One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

When am I going to learn? Capital One is just not that into me or my husband, for that matter.

But let me back up. So, as’ve mentioned last week, I got approved for Chase Hyatt Visa which requires $2,000 in minimum spending. I try to channel most of our expenses towards new sign-up bonuses because this strategy yields the most return. Unfortunately, there comes a time when you hit the proverbial wall. You either got all the best offers already, or don’t currently qualify for them. I think we are at that point.

But I still have a few options. We can easily handle around $5k in spending in the next three months due to upcoming property taxes bill and car payment I do via Plastiq (my referral link ). I don’t intend to stop getting new cards unless the banks stop me. The Hyatt offer will take up $2k of that amount, so technically, I had room for another card. But which one? I wanted to apply in my husband’s name in order to alternate credit pulls.

An unpleasant Merrill travel portal discovery

As most of you know, I’m currently in the midst of booking my trip to Tahiti, New Zealand and Australia. Everything has actually been going pretty smoothly as far as mileage redemptions are concerned. Sure, there were aggravating surprises along the way (cough, Avianca, cough). But with some work, patience and a little bit of alcohol I got through it.

One thing I did not anticipate is the fact that Merrill travel portal is not able to book flights on Air Tahiti (not to be confused with Air Tahiti Nui). This is a small regional airline that doesn’t partner with anyone. So, you can only book with cash or flexible points. I was really hoping to use Merrill portal for those flights. My husband currently has 50k points which can be utilized towards two tickets, each valued at up to $500. Guess how much my flights from Papeete to Bora Bora/ Bora Bora to Moorea will cost? Yup, $500.

It would be the perfect opportunity to burn those points. Alas, it can’t be done. At least not right now. I had a bad feeling when the online search returned no results. But surely if I call, they will see the flights, right? Wrong. The rep said she can’t help me, though she did put in a tech request. I’m not holding my breath.

So, it appears that I will have to budget another grand towards my trip. Ouch. But no, I am absolutely not skipping Bora Bora. As much as it pains me to drop an extra grand on two nights in a tiny island in the middle of South Pacific, this is non negotiable. I’m not flying that far and not including Bora Bora. That’s like when my father-in-law wanted to skip visiting Acropolis when we were in Athens. No way, Jose.

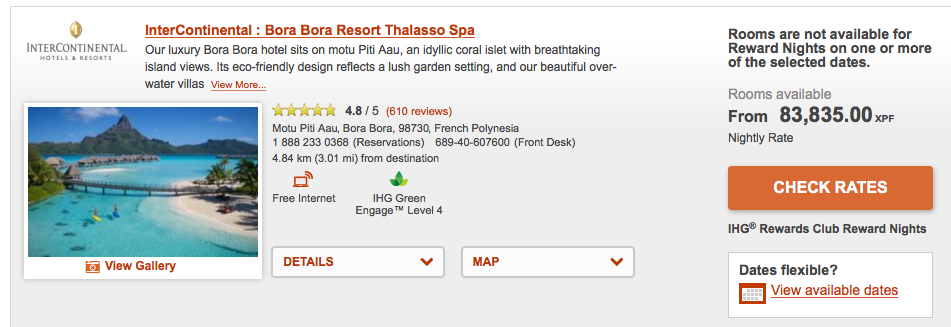

Guys, I just have to brag a little. I was able to book one night in an overwater bungalow at Intercontinental Thalasso on points. Yes, that one:

Spending 60k IHG points (54k after 10% rebate) on an actual overwater bungalow that retails for $1,200 per night just makes me feel giddy out of my freakin’ mind! As far as redemptions go, this is a tough nut to crack, but I got lucky, though only for one night. The previous night will be spent in a hut in someone’s backyard at a cost of $175. No complaints, y’all. I’ll have more on this topic in the next few weeks, so stay tuned. Needless to say, there is no way I’m skipping Bora Bora now.

Spending 60k IHG points (54k after 10% rebate) on an actual overwater bungalow that retails for $1,200 per night just makes me feel giddy out of my freakin’ mind! As far as redemptions go, this is a tough nut to crack, but I got lucky, though only for one night. The previous night will be spent in a hut in someone’s backyard at a cost of $175. No complaints, y’all. I’ll have more on this topic in the next few weeks, so stay tuned. Needless to say, there is no way I’m skipping Bora Bora now.

But I do need to find a way to offset the airfare expense. According to my research and feedback from readers, flights on Air Tahiti can be booked via UR and Citi Thank You portal. Unfortunately, at the moment neither my husband or me are eligible for any of Citi premium cards. I do plan to stop by Chase branch in January of 2018 and see if he is pre-approved for CSP, but it’s probably a pipe dream.

Both of us already have Barclaycard Arrival Plus, so my attention turned to Capital One Venture Rewards (read about these offers here). I really don’t like applying for Capital One cards because that bank pulls all three agencies. But $400 is $400. I’m not even going to bother applying in my name because they have rejected me, twice.

But my husband got approved for this card few years ago, followed by rejection last year. Could the pattern continue with approval? Nope. Flat out rejection. OK then, this is it for Capital One. I was very dumb and have three extra credit pulls to prove it.

What now?

The most logical thing to do is leave my husband’s credit alone for a few months. After all, he had two denials in a row. Granted, they were from the banks ( US Bank and Capital One) that are notoriously tough towards folks like us. Still, we are clearly at a point where my husband loooks undesirable. Not, I’m not referring to the fact that he thinks women don’t like his looks. Wait, why does he care that other women are not attracted to him anyway? Hmm…

Anyway, I’m addicted to chasing after new bonuses, so I just cant help myself. The plan is to eventually apply for US Bank Altitude card in my husband’s name again. I already have it, and just burned the points on various travel related purchases (a post coming up).

But we still need to find a way to cover those tickets to Bora Bora. In the meantime, I plan to follow up with Merrill travel department and see if they can somehow add Air Tahiti airline to their portal. How come Chase can see it and you can’t? Never mind, the card is issued by Bank of America. Enough said.

Miles, hotel points or cash?

The only cash back cards I found mildly enticing came with $200 bonus, not really all that juicy. I shoot for at least $300. One offer that I find sort of intriguing is Cathay Asia Miles credit card issued by Synchrony. I recently wrote about the program and some good uses for American families. There is a huge negative that I forgot to highlight. The miles expire after three years and there is no way to preserve them. Well, you can pay a huge fee, but it’s just not worth it.

I’m honestly not sure if I will be able to easily utilize them. My husband doesn’t really want us to go to Europe again for at least four years, so it will be cutting it close, even if I book a year ahead. The best option is Aer Lingus where non-stop flights from Dublin to Orlando cost 25k miles plus taxes. Aer Lingus currently adds mild fuel surcharges, so it’s a decent deal.

But it’s not spectacular, especially considering how cheap airfare to Europe has gotten lately. Plus, who knows what type of surcharges I would be looking at down the road, after Aer Lingus fully integrates into British Airways conglomerate. And Asia Miles program can increase the redemption rate at any time.

There is an option to burn miles on American flights, but sAAver availability is so poor, it’s laughable. We would have to be extremely flexible, and that is if I can convince my husband to fly in the first place. Reluctantly, I decided to skip this offer, though if you are a grizzled hobbysist, I do recommend you look into it.

I’ve noticed that Amex has brought back its 100k offer+free weekend night on Amex Surpass. Bingo! I was hoping to get in on it at some point, so why not now. I have a personal referral link where I get 25k points per approval. For us using up Hilton points shouldn’t be too hard. Florida has some nice beachfront and Disney area hotels that are located less than 90 minutes from our house.

Additonally, if you are an existing customer and end up getting rejected, Amex won’t pull your credit. The last thing my husband needs right now is another credit pull. So that’s what I did and we finally got an approval. He will get 100k points plus weekend night, and I should get 25k points for referring him.

So not a bad haul, all things considered. Sure, we will have to pay $150 in annual fees, but it’s still a pretty good deal, especially when factoring in complimentary breakfast at most Hilton properties. I speculatively value Hilton points at around 0.3 cents apiece, so let’s crunch some numbers.

If I get 125k points (factoring in my referral haul), it would be an equivalent of $375. The weekend certificate with breakfast at the beachfront hotel is worth at least $125. So, the total value (to me) is $500. If we deduct $150 in annual fees, we are left with $350. Not bad. Amex also brings lucrative offers now and again, but I’m not counting on those. Read my post on Amex Surpass from May of this year when the offer was identical to this one.

This card is in our affiliate network, and here is my referral link if you are interested in using it instead. Nancy has a personal referral link as well, so feel free to email her at nancy@milesforfamily.com and request it. You can generate your own referral link here

A shift in strategy

I also discovered something interesting. Right now I clearly value hotel points higher than airline miles or even cash, to some extent. After all, why would I speculatively apply for Hilton offer instead of Cathay card? This is a change from my previous strategy and has to do with my upcoming plans. We simply don’t intend to fly a whole lot within the next few years. We probably will at some point, but it’s unlikely that our plans will match up with sAAver availability on AA.com

Accumulating Asia Miles speculatively just doesn’t seem to make a lot of sense due to draconian expiration policy. I’m afraid I’ll end up burning miles for no reason other than out of fear of losing them. And we simply need to focus on other priorities rather than spontaneous costly vacations that further eat away at our savings. That said, I’m always up for an affordable weekend Hilton getaway that doesn’t involve the hassle or expense of flying. Free breakfast doesn’t hurt either.

Now if I can just find a way to cover those Bora Bora tickets….

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I know it would hurt, but if all else fails, you could redeem the 50k Merrill Lynch points for a $500 statement credit. Better than nothing if you just want a chunk of cash and especially if you arent planning to fly for a while afterward. And depending on when you opened the first one, you might be able to open another for another 50k before it goes away in a couple weeks. I personally got a second three months after opening my first, without canceling it or even needing to call recon, despite my churning history.

I feel you on Capital One… I did get a $500 Venture Rewards offer a few years back, but have been burned twice by them since. Never again!!! (I think.)

Are you well out of Irma’s danger where you live? Hope you and yours stay safe!

@Debra You make an excellent point and I actually planned to mention it as well. In reality, my “loss” is $500 because 50k Merrill points can be redeemed for $500 in cash. It’s true that if I’m very low on funds, there is always an option to cash out. I would hate to do this, of course, since flight value is double that amount. I’m still hopeful that the flights will be added to Merrill portal eventually, and at this point I still have time. The one that concerns me is Bora Bora- Moorea leg because there is only one per day. But I have almost 10 months, so it should be fine. We can even rearrange the trip a bit, though I would prefer not to. Overall, many things have gone quite well for us, so I need to focus on that. Spending an extra $500 stinks, but it’s not the end of the world.

P.S. We are gong to get some hurricane winds, but we are not in direct path (as of now). However, the track can change before Sunday. Those poor people in Miami area are probably going to get slammed, sadly. I really hope the hurricane turns away from Florida, fingers crossed.

@Leana isn’t there supposed to be a new BofA Premium card coming out this month? I’m waiting to hear what it offers because I’m in limbo right now with new cards – I could really use an $85 TSA Precheck reimbursement and some travel statement credits.

If that doesn’t pan out, I’m interested in 3 cards: Barclaycard Arrival Plus, Citi Premier, and Alaska Airlines (Barclay). Does Barclay limit you to 2 new cards per year? If so, I’m hoping it’s a calendar year so I can start applying in January.

I’m sure you’ll figure something out with your Bora Bora tickets, but man, that’s so frustrating with the Merrill Travel Portal.

@Stephanie Yes, there is a premium BoA card that’s supposed to come out soon. I did retweet the info on it a few times. I definitely plan to mention it once it’s actually out, but the release may get delayed. With BoA you just never know, so we’ll see. It looks like points will be worth 1 cent each, so I will definitely apply at some point. Unfortunately, it won’t really give me any incentive to use the bonus towards tickets. But cash is cash. The TSA pre check is a nice perk if it indeed materializes.

On Barclays, in general, I don’t recommend applying for more than two of their cards in one year. As in twelve months. It’s not an official rule, but Barclays is a conservative bank, so its best to not get too aggressive with their offers.

CONGRATS ON YOUR OVERWATER BUNGALOW.

@Natasha Thanks! I just wish we could get a second night reserved as well. But if not, we will survive. As the song goes, you can’t always get what you want.

Your lack of succes with CapOne has got me scratching my head. I just got approved for my first CapOne card (thru your referral link, btw) and am hoping my wife can get a second venture (1st has been downgraded) in a few weeks’ time. Gotta get those free Disney tickets.

And you are right about the credit card sign up wall. After we hit our minimum spends across the 2-3 cards we are working on now, I plan on taking a hiatus. We currently only have Disney this year and Hawaii next year on the travel calendar. Time to get back under 5:24 and shift our spending away from all the “free” trips for awhile.

@Cheapblackdad First of all, thank you so much for using my link and congrats on approval! Nancy and I really appreciate it. As for denials, I’m sure Capital One sees all of our recent credit pulls and like “Nope”. I don’t blame them, I wouldn’t approve me either. 🙂

I plan to take a break with my husband’s apps till next year. I hope to get him US Bank Altitude Reserve. I’m gonna cover those Bora Bora tickets, darn it!

Congratulations on the awesome redemption, Leana!! Happy to see your dream trip coming along, one mile/point at a time 😉

Stay safe this weekend!

@TropicGal Thanks! I’m telling you, we’ll be eating ramen noodles for few months after this trip over. Totally worth it, though.

Stay safe as well, my fellow Floridian. 🙂

That flight from PPT to Bora Bora is killer! Expensive and the airline is pretty old-fashioned – like, I don’t think you can check in until you get to the airport.

If I were you, I would arrive at the Thalasso bright and early. They are used to overnight flights so they would probably think nothing of you getting there at 8am. Then spend the day at the resort and maybe get your room early!

@Holly It’s insane, right? I’m used to paying around $500 to fly to Europe. Goodness, $500 for two 50-minute flights. But I think I would be kicking myself if I skipped Bora Bora, especially now after securing that overwater bungalow. I plan on (nicely) harassing Merrill portal folks to see if they can add it to their booking system.

Thanks for the tip on the early arrival. I think that’s what I might do. Worst case scenario: we can just hang around the pool for few hours. I’m hoping availability for the second night will open up when it gets closer, but I’m not counting on it.