Advertiser Disclosure: This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

Editorial Note – Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Update: Some offers below have expired. See our Hot Deals page for the latest info.

When my family first got serious about collecting miles and points to use on vacations, my knowledge base was small. One of the first credit cards we got was Chase Marriott Premier Visa (read about it here). We used the bonus points from the card, combined with the Marriott points my husband was already accumulating through work travel, for a few free hotel nights.

I was really hooked on Marriott, and before we would commit to visiting another place I would always check to see if there was a Marriott Springhill Suites (with rooms that sleep 6) available on points at our destination. It was Marriott or nothing!

Gradually, after opening Hilton and flexible points credit cards, we broadened our horizons when it came to hotel award redemptions. However, my family still likes to stay at places that don’t fall into the typical hotel chain award charts.

Great Wolf Lodge is a great example of such a hotel. Great Wolf Lodge is a fun family water park getaway, but it sure is a budget buster if you can’t find a reasonable rate through Groupon or a deep online discount.

My family also likes exploring oddball places that don’t fall under a “normal” hotel category, like cabins and B&Bs. We have a night at one such place coming up next year that I will write about in a future post.

So if the hotel you want to stay at is not on a typical hotel points chart, are you stuck paying cash or skipping it altogether? No way! There are many credit card options you can use to cover these “off the charts” places. Here are some possibilities:

Barclaycard Arrival Plus World Elite MasterCard

This card allows you to use points towards any expenses coded as “travel”. I’ve used Barclaycard Arrival Plus World Elite MasterCard points to help cover our last stay at Great Wolf Lodge and our 2015 stay at Disney’s Aulani Resort in Hawaii.

Note: House rentals on Airbnb are coded as travel, but currently HomeAway and VRBO do NOT show up as a travel expense (they are coded as real estate).

Capital One Venture Rewards

This card is very similar to the Barclaycard Arrival Plus World Elite MasterCard. It comes with 40,000 bonus points after spending $3000 in the first three months. All purchases earn 2X points, and the annual fee of $59 is waived the first year.

Redeeming points for travel is even easier than the Barclaycard Arrival Plus, as there is no minimum for total reimbursement and only a 2500 point minimum for partial travel reimbursement. The downside to the Capital One Venture Rewards card is that when you apply for it, the bank pulls from all three credit bureaus instead of just one like most other cards.

Since these two cards are so similar, which one should you get? I recommend getting the Barclaycard Arrival Plus first because of its higher bonus. But, you can get both cards over time. If you and your spouse/partner each get them over the span of a year, you could have $1800 in travel reimbursement combined, just by meeting the minimum spending requirement for the bonuses. Cha-ching!

Chase Sapphire Reserve

Are you sick of hearing about this card? I hope not, because it’s also a great card to use for “off the charts” redemptions. It has a $300 travel reimbursement for each calendar year. If you get the card in the middle of the year or even now, you’ll actually get $600 in travel reimbursement before your next annual fee is due. Read more on it here

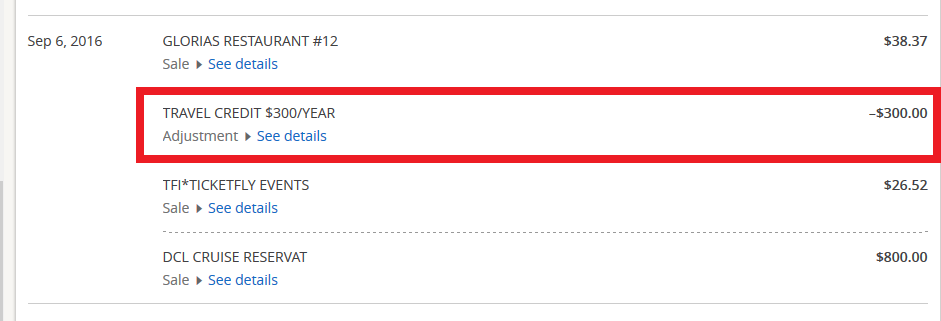

The travel credit shows up on your statement the same day your travel expense does. We recently put down some money for our upcoming Alaska cruise, and we saw the travel reimbursement kick in right away:

This card’s bonus is 100,000 Ultimate Rewards points after spending $4000 in the first three months. Update: The 100k bonus is currently only available through applications inside a Chase bank branch to applicants with less than 5 new cards in the past 24 months. You can use the UR portal to book $1500 of travel with your bonus points! There are a lot of all-inclusive resorts in Mexico and the Caribbean not available via traditional points awards, but bookable through the UR portal.

Alternatively, you could use 100,000 UR points for $1000 cash back. Then, feel free to book any resort, anywhere, on any website. Use your cash back to pay yourself back!

Of course, the downside to the CSR is that the $450 annual fee is not waived the first year, and it shows up on your very first statement. This can be a big hurdle to overcome if the fee isn’t in your budget, but worst case scenario: you still get $1150 profit ($1000 cash back plus $600 in travel credit the first year minus $450 annual fee).

American Express Premier Rewards Gold

This card currently offers 25,000 bonus points after spending $2000 in the first three months, but the bonus is routinely as high as 50,000 Membership Rewards points (and even as high as 75,000 points on targeted offers through the “Check for Pre-Qualified Offers” tab on the Amex website). You can also check CardMatch tool.

The $195 annual fee IS WAIVED the first year, and the card earns 3X points on travel booked through airlines, 2X points at restaurants/gas stations/supermarkets, and 1X points on everything else. The card offers a $100 airline fee reimbursement every calendar year.

While booking hotels through the portal is not a great redemption value, you can get Airbnb e-gift cards at 1 cent per point. When the card offers a 50,000-point bonus, that’s $500 in Airbnb e-gift cards. Not too shabby! (Note: Redeeming points for Airbnb e-gift cards is a better value than using points to book Airbnb directly through the Amex Membership Rewards portal).

Update: Dustin at Wallerswallet has mentioned that AirBnB gift card redemption option is currently unavailable.

American Express Platinum

While the current offer is only 40,000 points, the bonus on this card can reach as high as 100,000 points a few times a year (go to “Check for Pre-Qualified Offers” on the Amex website). You can also check CardMatch tool. Your credit will not be pulled.

That’s worth $1000 in Airbnb e-gift cards! If you’ve never used AirBnB, you can get $35 off your first rental via this referral link.

However, this card has a steep $450 annual fee. It also comes with a $200 per calendar year airline fee reimbursement and a $100 Global Entry reimbursement.

American Express Blue Cash Everyday

This card has a $100 bonus after spending $1000 in the first three months (though it is as high as $250 on targeted offers on the “Check for Pre-Qualified Offers” tab on the Amex website). It earns 5% cash back on travel within the first six months, 3% cash back at supermarkets (up to $6000 in purchases per year), 2% cash back at gas stations and 1% cash back on everything else.

There is no annual fee, and the card offers 0% interest on purchases and balance transfers for the first 12 months after opening. Cash back comes in the form of reward points for a statement credit.

This is as easy as it gets to offset the cost for hotels that are off the charts. Use the cash back on VRBO and HomeAway, or anywhere that accepts credit cards. This card is a keeper since it has no annual fee.

Citi Double Cash

It doesn’t get much simpler than this. The card earns 2% cash back on all purchases—1% at the time of purchase, and 1% when you pay your bill. It has no annual fee. You can use the cash back on any category of purchase, and there is no cap on the amount of cash back you can earn. The minimum cash back redemption is $25.

Although it doesn’t have a sign-up bonus, this could be a good card to use for everyday purchases when you’re not working on the minimum spending for another card.

Note: If you plan on applying for any of the mentioned cards, feel free to reach out and we will be happy to find the best deal available, even if it doesn’t pay us commission.

New Blog Series on “Off the Charts” Places to Stay

Since one of my favorite things to do is research and read about new travel destinations, we are starting a new series of posts on MilesForFamily featuring various “off the charts” places for families. Some of the places will be traditional hotels that are not part of a chain, while others will be quirky, unusual and “off the beaten path.”

I’m amazed at how many little-known gems are out there! I’ve already discovered several in my home state of Texas that I can’t wait to share in a future post. I also hope that readers will chime in with your local favorites that are off the point charts. Adventure awaits!

Do you use any of these credit cards to offset the cost of “off the chart” places?

This post was written by Nancy, who is a regular contributor. She also runs a blog Savingforadream and has an awesome YouTube channel.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Do you happen to know if great wolf lodge codes as travel on csr?

@Kacie Nancy who wrote the post is on vacation right now. I haven’t personally stayed there, but the charge definitely should code as travel.

Update on my VRBO bookings: So the 2 condos I booked for Hawaii had me book off VRBO and 1 of the owners had her own company name and it was coded as travel when I used my Chase Sapphire Reserve so I received the $300 credit and triple points on the purchase. I wouldn’t suggest booking off VRBO, but I had double checked these two owners with their references and ownership.

That’s great news, Stefanie!

So, I’ve had great success with the Barclay Arrival Plus in the past year. I cannot speak for VRBO, but I can speak to two instances wherein I called customer service and they adjusted two charges.

One was for a cabin rental that coded as rental property that was exactly $100. The other one was for a private railway train that coded as restaurant services (I have no idea why it coded that way) that was exactly $100. I mentioned in both that I wouldn’t have bought either purchase, which was true, if I knew it would have been coded incorrectly because cheaper options were available. When talking on the phone, I would mention both companies by name and their respective websites so that the customer service rep could type them into his/her report to show that they were legit cabin/train purchases.

Both issues took two weeks to resolve and be credited to my account, but the extra 20-30 minutes on the phone was worth the $200 I got back. Hope this helps some readers.

@Lisa M. This is terrific information. Thank you so much for letting us know!

Would you happen to know how VRBO is codes for Chase Sapphire Reserve? I just booked 2 condos and was looking forward to the 3X points and $300 travel credit.

@Stefanie–Unfortunately, my understanding is that VRBO is coded as “real estate” across all cards. 🙁 However, you could still use points from the CSR for cash back /statement credit to offset VRBO rentals.