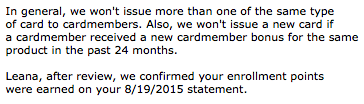

As I’m sure most of you’ve heard, Chase has just introduced draconian new rules for those who covet their Sapphire products. The biggest bummer and one I initially missed, is this little wording in the terms:![]()

So, what that means is if you’ve applied for Chase Sapphire Reserve last year and received the bonus, you won’t qualify for sign-up bonus on Chase Sapphire Preferred for two years after that date. I must say, this is a brilliant move by Chase and one I have not anticipated. In reality, though, it shouldn’t come as a surprise to anyone because another bank has been following a similar policy for over a year. I’m talking about Citi, of course.

And if you think about it, why would anyone need both Chase Sapphire Reserve and Chase Sapphire Preferred? Well, aside from wanting the bonus, of course. And Chase is not in business of handing out free points for no reason, but rather making a profit. So, I totally understand where they are coming from.

If you are new to miles and points hobby, you shouldn’t be too concerned. I personally would start with Chase Sapphire Preferred rather than Reserve unless you really need Priority Pass lounge access. Feel free to reach out to me at milesforfamily@gmail.com and I can give you tailored advice based on your specific situation.

You snooze, you lose

Some of you may remember my post where I debated on whether to stop by Chase branch and check for pre-approval status on Chase Sapphire Preferred. I had it in my profile last time, back when I applied for Chase Sapphire Reserve. So, I was hoping the lightning would strike twice. Unfortunately, Chase branch is located 1 hour from my house, and I’m a busy mom/small business owner.

So, I dragged my feet on this one. Well, I finally rearranged my schedule and made plans to stop by the branch tomorrow. Aaand it’s too little too late. Oh well, like I always say, you win some, you lose some in the miles and points hobby. I’m not going to stress over banks outsmarting me now and again. Besides, it’s possible I wouldn’t have had a pre-approval in my profile anyway.

My husband just got approved for Hyatt co-branded Visa few months ago, so we will leave Chase alone till next year. I’ve said before that I don’t like to get too aggressive with that bank. Chase has been very good to us over the years, and most of my non-bonus spending is thrown their way.

Chase Hyatt Visa it is

I was actually thinking about applying for it anyway, so this new development solved the dilemma. No, I’m not talking about elite status fast track offer for Hyatt Visa cardholders that is currently causing all the buzz in the miles and points industry. I’ve never pursued status via stays and not about to start now when I have bills coming out of my ears.

The offer may be appealing to some (stay 10 nights to get Explorist, 20 to get Globalist status through February of 2019), but I will only be staying in a Hyatt resort for two nights between now and the end of the year. I recommend you don’t get caught up in Globalist hysteria and do math first to see if having status will pay off in the long run.

Please, don’t start scheduling unnecessary hotel stays for the sake of “free” food and upgrades at some point in the future. Like I’ve said before, free travel in this hobby can get very expensive, fast. Watch out, because you too can easily get infected with “status chasing” bug. Check out the comment from reader Cheapblackdad that he made on Nancy’s Monday post: “Us buying DVC would be like giving up our saving money superpower. It’d be like Superman getting a kryptonite necklace because the salesman (Lex Luther), said it looked good on him in the store.” That’s how I feel about status chasing. But I’ll happily take it when it’s free.

For me, applying for this card is strictly about the points. My husband actually has Explorist status through February of 2018, and two out of four Club upgrades will go unredeemed. And I’m not concerned. My kids and spouse do really like Hyatt resorts, though, and I’m all for making my family happy. Just not if we have to pay for eighteen (!) additional hotel nights for no reason.

<

p style=”text-align: center;”>Waterpark at Hyatt Regency Coconut Point Resort and Spa

We use various hotel programs since my goal is to travel on the cheap. To me the chain doesn’t matter a whole lot. But I have to admit, when it comes to facilities and overall quality, Hyatt resorts blow Holiday Inn out of the water.

I got this card few years ago and recently reached out to Chase via secure message to double check when the bonus nights were deposited. This is a crucial detail because you are only eligible for new sign-up bonus after 24 months has passed. Here is the response I got:

So, it looks like I’m good to go. It is cutting it a bit close, but technically, it has been 24 months. So I went ahead and applied. Pending… I don’t like calling Chase reconsideration line and usually just let the application process run its course. So, I figured I would wait for the letter. To my shock and amazement, new Chase Hyatt card showed up in my profile just an hour later. Score! I didn’t get any email on it, but looks like it was approved.

This is a very good card to hold on to due to renewal certificate each year. For only $75 annual fee you can stay in a category 1-4 Hyatt property, a fantastic deal. It’s a decent price even for an airport hotel, but you can do much better. Here are just some of the properties in US where you can use the certificate:

California

D.C.

Florida

- Hyatt Centric South Beach Miami

- Hyatt Place Marathon/Florida Keys

- Hyatt Regency Coconut Point Resort and Spa

- Hyatt Regency Grand Cypress

- Hyatt Regency Orlando

Louisiana

New Mexico

Washington

All of these hotels are most certainly worth $75 all-in. As a Floridian, I have several decent options which I know my kids will enjoy. So, I plan to hang on to this card unless they gut the program. I canceled it previously because I thought it would help with CSR approval. I’m so glad Chase let me get it again, and with a sign-up bonus to boot. That’s why I have nothing but love for that bank, despite recent developments.

If you want to apply for this card, you will need to go to Hyatt.com and make a dummy booking. On a payment page you will see an offer that comes with 40k points +$50. Annual fee of $75 is not waived. You should also be eligible to get 5,000 points for adding an authorized user, but it’s not mentioned on the landing page. YMMV As of now, this card is not subject to Chase 5/24 restriction.

Plans going forward

Not much is going to change, really. I plan to apply for offers that fit into my upcoming plans. Short version: flexible points first, cash second, miles third, hotel points last. Occasionally, I make an exception like I just did with Chase Hyatt Visa. I don’t actually have any specific plans for the bonus. We are low on hotel points, though, and I would prefer that both of our annual certificates renew around the same time. That will make it easier to plan a weekend getaway at one of Florida Hyatt resorts.

For those of you who decided to skip recent good offers in hopes of staying under 5/24 and getting approved for Chase Sapphire Preferred, my sincere condolences. The game always changes and we have to adapt. The goal is not to let negative changes upset you, not even a little bit.

I’m looking forward to putting my Hyatt points to good use. And despite setbacks, I’m still having fun with this whole miles and points nonsense! Are you?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

We’re using hubby’s 2 free nights in NYC, and my free cert we’re using in Boston for a category 4 which was running $500 per night. Definitely worth the $75 annual fee.

@Stephanie This card is definitely a keeper! Staying in Boston for $75 per night is a steal.

I might have missed this, but did you apply for the Hyatt that gives points? I thought that was the current offer but you mentioned that you planned to use the free nights at the PH Sydney. Thanks!

@Kelly My husband applied for 2 free nights offer right before it expired. We pulled the trigger because of property in Sydney. Otherwise, the points offer is better IMO due to flexibility. That’s the one I just applied for and we plan to use the bonus on Florida resorts.

So glad you got the Hyatt. I snapped it up before it changed to points. We are using the 2 free nights next year at the Hyatt Regency Toronto as the Park Hyatt Toronto is being refurbished. Used the bonus 5,000 points to book a Hyatt place in the next town for Valentines weekend next February. Also got the $50 statement credit.

DH got the ihg card with the 100,000 bonus. No plan to use the points except for one night at cocoa, FL pre DIsney Cruise next August.

I was able to get the CSP because my Fairmont converted to a CSP, I downgraded it to a Chase Freedom Unlimited though so no CSP for me either.

It’s true that this game changes so frequently.

@Natasha Your plans sound like fun! We hope to use our two Hyatt nights in Sydney, fingers crossed. And congrats on getting 100K offer on IHG card. Despite its many quirks, IHG program has been very good to us. I just burned 60k points on an overwater bungalow in Bora Bora that goes for $1,200 per night. I felt like dancing for joy!

When do you plan on doing Park Hyatt Sydney? I have a trip there in October. We are considering using it there, but also thinking about doing Miraval in Tucson since we’d be at the resort more there than we would be at the Park Hyatt Sydney.

@Jim We will be there next July. It’s funny, I was actually tempted to burn the certs at Miraval resort as well. That’s my husband’s type of vacation! But it requires a separate trip to Arizona before September of next year, and that’s a deal breaker. Plus, Hyatt in Sydney looks like such a cool property.

Feel free to use those free nights at the Hyatt Ziva Cancun. As my wife, son, and I experienced earlier this year, it’s one of the best uses of free Hyatt nights in the Western Hemisphere.

Issuers are definitely tightening up. Thankfully, I applied for my 2nd CSP 2 months ago so we managed to get ahead of this issue.

And my, how the CSR has changed. ‘Twas just a year that it was the goal of every grizzled hobbyist and every fresh eyed newbie to have his card. Now, with sign up bonus cut in half, the travel credit moving to calendar year, and it precluding most people from also having a CSP it really may be worth avoiding.

@Cheapblackdad I would love to visit Hyatt Ziva Cancun, but I doubt we can make it happen on the account of being broke from the epic trip to South Pacific! But I sure am glad you were able to enjoy it. And good for you for snapping up CSP just in time.

I agree, CSR is not what it used to be. It was a truly spectacular offer, and I was shouting from the rooftops for people to get it. And it even paid us commission. Those were the days…