I look forward to buying a car like I look forward to having a root canal. Aside from spending our hard-earned money on material things (I much prefer experiences), I find it super stressful. But my husband was determined to get another car now, even though we agreed to wait until next summer.

A few things made me give my blessing, however. You can find some very good deals on used electric vehicles right now, and my husband has been coveting Ford Mustang Mach-E since it first came out. Also, he agreed to trade in his 2016 Ford Mustang instead of our 2009 junker van with 220k miles. I told him: I will give you my van when you pry it out of my cold dead hands! Probably after it falls apart on a highway.

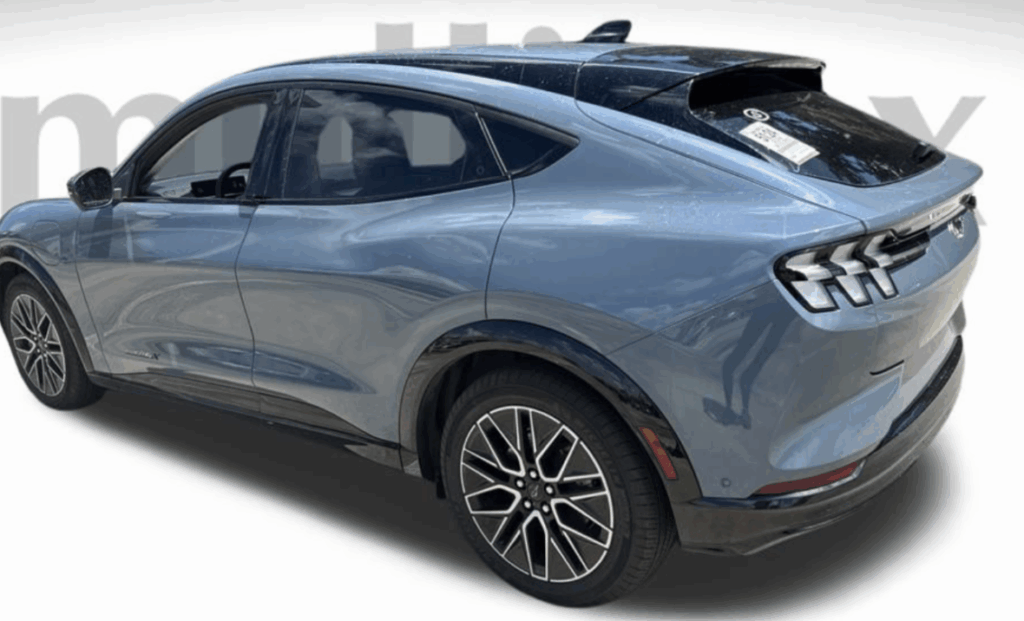

Anyway, my husband found the exact 2024 Mach-E premium model he wanted, the color he loves, and with only 10k miles on it. So, practically new, as far as I’m concerned.

After trade-in and fees, we would be on the hook for $16k total, which isn’t bad considering the fact that his Ford Mustang was almost a decade old. We will still need to pay $1k for electrical work in the garage in order to have a 220 outlet, but that was expected. We hope to keep the car for at least 13 years or however long the battery will last.

A few words on the Mach-E itself. It is fast! Seriously, I can’t believe how quickly it takes off, it’s like being on a rollercoaster. My husband has a stupid grin each time he drives it, so it makes me happy to see him enjoying his new toy. That’s how I feel when I book a dream trip. It’s also a pretty decent family vehicle. We are tall people, and the kids have plenty of legroom in the back.

All-in-all, I have to admit that it’s a pretty sweet car, though Ford reliability is an issue. Fortunately, we still have two years of full warranty left. We got an extended-range battery model (300 miles), which should suffice for our travel needs. We mostly do road trips in Florida and rarely drive further than 200 miles from our house.

The car buying process

This is the first car we bought sight unseen. The dealership is located two hours from our house and originally, we were planning to drive there on the weekend. We actually bought my husband’s old Mustang from them, and had a good experience.

However, the salesperson offered to bring it to our house for free and pick up the trade-in. I was very skeptical at first, but he asked to take some photos of our vehicle and made an offer we couldn’t refuse. Since the new (to us) car came with 15-day money-back guarantee, I figured we were not risking anything. My husband did a test drive of Mach-E in the past, so he knew what to expect. We took the deal.

Everything was done via text, email and phone. Naturally, I asked to use a credit card to cover $16k, but was told they would only allow $5k. That was also the case the previous time, and I didn’t push it. Depending on how desperate the dealer is to make the sale, there may be some wiggle room.

At the time, I was working on meeting minimum spending requirements on my new Amex Platinum card and had $4,500 to go. So, naturally, that’s the card I used. My 150k points bonus has already posted. The dealer sent me a payment link via text, and that was that. I had to decide how to cover the remaining $11k. I have an emergency fund at a local bank, but it’s locked up in a CD. We also have several Roth IRA’s in a local credit union, as well as Vanguard.

For those unfamiliar, you can take out original Roth IRA contributions without penalty at any time. Obviously, it’s not ideal, but I’ve always viewed these accounts as our savings of sorts, though we’ve never tapped into them until now. I went ahead and decided to transfer from Vanguard, since my Roth IRA is invested in a money market fund. Those come with some risk, and there were instances of funds breaking the buck, the term used when net asset value falls below $1. Vanguard seems solid and would likely get bailed out, but we live in crazy times where nothing is guaranteed.

Since I prefer to have my emergency fund and short-term savings in FDIC-insured accounts, it made more sense to tap into Vanguard Roth IRA, though that’s not a financial advice to others. Unfortunately, it would take a few days to get the funds transferred to our checking account, plus, we would have to physically show up in the dealership with a check. So, reluctantly, we’ve decided to apply for a loan and pay it off immediately.

I hate the idea of getting an extra credit inquiry for no reason, but it just made the most sense in this case. Plus, my husband was chomping at the bit to get the car ASAP. Even though it wasn’t my intention, I thought it would be an interesting case study to see what kind of rate he could get as someone applying for 4-5 new credit cards each year. Well, he qualified for 7% rate from Fifth Third bank, which is about as good as it gets on used cars these days.

There was no fee to apply and no early prepayment penalty. So, aside from extra credit inquiry, it’s not a huge deal. We did consider borrowing from his 401(k) to hedge our bets with the crazy stock market bubble forming as we speak. But, it’s hard to predict how long the party will go on, plus, 50% of his 401 (k) is invested in bonds anyway. I’m not one to try to time the market, so the money stays put. Plus, there are fees associated with 401(k) loans, which is not ideal.

Implications on future family travel

As crazy as it sounds, in some way, buying this car now is a relief. We were going to do it next year regardless, so it honestly feels like a giant monkey off my back. Tapping into Roth IRA isn’t ideal, but we’ll survive. I’m not about to pay 7% interest on car loan when our account earns only 3.5%. That’s counterproductive. I’m averse to paying interest on anything, unless I can safely earn more elsewhere. That’s just not the case here.

More importantly, not having car payments each month will allow us to have some money we can put towards travel. We have very expensive years ahead of us, with my daughter graduating high school and us losing child tax credit for both kids. There will also be extra money we have to spend on car insurance for having a teenage driver, though fortunately, at least my MIL has already gifted her a car. So, that’s one less thing to worry about. Of course, our son is not far behind, and we will have to do that for him as well just a few years later. In short, our expenses will go up exponentially in the next four years.

That’s why I’m not too picky when it comes to CPP value. We are simply not in a position to do that. It’s not a complaint (how obnoxious would that be!), but a statement of fact. I’m seriously thinking about using Ultimate Rewards points to offset the $550 annual fee on Chase Sapphire Reserve at 1.25 cents apiece. Don’t tell me I can get 10 CPM on business class, I don’t care.

We are a middle-class family trying to do several things at once, while also pursuing financial independence (eventually). It’s a lot. That said, I love travel and I’m not willing to give it up. So, I’ll be hustling to find creative ways to get more miles and points to offset our out-of-pocket costs. Family travel is an investment that is just as important to me as making a contribution to an IRA. Maybe more so.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Chelsea Thanks for advice! Just to clarify, we don’t have a ton of money in our Roth IRA accounts. That’s why I am not super concerned about squeezing as much as we can in terms of growth. It’s more of an extra layer in my emergency fund. I get that it’s not how most people do things. Our traditional IRA accounts and 401(K) are invested in mutual funds. Contacting a financial advisor is not a bad idea, and I will probably do it as we get closer to pulling the trigger on early retirement. Although, we live in crazy times, and I’m not sure the old rules apply. I think the best we can all do is to diversify investments as much as possible.

Congrats on the new car! Sometimes you gotta do what you gotta do to cover an expense. However, I would say that your emergency fund is not really an emergency fund if it’s locked up in a CD. Also, there’s no need for several roth IRAs each, you can roll over them all into one account (one for each of you of course). It’ll make tracking your portfolio much easier. A credit union is not an ideal place for investment vehicles. That’s not really what they’re best at and usually have much higher fees. Vanguard and Fidelity are amazing options.

Please have most of your roth IRAs invested for long term growth. Might be worth consulting a flat-fee based fiduciary CFP (NOT a assets under management fee!) to make sure you have your portfolio aligned with your goals and risk tolerance. Joe Kuhn who retired at 54 with a family is on YouTube and has some legit recommendations.

@Pam Good point! I actually thought about it, as I have a few offers right now. But I didn’t want to pay 3% in fees, and just wanted to keep it simple. Plus, I was concerned by what carrying this type of debt would do to my credit profile.

Another option at that low amount of debt are BT offers. Complete your cc SUBs with the initial amount, then do multiple BTs at 0% (3% transaction fee). More work but mo cheap

@harv Thanks! Glad you liked it. I wasn’t sure if I should even write about it, but there is a miles and points angle.

interesting write up.

@ffi Yes, absolutely. My requirement was at least 200 range, so it should be OK.

300 mile range is usually 250 miles in actual driving