I’ve mentioned Amtrak Guest Rewards World MasterCard before and the fact that it’s now issued by Bank of America. First things first. There are actually two versions of this product:

Amtrak Guest Rewards World MasterCard

Update: 30k offer is currently not available.

Update: there is currently a better 30K offer available. Direct link to offer

- Get 20,000 bonus points after you make at least $1,000 in purchases with your new card within 90 days of account opening

- One point is worth approximately 2.9 cents towards most fares.

- Annual fee is $79, not waived.

- Earn 3 Amtrak Guest Rewards points for every $1 you spend with Amtrak®, including travel and onboard purchases

- Earn 2 points per $1 spent on other qualifying travel purchases

- Earn 1 point per $1 spent on all other purchases

- Get a 5% Amtrak Guest Rewards point rebate when you book your Amtrak redemption travel

- Earn 1,000 Tier Qualifying Points (TQPs) toward earning status each time your eligible spending reaches $5,000 in a calendar year, up to 4,000 TQPs per year

- Enjoy a complimentary Companion Coupon, One-Class Upgrade and a single-day ClubAcela® pass for access to ClubAcela, Amtrak Metropolitan Lounge℠ or First class lounges upon account openingReceive a complimentary Companion Coupon and One-Class Upgrade every year

- This offer pays me commission.

Amtrak Guest Rewards Platinum MasterCard

- Get 12,000 bonus points after you make at least $1,000 in purchases with your new card within 90 days of account opening

- One point is worth approximately 2.9 cents towards most fares.

- No annual fee

- Earn 2 Amtrak Guest Rewards points for every $1 you spend with Amtrak®, including travel and onboard purchases

- Earn 1 point per $1 spent on all other purchases

- Get a 5% Amtrak Guest Rewards point rebate when you book your Amtrak redemption travel

- This offer pays me no commission. Here is a direct link

When you should go for no-fee version

If you already have a good amount of Amtrak points and only need to top off your account for a specific award, you might want to skip the version with an annual fee. Once again, I assume you have no use for all the perks and rarely take Amtrak.

If you are tight on money and coming up with $79 will put a strain on your budget, it’s OK to skip it. I realize many hobbyists are probably laughing right now. Pfft, $79, that’s peanuts! Well, not for everyone.

For most, the version with annual fee makes the most sense

First, let me show what you can do with 20,000 points. It’s quite impressive, actually. Next year, we are planning to visit NYC and Niagara Falls (the Canadian side). We’ll have to somehow get from Niagara Falls to New York.

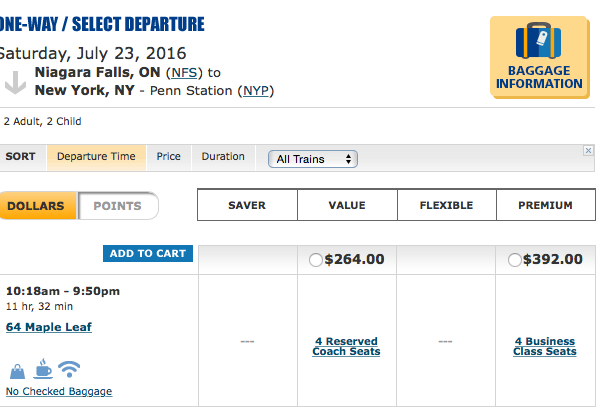

Believe it or not, there is a direct train route that connects the two areas. In addition, kids 12 and under get a hefty discount. Check out how much the fare will cost for 2 adults and 2 children in the middle of the summer:

And here is the cost in points:

That’s 2.9 cents per point, not too shabby! Plus, like I said, this is a very compelling option for families with young children due to age discount. Personally, I would splurge on business class to get more legroom.

Of course, you could rent a car, but it would probably be quite expensive due to one-way surcharge. Not to mention, you might have difficulty renting it in the first place due to border crossing.

Flying is an option, but once again, it will cost a good bit for four tickets. I checked and flights that leave at a reasonable time start at $125 per person, a grand total of $500 for four people. Plus, you would first have to get to Buffalo, NY or Toronto. Here you can take a train directly from Niagara Falls, Ontario. It is a very long ride, but for train fanatics like my son, this might be part of the appeal.

I’m not sure if we will end up doing it because my in-laws are coming with us. They would have to go along with my crazy scheme. But I am very tempted, to say the least. Just one credit card bonus will cover 4 tickets with some points leftover.

You can redeem your Amtrak points for gift cards

Not surprisingly, you won’t get 2.9 cents per point, but it’s an option. Check out a few possibilities here You can use 6,000 points for a variety of $50 gift cards to places like Olive Garden etc. Using 10,000 points will yield a better return and let you get a $100 gift card. Disney is one of them.

In fact, if you choose the premium Amtrak card version and only use 12,000 points for train fare, all you have to do is spend an extra $1,000, and you’ll have enough points for a $100 gift card. So, by that logic, the annual fee will be covered regardless.

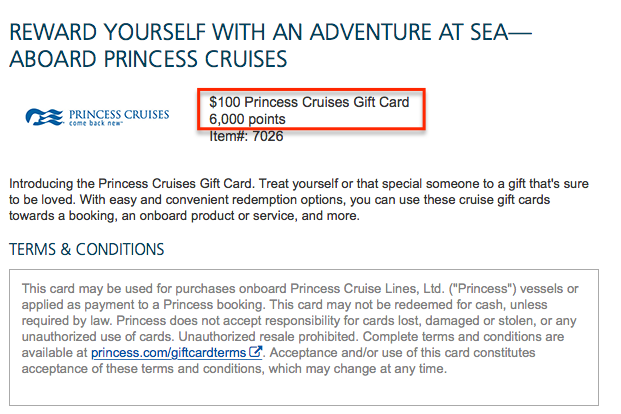

The gift card that caught my eye is the one for Princess cruises. I can only assume they have a special agreement because take a look here:

Hmm, this isn’t bad at all. Keep in mind, you are not allowed to resell or transfer this gift certificate, but it doesn’t have any expiration date. It’s valid on any cruise operated by Princess.

The best redemption option by far is Choice transfer that has 1:3 ratio. Unfortunately, you have to have elite Amtrak status. I don’t see how it can be obtained easily without sinking a ton of money. If you happen to have elite status already or are close to getting it, you should definitely look into this option and see if it makes sense. Of course, I assume you can easily utilize Choice points.

You can earn 4,000 status qualifying points with $20K in spending via premium version of Amtrak credit card, but you will still be 1,000 points short. That amount would require $500 in spending directly on Amtrak fares. Pass.

A keeper card?

The annual fee version of this card can be very compelling for non-bonus expenses, especially if you like Amtrak and spend a lot on travel. Remember, every point is worth approximately 2.9 cents, and you are getting 2 points per dollar on ALL travel purchases, 3 on Amtrak.

It could also make sense to use it for travel expenses if you happen to like Princess cruises. You would only need to spend $3,000 on travel in order to get $100 Princess gift card. Assuming you value it at $90, it’s still a return of 3%.

Be careful, transfer ratio could change tomorrow, so this is more of an afterthought. But for those who are looking to redeem points on Amtrak travel, this card makes a lot of sense. Of course, I’m assuming you would otherwise pay cash for your train rides.

I don’t know if it makes sense to renew this card for most normal families, but you may want to maximize it for spending during your first cardholder year. This is especially true if you don’t have Amex Starwood Preferred Guest credit card.

What does it have to do with anything? Well, it’s the only partner program where points transfer to Amtrak 1:1. Unfortunately, you can only earn 1 SPG point per dollar and there are no bonus categories. You also don’t get 5,000 points bonus for each 20,000 SPG points transfer like you would with most mileage programs.

Bottom line

I do think that the bonus on the version with an annual fee is compelling enough to make it on my secondary list of offers. If you are planning on traveling via Amtrak, you should definitely consider it.

However, if you don’t need all the extra perks and can cover your trip with a mere 12,000 points (not that hard, as you can see in the above example), it could make sense to go with no-fee version. The choice is yours. I’m seriously thinking about picking up the card that comes with 20,000 points in the next few months. Stay tuned.

Readers, are you considering this offer?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

[…] Apply here It’s definitely a good deal if you have upcoming Amtrak plans. Read my post on ways you can leverage the program (hat tip […]