In the last year or so, AAdvantage program has turned into Delta SkyMiles. As in everyone hates it, and AA miles are universally regarded as useless. But is it really so? Nope. Don’t get me wrong, domestic sAAver availability on AA is AAwful, an AAbomination. Sorry, I can’t help myself. If that’s the only reason you are thinking about applying for AA co-branded card, don’t.

Fortunately, there are many ways you can utilize AAdvantage miles and they don’t necessarily involve flights. But you can absolutely use AA miles on domestic flights, as long as you are willing to pay more. But before I list various ways you can burn this currency in order to save on travel, let me share what happened to me recently.

A hot targeted offer… or is it?

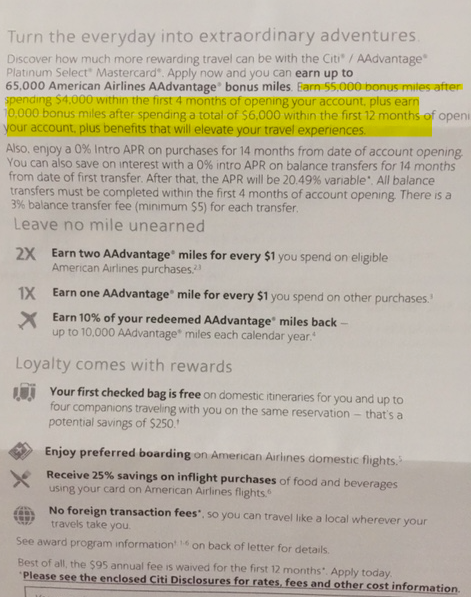

As you probably know, the current affiliate offer on Citi AAdvantage Platinum Select MasterCard has been recently increased to 60K miles. Here are the details, in case you are not familiar with them:

- For a limited time, earn 60,000 American Airlines AAdvantage® bonus miles after making $3,000 in purchases within the first 3 months of account opening

- First checked bag is free on domestic American Airlines itineraries for you and up to four companions traveling with you on the same reservation*

- Enjoy preferred boarding on American Airlines flights

- No Foreign Transaction Fees on purchases.

- Receive 25% savings on in-flight food and beverage purchases when you use your card on American Airlines flights*

- Double AAdvantage® miles on eligible American Airlines purchases*

- Earn 10% of your redeemed AAdvantage® miles back — up to 10,000 AAdvantage® miles each calendar year

- The annual fee of $95 is waived during first year.

There is one wrinkle. The official offer contains this language: “American Airlines AAdvantage® bonus miles are not available if you have had any Citi® / AAdvantage® card (other than a CitiBusiness® / AAdvantage® card) opened or closed in the past 24 months.” I closed my AA co-branded card in December of 2016 and I *thought* my husband closed his in December of 2015. That would mean that at this time neither one of us is eligible for the official 60K miles offer.

That’s why I was delighted when my husband got a targeted Citi offer in the mail. You guessed it, it didn’t contain “24 months” language.

Basically, we would have to commit $4,000 in spending during the first four months in order to get 55,000 miles. That’s a significant amount, for sure. If I wanted to get an extra 10,000 miles, I would have to commit an additional $2,000. I would probably stop at the first portion because I like to constantly chase various sign-up deals. Not telling readers to do it, just stating a fact.

I thought it was a decent offer, plus, like I said before, it didn’t contain targeted language. I wasn’t really planning on getting another card so soon after being approved for US Bank Altitude Reserve, but I didn’t want to miss out on chance to pick up extra AA miles. We do have a lot of bills coming up in the next few months, so I believe we can handle it. But before applying, I wanted to double check on whether my husband is indeed ineligible for the official offer.

Whoa! My memory tricked me. We canceled his previous Citi AA card in March of 2015. Clearly, my record-keeping skills are almost as bad as sAAver availability on American. So, turns out, he was eligible for the official offer after all. There was no contest. I didn’t think that extra 5,000 miles is worth the trouble. Plus, the official offer pays me commission (though it wasn’t a huge swaying factor).

My husband applied and was approved. You may wonder what my plans are for AAdvantage miles. I’m not yet sure, but I know we’ll put them to good use at some point. Maybe even soon. I have a crazy plan cooking in my brain right now. It probably won’t materialize, but if it does, AA miles will come in handy. I can’t tell you because it’s a secret. Cough, Tahiti, cough.

Should you consider current Citi AAdvantage offer?

It really depends on your plans and your ability to get approved for other cards. I’ve put together a post specifically tailored to newbies where I urged them to focus on Chase cards first. I also think that going after flexible points and cards like Citi Prestige, Citi Thank You Premier and US Bank Altitude Reserve cards can make a lot of sense. Read about them in my Hot Deals page.

That said, here are some reasons to consider current AA offer, personal or business version:

1) You are limited by 5/24 rule and already applied for all the other cards I’ve mentioned.

That’s really why I decided that applying for this offer made sense in our particular situation. Like I said, I don’t have a specific goal in mind, but I’m certain that we will utilize the miles eventually. And picking up 60K miles offer with no annual fee is nothing to sneeze at. I consider it equivalent to buying miles at a greatly reduced cost. Will I get huge value from redeeming them? Probably not, but I’m certain I won’t lose anything either.

2) You live in or near AA hub and have some flexibility in your schedule.

This is a very compelling reason to consider this offer. Why? Access to non-stop flights, which makes traveling with family much easier. But, but, but, what about poor sAAver availability? Just plan to burn miles at AAnytime level. Sure, it stinks, but if you save money in the end, it will be worth it.

Let me give you an example. Let’s say you want to fly from LAX to Orlando at the end of December, while the kids are out of school. Let’s check economy availability for four people, shall we?

Here is SAAver level:

<

p style=”text-align: center;”>SAAD

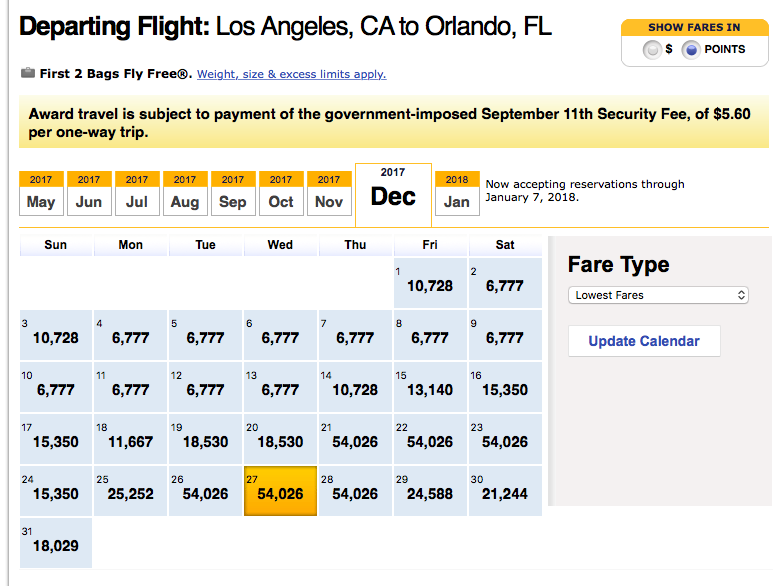

But let’s now take a look at AAnytime economy availability:

Much better! As you can see, you can easily get a seat for 20K-30K miles per person. The best part? You can get a direct flight.

But what about Southwest? They recently opened their schedule and in fact, I’m writing this post the day after it was loaded. Here is what you can expect to pay for one-way flight via Rapid Rewards program:

Sure, the beginning of December is quite reasonable points-wise. But if you absolutely have to fly on 26th-28th of December, you’ll be paying a fortune. AA award rate doesn’t seem so crazy now, does it? Plus, all Southwest flights from LAX to MCO have a connection.

Obviously, different routes will have a different pricing. My point is: don’t automatically dismiss AAdvantage program if you don’t see sAAver level availability. The goal is to save money. Let’s say you end up redeeming 60K miles on three one-way tickets. If those tickets run at $200 apiece, you just saved yourself $600. Winning!

Some routes have better sAAver availability than others. If you want to fly from LAX to Sydney (Australia), award availability in economy isn’t too bad. Let’s say you want to go next March.

Here is sAAver availability for four people:

Just burn other miles or points to get to LAX, and you’ll be fine.

I recommend you read a post It’s Raining AA Miles! Should You Scoop Them Up? written by my blogging partner Nancy. Nancy and her family live near Dallas (AA hub) and AAdvantage miles are still quite useful to them, despite the lack of sAAver availability.

3) You are OK with burning AA miles on hotels and car rentals.

I wrote about burning AA miles on a 2-bedroom vacation rental in Key Largo and getting about a penny per mile in value. There is also an option to use AA miles on car rentals at a fairly decent rate. Sure, there are drawbacks, plus, the rate is non-refundable. But if you are fairly certain about your travel plans, it’s definitely a worthwhile option to consider. I wouldn’t value the sign-up bonus at $600 in this case, but probably closer to $500. Still, it’s 500 freakin dollars!

4) You are savvy when it comes to redeeming miles on partners and international routes.

In this post I wanted to focus on domestic award availability because that’s most relevant to my target audience. But the truth is, you can redeem miles on partners at sAAver level as long as you have patience and flexibility. You will sometimes have to call, as is the case with Air Tahiti Nui because the awards are not displayed online. But it’s worth it if it allows you to save cash in the end.

It costs 40K miles one-way to fly from LAX to Tahiti, and availability is reportedly quite decent, precisely because it’s not displayed online.

Bottom line

The increased offer on Citi AAdvantage co-branded credit cards is most certainly not for everyone. There are other bonuses on the market that might be a better fit for your specific situation. If you live near Delta hub, you’ll be happy to know that the offers on both co-branded Amex versions have also been increased recently. See more details in my Hot Deals page.

Either way, I hope that my post showed you that 60K AA miles are far from worthless. After all, why would I personally apply for this card if they were?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Leana, how did you check the dates that you previously held the AA Platinum card? I have notes on this but would like to get the precise date as I have a large payment coming up in November to pay for a vacation rental and I’d like to reapply for the Platinum card and/or the Admiral’s Club card for both my wife and I. I would appreciate any pointers you can give me. :>)

@Russ Well, funny you should ask! I’m a terrible record keeper. In fact, I didn’t write the date down. So, I looked at my husband’s credit report https://www.annualcreditreport.com/index.action

It’s free. Whatever credit agency you choose will list the cards you’ve had and canceled with each bank, but it doesn’t give you the name. I knew I have canceled only one Citi card for him in 2015. I thought it was in December, but it was actually March.

Then I starting looking at some blog posts of mine for that time period and sure enough, that was the date. I don’t know the exact day, but since its May now, we should be OK. I really need to get my act together, those dates are important!

it’s funny how I always complain about their Saaver availability, but I guess I could take a look at their Aanytime especially if they offer non-stop flights. I’m always trying to squeeze out the best deals for the points we accumulate, but sometimes, just getting a free flight is worth it. We’ll be coming into some AA bonus miles in a little bit thanks to Barclaycard, and hopefully, we can put them to use within the next year. Thank goodness we live next to LAX because we’ll be working on accumulating some Delta miles with their recent promo.

@Stephanie I know how you feel! I also shoot for sAAver award flights if at all possible. The trouble is, if available, they usually leave at 6:00 AM. You can almost count on it. That, and the fact that there will be a connection. Frankly, I would rather pay an extra 7,500 miles to get a decent departure time and non-stop option. Small kids and my husband’s limited vacation time sort of shift the priorities a bit.

I’m not really interested in AA domestic flights and I’m very familiar with the terrible international offerings as they lay everything off to BA. I milked the US Air/AA merger for a lot of points I could not use until we began to visit Barbados. Now we fly Bus/First via Miami and can use these miles; I also booked flights from ORD to West Palm Beach (this Thursday, in fact) for our son and his family and this worked well. My bitches about AA are related to international flights to Europe as one of our sons resides permanently in Berlin, Germany, and their totally irrational policy on Admiral’s lounge usage on trips to the Caribbean.

@Russ Yep, BA option is a huge joke. Yet, that’s the airline that always has wide award availability on AA.com, as long as you are willing to pay $500-$1,000 in fuel surcharges, of course. What a scam! Fares to Europe have come down to the point that it’s cheaper to just pay cash, yet they insist on adding these scam fees.

But yes, depending on your needs, AA program still represents huge value. I don’t get all the moaning and categorical claims that AA miles are useless. They are useless in certain situations, yes. But there are many options, including redeeming miles on hotels at a penny each (via credit card sign-in), if all else fails.

I think folks who live in AA hubs should definitely consider stocking up on AA miles, if only for AAnytime redemption option.