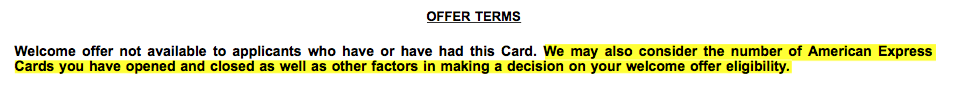

As first reported on Doctorofcredit blog, American Express has recently added new verbiage to ALL of its credit card offers:

To put it in simple terms, Amex may or may not give you the sign-up bonus after you’ve been approved for the card and met minimum spending threshold. And according to terms, there isn’t anything you can do about it.

But there was more to the story, I guess. Few hours ago, Thepointsguy blog has reported that Amex has added a special bonus qualification tool that will let you know if you are ineligible for that particular offer. You will see a pop-up before your credit is pulled so you don’t waste an inquiry. It does look like the tool is buggy at this point because the author’s credit was pulled anyway.

This is a positive development, but color me skeptical. There is no pop-up telling you that you are indeed eligible, so what will prevent Amex from claiming later on that you got the warning and applied anyway? Besides, one time I was assured by Amex rep via chat that my bonus was safe, and even saved the screenshot of the conversation. It didn’t matter. The points were clawed back anyway. Amex can always quote the line from the terms when telling you to pound sand.

I can’t imagine this verbiage will hold up in small claims court, but we are in uncharted territory here, so it’s anyone’s guess as to how this will play out long-term. One thing is for sure: Amex is serious about weeding out deadbeats.

If you are relatively new to this hobby and have’t yet applied for many Amex products, you should be fine. You are probably safe as long as you don’t buy Visa/Mastercard gift cards when meeting minimum spending requirements. Definitely make sure to check CardMatch tool that may present offers not available to the public.

My new Amex strategy

I was thinking about applying for Amex Hilton Aspire at some point this year, but will probably pass on it now. I simply can’t risk prepaying $450 and ending up empty-handed. Oh yes, you won’t be getting the annual fee back in case Amex denies you the bonus.

Ditto to new premium SPG card that is supposed to be relased in August. I just can’t afford to dip into my limited savings in hopes that Amex will decide that I haven’t yet been too abusive towards them. If you are active military, then your Amex annual fees are waived, so it’s a different story.

So, basically, as long as there is a non-waived annual fee involved, I will think long and hard before pulling the trigger. I may take a chance on $95, especially if no warning pop-up appears, but that’s probably the limit. I’m glad I applied for Amex Hilton Ascend card when I did (current increased offer expires June 27th).

I am seriously thinking about pulling the trigger on Hilton Honors card from American Express (like Ascend Amex card, it also pays us commission). Here are the details:

- Limited Time Offer: Earn 75,000 Hilton Honors Bonus Points with the Hilton Honors Card after you use your new Card to make $1,000 in eligible purchases within the first 3 months of Card Membership. Offer ends 06/27/2018.

- Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with a hotel or resort within the Hilton Honors portfolio of brands.

- Earn 5X Hilton Honors Bonus Points for each dollar of eligible purchases at U.S. restaurants, U.S. supermarkets, and U.S. gas stations.

- Earn 3X Hilton Honors Bonus Points for all other eligible purchases on your Card.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- Enjoy complimentary Hilton Honors Silver status with your Card. Plus, spend $20,000 on eligible purchases on your Card in a calendar year and you can earn an upgrade to Hilton Honors Gold status through the end of the next calendar year.

- No Annual Fee.

It’s a fairly low-commitment offer (you only have to spend $1,000 in 3 months), and there is no annual fee. Sure, Hilton points aren’t that valuable but at this point, I’m seriously running out of options.

Why every family should have at least one Amex credit card

Amex cards, including those without annual fees, provide valuable perks. The two most significant ones IMO are: access to “Offers for You” program and extended warranty.

The first one I utilize on a regular basis. Yes, you have to sift through many “stinkers” ($50 discount on $1,000 purchase at RalphLauren.com? Yawn!) But there are some good ones, like targeted “$20 off $50 Amazon purchase” offer I utilized few weeks ago. I simply bought a $50 Amazon gift card and voila, there was a $20 credit in my Amex account. Sweet. I save at least $100 each year via “Offers for you.”

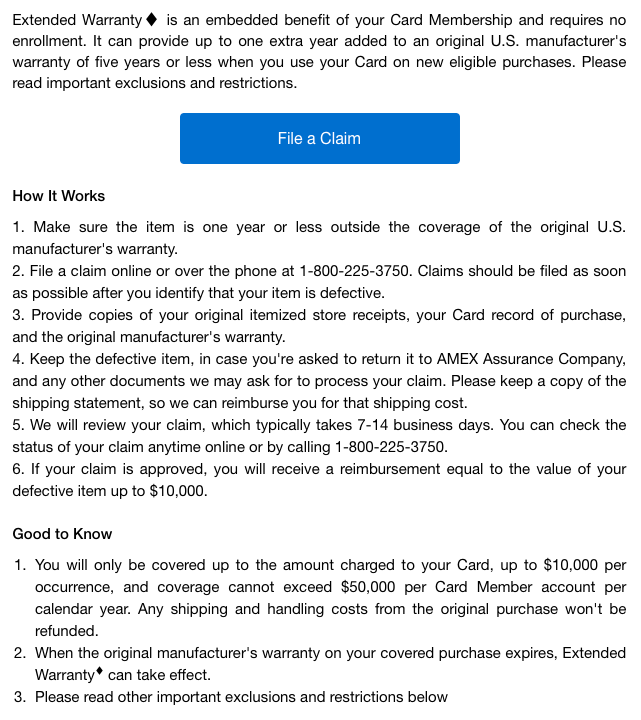

I don’t have any experience with Amex extended warranty, but this is also a potentially valuable benefit. Here are the terms:

I was actually debating on whether to put my new dishwasher on Amex card for that very reason, but decided to use Chase Freedom instead. I may end up regretting this decision, but oh well. Apparently, the extended warranty will be extended to two years, starting August 1st.

Best no-fee personal Amex cards:

1) Amex Everyday

Why: a great option for topping off your mileage accounts since the card earns transferrable Membership Rewards points. Earning 2 points per dollar on groceries (on up to $6,000 per year) isn’t amazing, but it’s better than 2% cash back. On top of it, you get 20% bonus when you have at least 20 transactions per billing period.

2) Blue Cash Everyday

Why: you get a respectable (though not amazing) 3% cash back on groceries, on up to $6,000 per year.

I have a personal referral link for this card that will give you $200 after spending $1,000 in 3 months. This is better than public offer of $100, though you may be able to pull up $250 offer in incognito mode. YMMV

2) Hilton Honors Card

Why: you get Silver status just by holding the card, which may get you a room upgrade in one of Hilton properties. You also earn 5 Hilton points per dollar on groceries.

Best Amex cards with a relatively low annual fee ($95)

1) Blue Cash Preferred

Why: earns 6% cash back on groceries (on up to $6,000 per year) and 3% cash back on gas.

2) Everyday Preferred

Why: earns 4.5 MR points on groceries, 3 points on gas, and 1.5 points on everything else as long as you make at least 30 transactions per month.

3) Hilton Honors Ascend

Why: automatic Gold Hilton status, plus 10 Priority Pass entries per year (can be used for other people in your traveling party). If you stay in Hilton resorts a few times per year and like to have occasional airline lounge access, the $95 fee will probably pay for itself in no time.

4) Starwood Preferred Guest credit card

Why: Amex has just added a new benefit that will give you free night upon renewal (good at any Marriott property that costs 35,000 points or less). This benefit will kick in in August when Marriott/SPG merger is complete.

Best no-fee business Amex card

The Blue Business Plus

Why: earns 2 MR points per dollar on everything on up to $50k per year.

Bottom line

These Amex changes are extremely unfortunate for people like myself, but I’m not going to lose sleep over this new development. Life goes on, and lucrative opportunities will still present themselves. I do hope that new banks will not follow suit, but all bets are off at this point.

Readers, what will be your Amex strategy going forward?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I’m curious to see how the popup qualification thing plays out. If it works properly and informs you of bonus eligibility before a hard pull, then that’s a definite silver lining to a crappy situation.

As an aside, Amex never really pulls my credit any more, which is kinda odd.

Austin, I agree that it is indeed a silver lining. Still, I just don’t trust this tool 100% for the reasons I’ve mentioned. As is the case with any technology, there will be bugs. I’ve already seen several data points from people not getting the pop up during the app, but who clearly don’t qualify to get the bonus due to receiving it few years ago. I highly doubt that Amex will give them the points even if they claim they didn’t see a pop up during application process. I really think Amex has installed the tool to cover their butt legally but as they say in insurance industry, the written terms always prevail. And the terms say they don’t have to give the bonus, end of story.