One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

I’ve said many times that value of hotel points is very subjective, even more so than airline miles. It depends on the size of a family, how much flexibility you have, as well as the amount that’s currently parked in your savings account.

Of course, there is also a matter of preference which should be taken into consideration. You may be a huge fan of Hyatt chain, and no amount of bribing will get you to stay at a Holiday Inn. And that’s OK.

Additionally, I’m of the opinion that families should always compare CPP (cents per point) value of hotel points to that of a vacation rental. Let’s face it, having two bedrooms and two bathrooms sure beats squeezing 4 or 5 people into one tiny room.

My point is, families should pretty much ignore inflated value of hotel points touted in the hobby and instead, do their own analysis. I’ve also always encouraged folks to only sign up for hotel credit card bonuses when they have a specific redemption in mind.

However, everyone’s situation is different. Perhaps you are running out of options. Or maybe you have a low supply of hotel points, and you are pretty certain that within the next few years you will utilize whatever bonus you’ll sign up for. Let’s call it a semi-speculative hoarding.

You also might be like me, and don’t really care where you stay as long as it’s almost free. How do you determine which hotel credit card bonus is worth what?

Well, few years ago I’ve put together a post with general guidelines. We are a regular middle-class family and don’t travel often, so in all likelihood, my very conservative estimates would apply to most of you. But once again, those numbers are very subjective.

However, there is a resource that will take most of the guesswork out of it. It’s a page on HotelHustle tool that calculates median values of hotel points based on retail rates. And it’s fascinating!

This page, in my opinion, should be your go-to resource when you are looking to speculatively sign up for a hotel credit card, accumulate hotel points via regular spending (without specific redemption in mind) or when you plan to participate in a promotion.

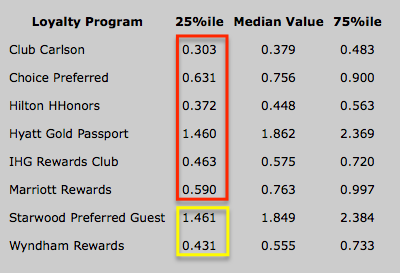

Check out this table of hotel values and let’s dig in:

As you can see, it’s split in three groups: 25%ile (meaning the lowest CPP value), Median Value (self-explanatory), and 75%ile (much better than usual redemptions). My opinion is that when you are looking to accumulate hotel points speculatively, you should base your value on 25%ile and subtract 20% from that. Why is that?

Two reasons:

1) When it comes to hotel points, you should always assume the worst. You may have an eye on several properties, but a lot can happen in few years. One of the hotels may leave the chain, and the other may go up a category or two. Just because your property falls in the “median value” or even 75%ile threshold now, doesn’t mean it will be that way in a near future.

2) These values are based on retail rate, which doesn’t take into account various promotions. Some cards like Citi Prestige offer “4th night free” benefit, and most travel booking sites offer coupons that will shave at least 20% off your rate. Also, for many families, vacation rentals will often offer better value than hotels. That’s why I believe you should deduct an additional 20%.

So, using this logic, here are the numbers (rounded up):

Club Carlson: 0.24 cents

Choice Preferred: 0.51 cents

Hilton HHonors: 0.3 cents

Hyatt Gold Passport: 1.2 cents

IHG: 0.37 cents

Marriott: 0.48 cents

Interestingly, these numbers are actually a bit higher than mine, but not by much. To put it in perspective, let’s say you are speculatively looking to apply for Chase Marriott Rewards Premier credit card (read about it here). The offer is 87,500 points after spending $3,000 in 3 months and adding an authorized user. There is also an annual fee of $85, not waived.

Let’s do the math. If we multiply 87,500 points by 0.48 and deduct the fee, we have a value of $335. Yes, the bonus is worth more if you redeem points on Hotel+Air package. But I doubt that this is something most normal families will be able to take advantage of.

There are two currencies I deliberately left out.

Wyndham rewards

The reason Wyndham point value on Hotel Hustle is so low is due to the fact that most of their properties fall into budget category and cost as little as $55 per night. But not all of them. Wyndham program also has semi-upscale hotels that go for $250-$350 per night or more. I’m not saying they are worth that much, but that’s the retail cost. The number of those properties is fairly small, which is why the data is skewed.

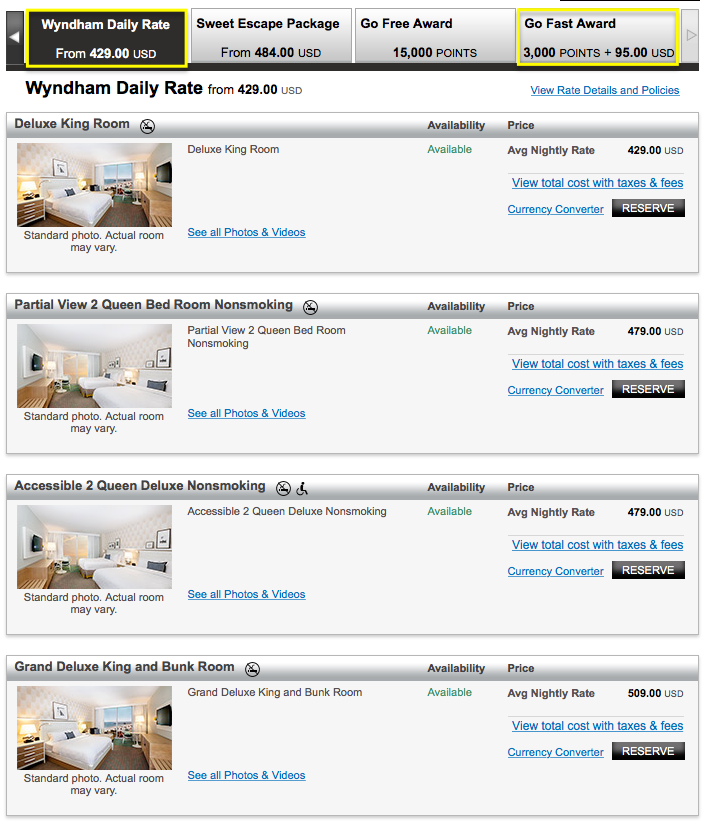

Also, a weird quirk of Wyndham program is that ALL hotels cost 15,000 points. So, you can burn them on a beachfront property or motel by the highway, the cost in points will be identical. You can also use just 3,000 points via “Go Fast” rate in order to get a hefty discount on many properties, but this option isn’t always available.

Wyndham program is definitely a weird beast, and I’m not saying that their points are super valuable. But I do believe they are worth at least 0.431 cents each, if not a bit more. I can say this because I actually paid 0.46 cents per Wyndham point not too long ago. It was a bit of a speculative move, but I have no regrets.

I’m talking, of course, about renewing Wyndham Rewards Visa Signature for $69 and in exchange, getting 15,000 points. Unfortunately, current offer isn’t nearly as good because you only get 6,000 points (nor worth it). But the sign-up bonus of three nights is very much worth it, at least IMO.

My affiliate offer comes with 30,000 points, but this zombie link will give you 45,000 points. Be aware, if you sign up for Wyndham card right now, you will probably have to forego increased bonus on Arrival Plus Only you can decide which offer is better for your current situation. You may get approved for two Barclaycards on the same day, but I wouldn’t count on it.

I’ve written about Wyndham program awhile back. Not too long ago, my cousin-in-law was able to use her points on a fabulous resort in Puerto Rico. While there are many issues with this program, I absolutely believe the sign-up bonus itself is a good deal. I’m thinking about using my 30,000 points on two nights at Wyndham Grand Clearwater, a beachfront resort that’s supposed to open in February of 2017.

Speaking of, this is a fantastic deal on points during Spring Break months:

Notice how by using only 3,000 points per night you can get a huge discount? This is just another proof that Wyndham currency, while quirky, can be quite valuable in certain circumstances. Of course, the program may change drastically in a year or two. But for now, I’m happy to speculatively buy Wyndham points for 0.46 cents apiece.

Notice how by using only 3,000 points per night you can get a huge discount? This is just another proof that Wyndham currency, while quirky, can be quite valuable in certain circumstances. Of course, the program may change drastically in a year or two. But for now, I’m happy to speculatively buy Wyndham points for 0.46 cents apiece.

Starwood Preferred Guest (SPG)

SPG points are unique, not to mention, the most valuable out there. You can use them on hotels, transfer them to miles or Amtrak points, and even redeem them on Amazon gift cards (at a somewhat poor ratio). So, while “25% percentile” number for hotel redemptions is only 1.46 cents, SPG points are worth more even if you collect them speculatively.

I keep going back and forth as far as estimating value, and the number is somewhere between 1.5 and 1.75 cents. I know I would pay 1.5 cents per SPG point if someone would offer them to me for that price. But it doesn’t really matter because no one ever will! SPG program never sells them for less than 2 cents, and that is too high for my specific situation.

Bottom line

While I wouldn’t call above approach scientific, I think it comes pretty close because it’s based on actual data from Hotel Hustle. Of course, your personal situation will have bearing on speculative value you assign to each hotel currency. It may be higher or lower, which is perfectly normal.

Why does it matter, you may ask?

Because at any given moment there are a number of cash sign-up bonuses available. By speculatively collecting hotel points instead, you are foregoing those and potentially decreasing your chances of approval when a truly spectacular offer comes along (CSR, I’m looking at you, baby!) So choose wisely.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Question – My HHonors Surpass card gives me 3 pts per dollar on regular and 6pts/$ on some specific non-hotel spends. So is my 3 pts worth 3 x .48? I get 5 Club Carlson pts for every ordinary dollar spend – so same question. ThankQ,

@Lulu Thanks for stoping by! Your question is not that simple to answer. It depends on how you value your Hilton and Club Carlson points. If you value Hilton at 0.48 cents each, then yes, you will be getting 3 x .48 cents per dollar on everyday spending. Club Carlson points are not as valuable as Hilton, IMO.

Personally, I currently value both at about 0.25 and 0.17 cents respectively. So earning them via everyday spending isn’t all that appealing (again, to me). I would much rather get 1.5 UR points (worth at least 1.5 cents) per dollar with Chase Freedom Unlimited. If you have a 2% cash back card, you may be better off going that route.

However, if you are trying to accumulate points for a specific redemption and are short a few points, then it definitely makes sense to go with a hotel card till you get what you need. Otherwise, I would look elsewhere.

Great post. I was just trying to figure out hotel programs when came across this post. Any offhand opinions about which hotel programs best for Vancouver and/or LA?

@Amanda Since you know which cities you’ll be staying in, I recommend you do a search here http://wandr.me/Hotel-Tools/Hotel-Hustle/

You can also check http://www.awardmapper.com Research hotels, and then sign up for cards based on that research.

What is the value of AVIOS points? I have about 400k points. Can I use the to redeem AA flights?

@Tammy It’s hard to say how much each Avios point is worth because it will depend on your specific situation. I value it speculatively at around 1 cent, maybe a bit less. And yes, you can definitely use Avios on AA flights. In fact, that’s where you will usually get the best value. Read this post for more on this topic https://milesforfamily.com/2016/02/01/a-bird-in-a-hand-with-the-help-of-british-airways-avios/ Be aware, AA flights have to be available via sAAver price on aa.com in order for you to book them while using Avios. Your 400K stash can go a long way if you play your cards right. Time to start burning those Avios points!