Who doesn’t love a good clickbait title now and again, right? Anyway, a bit over a month ago, I wrote a post on agonizing between applying for Amex Gold and Amex Platinum cards. It was completely silly of me and I said so in the post.

The winner was 175k points offer on Amex Platinum (as opposed to 100k Amex Gold bonus) and it should have taken me exactly two seconds to determine that. Instead, being the compulsive optimizer that I am, I kept going back and forth on whether I could justify the $695 annual fee.

We got the card in the end, and I figured even if we could squeeze out $300 in value, it would be totally fine. But it looks like we will do better than that. Much better. Since Amex Platinum slew of benefits is often referred to as a coupon book, here are some lucrative “coupons” I’ve utilized so far:

1) Uber credit of $15 each month, $20 extra in December

This one is super easy, and I knew I should be able to get my $200 in benefits by using Uber Eats and picking up my order at one of local fast food joints. So far, so good. Obviously, I can’t value this benefit at full $200, but I would probably pay $175 for it.

2) Flight incidentals credit

This one is very much YMMV, but worked for me. I needed to buy some cheap Southwest tickets and figured I might as well use my Amex Platinum. Naturally, you want to select Southwest as your airline of choice in your profile before the purchase. I figured if the tickets didn’t get reimbursed, no harm done. But I got $190 credit in the end (on two tickets costing $95 each). I can’t guarantee the same will happen to you, of course.

3) Saks $50 credit (twice a year)

Needless to say, Saks is not the place where I do my normal shopping. So, I was struggling to find a meaningful use for this credit since everything is so overpriced. I’ve noticed my MIL likes having diffusers in her house and pays retail price for them. So I bought her one as a present and she loves it. I’ve spent a total of $57, and got a credit of $50+cashback from Capital One. Not a super useful benefit for me personally, but if you buy perfume and various expensive junk, you may find it to be almost as good as cash.

4) Saving money on Sixt rental with the help of Amex Platinum

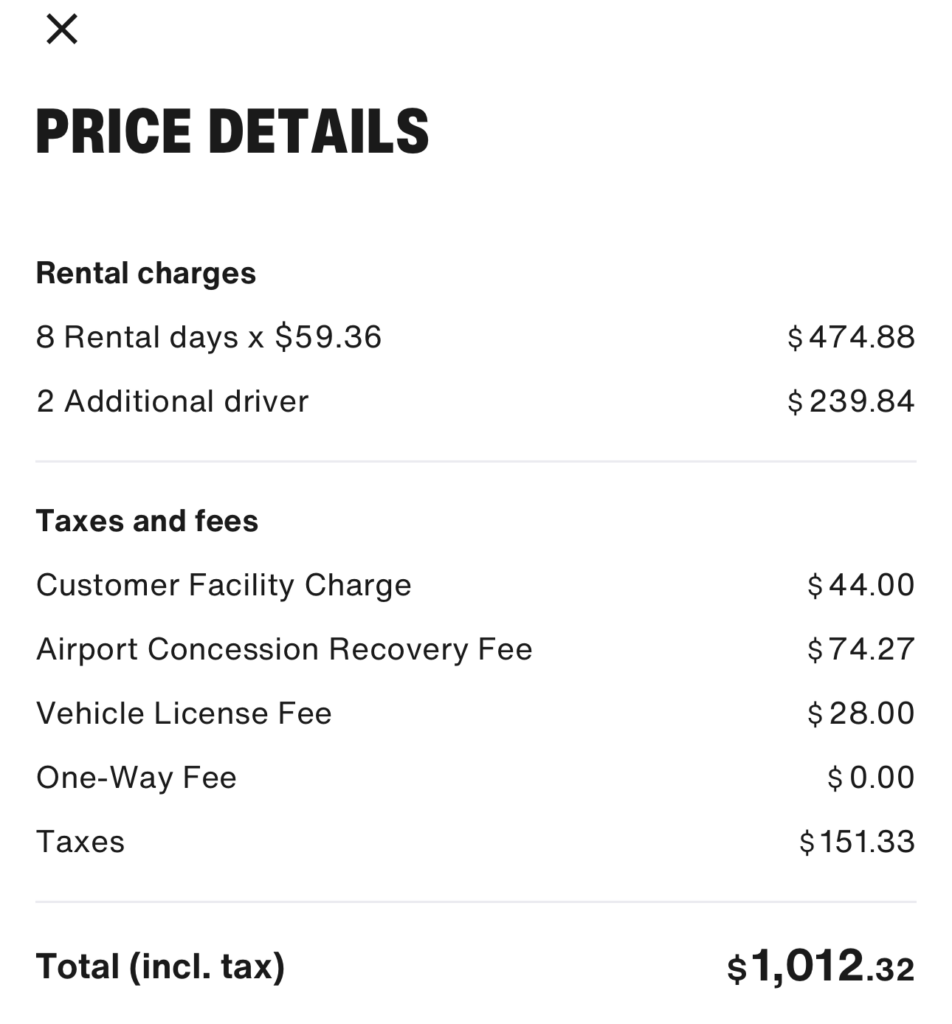

This is the “one that will shock you” from the tittle. It certainly shocked me! So, we rarely rent cars and I hardly ever pay attention to status promos. I simply book whatever is cheapest by looking at various websites, starting with Kayak.com So, when I needed a minivan rental for an upcoming trip to Southwest, I ended up booking through Capital One portal at $907 total for 8 days, including one-way drop-off fee. It would also cost me an extra $15 per day to add my MIL as an additional driver, and I figured I would pay the fee at pickup. She likes to drive, and is pretty good at it despite being 80 years young. Not cheap, but that was the best deal, bar none.

Of course, I kept checking periodically and last night saw that SIXT was offering a non-refundable special via Priceline.com for $650 total. I would also have to pay $15 per day extra for an additional driver on top of that. I don’t like booking non-refundable deals, but our dates are set and I figured I would use my husband’s Chase Sapphire Preferred to pay. It’s a great option for car rentals since it includes primary car insurance and regular travel insurance in case you need to cancel for a covered reason. I would be saving almost $260 compared to Enterprise, which is nothing to sneeze at.

I was about to book it and then I remembered that our newly minted Amex Platinum mentioned something about SIXT elite status in the brochure. Hmm.. I looked into it and lo and behold, my husband could get SIXT Gold status just by enrolling. I did that and voila, we could get the same rental for $668 (with 5% discount) by going through SIXT.com, and it would be refundable minus $100 fee. But that’s not what swayed me. I could add an additional driver for free! In fact, I was able to add two drivers. That way both me and my MIL could be listed on the rental. Since we are planning to put over 1,500 miles on that van, that’s very helpful.

Btw, you don’t have to use Amex Platinum to pay. Amazingly, having this card saved us at least $150, since I was planning to add an additional driver anyway. Not too shabby for a benefit that I originally dismissed as useless. We paid $668 total compared to what it would cost us without any status:

5) Disney+ bundle monthly credit of $20

Not a huge deal, but Amex Platinum saves us $5 per month and we don’t have to watch commercials. Previously, we used Amex Blue Cash $7 monthly benefit, so $5 is the difference.

Speaking of Disney+, anyone else watching the second season of “Andor”? That is a worthy prequel to the sequel, but I digress…

6) Fine Hotels and Resorts benefit (still planning to use)

This is a benefit I didn’t want to take advantage of just for the sake of not letting it go to waste. However, my husband and I like taking occasional trips without kids, so I wanted to see if I could maybe book a cheap two-night getaway in Florida. Since this benefit resets every calendar year, I would pay for one night in December of 2025 and second one in January of 2026. That way I would be able to knock $200 off each night. Reportedly, your Platinum card doesn’t have to be active at the time of stay, but you are required to present (any) Amex card for incidentals.

Florida hotels are very expensive these days, but I found that Isla Bella Beach Resort and Spa located in Florida Keys costs around $250 per night all-in during hurricane season. Obviously, this isn’t an ideal time to go, but for this price I’m game. I love Florida Keys, so any excuse to visit the area is fine with me. We don’t even need to fly since we live less than five hours away. Between resort credit of $100 and free breakfast each morning, Amex Platinum will essentially allow us to have a close to free getaway. Hopefully. Oh, and all the rooms have ocean view.

I don’t have a ton of hotel points at the moment, and would probably book something with cash otherwise. So, I feel like Amex will potentially save us real money if I end up booking.

Final thoughts

As you can see, I’m already close to breaking even, which frankly is surprising to me. My estimate was far more pessimistic, but I knew that 175k points would more than make up for any shortfall. Will I be renewing the card? I really doubt it, but never say never.

The 175k offer is targeted, so I recommend using Google and trying the links that come up in different browsers. We got it via email, so make sure you check your Amex messages as well. I hate using the word “investment” when it comes to annual fees, but that’s exactly how I view paying $695 upfront on Amex Platinum. In my case it was more than justified, but YMMV.

Readers, how are you maximizing your Amex Platinum “coupons”?

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Harv You are absolutely correct! I’ll fix the post. It’s hard to keep track of all these Amex coupons.

@Aleks Thank you for your suggestion on Alaska shopping portal promo. I just might do it. If I remember correctly, you are the one who mentioned the Greenlight deal. I did sign up and received my 4k miles. Thanks!

You are doing a good job of using the coupons. Note that for Uber the December credit is $35 (the usual $15 and a bonus of $20 more).

Good game play! Appreciate the details. I’m in for a Gold “play” for the rest of the year – lets see what I can scoop in credits/bennies.

By the way, if someone is looking to “buy” Alaska miles cheaper – Alaska Shopping running a Motley Fool promo now for up to 21,000 points (depending on plan purchased). Their previous game play with Greenlight sign-up ended up profitable – 4,000 miles posted.

Happy travels!!