One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

Last month I wrote a post about changing my parents’ flights and using Citi Thank You points instead of miles. I also mentioned that my mom will be coming back to visit us in November. Since I had about 50K points left in my Citi Thank You Prestige account, this is where I turned to first. And it didn’t disappoint. Revenue tickets from Belarus are quite reasonable at the moment, probably due to cheap fuel prices and country’s economic woes. Since I get 1.33 cents per point toward airfare by having Citi Prestige, this was a no-brainer option (for me).

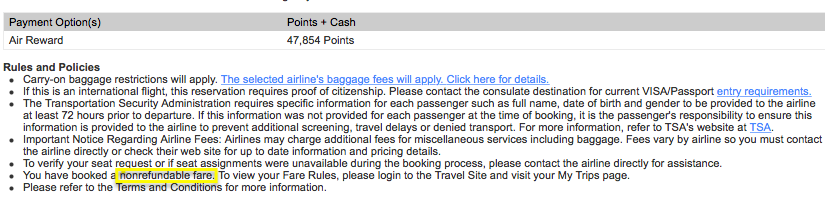

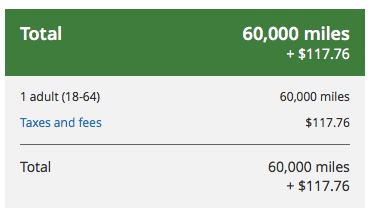

This price includes all taxes and fees, but the fare is non-refundable. Now let’s compare it to United redemption which partners with Lufthansa, our chosen carrier. These are the same exact flights:

As you can see, you have to pay 60,000 miles+$118 in taxes. If you value United miles at 1 cent each, this would be an equivalent of paying $718. Citi option beats United redemption hands down. Plus, you will earn miles with the first one. In fact, even if I didn’t have Citi Prestige, I would just buy revenue ticket at a cost of $633 and use my $400 sign-up bonus from Barclaycard Arrival Plus to offset the amount.

Alternatively, I would look into taking advantage of $250 airfare calendar allowance on Citi Prestige. Both cards come with an excellent sign-up bonus, but I would hold off applying for Prestige for few weeks so you don’t have any trouble taking advantage of $250 annual credit. The goal is to double-dip and cancel before the annual fee hits. Read more on both cards here Also, check this post on why Citi Prestige is an excellent choice for those who fly American Airlines.

While my policy is to save cash and use miles whenever possible, I do have a floor when it comes to value. And that amount currently happens to be 1 cent for United program. Out of all traditional mileage currencies, it’s the most valuable for my family (used to be AAdvantage). I know for a fact that we can utilize United miles in the future whether it comes to my parents’ tickets or ours’.

Of course, just because you can use miles, doesn’t mean you should. And I felt strongly that this was not the right time to “sell.” Speaking of United, they are currently running a promo where you can book tickets from US to Sydney for 60K miles roundtrip on certain dates and days of the week. A solid deal! Details here

Here are cases where using United miles would be preferable:

- You are not 100% sure on your plans. It costs $200 per ticket to re-deposit the miles, but you may be able to convince the agent to waive the fees like I did. Most things in this hobby (and life in general) are negotiable. Hey, I just convinced our Gold Gym’s manager to waive the extra $20 monthly charge to add me to my husband’s account. Anyway, I do recommend you insure your trip and pick “cancel for any reason” option if your plans aren’t set in stone.

- You are an infrequent traveler with a ton of United miles, and value them at much less than a penny each. I’ve always said that value is very subjective. The lifestyle of a single frequent traveler couldn’t be more different from that of a regular middle-class family. You valuation of miles will reflect that difference.

- You are redeeming for one-way international flights. It’s not much of an issue on domestic routes because they usually cost half of roundtrip price. If I wanted to keep the return date open and was buying a one-way ticket, it would cost a fortune to go the revenue route, but would still be flat 30K United miles+tax. If you look at the example below, you would obviously be better off just buying roundtrip ticket and throwing away the return portion.

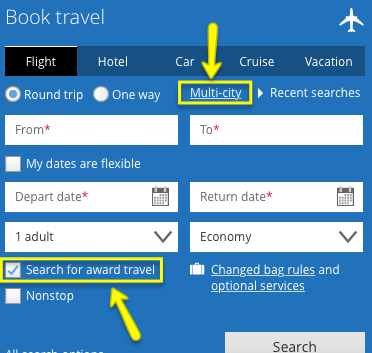

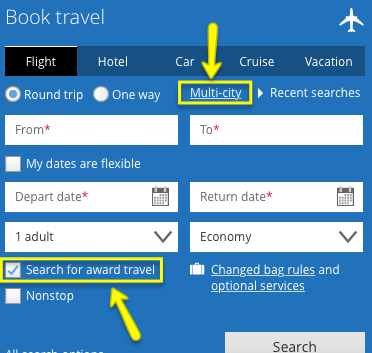

- You want to include a stopover. United allows to add it for free on roundtrip award tickets, and it can greatly increase the value of your redemption. Even if you don’t plan to have a stopover, it could make sense to burn miles. One of the reasons I wanted to save United currency was due to the fact that I plan to redeem them for 4 one-way tickets from Minsk to Tampa. The reason: due to traveling with small kids, we have to break up the trip and spend the night in Western Europe. Even though stopover isn’t technically allowed, as long as we stay less than 24 hours in Frankfurt (connecting airport), we can still burn miles and pay 30K+tax per ticket. This will allow us to go to hotel and get some rest before continuing on to Tampa. You can actually book these type of tickets online. Just select “multiple destinations” and make sure there is less than 24 hours between connecting flights.

- You need a last-minute ticket. That’s usually the time when your miles can be leveraged in the most advantageous way.

To me, the fifth point is the most compelling reason to have miles on-hand at all times. Of course, the question arises: Should you hoard them because it’s not like you can plan for emergencies? It’s a dilemma I struggle with, and there is no “one size fits all” answer. I do think if you have relatives in another state (or country), this is something you should definitely consider. I wrote about “emergency” miles on several occasions. See my posts here and here

When it comes to this hobby, I think it’s important to find the right balance so you don’t fall into a “hoarding” trap. I can say with an absolute certainty that no one needs a million miles for an emergency. Of course, if you want to have a reserve of points for future vacations, that’s totally up to you.

I recommend you read this excellent post on PFDigest on how Nick pulled off a holiday trip to Nicaragua for six people while using miles and points. In it he mentions that he collected these currencies (specifically Hilton) speculatively, not having any definitive plans at the time. But if you read the post, it’s obvious that his unapologetic hoarding paid off nicely.

I’ve mentioned many times that the extent to which you pursue this hobby as well as strategies will differ from others, and that’s OK. Don’t try to follow bloggers or other hobbyists. Find your own “sweet spot” and enjoy the ride!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

[…] particular case, so Avianca miles lay unredeemed, waiting for a better opportunity. Read my post An Anatomy of an Award: United Redemption vs. Revenue ticket for few reasons why. I’ve decided to utilize my husband’s 40K Flexperks points for […]