I’ve mentioned Friday that my husband and my brother-in-law both got approved for an increased offer on Chase United MileagePlus Explorer card (ends tomorrow). Originally, I planned to designate these miles as my emergency mileage account. However, we may end up burning them as soon as the bonus posts.

We’ve run into some problems with our flights from Germany to Italy next year. There just aren’t any good options, unfortunately. Even though the non-stop flights are relatively short, they are exorbitantly expensive. There are a couple of connecting flights, but they go through Madrid, not ideal to say the least, considering we are flying from Munich to Italy.

My family of 4 will be flying to Naples, and the rest of the clan will need to go to Rome. Don’t ask why, it’s a crazy plan concocted by my sister-in-law. While in Rome, they will rent a car and meet us in Naples. Both routes are served by Lufthansa, which has several non-stop flights per day.

The tickets from Munich to Naples/ Rome cost $720 and $600 per person respectively. Yeah, not happening. I would rather take a train, except it would involve several connections and take 11 hours. Without kids, I wouldn’t even hesitate to do it, but not with the way mine are. Unfortunately, I don’t have any miles that are redeemable on Lufthansa that don’t incur fuel surcharges.

I do have an option of transferring my Citi Thank You points to Singapore Airlines (Star Alliance member), but they pass on considerable amount in fuel tax on Lufthansa redemptions. That’s why I got my brother-in-law and my husband to apply for the increased offer on Mileage Plus card. The award costs 15,000 United miles one-way within Europe, not cheap at all. The silver lining is that there are no fuel surcharges. It’s not a spectacular award, but it’s what we need.

After we meet minimum spend on both cards, we will have 57,000 miles each. We have small balances in several other accounts, and either will pay to transfer miles, or participate in promotions to make sure that each account has 60,000 miles, enough for 4 one-way tickets. I need a total of 9 one-way flights, so we will be one ticket short. For that, I will probably utilize my Thank You points and transfer to Singapore program, which charges 12,500 miles for flights within Europe.

The Twist

Except, there has been an interesting development that may change my plans altogether. Thank You points now transfer to Air France program, which belongs to Sky Team. These miles are redeemable on Alitalia with no fuel surcharges. The cost is 12,500 miles one-way, and they have direct flights from Munich to Rome, though not Naples. I don’t know how availability is on Alitalia, but it gives me yet another option for my in-laws’ flight. I would much rather use 12,500 Citi Thank You points than 15,000 United miles. Stay tuned for that one.

What does the addition of airline partners to Thank You program mean to you?

This is a significant development, and effectively makes Thank You points a flexible currency similar to SPG and Membership Rewards. Of course, the list of partners isn’t impressive yet, but it’s a good start. Add AAdvantage, please! The most valuable transfer options at the moment are Singapore Airlines and Air France. Let’s take a look at how we can leverage these for family:

Singapore KrisFlyer: Costs 12,500 miles one-way to fly to Alaska on United, compared to 17,500 through United Mileage Plus. Also costs 17,500 miles one-way to fly to Hawaii, compared to 22.500 through United program. The transfer take 1-2 days.

Air France Flying Blue : Can be redeemed for one-way tickets on Delta. It costs 15,000 miles one-way to fly to Hawaii and Caribbean (less than through Delta award chart), though availability is very poor.

You can also redeem for economy tickets to Europe on Air France with minimal fuel surcharges. The normal cost is 25,000 miles one-way ( a decent deal from West coast). However, they regularly have a a 25% and 50% off sale on award mileage requirements from certain cities in US. Potentially, you can fly for 12,500 miles (Thank You points) one-way to most of Europe.

Any other decent options?

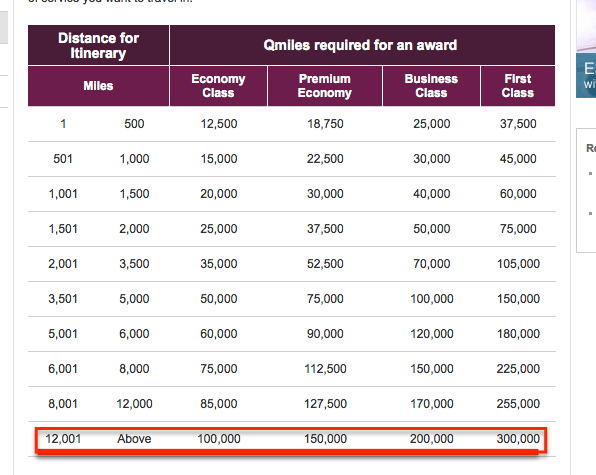

I looked at other partners and couldn’t find any bargains for family travel. For my single readers who have no kids (and there are quite a few), there is a potential to leverage the heck out of Qatar Privilege club:

Take a look at the last level. I haven’t seen any requirements for stopovers, so in theory, you can take around-the-world journey on One World partners, and visit every continent for a total of 100,000 miles in economy per person. I haven’t investigated it any further, since it’s of limited use to a regular family, but perhaps an expert can shed light on this. What say you, Gary Leff ? Qatar miles also transfer from SPG program.

How you can get Citi Thank You points that transfer to airline partners

Only several Citi cards are eligible for this transfer, and among them is Citi Thank You Premier Visa (pays me commission). You can read more on it in my list of bonuses. The short version is: If you are willing to jump through some hoops and wait more than a year for your full bonus to post, you will have 55,000 Thank You points by the end of it. So, if both spouses get one, they would have 110,000 points between them, which can be combined for free.

That amount is currently good for 3 roundtrip tickets to Hawaii or 4 roundtrip tickets to Alaska on United (through Singapore program).

You can also redeem for 4 roundtrip tickets to Europe on Air France if you get in on a discounted awards deal.

Plus, let’s not forget, you can potentially send one of you around the world through Qatar program! But come back to your family, OK?

Should you get this card? Only you can decide. There are many factors to consider. Are you OK with waiting a whole year for your bonus? A lot can change during that time when it comes to award programs. Of course, you can always redeem the points for flights and get 25% more in value. Worst case scenario: Get $550 in Walmart gift cards. Remember, the second year annual fee is $125, not waived.

For what it’s worth, both my husband and I got this card last year. The addition of airline partners definitely sweetened this bonus substantially.

Readers, does this new development make the card more enticing to you?

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I always transfer CHASE Ultimate Rewards to my United account to redeem for tickets.

@Hilde H Makes perfect sense. Ultimate Rewards are great in that respect, as Chase pretty much monopolized United program transfer. There is a way to transfer from SPG, but the ratio is awful 2:1.

Sadly, I don’t have any Ultimate Rewards because I refuse to pay the annual fee on CSP, and I don’t sign up for their business cards like Ink or Bold. I went ahead and dumped my last CSP bonus into Southwest. This United offer came at a good time. Hopefully, I’ll get my four tickets out of it. Then next year, I’ll sign up for Chase Sapphire Preferred to get more points. The new rule of getting the bonus as long as it’s been 24 months since the last one, is a huge development. Between my husband and I, we should get a steady supply of Ultimate Rewards by alternating the apps.

Did you consider the night train from Munich to Rome? Solves the problem and saves a night of hotel costs.

http://www.bahn.com/i/view/GBR/en/prices/europe/overnight-travel.shtml

John, thanks so much for your suggestion! The problem is, we have small kids, and they would stay up all night, guaranteed. 🙂 Also, my sister-in-law already reserved the rentals in both Germany and Italy. I’m hoping the miles will get us what we need as far as flights are concerned. I don’t get attached to points, so as long as I can save money, it’s all good.