So, I finally got myself Serve. I need to meet a minimum spend on quite a few cards, and my regular bills just aren’t sufficient. This is what happens when you get greedy. To add to my happiness/misery, Discover sent me an offer I couldn’t refuse. All I had to do is spend $1,000 before the end of October, and I would get $100 cash back. I accept!

I’ve mentioned before that you can load American Express Serve (pays me small commission) with up to $1,000 for free via credit card each month and pay your bills online or withdraw it to your checking account. First, I had to cancel my Bluebird, since you can’t have both. So I called the phone number listed on the back of the card. The agent was very polite and helpful.

Unfortunately, it was very hard to hear him, so I had to ask him to repeat his questions a few times. I could tell that he thought I was an idiot, because he finally started saying things veeery slowly. My accent didn’t help either, I’m sure. Oh well, not the first time someone doubted my intelligence (Miles for Cats flashback). I even played along and did a crazy laugh at one point.

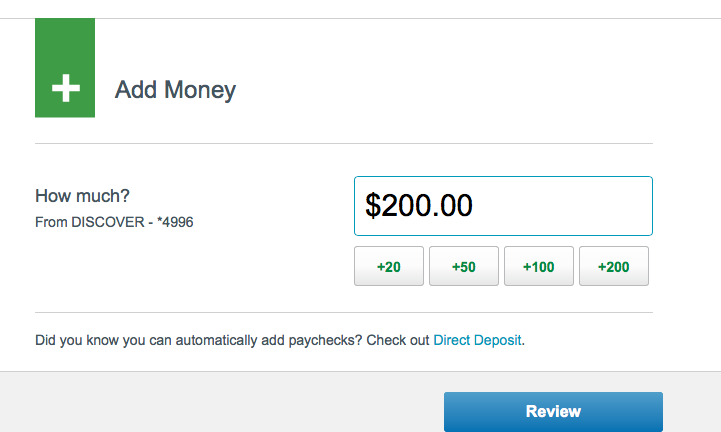

The agent told me that I could apply for a Serve account in a couple days, and so I did. After getting my shiny new card, I added my Discover to the profile and made my first $200 load. Woohoo! The setup is very simple and user-friendly.

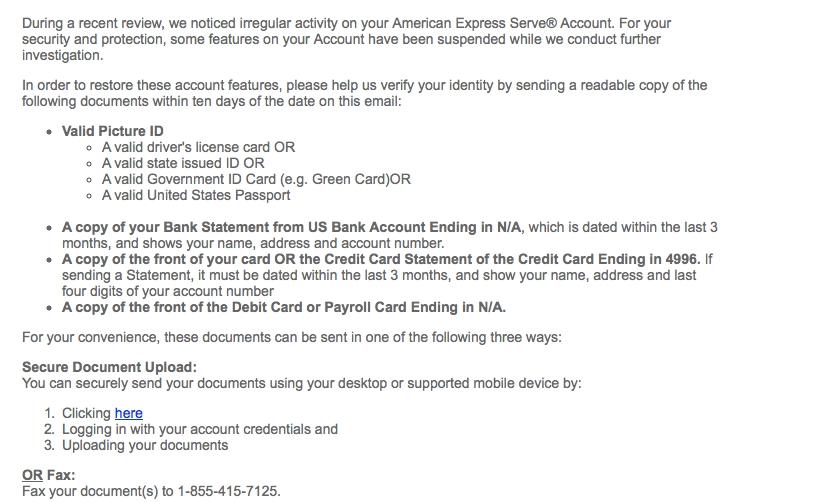

Emboldened by my first MS adventure, I was ready to contact Marathon Man to learn more tricks. Except… the next day I got this email:

Say what??? I called and they wanted me to fax my ID, bank statement (!), and the credit card info, a recipe for identity theft. Apparently, the card triggered a fraud alert, and of course, I only did one measly load with it. I asked if I could just put in another card’s info, and was told NO. Basically, my account would be frozen till they had all the documents.

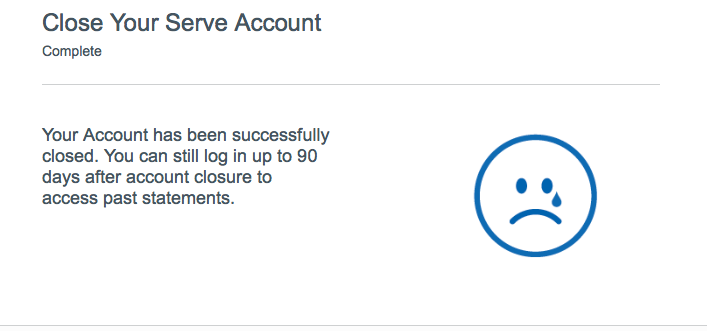

I told the agent I wasn’t going to send it and just wanted to withdraw the money and be done with it. She said I could do a swipe at the store, but the online bill paying feature was deactivated. I tried it anyway, and was able to pay $200 toward my Citi credit card account, despite of what she told me. After that, I canceled the account and received this heartbreaking message.

Heck, yeah, you should be crying. You had your chance. Serves you right, pun intended. Truth be told, I’m crying a little too. I’ve mentioned before that I’m not comfortable with some MS methods, though don’t impose my views on others.

So, what now? Well, I got a few tricks (and Trix, as in cereal) up my sleeve. I may still apply for Serve in my husband’s name and hope for better luck next time. I’ve read that your name has to be on the credit card you add to your Serve account, and I was an authorized user on Discover that triggered the issue. Not sure if that’s what caused it, but it could have been.

I also asked to pay my in-laws’ power bill with my credit card, and have them reimburse me via Paypal. They are not working on any minimum spending at the moment, and it would be easy to keep track of large bills. It’s a bit of a hassle, but worth it to get my bonuses. All ten of them. I may prepay my own power bill ahead of time with a credit card, since my company allows it.

I also have been doing tiny amounts of MS by requesting cash back when paying at Walmart and Dollar General. The last one lets you get $40 back with each purchase when paying with a credit card. It’s not ideal, but it’s on the way when I go to pick up my daughter from school. Five more trips, and I’ll be done with Discover offer, so I can collect my sweet $100 reward. Even with my puny MS levels, I am the Marathon Woman of my city, I guarantee it!

What all this rambling means to you

Well, as I said before, manufactured spending definitely involves some hassle. Even the more innocent method could turn into a problem, as it did in my case. Of course, it doesn’t mean that you will encounter the same issues. Most people don’t.

As I’ve said last week, all shopping portals have pulled Amex gift cards, and there is no telling if they will ever come back. The world of MS is ever changing, and the trend is generally not positive.

What I hope you do is count the costs before signing up for new bonuses. Take on too much, and you will depend on manufactured spending techniques, in order to collect the bonus. Will they be there when you need them?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

This is standard practice for AMEX. All you had to do was upload a pic of your credit card and I’D with the link they provide, call back and in 5 min they approve it. I had to do this with both my credit card and debit card on my Serve account. My wife also had the same issue with her account and my wife is using an AU credit card. So far no issues. Hope you have better luck next time

Rich, thanks for sharing your experience. What spooked me was that they also wanted my bank statement which included my address, full name etc. Maybe I’m paranoid, but the risk just didn’t seem worth it. I did send in tax returns to Wells Fargo to get approved for Propel card, but I got $500 in exchange for my trouble. And even then I hesitated. I’ll try to get Serve for my husband and see if we can avoid this hassle next time.

I still use Bluebird, although not all the time. I buy $500 Visa gift cards at Kroger and load them to Bluebird at the Walmart kiosk thingy. It isn’t a huge hassle for me because both stores are so close and I go there a lot anyway. Between mine and my husband’s Bluebird, we can do 10K a month. We never do though- it just isn’t necessary. The only time I have MSed recently was wen the Citi 100K offers were out there.

Holly, I’ve actually never loaded my Bluebird with VR. It just never seemed to work out. We have very few stores around here that sell gift cards via credit. Our Walmart doesn’t even have a money center. As far as that Citi 100K offer, that was a good one, for sure!

I have a Bluebird in my name, and a Serve in my wife’s name. I had to send in pics of the credit and debit card and her drivers license, and we’ve had no trouble since. I had the same deal when I created my Bluebird account. Seems par for the course with the Amex prepaids…

Jesse, I debated on sending the stuff, but the fact that they wanted my bank statement was just a deal breaker. I may apply for Serve again and hope for better luck next time. There is no credit pull, so it’s no biggie.

Sorry to hear about your Serve Card. I think the problem, as you speculated, is that you have to be the owner of the CC or DC in order to load Serve, not an AU. Also the $200 load may have caused some flags. If/when you sign up your husband. Start with a $100 load with a card that he is the owner. Its a great way for MS and making some extra $$.

Jason, thanks for your advice! I’ll do just what you said. It is a very easy way to MS, no question. I just need to close his Bluebird at some point and try this whole crazy thing again.