Travel insurance can be a very confusing subject. But I truly believe that this is one of the most important topics for me to address as a blogger who caters to regular families. I’m a great believer in travel insurance and wrote about it quite a few times.

Very often you see credit cards advertise travel insurance as one of the included perks, as long as you use that product to pay for at least a portion of the trip. That sounds great but be aware, no card out there includes a comprehensive medical insurance policy. Sure, some do provide complimentary medical evacuation, but they still don’t have routine medical care benefit.

So, I recommend you always buy a separate medical policy when going to another country. Fortunately, those are usually quite cheap. For example, I paid about $14 for three days in Jamaica for my family of four. When you are getting a quote, you can narrow down your options by checking Insuremytrip

For example, I put in a trip for two travelers in their late thirties, going to Tahiti (followed by other destinations) for two weeks. Here is the quote for medical-only policy:

That’s not bad, and definitely a drop in the bucket when it comes to budgeting for an expensive destination like French Polynesia. When getting a quote for a multi-destination trip, you normally have to put in a country where you begin the journey. So, depending on your payment method, this may be all you need.

Cards like Chase Sapphire Preferred, Chase Sapphire Reserve and Citi Prestige all have excellent travel insurance policies. I have relied on credit card travel insurance for some of our vacations. However, if your trip is a complicated one, you may want to consider purchasing a separate “comprehensive” policy. That’s what I did for our upcoming trip to South Pacific. I seriously debated on renewing my Chase Sapphire Reserve and simply charging everything on that card, but in the end, it ended up on the chopping block. Here is why:

1) I would have to pay $450 renewal fee (twice).

Sure, I would get $300 reimbursed via annual travel credit, but I would still have to justify a $150 premium. I went back and forth on whether a lounge access/travel insurance would be worth that amount and decided Nope. I didn’t know it at the time, but Amex Hilton Surpass card will have 10 airline lounge passes per year starting in 2018.

Both me and my husband have this credit card, and I won’t need to access the lounges more than 10 times (if that). Sometimes being an optimist pays off. I was planning to renew those credit cards anyway in order to get the weekend night certificates, so lounge access didn’t factor into my decision. But I’ll take it!

Foregoing the travel insurance benefit did give me pause. Here was my reasoning. Our trip would conclude close to the renewal time of CSR in 2018. It takes few weeks, sometimes months, to get your claim processed. That means I would have to renew my card again and pay $450, while waiting for my payout.

While I recognize that paying annual fees does make sense sometimes, spending $150 X 2 is a lot for a travel policy that may or may not pay off. Which brings me to my next point…

2) Chase may cancel my credit card accounts and there goes CSR travel insurance.

That’s the thing I don’t see mentioned very often. Sure, some cards offer excellent benefits, but they all have to be open at the time of the claim. I seriously doubt that Chase will decide to dump someone like me. I don’t do any MS or other funny business. If you do, beware.

3) Policy restrictions and fine print make me nervous.

If you followed my redemption saga, you know that I used a mix of mileage programs. Some of them, like AAdvantage and Avianca, don’t partner with Chase. The benefits guide for CSR (page 12) does mention that Chase will reimburse you for loss of frequent miles at a penny each. But! Notice this little tidbit of information:

Will Chase reimburse your re-deposit fees to a program like Avianca? It might, but it might not. This issue isn’t addressed directly in the benefits guide. Overall, CSR has a very good and comprehensive set of travel insurance benefits. However, I’m not sure I’m comfortable with relying on it when it comes to my highly complicated itinerary.

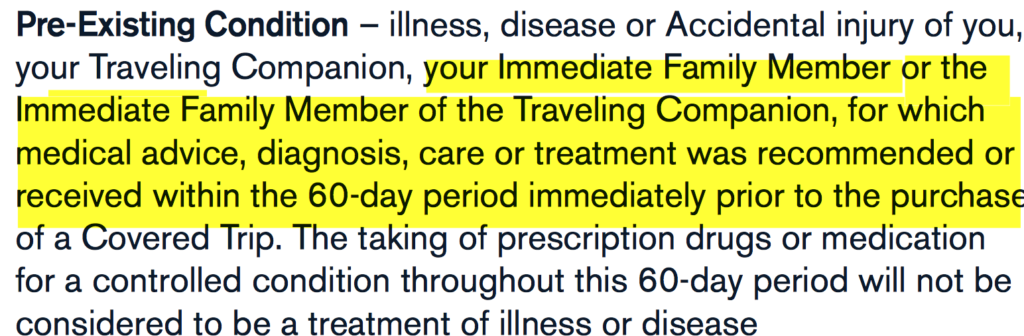

4) No coverage if you or your immediate family members have a pre-existing condition.

Fortunately, my husband and I are fairly healthy, but this is something for you to keep in mind. Be aware that if you (or your close relative) have a pre-existing condition, your trip will NOT be covered:

For example, let’s say you broke a leg, but it healed enough that you felt comfortable booking a trip the following year. Then, close to the date of departure, the doctor says you need a surgery because something went wrong. Your CSR travel insurance will not cover your financial loss due to cancellation. In contrast, Insuremytrip does offer policies that waive pre-existing condition clause as long as you purchase it within a certain period of time after making your first deposit (usually 14-21 days).

5) Unlike standalone policy, you can’t add “cancel for any reason” benefit when using your credit card.

This is what sealed the deal for me. I have invested a lot of money into this trip, not to mention, a ton of miles. A lot can happen in one year. My husband could lose his job and start another one wth zero vacation days in the bank. I certainly don’t want to go to Bora Bora alone. How sad would that be? If I have to redeposit my miles and cancel all the reservations, it will cost me a small fortune. This is not something credit card would cover.

In addition, my in-laws are quite old and you never know what will transpire between now and this summer. Just few weeks ago, my father-in-law had a stroke. Fortunately, he is mostly OK, aside from some memory loss. He will also have to re-learn how to read.

We still plan on making the trip, but things could definitely change between now and then. If my in-laws end up backing out, my husband and I will probably still go to Tahiti for a week. In that case, I will have to cancel a portion of the trip and book a return flight from Papeete to US.

My CSR credit card would not pay for mileage redeposit fees, but my standalone travel insurance policy will. I would get 75% reimbursed under “cancel for any reason” benefit, but 75% is better than zero.

Paying $210 for peace of mind (is worth it)

Well, to me at least. That’s what I ended up paying for a $4,000 comprehensive policy with “cancel for any reason” benefit, plus medical insurance. No, it’s certainly not cheap, but I have no regrets. I definitely hope that I never have to use it, but it’s nice to know it’s there. This unfortunate recent development with my father-in-law has convinced me that I made the right decision.

If you are looking to redeem miles on award tickets and are not sure what credit card to use to pay taxes, I highly recommend this post on Frequent Miler: When does credit card travel insurance cover award flights? Just keep in mind that when filing a claim, you might be in for a nasty surprise. A lot of the statements in the policy booklets are IMO open to interpretation.

Maybe I’m paranoid, but I believe that it’s better to over-insure then to under-insure, especially if you are low on savings. Yes, it stinks to spend extra when your credit card already offers some type of insurance benefit. And to be fair, for simple trips, that may be all you need.

However, do your research and think of the worst case scenario. Can you handle financial loss if everything goes south all of a sudden? Will it impact your future for years to come? And whatever you do, don’t skimp on medical insurance, especially when taking a cruise or going overseas.

Readers, share your data points on filing travel insurance claims with your credit card company!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

In regards to cruises. The insurance from credit cards does not offer some coverage specific to cruises such as Missed Connections, Excursion Re-reimbursement, etc…, Because of this I usually end up buying cruise insurance in addition to the card ‘s insurance.

@Hugh An interesting observation! I always thought that verbiage on cruise coverage via credit cards is a bit fuzzy. For that reason, I always buy a separate policy. I know in CSR benefits booklet there is a mention of sea transportation, which I assume includes cruises. Like I said in the post, it’s better to overinsure than to underinsure. The stakes are just too high.

Wishing your father in-law a complete recovery!

@HML Thank you! He is doing better, and is currently able to read one word at a time. He still has a hard time with comprehension, which is very depressing to him. But we hope for the best. He is a tough cookie!

I’m a firm believer of trip insurance and have used insuremytrip.com many times. I usually buy the comprehensive packages (especially for cruises) and look for a high amount for medical evacuations when doing comparisons. I don’t want to be stuck with that bill should one of us need to be flown to the US from another country. I’d rather be safe than sorry. My aunt fortunately bought trip insurance for her Hawaii trip when her husband unexpectedly passed away – whole thing was covered – thank goodness.

@Stephanie I’m very sorry to hear about your aunt’s husband. How sad! But I agree, at least she didn’t suffer a financial loss.

This was such a timely article! I may get to go on my dream trip to Ireland with my father in law and they were urging us to purchase this type of insurance. I have a CSR that’s up for renewal in June and I was debating on downgrading to a CSP. I also have a Schwab Plat that I’m keeping for cash deposits in combination with Blu Biz Plus. I probably won’t have the opportunity to take a trip like this again for several years.

David, I hope you get to go to Ireland! We only spent one day in that country, but I really enjoyed it. Very friendly people and beautiful scenery. I hope to go back someday.

As far as purchasing a separate policy, I can’t tell you what to do, of course. Depending on complexity, renewing CSR and using it for the trip expenses may be the way to go. Just don’t skimp on a separate medical policy.