Most normal people sign up for credit cards with the intention of keeping them for a very long time. Of course, it doesn’t hurt to get a nice sign-up bonus in the process as well. Even though I’m quite stingy when it comes to annual fees, I personally renew a few credit cards each year. Most of them are hotel products. Paying $49 on the old version of IHG card in exchange for certificate good at any IHG property was 100% worth it (to me).

Unfortunately, as many of you know, the card was recently rebranded and now comes with $89 fee, and the certificate usage is now capped at 40,000-points-level properties. Reportedly, you can sign up for it and get the bonus even if you currently have the old version of the card, since they are considered to be separate products. According to many data points, it’s not currently subject to 5/24 rule. Speaking of, did you get the pathetic upgrade offer of 5,000 points? Umm, tempting, but no thanks.

There is another lucrative hotel offer on the market: Chase Marriott Rewards Premier. This card was also rebranded and unlike IHG card, the new version is actually superior to the old one. It is subject to 5/24 rule. If you are looking for a decent hotel card that you can keep long-term, this article is for you. First, here are the most important details on each offer:

IHG Rewards Club Premier (non-affiliate link that comes with $50 statement credit)

- Earn 80,000 bonus points after spending $2,000 on purchases within the first three months of account opening

- Earn 5,000 bonus points after you add your first authorized user and make your first purchase in the first three months from account opening

- Enjoy a Free Night after each account anniversary year at eligible IHG hotels worldwide (when it costs 40,000 points or less). Plus, enjoy a free reward night when you redeem points for any stay of 4 or more nights and Platinum Elite status as long as you remain a Premier card member

- Global Entry or TSA Pre✓® Fee Credit of up to $100 every 4 years as reimbursement for the application fee charged to your card

- Annual fee is $89

Marriott Rewards Premier Plus (pays us commission)

- Limited Time Offer! Earn 100,000 Bonus Points after you spend $5,000 on purchases in the first 3 months from account opening.

- Free Night Award (valued up to 35,000 points) every year after account anniversary.

- Automatic Silver Elite Status each account anniversary year.

- Annual fee is $95

Sign-up bonus value

There is absolutely no question that 100,000 Marriott points are worth more than 85,000 IHG points+$50. First, you can often purchase IHG points for 0.57 cents apiece. Not so with Marriott currency. The cheapest rate at which you can acquire them is via purchase of SPG points and then transfer to Marriott program on 1:3 basis. The rate works out to be around 0.75 cents per point via current promo. Many people seem to be buying SPG points right now, which indicates that the market agrees with this price.

Of course, it’s not proof in of itself, and I wouldn’t speculatively buy either currency at this rate. Nonetheless, it’s a strong indicator of market value. But wait, there is more! You can transfer 10,000 IHG points to 2,000 miles. By comparison, 9,000 Marriott points will give you 3,000 miles if you transfer your points to SPG first. This rate will be preserved after Marriott absorbs SPG on August 1st.

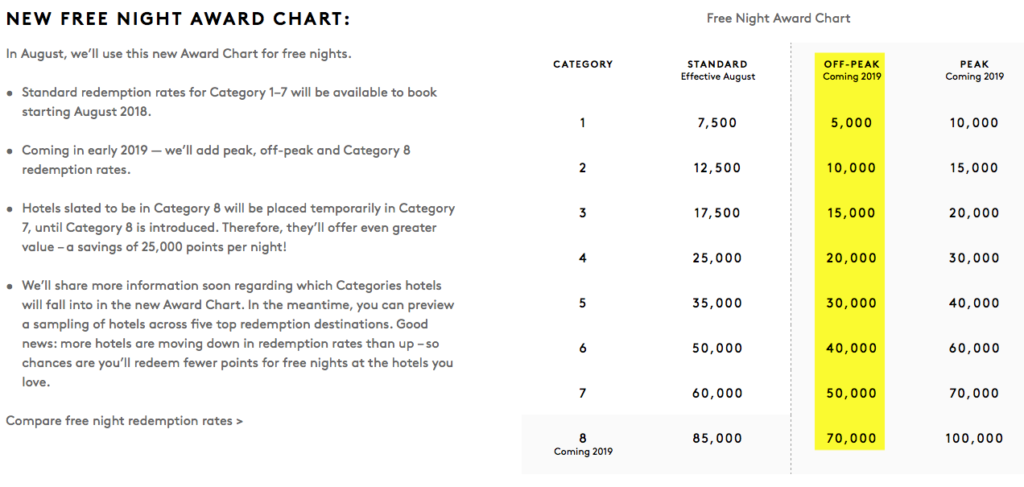

Finally, right now Marriott properties start out at 7,500 points per night, and beginning next year, you’ll be able to get a free off-peak night for only 5,000 points. You will still get every 5th night free under the new scheme.

IHG properties start out at 10,000 points per night, aside from PointBreaks promo where some hotels cost as little as 5,000 points. You can’t really count on the latter to coincide with your travel plans, so it’s a bit of a “red herring” meant to make IHG program appear to be better that it actually is.

Originally, I wanted to wait to put this post together due to the fact that we don’t yet have a full new Marriott award chart. We do have a preview though, which is a good indicator of things to come. Plus, it doesn’t really matter. Programs shift categories of individual properties without notice all the time. Having award chart is helpful, but I would never count on it 100%.

Renewal certificate

The difference between annual fees is negligible ($6), so it comes down to this question: Is the juice worth the squeeze? Spoiler alert! It probably is for most people.

Marriott

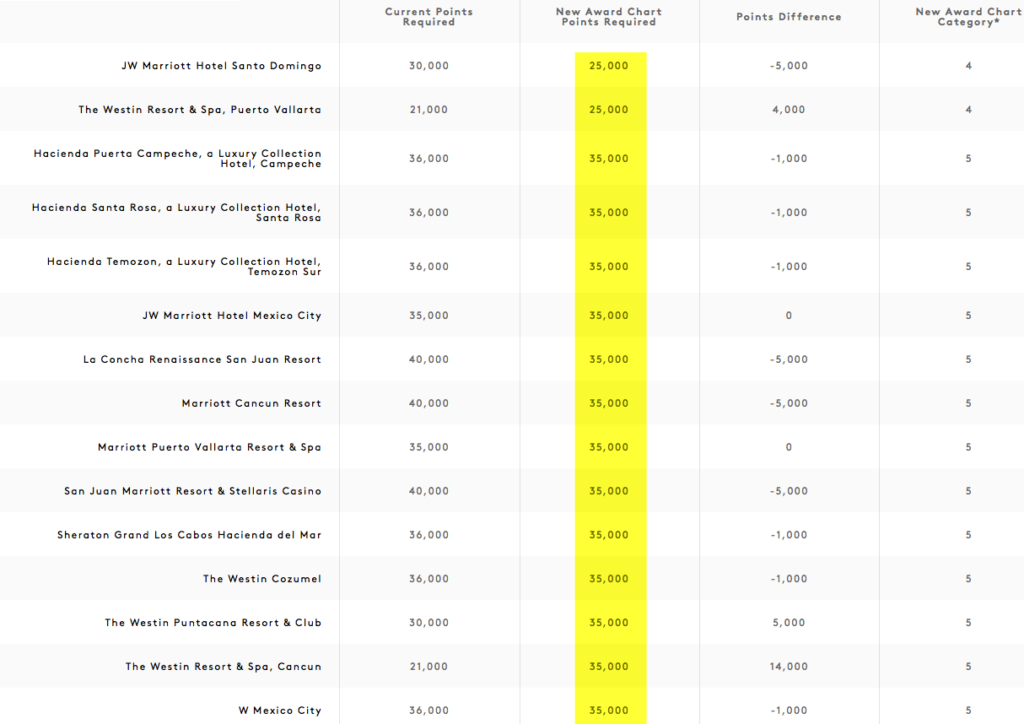

Judging by Marriott new chart preview, quite a few desirable properties will cost 35,000 points or less, starting August 1st. Here are just a few examples:

Caribbean and Mexico:

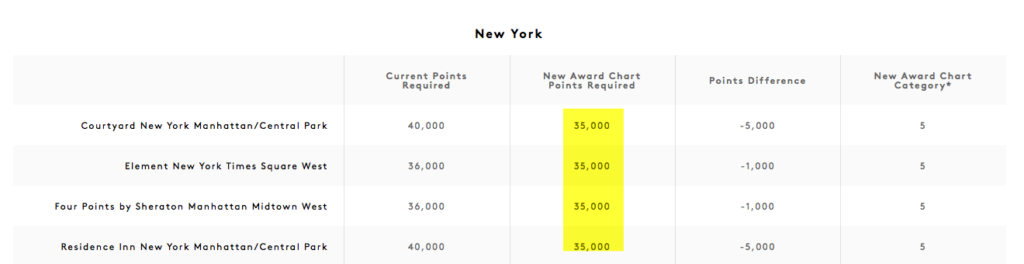

New York City:

You can see the current list of properties that cost 35,000 points via this link Here are some hotels that IMO offer decent value for families, especially during peak season:

Anaheim: Residence Inn Anaheim Maingate

Aurora: Gaylord Rockies Resort & Convention Center

Clearwater Beach: Residence Inn Clearwater Beach

Key Largo: Courtyard Key Largo

Daytona Beach Shores: Residence Inn Daytona Beach Oceanfront

Honolulu: Courtyard Waikiki Beach

Kailua-Kona: Courtyard King Kamehameha’s Kona Beach Hotel

Nassau: Courtyard Nassau Downtown/Junkanoo Beach

Paradise Island: The Beach at Atlantis, Autograph Collection

Some hotels will obviously shift categories when the new chart comes out, but I’m certain that many won’t. With the takeover of SPG, you will have access to many more properties. Nancy has stayed at Sheraton Sand Key Clearwater last year. It currently costs 10,000 SPG points. I would guess that it will cost 30,000 to 35,000 Marriott points in the new chart, which will make it eligible for the renewal certificate.

IHG

While the new restriction has certainly lowered the value of the renewal certificate, there are still good deals to be had. You can use the cert on this beachfront hotel in Sarasota, or a 2-bedroom/2- bath unit in Holiday Inn Club Vacations at Orange lake resort

Here are a few other decent-value properties that are currently eligible for renewal certificate:

Holiday Inn Express Manhattan Midtown West

Holiday Inn San Francisco-Civic Center

Holiday Inn Express Pensacola Beach

There are many more examples. Of course, as is the case with Marriott, you should never assume that your desired property will remain in the same category years from now. In fact, I almost guarantee that it won’t.

Winner: I would have to go with Marriott (for now) because it appears that you will have more options in the most popular destinations. But my opinion may change when the new award chart is released.

Status and other perks

Marriott card gives you automatic Silver status, and IHG gives Platinum status. Neither is particularly valuable (no free breakfast), though based on my experience, you are more likely to get an upgrade as an IHG Platinum member. A nice perk that comes with the new IHG card is “4th night free” when redeeming points. According to several reports, you can even combine it with 10% rebate if you also happen to have the old version of IHG card.

This can come in handy if you are able to acquire IHG points at a relatively low cost. Let’s take this all-inclusive resort in Jamaica as an example.

It currently costs 50,000 points per night. Let’s say you want to stay 4 nights and decide to buy points for 0.57 cents apiece, a sale that comes around regularly. BTW, reportedly, you don’t get a 20% discount when buying points on sale. So, it’s a totally useless benefit. Anyway, you will pay $855, or $214 per night all-in.

It currently costs 50,000 points per night. Let’s say you want to stay 4 nights and decide to buy points for 0.57 cents apiece, a sale that comes around regularly. BTW, reportedly, you don’t get a 20% discount when buying points on sale. So, it’s a totally useless benefit. Anyway, you will pay $855, or $214 per night all-in.

While not a bargain per se, it’s a decent price during high season, especially since kids 12 and under stay free when sharing parents’ room. Also, as a Platinum member, you are likely to get an upgrade, though according to my reader Audrey, it’s now merely a junior suite (used to be a one-bedroom unit).

If you stay in a Category 1 IHG hotel (costs 10,000 points per night), you will pay $171 for four nights, which isn’t bad at all. The 4th night free benefit is even valid on PointBreaks hotels.

Marriott card does come with some decent perks, like trip delay reimbursement. If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

It may come in handy, but it’s already offered via several premium credit cards like Citi Prestige, Chase Sapphire Reserve and Chase Sapphire Preferred. IHG card offers Global Entry reimbursement every 4 years, but then again, so do many other products.

Overall, when it comes to actual hotel stays in respective programs, IHG card provides more potential value IMO. Aside from IHG and Marriott stays, it’s not worth it to put spending on either product. I recommend that you stick to cash back or flexible points.

Winner: IHG

Award availability and program stability

My biggest pet peeve with IHG is the fact that last-minute award availability is horrendous. Unless you plan your stays far in advance, good luck finding a decent property. Marriott is a bit better in this respect, at least in my limited experience. The program does use capacity controls, though, unlike Hyatt and Hilton where you are guaranteed a room as long as standard award is available.

I also think IHG currency is extremely volatile, much more so than Marriott currency. They often run lucrative promos and sales on points purchases. As a result, the market is currently flooded with IHG points, which has led to lack of award availability in most desirable properties, plus brutal devaluations in recent years.

Marriott is very stingy with points promos, and 1:1 transfer from Chase Ultimate Rewards just isn’t all that attractive, especially when compared to Hyatt alternative. Even though Marriott has devalued the program substantially in the last few years, IHG has fared even worse, at least in my opinion. IHG also has the most frustrating customer service, while I found Marriott reps to be fairly competent.

Based on the recent announcements concerning new Marriott program, it appears they are trying to make SPG loyalists happy. I believe we will see many decent off-peak deals when Cat. 1 and Cat. 2 SPG properties are rolled into the combined award chart. Those currently cost 3,000 and 4,000 SPG points per night, or 9,000 and 12,000 Marriott points respectively.

Winner: Marriott

Bottom line

For those who are not subject to 5/24 restriction, it makes sense to use their available Chase “slot” for new Marriott card. The offer is very attractive when it comes to hotel stays, plus, you always have the option to transfer points to miles. I’m fairly confident that due to new renewal certificate structure, it will become a “keeper” card for many folks. If you decide to support the site via your application, I thank you in advance.

Those who are subject to 5/24 restriction should definitely look into new IHG credit card, especially if you currently have the old version. Though I suspect we may see a higher sign-up bonus in the future. You can view other lucrative hotel bonus offers here

Readers, what are your thoughts on both cards?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I am keeping my $49 IHG card rather than upgrading. I think the 10% points rebate is supposed to stick around for that card.

I can’t get excited about points opportunities with this chain. Nothing high end for my family, so it is basically just “might as well stay at a Holiday Inn Express” kinda points, though I do like Staybridge Suites when that is an option.

I’m considering buying SPG points but not seeing the new chart is a gamble, so I need to think about it. Not going for the new Marriott card now as hitting the minimum spend will be difficult right now.

Kicking myself because in March and April we had some big expenses and did I put that toward a new sign up? No, that would be too clever of me ????

I couldn’t believe that Chase would think getting 5,000 IHG points would make up for increase in fee and getting a capped certificate this year. You would have to be nuts to accept the offer! I’m nuts, but not that nuts. 🙂 I do think eventually they will forcefully convert everyone, but hopefully I’m wrong.

I agree with you that for the most part, IHG chain is pretty unexciting, at least when it comes to reasonably priced options. And I sure won’t be paying 70k points per night, unless it’s their two properties in Bora Bora. Those are definitely worth 70k Points, especially the overwater bungalow in Thalasso IC. But finding availability is next to impossible.