This will be my final update. As some of you know, I did get the funds back. Two weeks ago, I actually emailed the CEO of Bank of America and evidently, my complaint was forwarded to an executive office or something along those lines. That got things moving, and the matter was resolved less than a week later. Otherwise, I would probably still be waiting for my “precious”, err… money.

Even though Bank of America considers this matter closed (at least that’s what their letter said), here are a few observations I wanted to make as my parting gift to them and you, my dear readers:

1) Everyone has a plan until they get punched in the face

My point is, banks in the United States can freeze your assets at any time. It’s nothing personal, and most just try to comply with rigorous requirements imposed by US government. It’s much easier to just close an account and freeze the funds for a number of weeks or months than get hit with a heavy penalty later on. There are many bad actors out there, and money laundering/fraud is a real issue.

If you are opening a new account, you will be under heavier scrutiny than an average Joe who banked with them for many years. Though to be clear, even an average Joe can have their assets frozen at any time, and Reddit is full of stories like that.

Will you be OK without your money for weeks or potentially months? How about your spouse? In my case, I was annoyed, but not super worried. We don’t live in a Banana Republic (yet), and I knew that BoA is required by law to give money back to the rightful owner, which is me. Worst case scenario: I would get a lawyer and sue the pants off BoA. Not my preferred course of action, but I would not hesitate to go that route if necessary. In short, I wasn’t too worried.

However, my husband was worried and in fact, slightly panicking. There was even a talk about canceling some upcoming trips. Whoa, let’s not go crazy here! To be clear, he wasn’t blaming me. He knew I was simply trying to take advantage of a bonus offer, which isn’t illegal. But this was our emergency fund, and a bank just took it from us with no explanation and no timeline as to when we would get it back. And by the way, they are not required by law to provide an explanation.

As I predicted, they canceled my credit cards shortly after closing the checking account. I didn’t shed any tears and in fact, they did me a favor as I was planning to cancel them anyway. Fortunately, I’ve already received my sign-up bonus on both cards. Of course, now I’m probably banned for life, but that’s how it goes sometimes. Again, it’s nothing personal.

So, if after reading my cautionary tale, you still decide to open a checking account with BoA, my advice is to wait until you receive a bonus on your BoA card first. That way, at least you will mitigate your losses in case things go sideways. I was lucky.

Alas, my check was finally mailed and I was happy that this ordeal was over. As to the funds, I deposited them in a local bank where we had an account for many years. It’s earning a bit lower interest rate on a CD compared to Discover bank, but at least I can walk in and talk to a manager, who I personally know, if a problem arises. And that’s worth something, especially to my husband.

Will I still open new bank accounts? Most definitely, but I will never deposit such a large amount (for us) ever again. I would be OK tying up a few grand because I can always go to small claims court in Florida for an amount less than $8k. Though again, I wouldn’t deposit anything close to that limit. By the way, one of our readers had to take Citi to small claims court after they closed his account and refused to release the funds. Still, it’s important to keep things in perspective, as I’ve “won” far more than I’ve lost so far.

2) On my “Schrödinger’s funds” and BoA ineptitude

Where to begin? First of all, when nefarious action is suspected, I get that the bank won’t give you advance notice before freezing funds. That makes sense. What doesn’t make sense is notifying the owner after the fact via regular MAIL. Is it too much to ask to get an e-mail or text message with a short explanation? I’m not asking for a phone call, though it too would be nice. Let the person know what’s going on before they log in and see their funds disappear without any explanation as to why. Some folks may have a heart attack as a result, no joke.

And don’t get me started on an outsourced BoA office handling CFPB complaints. The dude who called had no clue what was going on, and was saying the only way for me to get my money back was to file a claim via the bank that performed the original transfer. That is most definitely incorrect. He said they will not mail me my check, ever. What a clown.

He was only interested in having a record of official response, something all banks are required to do when a CFPB complaint is filed. He also said that he would email me, but that never happened. An absolute joke, though I recommend you still file a CFPB and OCC complaints if your money is tied up for more than a few weeks. Might as well, just don’t expect too much. Emailing the CEO does appear to be the way to go, especially when you are dealing with an inept bank.

In the case of BoA it really seems like the right hand doesn’t know what the left hand is doing. I can see why these guys had to be bailed out in 2009. When I called the relevant department, I kept getting mixed messages. One employee said I can go to any BoA branch, provide my photo ID, and my funds would be released on the spot. I got all excited, but then she put me on hold, came back and said “Oops, my bad!” Another lady said my check is approved and scheduled to be mailed the following day, which didn’t turn out to be the case. And so on.

I also never got a clear answer as to what exactly I should do to prove my identity, as that appeared to be the issue at hand. Surely going to BoA branch in person with passport and driver’s license would solve the problem. But nope, some department was handling it, and I wasn’t allowed to talk to the person in charge of my case. In fact, the people I dealt with could only email that department and wait a few days for the response that may or may not come.

Of course, in the grand scheme of things, it wasn’t the end of the world. And it was a piece of cake compared to my battle with our health insurance company. In fact, BoA matter was technically resolved in less than three weeks. But it sure seemed much longer and my husband was freaking out by the end of it. Rest assured, BoA will never get a cent of our money. Though to be fair, the feeling is mutual. End rant.

Update on 1/16/2025:

I already got a call from BoA rep in response to my CFPB complaint. That was fast! Unfortunately, it only added to confusion. The rep (who appeared to be a worker in India) told me to reach out to Discover bank where the funds were originally transferred from. I was advised to initiate a claim to return the money. That didn’t sound right, but he said it’s the only way to get my funds. I called Discover bank and was told they don’t do it too often, but it’s possible, though the process would take some time. I’ve decided to hold off for now.

I then called the original BoA phone number and was able to talk to the same manager who I spoke to a few days ago. He said he was able to escalate the issue, and that the review would take five business days. At that point they will either release the funds or require more proof that the money is actually mine. From what I gathered, the issue does appear to be with proving my identity and the fact that the original funds belong to me. I offered to send in Discover statements, but was told the review has to run its course first. What an absolute mess, but at least there is some progress. I’ll hopefully write the final update soon when the check is actually in my possession. Stay tuned.

Original post below:

Even though going after credit card rewards is my proverbial bread and butter, I do occasionally dabble in pursuing new bank account bonuses. The latter is definitely more of a nuisance, at least to me. But hey, money is money, right? Well, my latest experience with opening a new Bank of America checking account was/is the mother of all nuisances.

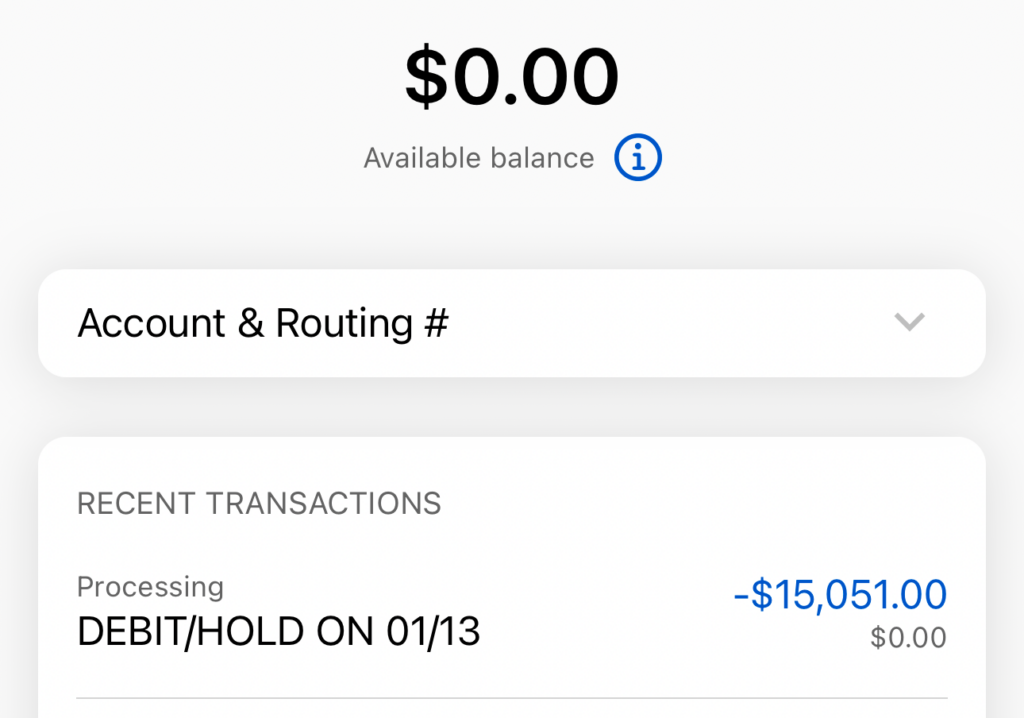

I won’t bore you with all the details of the bonus (hat tip to DOC blog), plus, the deal is now dead anyway. Basically, I had to deposit $15k in order to (hopefully) earn $500 a few months later. I fulfilled all the requirements, and was making all kinds of plans for my new windfall. Travel, naturally. Well. Yesterday, I got an email telling me that that my account balance has dropped to zero. Say what?

That’s not right. I figured it was some kind of a glitch or possibly fraud, so called Bank of America right away. Turns out, they have decided to close my account. When I asked why, the reason was not given. Apparently, the law doesn’t require banks to notify you before closure and they can do so for any reason whatsoever.

What triggered it? Beats me. I’m not a money launderer, that’s for sure. I made several transfers from my Discover savings account in order to reach the required $15k balance, and also made a $1 mobile check deposit. That’s it. The lady I spoke with was pleasant, and I actually told her to stop apologizing, as it’s not her fault. She was simply doing her job. She has assured me that the funds would be released the next day and they would mail me a check. Fair enough.

My credit cards with BoA are not closed yet, but I’m sure they are next.

No soup (money) for you!

Today I tried to log into my account only to find that all trace of it has vanished. I’m glad I took a screenshot of my last statement, plus the recent debit. I’ve decided to call BoA, except they were trying to direct me to their credit card department. The rep I spoke with the previous day did tell me the check was scheduled to be mailed and to call in order to get the tracking number.

Eventually, I got someone to transfer me, and a lady on the other end cheerfully notified me that there is now an investigation in connection with my cursed checking account. Excuse me? I asked her how long it would take and she couldn’t come up with a timeline. Could be months… Terrific.

I asked to speak to a supervisor who was more sympathetic to my plight. However, he said that he didn’t have any power to affect the outcome, but would send an email inquiry. So, the bottom line is, you can’t talk directly to decision-makers.

Folks, this is my entire emergency fund right there. It seems crazy that they can just keep my money indefinitely and not provide any reason whatsoever. Not to mention, not give me a specific timeline of when I can expect some sort of resolution. If they need proof of my identity, why not ask me to send it?!

Naturally, I filed a CFPB complaint right away. I’m not sitting and waiting for BoA to do the right thing. I’ll update this post with the outcome. I should get the money back eventually and won’t be losing any sleep in the meantime. But man, this is nuts. I’ll think twice before I ever open another checking or savings account again. And you better believe I won’t be tying up my entire emergency fund.

I had to laugh at the absurdity of the whole thing. It also made me think about a friend of ours, who thinks that the government and banks are out to get him. In fact, I once had an argument trying to convince him that he needs to at least contribute enough to 401(k) in order to get the company match. Of course, it would require setting up a dedicated account. His response to me was: “What if they just take my money?”

When I tell him about what happened, I’m pretty sure his reaction will be similar to Captain Holt on Brooklyn 99 show where he yells “Vindication!”:

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Cari D What a hassle! But glad you got it sorted out.

I thought about driving to BoA branch (40 minutes from my home) and speaking to a banker who may help. But I’ve decided to wait it out. I’m hoping it gets resolved on its own next week. If not, I’ll escalate further. I just need to be patient, I guess.

I unfortunately have had this experience as well. It was a small bank with just one branch in my state that was about a 8 hour drive round trip. I did NOT want to make that drive! They flagged the account for something they thought was suspicious (paying my charge card bills from 3 different banks from the account). Had to send them copies of driver’s license, electric bill, it was a huge hassle. Tied up the money for about a month until they finally mailed me a check. But on the flip side, I have successfully received a bank bonus with no trouble about 15 times. I did the Chase $900 deal about 3 years ago and my husband got it for $900 in 2024.

@ted I’ve actually found a lot of horror stories on Citi, and would never open an account with them now based on that. I’m sorry this happened to you.

I’m hoping to get it resolved peacefully, but of course will pursue litigation if needed. Fingers crossed, it doesn’t come to that.

Same thing happened to me last year with Citibank. I am afraid you won’t get your money back the normal way. I had to take them to small claims to get my money plus interest back. They decided to settle in court before we saw the judge instead of admitting fault.

@Lynn Thanks! It’s very odd, indeed.

So sorry! Amazing that happened to you. Yes, wonder what triggered it!

@Advocare Thanks! If this happened to me, it can happen to anyone.

@Tom That’s what I thought too. I’m not super worried about eventually getting the money back, but the lack of clarity makes me feel uneasy. My husband is normally a chill guy, but this ordeal has him a bit rattled. That’s pretty much all of our liquid savings at the moment. I feel bad adding more stress to his already stressful life. Very unpleasant experience, but a valuable lesson.

“Sorry to hear about your experience with Bank of America! It’s incredibly frustrating when something like this happens, and I hope the situation is resolved quickly. Thanks for sharing your story, it’s a valuable reminder to be aware of account management practices.”

I don’t understand how they can legally hold on to your money for an indefinite time with no explanation of exactly why they are “investigating” the account. I guess they might have the right to close accounts, but not distributing the funds right away right away when they decide to close and account def does not seem legal. Good luck !

@Nancy I definitely never thought it would happen to me. I’m very much a “vanilla” citizen, so I’m not sure what nefarious activity they think I’m engaged in.

Ugh, this does sound aggravating! I hope the investigation is closed soon. What a pain!

@GUWonder That’s good to know. Though I sure hope it’s less than 90 days.

@Russ You better believe I’ll never open another BoA account again. Though I’m pretty sure the feeling is mutual!

@Sebas You nailed it.

@AJ That’s a fair question. Perhaps I should have added it in the post, but during my first phone call the lady told me that the check is scheduled to be mailed out the next day and that I could call them for tracking number. Which is what I did.

So imagine my surprise when I was told not only will they not be mailing the check, but now there is an investigation with an indefinite timeline. Even if they are allowed to get away with it by law, it’s still super shady.

It’s true, I don’t need the money right now, but I might in two weeks. You never know.

As long as they have your correct mailing address on file, then within 90 days or way less you should receive a banker’s check with the funds from the shut down account. Then you can cash the check at a BOA branch in the US.

Cheapblackdad sighting in the wild! I knew that stock photo would lure you in. 😉

Love the Lord of the Rings reference, my friend.

This is the first time this happened to me, and you better believe I’ll be more selective about opening new accounts going forward.

Because if there is an emergency, she could have transfer them back to her account to use it.

As of now, the money is held by the bank and won’t be returned until the investigation is over.

Bank of America and Wells Fargo–strictly no-fly zone. I would never trust either one, just too much fraud in their past.

Why not give them a few days to sort it out? You were perfectly happy leaving it there for months to get the 500 bonus and now suddenly it’s your emergency fund and you need it asap?

I really want to get into the bank bonus game! But something about it feels so risky to me. I think it’s the idea of putting my actual dollars on the line, as this situation indicates.

If something goes wrong with the issuer on credit card bonuses I don’t lose any savings or funds, just the potential to get more bonuses, which is the gravy on my mashed potatoes. Bank account bonuses play with my mashed potatoes. Like a hobbit, I need them taters. Gravy is optional.

Regardless, this stiiiiiiiinnnkksss. They better do right by you.

@Boonie As of now, yes. I was told they have to complete the investigation first. And they have no idea how long it may take.

So they are holding your 15k and not mailing you check like the lady indicated?