Update: it looks like the $500 travel credit has been removed via referral links, but the points bonus was increased to 125k points from 100k points, which will probably appeal to those who transfer to partners.

Back in June, Chase Sapphire Reserve has undergone significant changes. Call it Amex-ization, couponification, whatever. See Nancy’s post for more details. Either way, it’s clear that CSR is a different beast compared to the original product launched in 2017. I went ahead and locked in the old rewards structure by converting my Chase Freedom Flex, with the idea of using up my points through Chase Travel portal at 1.5 cents apiece. There is no question that I’ll be downgrading the card before my next renewal. I’ll address this later in the post, but for now let’s talk about the current signup offer that is due to expire tomorrow morning.

Is it worth it?

For me, there is no question that it is indeed worth it. When the card came out in 2017, it had a 100k Ultimate Rewards points bonus and $450 annual fee. I can’t overstate the level of excitement in this community at the time of launch, including from yours truly. I applied for it then and would absolutely apply for it now (if I could). Unfortunately, Chase won’t approve me, and rightfully so.

The current offer still comes with 100k points, but you also get $500 travel credit on top of it. You have to use it up in one transaction, but it can be utilized towards cruises, airfare, hotels and activities. That’s not too shabby if you ask me, even though some Chase travel portal prices are inflated.

Sure, the annual fee is now $795, which is admittedly a big chunk of change. But remember, you still get a separate $300 travel credit that is almost as good as cash if you travel at all. That one doesn’t need to be used through the portal. So even if you don’t use all the other perks, I would argue that $345 annual fee difference is a good deal for getting a $500 Chase travel portal credit. It’s a significant discount despite some obvious limitations, and I would pay it personally.

Of course, times have changed, and it’s not unusual to see 150k or higher points bonuses on Amex cards these days. Still, I would argue that 100k Ultimate Rewards points+$500 travel credit is kind of a big deal. Now that Chase has implemented a pop-up for verifying bonus eligibility, you want to get the highest offer you can because it may very well be once-in-a-lifetime.

The problem is, we don’t know what the new offer on Chase Sapphire Reserve will be tomorrow. I have no clue, though I personally doubt it will be higher. My guess is that they will reduce either travel credit, points bonus or both. But again, it’s only a guess. Nancy and I try our best to look out for readers’ best interests and we always have. A few months ago, we mentioned that Rakuten was offering an extra $300 on Chase Sapphire Preferred (now dead), which meant foregoing referral points for ourselves. I’m not saying this to pat myself on the back, it was obviously the right thing to do.

But we’ve always tried to be as transparent as possible when recommending credit cards. We don’t write about every offer under the sun, but this isn’t your run-of-the-mill bonus. If you are looking to apply, make sure to do so before 9 AM tomorrow morning (August 21st), as according to many bloggers, that’s when the offer will end. Sometimes personal referral links work longer, but I wouldn’t count on that.

If you want to support the blog, here are our personal referral links:

New CSR perks may be more valuable than you think

If you get the CSR card now, you will only get 1 cent per point towards most travel purchases, but it’s not as bad of a change as it appears at first glance. Originally, I planned to use up the points towards a cruise to Alaska at 1.5 cents each, but that has been postponed by a year due to coordinating with other relatives. We are looking to turn it into a family reunion, so there are a lot of moving parts. I don’t intend to pay a $795 renewal fee on CSR just to have access to 1.5 cents on travel, so will be looking to burn them elsewhere. After all, 1.5 cents is really closer to 1.35 cents most of the time. Here is why.

When it comes to Chase Travel Portal, your two best options are airfare and cruises. That’s where you will really get close to 1.5 cents per point. Car rentals can be hit or miss, but usually I can find a better deal elsewhere. Hotels are almost always overpriced, but using Points Boost can be a good deal. Do keep in mind that you are foregoing portal cash back, which can be 10% or higher. That’s why I said that 1.5 cents is more like 1.35 cents in reality.

I’m actually OK with getting that value out of my UR stash, so will be burning points on a small lodge near Yosemite next summer. We need something close to the park and can’t afford high prices inside of Yosemite. There aren’t any chain hotels in the area, at least not close by. That will cost me around 65k UR points for two rooms, a relative bargain for Yosemite area in the summer months.

Since I locked in the old $550 annual fee and rewards structure before the switchover, I won’t have access to new CSR perks until October 26th. If you apply for it now, you will get access immediately. Here are a few things I plan to do then:

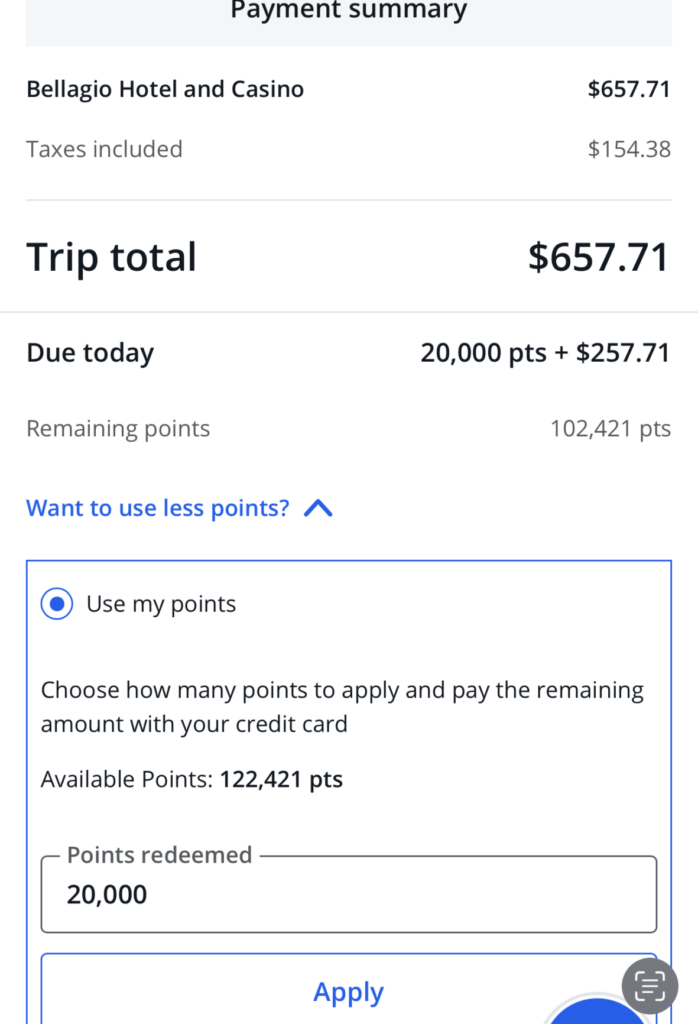

1) Book a stay at Bellagio for my MIL and kids

It’s part of The Edit collection, so CSR will reimburse us $250 towards 2-night stay. Incidentally, that’s how long we plan to stay in Vegas. The reason I want to book Bellagio is because my MIL wants to see the O show at the resort. That way she won’t have to look for a cab in the evening.

So, after the $250 credit, the cost will be 20k Ultimate Rewards points for two nights. For that, my MIL will also get $100 dining credit and free breakfast each morning. Not a bad deal.

2) Use $150 StubHub benefit on the O show

Self-explanatory.

3) Use $150 dining credit X 3

We plan to be in Las Vegas at the end of this year, in Phoenix next January and San Francisco in July. All three cities have CSR participating restaurants Sure, most are overpriced, but if just me and my husband go, we should be able to dine for $150 total each time, making it free. I hope. This one is a use-it-or-lose-it as we live in a small town.

4) Lyft $10 monthly credits

Should be able to get at least $30 out of that one.

5) Apple TV+ subscription

Not sure on this one, as my husband handles it. But I know we pay for Apple subscription each month, so may be able to squeeze some value there.

6) A second $300 travel credit

This one is specific to my situation, but since my $550 annual fee will hit in a few weeks, I should be able to use up a second $300 travel credit next June when it resets.

Final thoughts

I’m not a fan of measly/convoluted credits, but if I have access to them, you better believe I’ll try to use them. But as far as renewing my CSR card, that’s a hard no. Still, this card is absolutely worth it (for everyone) in the first year due to signup bonus. Anyone who says otherwise is not really a miles and points expert in my book.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Russ I hear you! To be honest, I was too cheap to pay the $550 fee on a regular basis, and I certainly won’t be paying $800. I did upgrade to CSR a few years ago (due to several specific benefits) and was surprised by the fact that the annual fee took a few months to post. As a result, I got $300 travel credit twice before downgrading, so I made money on the upgrade. 😉 Wasn’t my intention, but glad it worked out that way. This time I upgraded because I wanted to lock in 1.5 cents per point on travel. Although you are correct that prices are usually inflated. Still, I’m willing to liquidate UR points at 1.35 cents, and might even use them to offset the annual fee at 1.25 cents once it posts. We just bought a car, so every bit helps.

I will need to think on that one, as we might have a better use for points before next renewal. All of my travel plans were made before the benefits refresh, so it’s a bonus to utilize all the “coupons”. I do hope to use $150 dining benefit three times. The maximizer in me just can’t pass up this opportunity!

We currently have the card in my wife’s name and I had planned on renewing, but increase in the annual fee is a deal breaker for me. That said, I am eligible to get the card, but it would be in the future. Most of the “coupon benefits” do not fit our lifestyle or our geographical location, so that’s a negative. The $300 travel benefit we used immediately to defer costs to Barbados in January and it worked exactly as advertised. I have never found the Chase travel portal to be a worthwhile booking option as prices are inflated, more so since they outsourced it to one of the booking apps. We are currently trying to squeeze one more Barclay’s AA card out before it shuts down.

@Pam Hmm, not sure what is confusing? The bonus on the card is worth it in the first year if you can get approved. The card may or may not be worth renewing, depending on your situation. For me, I don’t believe it’s worth it. The UR points are still valuable, and travel credits can be as well under the right circumstances. Sorry if I didn’t make it clear.

I am so confused on your stance on this card…you do but you don’t?! Holding out for all URs not yet another travel portal credit.