One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

Update: the link for Merrill card appears to be dead.

Have you read my post A Reality Check for New Readers? Here is a tongue-in-cheek quote from yours truly: “I’m very much a regular SAHM, yet I’m capable of doing basic math.” Yeah, about that...

So, few months ago I signed up for Merrill+ Visa Signature card. It offers a terrific sign-up bonus (no, the card doesn’t pay me commission) and I’m truly surprised that the link is still alive. The main appeal of the offer is the fact that you can redeem 25,000 points for a ticket worth up to $500, and get 1 cent per point afterwards. And I knew just what to do with the bonus: get a roundtrip ticket to US for one of my parents.

My huge blunder

When it comes to sign-up bonuses, I really don’t like to wait till the last minute. I try to complete my spending at least 3 weeks before deadline and also charge an extra few hundred dollars in case I end up having to return something. In the past, Bank of America started the clock from the day you’ve activated the card, NOT the day you got approved. But since I don’t like taking chances, I met my spending based on the day of approval. Or so I thought…

Unfortunately, I was in a rush and ended up miscalculating the totals. Yes, I’ve added up the numbers WRONG, so I guess I’m not capable of doing basic math. My statement closed, but there was no bonus. In fact, according to the information on it, I have spent only $2,700 in the last three months instead of $3,200 that I thought I did. Oops.

But it’s OK because Bank of America goes by activation date. Or does it? I called on February 7th and the rep said the clock started on November 8th, the date of approval. BoA Twitter team also confirmed it. In desperation, I called again and was told the same thing. The last rep said that as long as my purchases post by the next day, I would get the bonus. Gulp.

I went into panic mode, but there was nothing I could change at that point. I made a seriously stupid mistake, though there was some hope. I charged some expenses right away: prepaid my power bill, bought some discounted gift cards for future use etc. I prepared myself for the worst and figured I wouldn’t know the outcome till the next statement’s closing date.

Happy ending

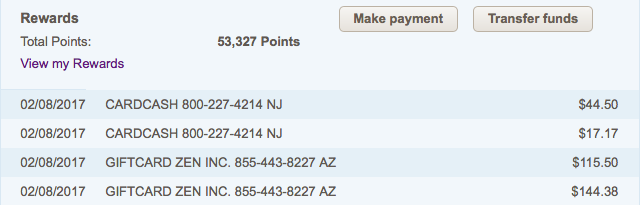

Fortunately, my agony was over merely two days later:

Phew, I got my 50,000 points in the end. Notice the date, that’s the deadline the agent mentioned. This is what it felt like when I saw the points:

Image courtesy of stockimages at FreeDigitalPhotos.net

I still can’t believe I did something that dumb. If I checked on my card just one day later, I would have missed out on 50,000 points, good for two $500 flights or one $750 airline ticket. I told my husband that I finally have enough points to bring my parents here next year and he let out the most pathetic “yay” I’ve ever heard. Why pretend? 🙂

Here is how the airline redemption works in practice

While you can redeem 50,000 points for $500 in cash, airline redemption option is the “sweet spot” in the program. Some airlines like Southwest, Spirit and Allegiant don’t show up in search, but most do.

Several bloggers have been experimenting with Merrill travel site. Check this post on Milesperday on how you can potentially book and cancel flights on Alaska Air or Jet Blue, while banking $1,000 in value towards future flights. Just be aware of funds’ expiration date. I’ve linked to DoC before, but it’s a really valuable and well-researched post, so here it is again: Redeeming Merrill Points: a Guide (DoC guys, sorry for the double link, I don’t mean to annoy you!)

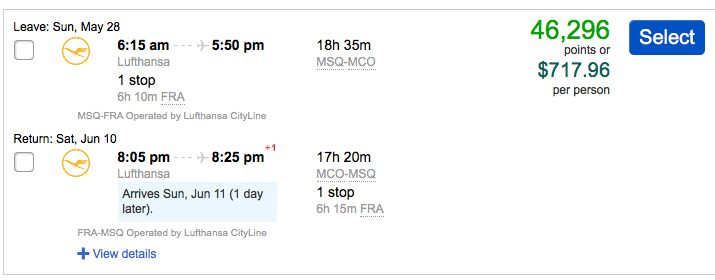

Let me show you a hypothetical example of booking a roundtrip ticket from Minsk, Belarus to Orlando, USA. The cost is $717 per person.

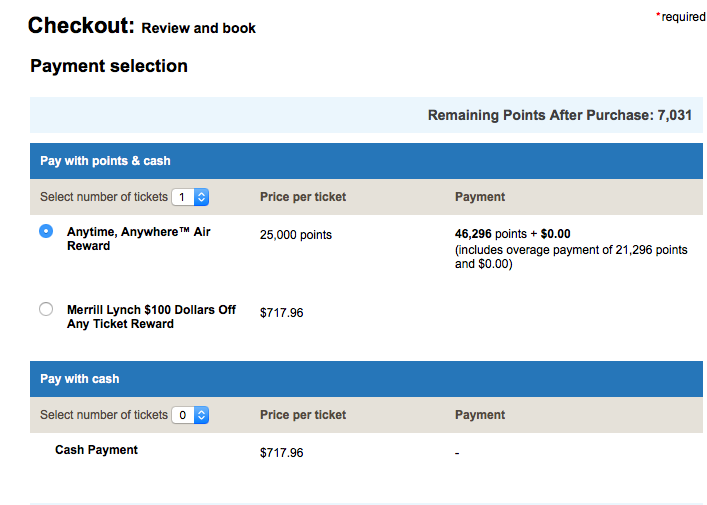

You can’t just redeem 25,000 points and pay the rest with cash in order to maximize value. The system will make you use up your existing points balance first:

Since I have enough points to cover the ticket, there is no cash component involved. If I were short on points, I would be given an option to charge the remaining balance on a credit card, which is a huge plus. There is a possibility to get $100 discount on any flight, but since the points can be redeemed towards cash at a penny each, there isn’t much benefit there. “Anytime, Anywhere” option is where real value is.

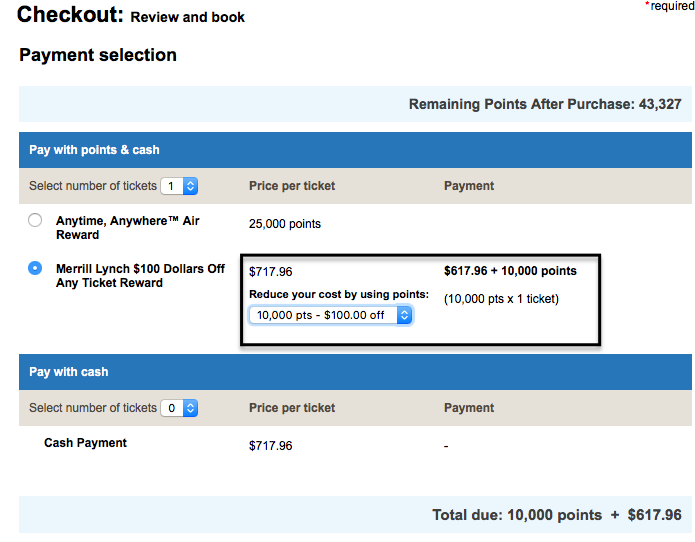

You can use increments of 10,000 points up to the amount you currently have, but you really shouldn’t

So, you will get the best bang for your buck on flights that are around $500 or slightly over that amount. If you can find a relatively cheap ticket to Europe or Hawaii, this bonus will definitely come in handy. The flight doesn’t have to be roundtrip, you can select multi-city or one-way option.

You can put in two travelers in your search, the portal will price out the tickets individually. Here is an example of random flight from New York to Vancouver in April:

While it’s not the cheapest price, if you are looking for non-stop flight, this is an ideal way to redeem your points.

Should you apply for Merrill + Visa Signature?

It really depends. If you have an option of applying for Chase Sapphire Reserve in-branch before March 12th, I would go for that offer instead. Yes, you would be taking a chance on Merrill card disappearing from the face of the earth, but that’s how things go in this hobby of ours. See my post on Chase Sapphire Reserve and decide for yourself.

The bonus on CSR will drop from 100K to 50K points on March 12th. Be aware, in-branch pre-approvals for this card have been removed, so this will only work if you are under 5/24. It is a spectacular offer despite the monster $450 fee (not waived). If you absolutely can’t stomach prepaying $450, Merrill+ Visa Signature may be a better option. But I recommend you try to view $450 fee on CSR as an investment which will pay handsome dividends in a near future.

Another reason to skip Merril + Visa Signature card is if you are waiting to get under 5/24 limit. One of my readers was thinking about applying, but decided to forego it and stick to business cards which don’t show up on your personal credit report. I believe in “bird in hand” approach, which is why I recently applied for Merrill offer in my husband’s name.

He was actually declined for this card few months ago (it went to pending first), but I’ve decided to give it another shot. The app went to pending again, so with heavy heart, I asked him to call reconsideration line (current working number is 1-877-721-9405). When I dialed it, it gave me an option to check on status of application and that’s how I found out that he was approved! No human interaction required, something my husband was very grateful for. I saved the “honey do” for another occasion.

Originally, I planned to hit Chase branch with my husband for eleventh-hour application on Chase Sapphire Reserve (if pre-approved). But it appears this strategy will no longer work. With this Merrill offer I’m actually biting off more than I can “chew” since we recently got Barclaycard Arrival Plus due to current 50,000 points bonus.

I plan to buy some Visa gift cards either through Giftcardmall or at a local CVS, and prepay few expenses. I have $2,500 in insurance bills that will hit us at the end of May, so my money will be tied up for only about a month, tops. This is not a recommendation to readers, just something I personally feel comfortable doing.

This offer is compelling enough that I’m willing to go through some inconvenience in order to collect the points. The card doesn’t have an annual fee, so there is no pressure to use up the bonus before canceling it. In fact, I don’t really plan to cancel it.

Bottom line

This is a terrific sign-up offer which I strongly recommend you consider if you can handle spending $3,000 in 3 months. At the very least, you’ll get $500 in cold hard cash, the most flexible type of currency there is. Best case scenario: two $500 airline tickets on most airlines. Here is direct application link Just don’t forget to do the math correctly so you don’t miss out on the bonus. Learn from my embarrassing mistakes, that’s why I record them in the blog.

Readers, who is considering this offer?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I hear ya. I just barely got my spending in for my Arrival+. I knew I had applied Oct. 20-something, so in my head I had till Jan. 20-something to complete that spending. Wrong! I had actually applied Oct. 23, but counting 90 days meant I had till exactly Oct. 20. Chase gives a few days grace period, but I don’t think Barclays does. Fortunately, I realized how close I was before it was too late, and had enough *pending* purchases by the 20th. I was definitely biting my nails until they posted and my 50k miles showed up! I will never be that vague about a minimum spending deadline again.

@Debra Phew! Glad you got the bonus. I was having a panic attack when I realized what I’ve done. It’s easy, though. Life gets busy and stuff like that gets pushed into background. That’s why I usually try to complete spending way ahead. Oh well, lesson learned.

I am glad sign up worked for you. Your post made me wonder about ‘banking’ my ~85K Thank You points since I don’t plan to renew my prestige card. Can I use the trick described above to book say few Southwest or JetBlue flights using Thankyou points on their portal, cancel them 2 days later and then get the value ‘banked’ in their wallet?

Thanks, Raj! I don’t see why it wouldn’t work with Southwest. You’ll have to call and book the flights over the phone. What you do with flights afterwards is up to you. I believe you’ll have 12 months to use up the funds. Are you sure you can’t use the points on American flights? You’ll get 1.6 cents per point on those.

I’m not familiar with Jet Blue policies, you may what to investigate those. I believe it depends on a fare, you would need to book Blue Flex. I had a post on it awhile back https://milesforfamily.com/2017/01/13/jet-blue-program-gem-many-middle-class-families/

Hope this helps!