yearly is truly worth it. Is staying in a Hyatt via transfer from Ultimate Rewards a non-negotiable? Can you simply pay cash for your Southwest flights? Obviously, it does depend on how many UR points you accumulate each year. The blog targets low-spenders, hence this post.

If you are a Hyatt lover, you may want to consider getting a Chase Hyatt card (read about it here) Most people will benefit from keeping it long-term due to free Category 1-4 certificate anyway.

<

p style=”text-align: center;”>One of Hyatt resorts where you can burn your renewal certificate

On top of it, it pays 2 Hyatt points for every $1 spent at restaurants, on airlines tickets purchased directly from the airlines and at car rental agencies.

This will somewhat make up for not having Chase Sapphire Preferred or Reserve in your wallet. You will still pay $75 each year, but at least you will get a hotel night certificate out of it. Did you know that Hyatt card also comes with travel insurance benefit?

In my opinion, Hyatt transfer option is the main reason to stick with Ultimate Rewards program. Many times you just can’t beat 5,000 points/per night rate on a Category 1 Hyatt. But do keep in mind that those nights are not free since you are foregoing cash back and paying the annual fee for this privilege. Ditto to Southwest transfer option, though I can understand how having a Companion Pass can be a huge motivating factor in this.

What about getting 1.5 cents towards travel via Chase Sapphire Reserve? This to me is one of the best benefits of the card when it comes to regular families. But once again, make sure you are getting more than $150 ($450 fee minus $300 yearly travel credit) worth out of it, assuming you don’t really need lounge access or any other perks.

You would have to redeem 30k Ultimate Rewards Points each year without fail in order to just break even. And that’s assuming you view $300 travel credit as a cash equivalent. But what about earning 3 points per dollar on travel and dining? Several no-fee cash back cards will give you 3% (or more) return in those categories. Uber Visa Card is just one example.

Bottom line

I can’t say whether you should only stick to no-fee cards or if paying an annual fee is worth it in your particular case. Everyone has unique goals and circumstances. People also value perks differently. To me, lounge access is nice to have, but I wouldn’t pay $ for it. Others consider it the best thing since sliced bread, which is fine.

I like Hyatt, but I don’t have to stay in a Hyatt. I’m also happy to fly Spirit or Jet Blue instead of Southwest when the rate makes sense. I also decided to invest in Membership Rewards because I can keep points alive via no-fee Amex Everyday card. It works for me, though it may not work for you, of course.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I want to experiment with cycling Chase cards every 2 years. Paying $150 on Reserve is worth it to maximize redeeming one card bonus. Anyone has experience with closing Chase Card, then open a new- same kind, 2 months later?

@Agnes As long as you are under 5/24, you should be able to switch between CSP and CSR every few years. Just keep in mind that you have to wait 24 months after getting the sign-up bonus on one in order to get it on the other. Chase has added this new restriction last year. Of course, if you have a spouse, then they can open CSP or CSR in their own name and you can pull the points.

You can also keep on accumulating UR points via Chase Freedom/Freedom Unlimited and then convert one of them to CSR later on. Of course, I’m assuming it will be possible, but I don’t see why not, especially since you are paying the annual fee upfront. I actually plan to convert my Freedom to CSP next year so I can transfer points to United. But my situation is a bit unusual, and I may come up with a different alternative.

Timely post. I was just thinking I should downgrade my CSP to the Freedom Unlimited since my AF just posted. Basically I pay $95 a year for the privilege of being able to transfer my UR points to partners, and I am not convinced that is a good investment. Problem is I have no idea where to transfer my UR points to if I downgrade the card. One option is to just keep them in the FU account until I am able to apply for a CSR in the future. However, if Chase eliminates the ability to transfer UR points between accounts then I will be SOL.

@John Unfortunately, I can’t tell you where to transfer the points to. Do you often fly Southwest? If you do, that’s a decent investment since points are currently worth 1.4 cents towards airfare, sometimes more. I doubt they will be worth much less in a near future. Hyatt is a decent option too, but only if you would actually stay in a Hyatt anyway. You could also just leave the points where they are. Even if Chase eliminates the ability to combine points, you should be able to convert Freedom Unlimited back to CSP.