A few days ago, Choice program has increased their booking window from 100 days to 50 weeks. To be clear, this appears to be the case of YMMV, as personally I’m not able to book hotels that far ahead. But some can. Perhaps trying in a different browser would do the trick. Anyway, what (rightly) upset many folks was the brutal devaluation that followed. The cost of many hotels went up from 20k to 40K points with zero notice.

Tim Steinke from Frequent Miler blog has reached out to Choice program representative who has responded saying that it was a technical glitch and that the old pricing has now been restored. Call me paranoid, but I tend to see these kind of developments as a “canary in a coal mine” of sorts. In many cases, it’s a preview of things to come.

The truth is, many Choice hotels are currently underpriced via points, especially when it comes to Scandinavia region. If you bought them at 0.5 cents apiece via Daily Getaways, you can snag some unbelievable deals, assuming you actually plan to visit these locations anyway.

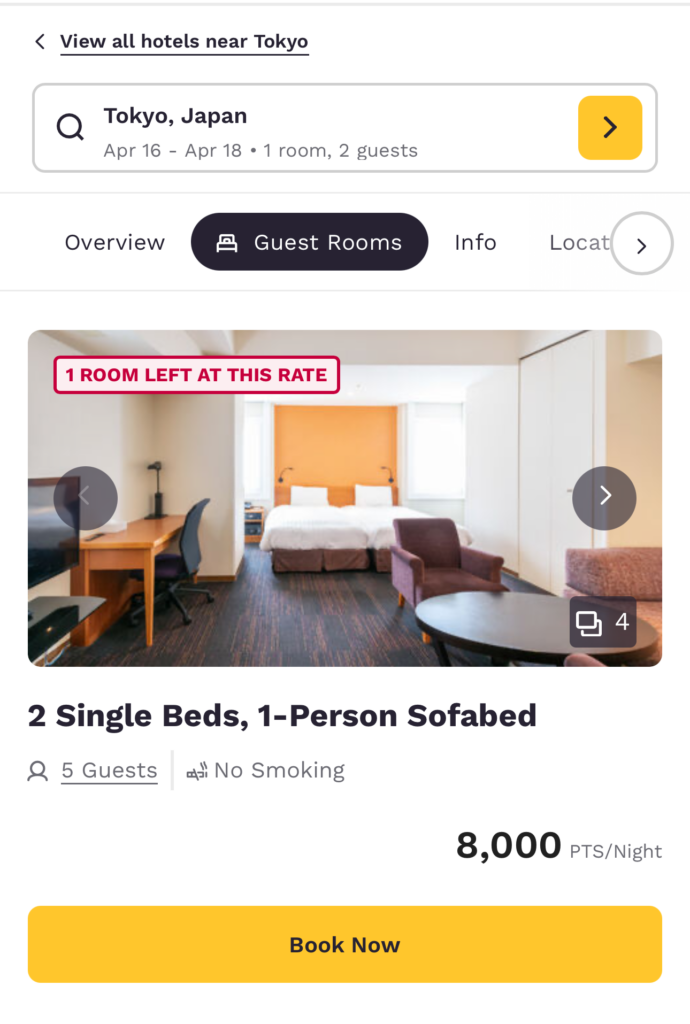

But it gets more interesting. I’ve checked several Choice hotels where we’ve stayed recently: Comfort Inn Roppongi Tokyo (see review) and Comfort Inn Victoria London (see review). The former used to cost 16k points per night, then went up to 20k points a few days ago. But right now you can book it for only 8k points per night. That’s the sort of glitch I can get behind.

This is the exact same room we stayed it, and it’s huge by Tokyo standards

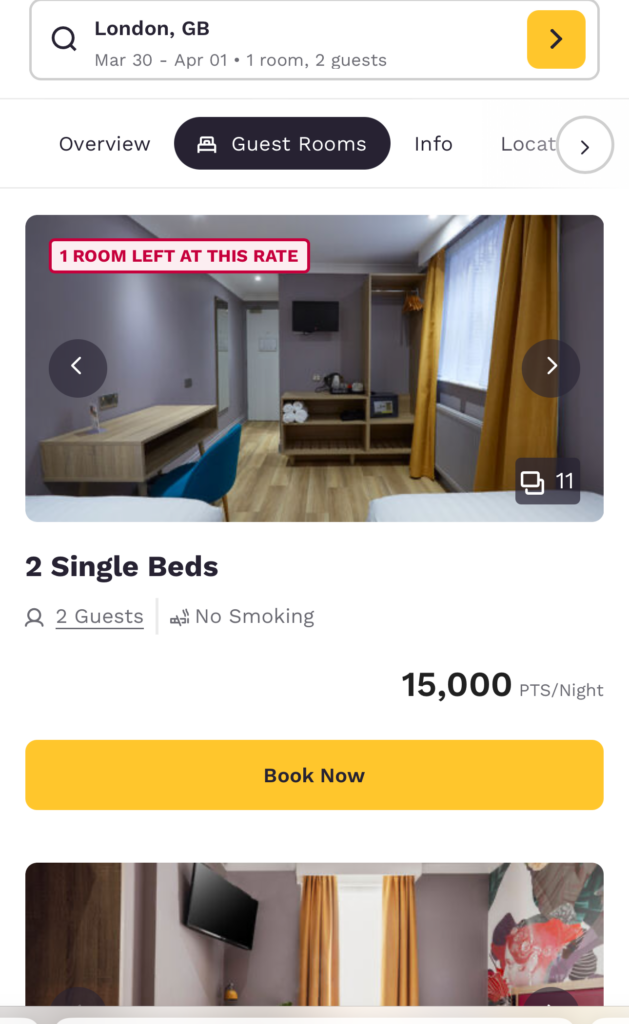

In case of Comfort Inn Victoria, it originally went up to 40k points, then reverted back to 30k points, with some dates now costing just 15k points per night:

This is an absolute bargain for ultra expensive London. And I’m sure there are many other examples. So if you have a healthy stash of Choice points, it pays to check and see if you can utilize it towards your upcoming trips. Happy hunting!

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Christian If you can make use of your Choice points in Scandinavia, that’s about the best value you can hope for IMO.

Normally, I’m not a fan of planning a trip solely due to potential devaluation. That’s akin to “tail wagging the dog” to me. However, if you have been wanting to visit Scandinavia or Prague ( I recommend both), there is a case to be made to do it sooner rather than later.

I actually recommended Choice card to friends of mine because they booked a flight to Norway. Unfortunately, they had to scrap the trip due to her father’s death. I’m concerned they may end up needing more Choice points if they rebook at some point in the future. But such is life, and there are no guarantees.

Like @C.J. and you imply I suspect that this was an oopsie where the new and improved pricing was accidentally released to the public before Choice was ready. I’ve been sitting on 275,000 points that go back to the ancient days of yore with Club Carlson and been trying to find some solid value usage but the only things I see that are interesting are Prague or Scandinavia, since Choice has such a limited footprint.

@Aleks Yeah, Choice is a backup program for me as well. It’s great for certain situations, and I was thrilled to use the points for our recent London stay. It was a tremendous value in my book, with an ideal location for our sightseeing needs. But it’s a hit or miss, and many Choice properties are dumps.

I remember the good old days of Club Carlson credit card with BOGO benefit. I got in on it kind of late, but it was fun!

@GUWonder I totally agree. There was a clear pattern to award rate changes for it to be a glitch. My guess is that Choice program is planning to switch to dynamic award pricing in a near future.

If I were sitting on a ton of Choice points, I would be looking for an exit strategy right about now. Too many sweet spots that are vulnerable to being gutted.

It is certainly a warning that things might change soon (typically for worse). I’ve only received an email from Choice announcing 50 weeks booking window and other marketing terms. So seems to me they just finished the update.

I’ve made a booking for this summer, but did not have a large stash of points to begin with. It’s my back-up program for one-off stays (like before cruises and similar). They might be turning to a (more) dynamic pricing, as I saw few dates higher than norm point pricing: i.e. 37K for July 4th vs 20K other days.

It makes sense to Choice as a company, so they can keep a point value more universal across properties. IHG went that way a few years back, but still hold decent rates for most users of the program (although not as lucrative as it used to be 5-10 years back). The now forgotten Club Carlson (Radisson) hotel program used to be phenomenal, especially when tied with their credit card – hence those days are in the past too.

We have to remember that both parties are in this game together, and the house typically holds the upper hand, and can change the rules once threatened by large number of players trying to hack the system. Also the price depends on demand, and overtourism does not help the case…

Lets keep watching the development here. Hope nothing too dramatic wait ahead (but earn & burn as you wish).

Happy travels!!

@C.J. I totally agree. I will be surprised if the new pricing won’t be implemented relatively soon. I don’t have a big stash of Choice points, so probably won’t bother burning them on speculative reservations. Fortunately, I got the points from Wells Fargo relatively cheap, aka paying $95 renewal fee X 2. So it’s not a huge investment either way, and I’m planning a road trip next year where the stash should come in handy. As of now, I still plan to renew both of our WF cards in a few months even if there is a brutal devaluation coming soon. I’m fairly confident that I should get more than $95 in value out of 30k points. At that price I’m ok accumulating Choice points speculatively (for now).

The pricing shown wasn’t entirely a glitch except in that it was a prequel.

There was such rhyme and reason to the pricing in points that I was able to search other properties familiar to me to see if my prediction on the relative and absolute pricing in points was on target or off target. I was so consistently right that there would be almost no way to explain the situation as being completely unrepresentative of what Choice intends to have as pricing or direction of price move in points at some point.

There is currently a great window of opportunity to use the Choice points, so I have used it to get in front of the next devaluation.

I too am skeptical. I have a crazy feeling that what we saw the other day may be the new pricing that accidentally went live ahead of schedule. If so, I’m pretty much done with Choice and Wells Fargo (issuer of the Chase credit card) other than to burn my existing stash of points.