In general, I’m very picky when it comes to renewal fees on credit cards, and only try to keep those that offer a solid perk in return. In addition, I hate dealing with measly monthly credits and elaborate schemes that supposedly justify parting with $400-$600 upfront each year. We are not the kind of family that can absorb it without batting an eye. One product that I have considered to be an outlier (still do) is Capital One Venture X card.

That’s why I renewed it twice despite having to cough up $395 each year. But it was an easy sell, since you get 10k points which you can redeem against a $100 in travel charges or transfer to miles. You also get a $300 travel credit that you can utilize via Capital One travel portal. I used it towards flights where burning miles wasn’t an option, so essentially it was almost as good as cash. Also, last year I happened to have a targeted referral link for 90k points offer, and a few readers applied which gave me 100k points. Thanks, y’all! Of course, this isn’t something that I can count on every year.

The card also offers some niche benefits as well. For example, a few months ago I was able to get two entry tickets to The Met museum for free, which saved me over $50. Unfortunately, this perk is now dead.

But to me, the most appealing part of renewing the card was/is Priority Pass access. It’s ridiculously generous, as four authorized card users get it as well, and can in turn bring two guests each. I’ve written a post on signing up my mom and sister who live in Belarus, and how the whole family got free food in Minsk and Istanbul airports.

Normally, my husband isn’t a huge fan of lounges, but I keep reminding him that Priority Pass saves us real cash on food, so he begrudgingly complies. However, after our last trip to Europe he told me he will never complain about lounges again. You see, we made out like bandits in JFK airport. First, we got to skip security line by going through VIP One lounge. You enter the terminal area through a special door ahead of all the other passengers. The whole thing took maybe two minutes total. Amazing and much faster than using TSA Pre-check. My husband was very pleased, as he hates security lines.

We then entered Turkish Airlines lounge which had comfortable seating, nice views and surprisingly decent food.

After being there for about thirty minutes, I got a notification that we were assigned to a different gate for our Brussels Airlines flight. There was also a delay due to weather. When we got to the gate, the area was completely full, with nowhere to sit. Fortunately, there was a Primeclass lounge right next to the gate and we took advantage of it as well.

My Priority Pass benefit covered all three lounges, and my husband finally admitted that this is an amazing perk, indeed. We also got to use it in Brussels Charleroi airport, which saved us at least $80 on food.

My Priority Pass benefit covered all three lounges, and my husband finally admitted that this is an amazing perk, indeed. We also got to use it in Brussels Charleroi airport, which saved us at least $80 on food.

Pleasant atmosphere and nice views

Next year we are planning a trip to South America, and may be able to utilize Priority Pass in Miami, Lima and Santiago airports. Even using it once would justify having this benefit on hand.

Despite all that, I’ve recently downgraded my Capital One Venture X to Capital One VentureOne Rewards ($0 annual fee). Why? I was approved for US Bank Altitude Reserve card right before the application link disappeared. It’s possible it will come back, as this has happened before.

I’ve had this US Bank card six years ago, which made me eligible for the sign-up bonus of 50k points again (redeemable towards $750 in travel purchases). My application went to pending status, and I was 99% sure I would be denied. So, imagine my surprise when I got an email saying that my new card was shipped.

I was mostly interested in the sign-up bonus, but this card also comes with 8 Priority Pass entries per year, which can also be used for folks accompanying the cardholder. That’s enough for two Priority Pass lounge visits for my family of four. It should suffice. I’m also thinking about converting my husband’s US Bank Cash+ to US Bank Altitude Connect card (non-affiliate link). The latter has no annual fee and comes with 4 Priority Pass entries. That’s quite remarkable for a no-fee card. But it gets better. As of now, US Bank cards still cover airport restaurants, a perk that is rare these days.

This was perfect timing, as I wasn’t sure I would be able to easily utilize Capital One Venture X $300 travel credit. I’ve used miles towards all of our flights in 2025, and the only eligible expense I could think of was a rental car. However, it is planned for the end of the year, so if I canceled the trip, I would have to find some other way to utilize the credit, and fast. You see, my renewal fee is billed at the beginning of January. I was still thinking about renewing the card, but my Altitude Reserve approval changed everything.

Like most immigrants, I help my family in Belarus financially. Due to sanctions, wiring money has become much more difficult. Fortunately, credit cards are still accepted. Previously, my relatives used my Capital One Venture X for groceries. I’m glad I brought a few other credit cards with no forex fees when I last saw them a few months ago. Otherwise, getting rid of Venture X would essentially cut off my financial help.

I do still recommend Capital One Venture X (our affiliate link) as a very good travel card for families, especially those who can utilize Priority Pass benefit a few times per year. Keep in mind, right now the bonus is 75k points, though as mentioned earlier, occasionally there are higher targeted offers.

Not burning my bridges with Capital One

Normally, when I decide not to renew a card, I simply cancel it. However, over the years, getting approved for Capital One cards has been very difficult for me and my husband. That’s why I’ve decided to downgrade it instead. At some point in the future I may decide to upgrade to Venture X again, so don’t want to burn my bridges.

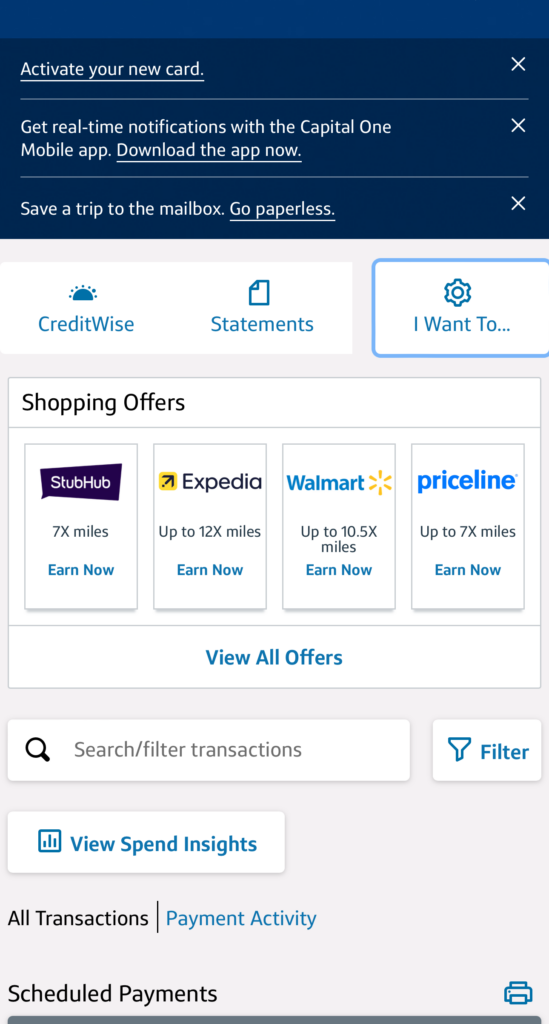

Downgrading a Capital One card is remarkably simple. First you go to your online profile and click on “I want to…”:

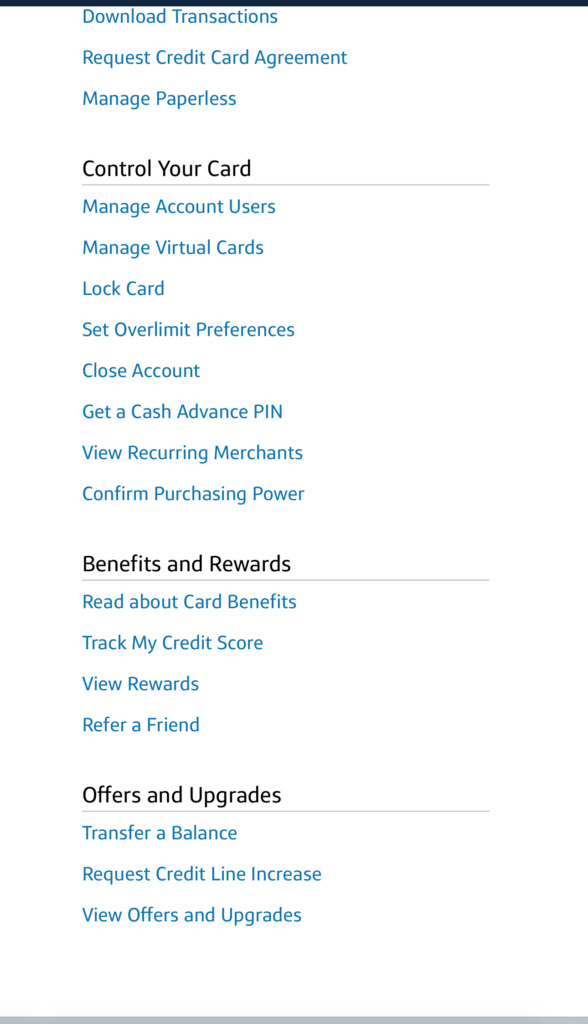

Afterwards, you see what options (if any) are available by clicking “View offers and upgrades” at the bottom:

When I followed these steps, VentureOne Rewards product was listed as one of the options. There is no annual fee, but the card still earns transferrable 1.25 points per dollar. I’ll take it. I was surprised when my new account was credited $98 prorated annual fee refund, since there were still 3 months left until Venture X renewal. Sweet.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Sad to see the Venture X go, but it’s great to hear about the journey with it! Thanks for sharing your thoughts, it’s always helpful to hear others’ experiences with these cards.

Great read! It’s always tough to say goodbye to a good travel companion, but your reflections make it clear how valuable the card was. Looking forward to hearing about your next adventure!

@HMl Glad it worked out! I was honestly surprised to get the partial refund.

I wanted to cancel last year but they told me I wouldn’t get the annual fee reimbursed once it was billed so I kept it for another year and put in my calendar and reminder to cancel it before year was up which is right now. I was just going to cancel it outright but decided to try downgrading it first to see if I could get the credit and I did!!!

Amazing.

Thanks

Really enjoyed reading your experience with the Capital One Venture X! It’s always interesting to hear about the pros and cons of loyalty programs. Thanks for sharing your insights!

Sad to see goodbye to the Capital One Venture X, but it’s great to hear about the memories made! Thanks for sharing your experience with the card and what worked well for you.

@ al613 It is possible for now, as long as you can get a visa. My mom has an easier time with it due to having old US visas in her passport, my nephew not so much. We were able to meet up in Poland a few months ago, here is my trip report https://milesforfamily.com/2024/10/01/polish-mountain-town-of-zakopane-postcard-views-and-affordable-prices/

I’m thinking about taking mom to France, Switzerland, Italy and Spain in a few years, a grand European tour of sorts. She is healthy for now, unfortunately, the same can not be said about my dad. Carpe diem and all that.

Can you still cross from Belarus to Poland?

@al613 That’s true, though Moscow is quite a trek from my hometown. I’m actually hoping to fly my mom from Poland, as long as she can get EU visa approved. That opens all kinds of options (Lot Polish and many low-cost carriers).

Thank you! It looks like a good one! No fee! It’s certainly worth getting just for those 4 lounge passes!

Its interesting because they do fly to Moscow. And its not necessarily for you to visit there, but for your family to fly to other countries.

@al613 Yeah, I hear where you are coming from. I’ve been able to use that $300 credit at face value for three years for planned travel expenses. But there is always some risk involved, due to hard expiration. I have been willing to roll the dice because I figured that Priority Pass would make up for any potential loss. Since I have 8 entries via Altitude Reserve, it no longer makes sense to “prepay” $300 in travel with the hope of recouping it later on. Perhaps I’m overthinking it, but we just don’t have the extra funds to make this type of bet. I try to be rational and look at the worst case scenarios. Sure, if it comes down to it, I’d utilize the $300 credit by booking Jet Blue tickets, and then canceling them for travel credit (that expires). Or something like that. But then it’s not really free travel, is it? It’s very easy to get carried away and pay thousands of dollars in annual fees by justifying it through various schemes. Amex is notorious for that, though to each his own.

As far as Turkish program goes, they don’t fly to Belarus right now due to war in Ukraine. But even if they resume flights, I won’t be visiting under current regime. I know the program can be useful, I just haven’t been able to utilize it so far. Again, just my experience.

$300 credit can be used for flights, car rentals and hotels. Their prices are same as any other travel site. They sell basic economy, LCCs, etc.not like Amex travel. Also, they offer price match by phone up to $50 instantly. If its over $50 it goes to a review. Even if you paid with credit. I did it several times. Very easy. Also, number of hotel promos. There are several now but I like $40 any hotel in Chicago. Even you pay with travel credit. You should look into Turkish program if you want to buy tickets to or from Belarus. Not many airlines fly there now.

@al613 All the perks you’ve mentioned are the reason I’ve renewed the card twice. The issue is $300 travel credit, or rather its limitations. I’ve already booked my flights with miles and don’t plan to add any extra trips. I’m also planning to use hotel points on lodging. The only possible usage is a car rental, but even that is iffy. So, I don’t assign face value to this $300 credit, since it expires in one year. Right now I would probably pay $200 for it, which would make the Priority Pass benefit cost me $95. Why pay it if I have what I need via US Bank Altitude Reserve for the next year? And by then something else may come up, like getting Connect cards via conversion. I also have transferable points via Amex and Chase. Never used Turkish program and that’s unlikely to change. Again, I’m not arguing that Capital One Venture X isn’t useful, it very much is. But my circumstances have changed.

The annual fee is $395. They give you $300 travel credit and 10k miles. Plus you get a bunch of other benefits like transferring miles to programs like Turkish, etc. SO, you get back more then annual fee. Why to cancel it? Reg. Priority Pass. Ritz card from Chase that you can get by converting Chase Marriott after a year gives you unlimited Priority pass memberships for all authorized users.

@Evelyn If you don’t have any US Bank cards you can convert, you may want to consider applying for Altitude Connect card that gives 4 free Priority Pass entries per year. If you are married, your spouse can apply as well, giving you a total of 8 passes. This card is quite possibly the best no-fee card out there, though sign-up bonus is low. Here is a link that doesn’t pay us commission https://www.usbank.com/credit-cards/altitude-connect-visa-signature-credit-card.html

Thank you! I did not see it when I looked at all US Banks Visa cards. The lounge passes are far and few now so it’s a possibility that they withdrew the offer. I’ll keep looking though since Amex Hilton Surpass no longer offers lounge passes.

@Evelyn That’s US Bank Altitude Reserve. Unfortunately, the link to apply for that card is currently not working. Not sure if it’s permanent, hopefully not.

@Danny Thanks for the data point. That is definitely something to consider. I’m ok with the possibility of never being able to upgrade to Venture X. I’m set for the next year as far as Priority Pass is concerned, and plan to eventually downgrade my Altitude Reserve to Connect card. So, hopefully, we will have 8 Priority Pass entries per year between two Connect cards. That is if they don’t remove the perk. But either way, I didn’t feel comfortable renewing Venture X without a clear plan to use $300 travel credit.

I don’t see a US Bank card that gives you 8 lounge passes.

just as a word of caution, cap1 does not offer the ability to downgrade or upgrade by default – it’s an offer, so venture one card holders may or may not be able to upgrade in the future. i wasn’t able to downgrade/upgrade a regular venture, so i had to apply for the venture x, and then cancel the venture. but now i see an option to downgrade to the venture one.

@Caveman Completely understandable. It’s a very good card and I have renewed it twice for that reason. It’s very unlike me to keep a card with a $400 annual fee, that’s for sure. If I didn’t have to utilize $300 credit through the C1 portal, it would be a no-brainer. Alas..

My situation is somewhat like you as I was also approved for Altitude reserve card at the last moment but there is no way that I would downgrade or cancel my capital 1 venture x card.