Limited time offer! Get it now! Ends soon! Relax. This isn’t that type of a post. There have been several major developments in the hobby as of late, so I wanted to put this list together for those who are on the fence as to which offer to get. As always, each person is unique, so feel free to email me with further concerns. Without further ado:

1) Bank of America Alaska Airlines Visa Signature card

Say what? Didn’t I just bash this offer not too long ago? Well, kind of. But the upcoming AAdvantage devaluation changed everything. What does it have to do with Alaska program, you may ask? It partners with American Airlines and mimics AAdvantage pricing. If you don’t have enough AA miles for a specific award that will be going up in price, you may want to read my post which includes a non-affiliate link (comes with $100 credit.) If you have a family and need 4 (or more) seats, you can always use Alaska miles for one of them, use AAdvantage for the rest.

2) Citi AAdvantage Platinum Select MasterCard

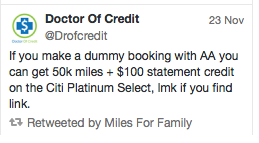

Speaking of AA program, here is a post that outlines the upcoming changes that are supposed to kick in March 22nd. Naturally, the easiest way to get AA miles is to get a co-branded credit card. You can read about it in this page. This offer does pay me referral, but Will at Doctorofcredit reports that you may be able to get a better deal:

3) Chase British Airways Signature Visa

I wrote a post on it already, so won’t repeat myself. In short, consider it if you need to utilize 4,500 Avios redemptions in US and Caribbean before February 2nd 2016. You have to spend $2,000 in order to get 50K Avios points. If you apply right now and complete your spending soon, you should have your bonus deposited before cut-off date. Make sure to read this post on Free-quent Flyer on how you may still be able to use Iberia program for short distance flights even after Avios devaluation.

This is definitely a “niche” offer, but it’s a hot deal for some, no doubt.

4) Chase Sapphire Preferred

There isn’t any real hurry on this one since it looks like personal referral links are valid till March. This offer does pay me commission, and you can once again read more on it here I think it’s mostly a good fit for those just starting out in this hobby, and those who are not sure which card to get. The sign-up bonus is terrific, but read this post on Chase restrictions as far as getting approved.

5) Citi Prestige

This offer should be of interest to those who want to utilize $250 airline credit for year 2015. Read more on Citi Prestige in this page. It contains a link to a post on how you may be able to apply for this card with $350 annual fee. Chuck at Doctorofcredit has also mentioned how you can potentially get a triple dip on this offer.

6) Personal and business versions of Chase Southwest Rapid Rewards Visa

Obviously, the purpose is to get a Companion pass. Read more here

And it’s a wrap!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

For the CSP, I am well aware of the past 2 year rules now in place. But do you or others know if they are looking at ALL credit reports, or just the 1 they pull? Wouldn’t that make a material difference?

The only bonus I really, truly, want is the CSP. Mostly because I am so indecisive about our plans for the next year. So, flexible points sound perfecto right now.

Otherwise, I may get the British Airways and just spend away on it as we figure out our travel priorities next year. By the time we make a decision, we could have 100,000+ avios. May be the right choice for someone as indecisive as me right now.

I also have about 100k AAmiles sitting around so maybe we should just go all in there….so many options.

Hey, Cheapblackdad! Ok, so the way it works on 2-year rule is this: Chase will usually pull one report (sometimes two). What they are looking at is how many accounts you’ve opened in the last 2 years. All agencies will have that info. So, basically, the number of inquiries doesn’t matter, it’s how many fresh accounts are listed. And they do count those where you are an authorized user, but you might be able to call and get them to not throw those in the mix.

I do agree on CSP, I would love to have it. But I just don’t believe it will be approved. I’m thinking about giving it a shot anyway. Decisions, decisions…

If you have been thinking about trip to Hawaii, you might want to look into getting AA card, Alaska offer or possibly Chase British Airways Visa. The idea is to redeem on AA flights at 35K roundtrip while you still can. Of course, it will cost more with Avios, but you ca always redeem those from LAX at 12,500 miles one-way, use Rapid Rewards to get there. I know how much you love Avios, so this would give you some flexibility in case you change your mind on Hawaii. Makes sense?