It looks like if you apply for Chase Sapphire Reserve after May 20th, the travel credit will be based on cardmember, rather than calendar year. Read full details on Doctorofcredit. This is not a rumor, and you can see the official update to terms on this Chase page.

Obviously, it’s a huge blow because it means a loss of a second $300 travel credit. Why did Chase decide to implement this change? Well, they want to prevent gaming and dissuade those who are only in it for the bonus. They also don’t want people making conversions from other no-annual-fee Ultimate Rewards earning cards just for the sake of maximizing the credit twice, before converting them back the following year, a strategy I described in this post.

Also, I think the new US Bank Altitude Reserve card is responsible to an extent. Banks are copycats, and when Chase saw that Altitude card bases its credit on cardholder year, they thought: hey, why don’t we do the same thing? So, in light of these upcoming changes, I’ve put together a guide for those who are thinking about applying.

If you are new to this hobby

My previous advice was to hold off on applying for Chase Sapphire Reserve. I’ve put together a post with suggested order of Chase applications and told readers to go for Chase Sapphire Preferred first. In light of this new information, my suggestion is to consider applying for Chase Sapphire Reserve instead. Update: the terms have been adjusted, so I recommend you hold off on applying for this card for now.

Yes, Chase may increase the bonus in a near future, so don’t blame me if you miss out on additional points. I’m simply telling you what I would do, what I would recommend my relatives to do in this particular case. Besides, CSR doesn’t pay me commission, while Chase Sapphire Preferred does. So, obviously, I’m shooting myself in the foot here because it’s the right thing to do.

Of course, I’m assuming that you can handle $4,000 in minimum spending requirements. Otherwise, if you end up getting into debt, no amount of points will make up for it.

If you are under 5/24 restriction

There is not a whole lot you can do as far as getting approved for this bonus. I don’t believe they reinstated pre-approval for this card in branches, so it’s a no-go at this point. There is one possible workaround. You should check your Chase profile and click here:

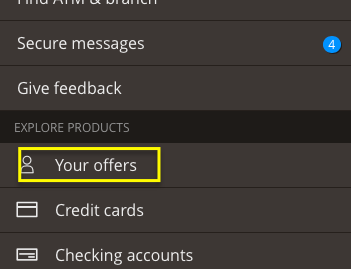

Then look for green mark next to “your offers” :

Then look for green mark next to “your offers” :

If there is a green mark next to Chase Sapphire Reserve (important!), it means you are pre-approved. It doesn’t mean you’ll get the card, but there is hope.

If you have another personal Ultimate Rewards earning card

I’m referring to Chase Sapphire Preferred, Chase Freedom and Chase Freedom Unlimited. In that case, you may want to consider converting one of them to Chase Sapphire Reserve now. Why? To double dip on $300 credit, of course. Plus, CSR comes with a host of perks, like Global Entry credit, lounge access, and ability to redeem points at 1.5 cents toward travel.

Sure, you may forgo the ability to earn 5 points on rotating categories with Chase Freedom or 1.5 points on everything with Chase Freedom Unlimited. But you’ll be getting a net gain of around $150 (assuming you consider travel credit to be almost as good as cash). That’s because you’ll pay $450 and collect $600 by double dipping. Caution! I’m assuming that Chase will allow this conversion under existing terms, so make sure you save details of your phone conversation or a screenshot of a chat.

If you are trying to decide between US Bank Altitude Reserve and Chase Sapphire Reserve and you are NOT under 5/24 restriction

There is no competition, really. Chase Sapphire Reserve is superior due to ability to transfer to airline and hotel partners. Also, you can redeem points towards vacation rentals, cruises, and use combination of points+cash towards travel bookings. The perks like lounge access are better too, but those are usually not a swaying factor to me.

Bottom line

I hate to make this recommendation because Chase may increase the bonus in a near future, maybe even raise it back to 100K points. Then people will be angry at me for telling them to settle for 50K points. I do think this scenario is somewhat unlikely. The competitors currently offer a similar bonus, and UR program is much stronger than other ones on the market. I say: Buy (maybe).

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

If my understanding is correct, I think the double dip for the $300 should still be possible. Chase lets you get a refund on your annual fee if you cancel or downgrade it within 30 days of the annual fee being charged, right? So couldn’t you pay for your $300 worth of travel as soon as the second travel credit is available, then call to downgrade and ask for a refund for the $450 fee.

Obviously, it gives you a smaller window for the double dip – only 30 days instead of potentially a year – but I think you can still get the double dip, at least if my understanding is right.

@Finanacial Panther First of all, I LOVE the name! So yes, you are correct. Technically it’s possible to do what you’ve described. However, there are a few issues;

1) There is no guarantee that Chase will refund the fee. Yes, it is the case right, but things can change in the future.

2) It’s a bit too advanced for my audience. I try to keep it simple, and there is a high probability of messing up and not cancelling on time, and being stuck with the fee.

3) It could potentially harm the relationship with Chase. Banks are not stupid, and can easily see your prior history with them.

4) Some may consider it unethical. I think it’s borderline, though it’s technically within the rules.

Makes sense! It’s definitely an advanced move with no guarantees. My wife is missing out a the CSR for herself just because we’re in the middle of some churning right now, but I think we’ll go ahead and try it out when we get a chance – probably later in the year. We’ll see…!

Honestly, I have a hunch that Chase will raise the bonus on CSR before the end of the year. I could be wrong, of course. But maybe it is best to skip it right now.