My goal with this blog is to make miles and points hobby easy to understand. Of course, certain level of intelligence is required. Not everyone can do it, period.

That said, you don’t have to be a brain surgeon or rocket scientist to master this hobby/obsession. I’m definitely not a person with superior intelligence and never claimed to be one. I like it when things are presented to me in a simple, easy to understand form. And I try to do the same in my blog.

Unfortunately, it appears I needlessly confused some readers with my recent post Renew Vs. Downgrade CSR Guide for an Average Joe Most of the issues arose not from analysis itself but from a side topic, which should have probably been covered by me in a separate write-up.

Here is the portion of the post that caused all the confusion, now updated:

“If you are under 5/24 (or get pre-approval in branch), and qualify for a sign-up bonus on Chase Sapphire Preferred, I recommend you try to get it in the next few months. Then, at CSR renewal time, you can decide on which one to keep open. If you settle on CSP, then simply cancel CSR (or convert it to Chase Freedom or Freedom Unlimited, as one of the readers pointed out). If you decide that CSR is a good long-term option, cancel your existing CSR first, then upgrade your CSP to CSR. Makes sense?

This will allow you to retain transferability of UR points and to double dip on $300 calendar year travel credit. If you do decide to convert CSP to CSR, make sure to do it before last statement for 2017 generates.

That way you can take advantage of this year’s $300 credit. Actually, by this logic, it could make sense to convert CSP to CSR regardless, if the option is available. Of course, there is some risk that Chase will not allow you to get a second $300 credit for 2017. See my response to one of the commenters for further explanation.”

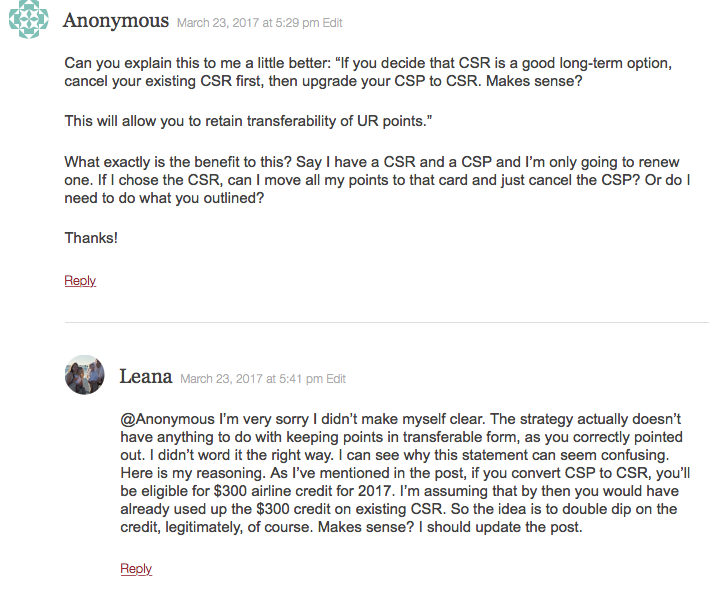

And here is my exchange in the comments section:

So, basically, using this logic, converting CSP to CSR is probably best if the option is available. That way you can take advantage of $300 credit for 2017 (again) and you’ll cover $450 fee completely after getting another $300 in 2018. However, I’m not certain that Chase will give the $300 credit for 2017 after you’ve previously received it on your old CSR card. If anyone has experience with it, let me know in the comments.

In fact, if you have Chase Freedom or Chase Freedom Unlimited, you can convert those to CSR as well. Collect $300 in 2017, then another $300 in 2018, then boom, downgrade the card back to Freedom or Freedom Unlimited before next annual fee hits.

To be clear, I’m not endorsing this strategy, and I’m pretty sure Chase will notice what you are doing… eventually. And they ain’t gonna like it. But it is an option, so I’m presenting it for those who might be interested. This isn’t fraud, but simply taking advantage of a loophole. YMMV

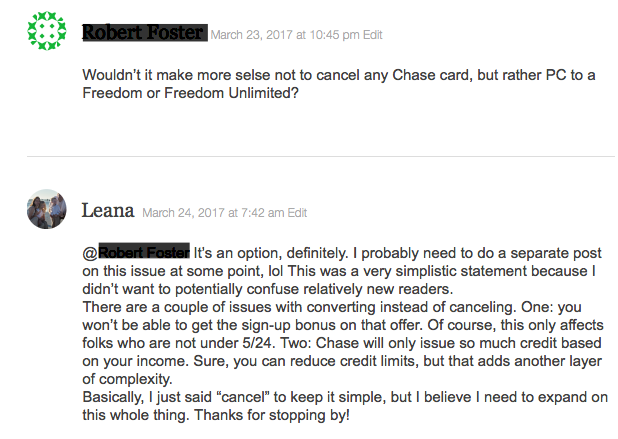

The issue of downgrading vs. canceling Chase card

This was another point of confusion, based on the comment from one of my readers:

So, basically, the issue of canceling vs. downgrading is not that simple. It will depend on whether you fall under 5/24 rule and whether you already have Chase Freedom or Chase Freedom Unlimited. We currently have both. Personally, I don’t max out 5% categories on the former card, so have zero need for a second Chase Freedom. The same goes for my husband’s Freedom Unlimited. It earns 1.5 UR points on everything, no bonus categories.

The biggest reason to cancel existing CSR rather than convert it is so you can be eligible for a sign-up bonus on new Freedom or Freedom Unlimited. Some have been able to get 30,000 UR points offer on Chase Freedom when applying in branch. That’s a significant amount. Of course, if you are over 5/24, your only way of getting this card will be through pre-approval.

I usually (but not always) cancel Chase cards. The reason? I believe it improves my chances of being approved for a new Chase offer down the road. Nobody knows the exact formula the banks use when it comes to credit card approval, but in general, the more accounts you have open, the less chance you have at success.

Banks base their criteria on your income level and credit score when they determine your credit limit. So, at some point, you will hit that limit if you keep collecting cards. Of course, you can always request to reduce your credit limit and it may help. But I like to keep my Chase card collection at three accounts max.

Once again, not an exact science, just something I try to stick to. And so far, it’s been working. Most of my new Chase applications (branch pre-approvals and those not under 5/24) are approved instantly. Would the same hold true if I had four existing accounts? I have no idea, but I prefer to stick with what works. If I don’t have a clear need for a certain credit card and qualify for a sign-up bonus on that product, I simply cancel it.

It does depend, though. Take Chase IHG Rewards Club Select credit card. Technically, I could cancel it and reapply since it’s not under 5/24 umbrella (for now). The sign-up bonus is substantial, so what’s stopping me? I like the perks so much, I can’t bear to part with the card and risk not ever getting approved for it again.

Just few weeks ago I used the renewal certificate for a suite at an all-inclusive resort in Jamaica (see my new trip report). That same suite goes for $550 per night during spring months. Sure, I can live without my Platinum status, 10% rebate and renewal certificate (my favorite perk), but I don’t want to. A lot of what we do in life comes down to wants and preferences.

And most of the things in miles and points hobby are not “one size fits all.” I know I say that a lot, but it’s really true. There are few indisputable facts. UR points are very valuable. Fact. Chasing after sign-up bonuses will give a normal person (not MS junkie) the best bang for his/her buck. Another fact. But most other stuff falls into YMMV category. Do whatever works for you.

Of course, it goes without saying that before canceling any card it usually makes sense to call and ask for retention offer. I don’t like doing it, but it can pay off big time. Several of my readers have reported getting an offer of 10,000 SPG points in exchange for keeping their Amex SPG card open. Getting 10,000 highly valuable points for only $95? Yes please! Sometimes you can have your cake and eat it too.

Readers, what is your strategy on canceling vs. converting credit cards?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

[…] Obviously, it’s a huge blow because it means a loss of a second $300 travel credit. Why did Chase decide to implement this change? Well, obviously, they want to prevent gaming and dissuade those who are only in it for the bonus. They also don’t want people making conversions from other no-annual-fee Ultimate Rewards earning cards just for the sake of maximizing the credit twice, before converting them back the following year, a strategy I described in this post. […]