I’m sure by now you’ve heard about Marriott/SPG Monday announcement and the upcoming changes to the program. If not, you can see this official page on Marriott.com I won’t rehash all the details, as lots of bloggers have covered this topic already.

Instead, let me highlight the changes that are pertinent to someone like myself. As in, a person who doesn’t chase elite status via actual hotel stays, and who is not swimming in SPG or Marriott points.

The good

1) The changes will kick in on August 1st, and are (mostly) good news for regular folks. I like the fact that Marriott gave customers plenty of notice.

2) Transfers to airline programs are staying in their current form. Going forward, you will be able to transfer 3,000 Marriott points to 1,000 miles. You will also get a bonus of 5,000 miles when you transfer 60,000 Marriott points. So, basically, it’s the same system as the current one in SPG program. Since 1 SPG point=3 Marriott points, it’s essentially a wash.

3) Marriott travel packages are staying for now, but we are not sure what the redemption value will be like in the future. I’m guessing Marriott will give advance notice if they choose to substantially devalue this perk.

4) You will still get 5th night free.

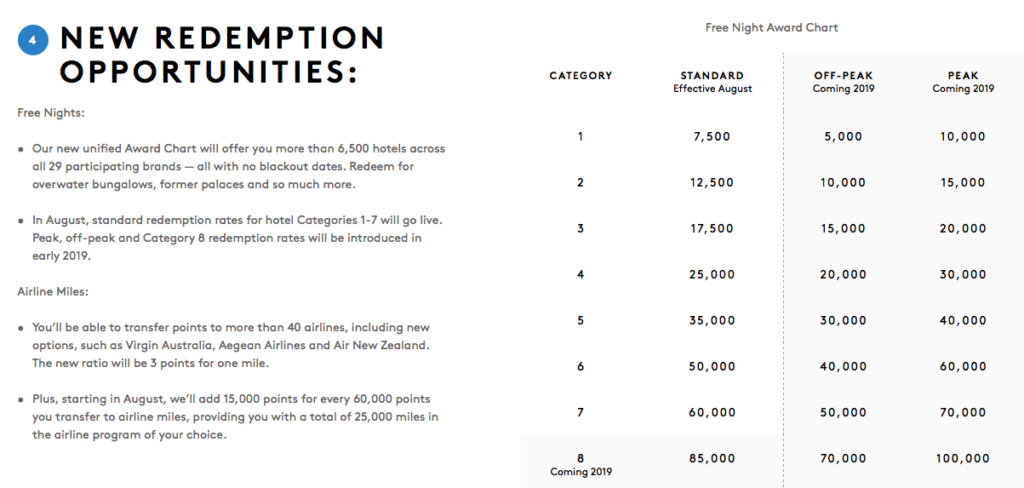

5) Marriott and SPG will introduce a unified award chart in August. However, Category 8 will not kick in till February 2019:

This will present some decent opportunities for those who are sitting on a huge pile of SPG points. Presumably, you will be able to get some bargains on top tier Starwood properties. But bargain is in the eye of the beholder because let’s face it, redeeming 20k SPG points on ONE hotel night is anything but cheap. Sure, you will get 5th night free, but that’s still 80k SPG points. Plus, I expect award availability to be almost non-existent at some of the most desirable properties.

6) After August 1st, Amex SPG cards will come with a free annual night certificate, good at any SPG/Marriott property that costs up to (and including) 35,000 Marriott points. That’s a great development and makes the card much more compelling when it comes to renewal.

There will also be a new Starwood Preferred Guest American Express Luxury Credit Card that will have a $450 annual fee, a $300 credit at Marriott hotels, an annual free night award (up to 50,000 points) after card renewal, a Priority Pass membership and a few other benefits. We don’t yet know any of the details on the sign-up bonus. Chase will introduce a new line-up as well.

The bad

1) Starting August 1st, your SPG cards will earn 2 Marriott points per dollar. That’s a decrease of 33% compared to current rate of earnings. Honestly, I don’t consider this card to be all that compelling when it comes to everyday spending now, though many will disagree. Regardless, if you value SPG points, you may want to focus on accumulating them between now and August.

2) Starting in August, you will no longer get Sheraton Club access with your business version of Amex SPG card. It’s not a huge loss for most people, but still. I thought it was a nice perk that made $95 annual fee sting a bit less.

3) I didn’t see anything mentioned about Amtrak program that currently partners with SPG. I think there is a good chance it will go away in August.

4) Several currently available cards will be discontinued soon. Those are: personal version of Starwood Preferred Guest (SPG) card from American Express, and both personal and business versions of Chase Marriott Premier card.

You can see more details on personal versions of Marriott (subject to 5/24) and SPG card here Both cards pay us commission. Be aware that you may be able to pull up an offer of 30k points on SPG card in incognito mode. YMMV

Here is a non-affiliate link for business version of Marriott card, NOT subject to 5/24. We don’t know exactly when all these cards will be discontinued, but it will probably be soon.

Update: it looks like the current personal version of Marriott card will no longer be available as of May 3rd. It will be updated and reissued by Chase, but business version will eventually be closed to new applications.

Also, I got an email from Amex rep letting me know that personal version of Amex SPG card will still be issued after August 1st.

What you should do now

If you’ve never had a personal version of Amex SPG card, you may want to consider getting it while you still can. According to DoC there is a rumor from a normally reliable source that the bonus of 25k points will very soon be replaced with $200 credit. The former is a much better incentive, no question about it.

Even if you redeem points on Amazon gift cards (poor value), you will get more than $250 out of it. I don’t know if the rumor is true, but it’s worth mentioning. Some blogs are even saying that the card may be discontinued today but once again, I have no way to verify this claim.

Update: the offer has indeed been changed as of Thursday.

If you are not familiar with SPG program, you may want to read my recent post to get an idea on some of its best uses when its comes to family travel. It focuses on business version of the SPG card, but most of the same principles apply. I think you have a bit more time with Marriott cards, so I would prioritize Amex SPG at this point, assuming you never had it in the past.

Bottom line

I’ll be honest, my main reaction to this whole thing was a big fat yawn. It’s part of the reason why I didn’t write a post until now. I realize it’s a big deal for some people, just not for me.

Things in this hobby change constantly, and Marriott/SPG new program development is no exception. Hopefully, this announcement will motivate some people to part with their precious stash of SPG points at last.

My personal strategy will remain the same: accumulate cash, miles and points at the lowest possible cost (aka sign-up bonuses), match to elite status when it’s free, and try not to let this hobby take over my life. Boom.

Readers, what do you make of these changes?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Any chance the new personal Amex SPG card will be considered a new product and not subject to the once-in-a-lifetime rule? I’d love to get some Marriott/SPG points, but I already had the personal Amex SPG and I’m over 5/24 for the Chase options.

@Nancy Personal version of Amex SPG will be discontinued, period. Those who currently have the card will keep it, though.

@Nancy Did you mean the new card with $450 fee? If so, yes, it should be considered a new product. I’ll see what the bonus is before pulling the trigger.

I hope it has a huge bonus! 🙂

@Leana so here’s my dilemma. Personal SPG card’s AF is coming up for renewal in a few weeks. The plan was to renew, but is it worth keeping? We don’t have any MR points, and I do like having the SPG points for airline transfers. Should I keep the SPG points where they’re at or move them over to Marriott now to get the 3X points instead of the 2X in August?

@Stephanie I recommend you call and ask for a retention offer. I’ve seen reports that folks are getting 10k SPG Points for keeping the card. You could also try a chat if you don’t like calling. If they don’t offer any incentive, it will be your call on whether to keep the card or not. Keep in mind, personal version will be discontinued soon. You will also be giving up future certs from renewal, and those will probably be worth $95. I say “probably” because we don’t yet know what the new award chart will look like. Plus, you will have to potentially swallow the upcoming $95 fee unless there is a retention offer.

On your existing stash of SPG points: those will transfer 3:1 in August, so no worries. The cut in earning rate is if you use the SPG card in August and afterwards.

@Leana – I’ll give them a call. Thanks!

*personal card that I now have*

Are you saying that the current SPG personal I now gave will get a free Marriott night, up to 35,000 points, upon renewal after this August?

@PT That’s correct. According to the email I got from Amex rep, both personal and business versions will get this perk as long as the renewal date of the card is in August or later. So, you will have to wait till your next renewal to receive it. It is definitely a game changer, at least IMO. Of course, we need to see what the new award chart will look like. But I imagine there will be plenty of nice hotels that will cost 35k or less.

I recently got an SPG but have no plans for travel. Will my points just transition into the Marriott program? I know a few months ago I had to link my husband’s SPG card to a Marriott Rewards site to use SPG points at the Marriott. I’m assuming this will no longer be necessary for my card?

@Michelle It’s my understanding that SPG points will simply transfer to your Marriott account in August at 1:3 ratio. You may have to manually link them, which will be communicated, I’m sure.

I’m curious how many points the Dolphin will be now.

I’m finally under 5/24 and am frozen in indecision on what to do next with all of this. I’ve had the SPG cards already.

Will probably just stick with the CSP….I like the primary car insurance benefit…

@HML That’s a tough one. I think it depends on when you will be again under 5/24 limit after this application. The bonus on CSP to me is better than one on Marriott card. That said, the latter will be discontinued soon, so it’s the case of “use it or lose it”. Of course, applying for business version should not affect 5/24 status, but not everyone has an actual business to qualify. Plus, Chase is becoming picky with business card approvals. I would be inclined to apply for personal Marriott card right now, but that’s just me. It’s an easy way to pick up some Marriott Points. If you mostly care about travel insurance, you can always buy a separate policy. Plus, other cards have this benefit as well.

As far as Dolphin property goes, I imagine it will cost the same amount, possibly less during off-peak dates.

July would be the next time I could get 5/24 card.

@HML Yep, you would have to wait till that date in order to qualify for bonus. The bad news is, it looks like personal Marriott version will be discontinued in early May. The good news is, there will be a new version issued and you can potentially apply for it in the summer.

So, yeah, CSP might be your best bet right now. It does pay us commission if you feel inclined to support the site. There was a version with 60k points where the fee was not waived, but the link stopped working recently. So as far as I know, the affiliate offer is the best deal in town. Of course, it does depend on your goals. I was trying to give the best advice possible, regardless of commission.

@HML In that case, I honestly think you should consider getting Marriott Card first. Obviously, the decision is yours and I can’t gurantee that Chase won’t introduce new restrictions between now and July. I like UR program best, but Marriott Points will give you access to more mileage partners, plus hotels like Dolphin. But you can’t lose either way. It’s a good problem to have: CSP vs. Marriott card. I wish I were in your shoes! 🙂

HA! There is no can only get bonus once every 24 months language is there? Cause then I would have to wait a few months I think…the last bonus posted 6/19/16.