One of the benefits of hosting my European parents here in US is that meeting minimum spending requirements on a new credit card becomes a non-issue. The cost of restaurants and entertainment for six people adds up fast. But it’s my family, so I try my best to be a good/generous hostess. As a result, we met the $3,000 spending on my husband’s new Amex WF Propel World within a month.

Since I like to use my limited spending towards new offers, I started looking at various credit cards. I plan to sign up for Citi Thank You Premier, but won’t be eligible for bonus till the middle of May. And I certainly don’t want a month and a half to go by without a hustle of some sort.

I was intrigued by Delta co-branded credit cards. As you’ve guessed from the title, I ended up passing on them, which I will explain at the end of the post. However, let me highlight reasons on why you may want to consider them. You can read about two personal versions here, and business version here

You may only receive one bonus/per card/ per lifetime. All current offers are supposed to expire 4/11/2018, but I’m certain they will be back. So, I’m definitely not trying to create a false sense of urgency. All three cards pay us commission, and I hope you consider supporting the blog if you choose to apply.

Let’s take a look at Gold Delta SkyMiles Credit Card from American Express because it has the lowest barrier to entry and a waived first-year fee:

- Limited Time Offer: Earn 50,000 Bonus Miles after you spend $2,000 in purchases within the first 3 months and a $50 statement credit after you make a Delta purchase with your new Card within your first 3 months.

- Plus, earn an additional 10,000 bonus miles after you spend an additional $1,000 with your new Card within your first 6 months. Offer expires on 4/11/2018.

- Earn 2 miles on every eligible dollar spent on purchases made directly with Delta. Earn 1 mile for every eligible dollar spent on other purchases.

- Check your first bag free on Delta flights – that’s a savings of up to $200 per round trip for a family of four.

- Settle into your seat sooner with Priority Boarding.

- Enjoy a $0 introductory annual fee for the first year, then $95.

So, assuming you are able to spend $3,000 in 3 months, you will collect 60,000 miles+$50 credit after Delta purchase.

Delta’s (bad) reputation

Delta has a terrible reputation in the miles and points hobby, and there is a good reason for it. Years ago, they used to require you to redeem miles on a roundtrip ticket, and award availability was pathetic. These days there is zero transparency when it comes to award pricing. You basically pay what they tell you to pay. But!

Using miles is so much easier than it used to be. Plus, you can redeem them on one-way awards, which is huge for families who have little flexibility. While things got worse for premium Delta cabin flyers, they actually got better for economy lovers.

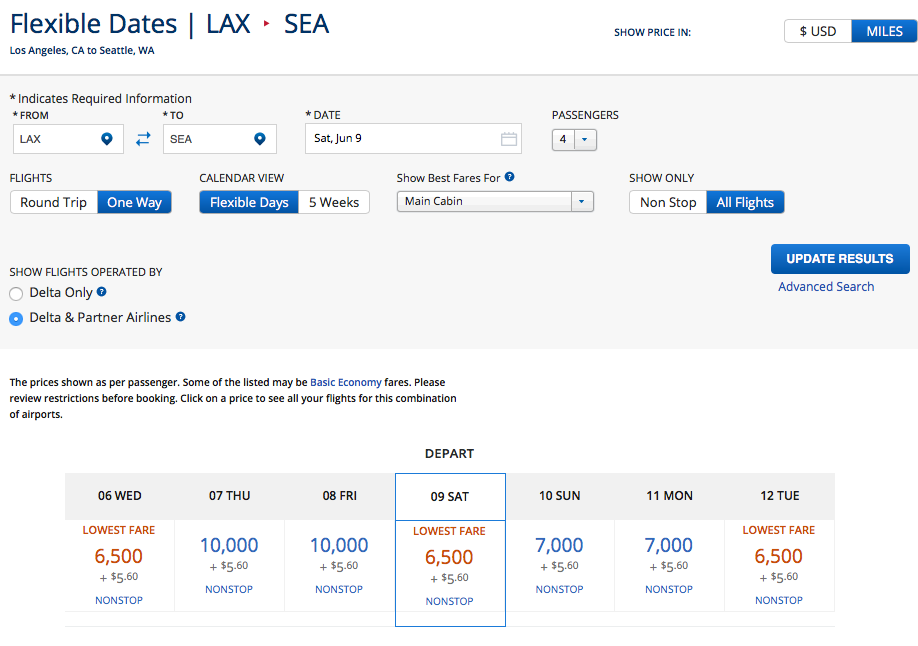

But don’t take my word for it. One of my readers lives in Los Angeles, so let’s take her as an example. Suppose, she wants to take her family to Seattle and fly on a Saturday in June. Here is a sample pricing in miles:

And here is the pricing in USD:

And here is the pricing in USD:

Burning miles will yield around 2 CPM (cents per mile). Not too shabby! Plus, everything can be done online, no need to call as is usually the case with foreign programs. Sure, you may be able to find lower cost revenue alternatives to Delta. Still, there is no arguing that paying 6,500 miles for a non-stop flight from LAX to SEA is a sweet deal. That 60,000 miles bonus can go quite far. Value will depend on a route, and redeeming on places like Hawaii is not the best use of Delta miles. You will be better off using programs like Korean Air SkyPass or Air France Flying Blue.

Can’t find any award availability for the route and date you are looking for? Just use your bonus towards revenue Delta fare and get 1 cent per mile. So, in that case, 60,000 miles will yield a $600 discount. Again, not too shabby. Plus, don’t forget, you will be able to check in one bag for free, which is a nice perk.

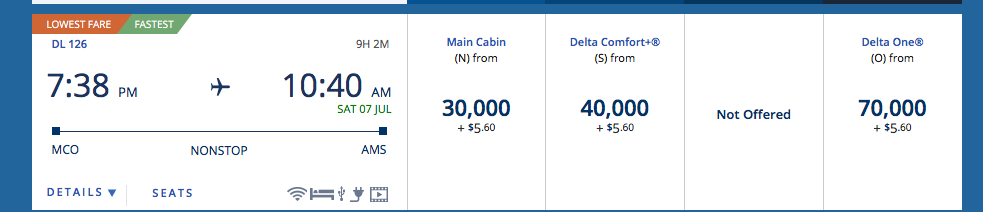

There is one big reason I’m keeping an eye on Delta co-branded offers. For years I’ve wanted to stop in Amsterdam on my way to Belarus. Things just never lined up, but I’m hoping to do it next time we go. As it turns out, Delta flies non-stop from Orlando to Amsterdam, and summer availability for four people is quite decent at the lowest level:

<

p style=”text-align: center;”>The times are also very convenient and would allow my husband to work part of the day:

Some dates even have availability in Delta One class, and I wouldn’t mind splurging miles on one seat to treat my very large husband.

That said, we don’t have plans to fly to Europe for at least 2-3 years. That’s why I reluctantly decided to put these Delta offers on a back burner…for now. As I’ve said earlier, I’m quite certain they will be back. Plus, Delta may discontinue this route by the time I’m finally ready to book it. Besides, I have other priorities right now. Speaking of…

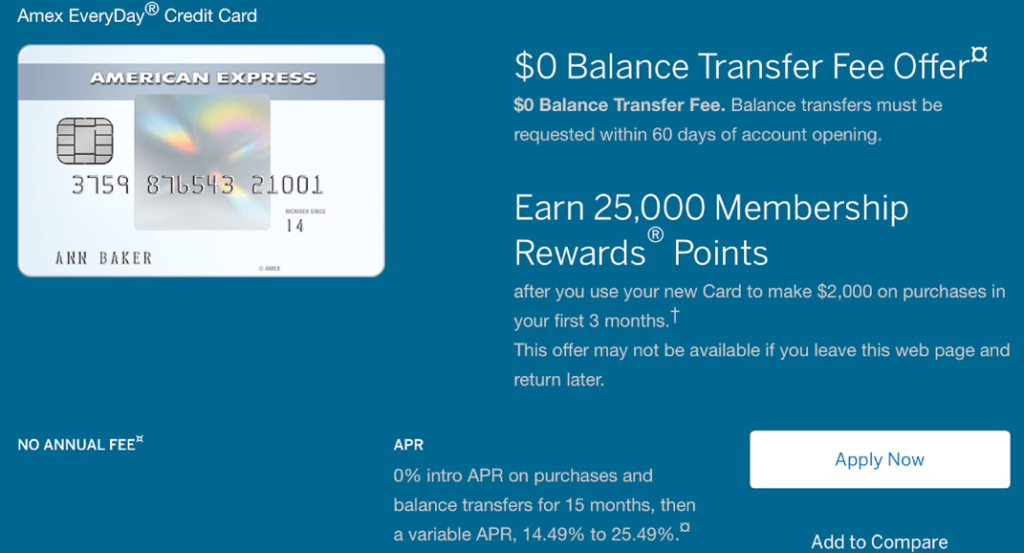

Hunting for 25k offer on Amex Everyday card

As I’ve mentioned before, Amex likes to play games with customers and usually saves the best offers for strangers. A quick tip for new readers: make sure to check CardMatch tool. I’ve recently written a post on being able to find 50k Amex Premier Rewards Gold offer for my husband in incognito mode. The bonus has already posted, so we are now proud owners of 53k Membership Rewards points.

There is one issue with Amex Gold card. It has an annual fee of $195 that is supposed to hit upon renewal next year, and I certainly have no intention of paying it. According to terms, we have to keep the card for at least 12 months or risk losing the bonus. Fortunately, you can get a refund of the Amex fee within 30 days of the date when the statement with it posts to your account. That will give me plenty of time.

However, I would like to keep the points intact and my husband has no other MR cards. Enter Amex Everyday. It has no annual fee, so there is no pressure to cancel it. Unfortunately, the affiliate offer only comes with 10,000 points (yawn). Fortunately, according to DoC and few other blogs, it may be possible to find 25k offer in incognito browser.

I tried, and was only able to pull up 15k offer. I did all kinds of stuff: left the browser open for few hours, refreshed it multiple times and nothing. I was ready to give up on it for now, but decided to ask my husband to check it on his iPad. Voila! The elusive 25k offer finally showed up.

He applied and was approved. So, if you are not successful the first time, I recommend pulling up Amex website in incognito Chrome mode on several iPads or PC’s.

He applied and was approved. So, if you are not successful the first time, I recommend pulling up Amex website in incognito Chrome mode on several iPads or PC’s.

The offer of 60k Delta miles to me is worth more than 25k Membership Rewards, but there is a twist. I absolutely had to come up with a plan to preserve my MR points after canceling Amex Gold Premier card. I don’t have any other flexible points currency, and want to hang on to my stash in case there is a sudden need for it.

I’ve written about MR program highlighting its strength and weaknesses. While it’s not as valuable or versatile as UR program, the fact that you don’t have to pay an annual fee is a game-changer for me.

Delta cards, we’ll meet again, I’m sure of it.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I had a friend refer me for the Delta Plat 70k offer, and the referral offer extends longer than the public, so let me know if you ever need a hook up ;). I’m hoping to use the companion ticket at least once before downgrading, but some people really get a lot of value out of this card, so we’ll see.

AmEx is harder for me to meet minimum spending on, depending on which places take the card and what I need to buy.

I didn’t realize you don’t have flexible currency anymore — do you still have Chase Freedoms? I’m hoping to hang on to those for the long haul, even if I don’t have a CSR or CSP for a time. AmEx Everyday is a great no-fee option for those MR. Good job

@Kacie I do have Chase Freedom which I plan to convert to Chase Sapphire Preferred at some point. See this post https://milesforfamily.com/2018/04/19/looking-for-creative-ways-to-cover-my-parents-tickets-to-usa/

As far as Delta cards go, I will probably use my own affiliate link. However, if we lose the links, I will reach out to you for your personal referral. No problem at all! But it may not be till next year.

Not a sales pitch at all. I know your blog is different. I feel the times of churning are ending, but there is always other venues to explore. I am on the fence about attending FTU in NYC. I want to learn more about MS, but I am not sure if I have enough cash to play with the big dogs. I attended FTU once back in 2012 and it was very useful because I was a newbie. Now I feel I am pretty good with accruing/redeeming miles and points. I still have time to decide 🙂

@Tania I agree with you that accumulating miles and Points the easy way (aka sign-up bonuses) is getting harder and harder. We don’t travel too often, so I still get plenty for my family’s needs. But a lot of avenues are closing, no question about it. I guess it comes down to one’s expectations. For me, it’s still a hobby, something I enjoy doing. Well, most of the time. If it goes away, I will simply shift my focus to maximizing rewards on everyday spending. Renewing a few hotel credit cards will hopefully provide me with few getaways in our state of Florida.

I don’t do MS, but from everything I’ve read, that Avenue is slowly dying as well. Of course, there are lucrative opportunities out there, but they are closely guarded. I’m not sure what to tell you on attending FTU. You may learn a trick or two, but upfront cost is quite high IMO. On the other hand, you don’t have to fly anywhere, so that’s good. I think everyone will probably be going with the same idea, though. If something is easy AND super lucrative, people will be leery to divulge it. Plus, I’ve read many times that NYC is tough for MS, period. So even if someone tells the audience about some great opportunity in Texas, what use is it to you? I recommend you go with the idea of having a good time and meeting folks who share the same interests. If you learn a neat trick, great. Just don’t expect any earth-shattering info. The juiciest stuff is kept underground these days.

That’s why I am on the fence about FTU. NYC is almost impossible to MS but one of the panel is about MS in tri state area. I would love to meet people to talk about miles and points.I am hoping they have a flash sale so my out of pocket can be less than $200. Also I have to consider my son – pay a babysitter is not an option. If my friends are willing to babysit for me I might go. I also agree with you people are VERY protective of their tricks. I will keep you posted 🙂

Leana,

I am so torn about this offer. Lately I’ve had great experience with Delta. Weirdly enough I have Gold status with them until May and I just earned Silver status until next February. I want to write a post about this – long story short – I got an strange email from AA with a free Platinum status trial for 3 months(I don’t even remember last time I flew AA). So I called Delta and ask for status match. They granted me for 3 months (Feb-May) and offered me a Silver status challenge (6250 MQM and $750 MQD). I had to go to Brazil for a quick turn around trip and I found a super cheap fare with Delta through a Brazilian travel agency ($790). Because of my Gold status I got upgraded to Comfort + and my 9 hour flight was not bad. This trip alone got me to the MQD and MQD to reach Silver status. How crazy is that??? Single mom, never travel for work and I have status. Who knew?? I decided to fly so SFO (I have friends there = FREE hotel) before my Gold status expires so I can have a shot on Delta One free upgrade.I found super affordable fare from NY ($218 RT) and use my Citi Prestige credit.

Even Delta is constantly overlook by bloggers my experience is great even redeeming miles. I got a good deal from NY to Nassau with miles last January.

But I don’t feel like wasting $195 on annual fees. Should I wait? Do you think there is another 70k offer in the horizon?

Thanks,

Tania

@Tania Nice work on status matching! I’ve heard about AA sending out those offers to some members randomly. Gotta love the competition, or whatever is left of it in US airline industry.

As far as Platinum offer goes, here is what I think. Keep in mind, it does pay us commission, but I will try to be as honest as possible.

Anyway, I do think it’s a good offer in theory. Yes, the $195 annual fee stinks. But here is what you need to keep in mind. You are getting 10,000 more miles compared to Gold offer, plus an extra $50 statement credit. Reportedly, you can buy a $50 Delta gift card, and you will still get $100 credit. Whether 10,000 miles+$50 is worth $195 is up to you to decide. If you deduct the $50, that’s an equivalent of paying 1.45 cents per mile. It’s not the best price if you are accumulating miles speculatively. If you need to book an award with high CPM, it’s a steal. Plus, if you are not eligible for Gold offer, this argument is irrelevant. Then you are really paying $195 for 70,000 miles, plus $100 credit. That’s a GREAT deal.

Then again, it depends on what other offers you are considering at the moment. I decided to skip it for all the reasons outlined in the post. But I absolutely plan to apply at some point in the future. These increased offers usually come around at least twice per year. I think we will see them in 6 months or so, but I can’t guarantee it. Something else to keep in mind: in the meantime Amex may institute a rule similar to Chase 5/24.

I pulled the trigger. Instant approval 🙂 Hopefully you get the commission. I don’t have any plans in mind, but as I told you, Skypesos are valuable to me. I had the Delta Gold card 2 years ago so Platinum was my only option. I had a hiccup last apor and applied for Delta Gold. I didn’t look on my Excel spreadsheet and I forgot I had Amex Gold 3 years ago so I wasted one app and no bonus. I tried to negotiate but they gave me 5k only.

I always applied for 2-3 cards on the same day (Citi Platinum and Avianca) but it went pending. Let’s keep my fingers crossed.

I feel this is my last shot with Amex. I have 2 cards already (Amex Gold and Hilton) and the past 2 years I applied/canceled 3 cards. Also I am staying away from Chase. My last app (Chase Hyatt) was on March/2016. I feel I have zero chance with Chase. The past 2 years I applied for more than 10 cards (12 to be precise). I am going to wait with Chase or try a business card on the future.

@Tania First of all, thank you so much for your support! I really hope my advice didn’t come across as a sales pitch. 🙂

I do honestly believe it’s a good offer. For someone who lives near Delta hub (like you do), it’s actually a VERY good offer. Delta miles don’t expire, so that’s a big plus. Is this the most valuable currency in the hobby? Not even close. But if you get even $700 out of it, it would be a very good return in exchange for one credit pull. Sorry you wasted an inquiry on Gold offer. Don’t beat yourself up, those things happen.

I’m kind of in the same boat as you. I’m pretty much maxed out with Chase, and have gotten rejected by US Bank, Capital One and so on. But I still find opportunities here and there. My next card will hopefully be Citi Thank you Premier. Fingers crossed!

Thank you for this! I’m in a similar boat, Amex PRG fee coming due next month, but have MR points that I want to keep. Kept at it and found 25K offer incognito.

@CF Yay! So happy to help. I was driving myself crazy trying to get the 25k link to come up. I’m persistent to the point of being obsessive. 🙂

I didn’t think much of Skymiles because so many bloggers refer to them as “skypesos,” but I searched around for flights within Europe and Europe/Asia combo and there were a bunch of route options w/good redemptions! Now my hubby and I really really want the card.. but we’re already 5/5 on cc limits.. gonna have to wait few months until we can cancel some of them!

@Army Nice! Bad reputation in this hobby can be hard to live down, that’s for sure. I don’t think the term “skypeso” is accurate at this point in time. Sure, for premium redemptions, Delta can be awful. But many economy routes are reasonable via miles, and availability is often plentiful. It just depends on what you are looking for.