As most of you probably know, Amex has recently made some changes to its Gold credit card, making the setup even more complicated. Naturally, along with a few enhancements, the annual fee has increased from $250 to $325. Since I applied for the card before the switchover, I couldn’t be happier about this change.

We (unfortunately) go to Dunkin at least a few times per week, so $7 monthly credit is basically free money. I wasn’t familiar with Resy.com before this change, but was determined to take advantage of $50 biannual credit thrown my way.

My first piece of advice for all of you Resy.com newbies is to look at Resy app instead of website, as the former had more restaurants listed in our area. The app appears to be more up-to-date. Another thing you should know is that you don’t have to make a dining reservation, you can simply show up. As long as you pay with your Amex Gold, the credit should post at the same time as the transaction itself.

We live in a rural area in Florida, so the closest city that has an abundance of Resy-associated restaurants was Sarasota, about an hour away from our home. We do go there at least a few times per year anyway. Since our wedding anniversary was coming up, I figured it would be a perfect excuse to take my new Resy benefit for a spin.

I saw a relatively new restaurant called Kojo, specializing in Asian fusion cuisine, so that’s where we went. The building itself had a pretty neat decor:

I loved the chopsticks set and napkins made to look like tiny kimonos:

The food itself was a bit of a mixed bag, but I mostly give it thumbs up. Appetizers were expensive/tiny/bland, but fried rice was out of this world delicious, and “shaved ice” dessert was amazing.

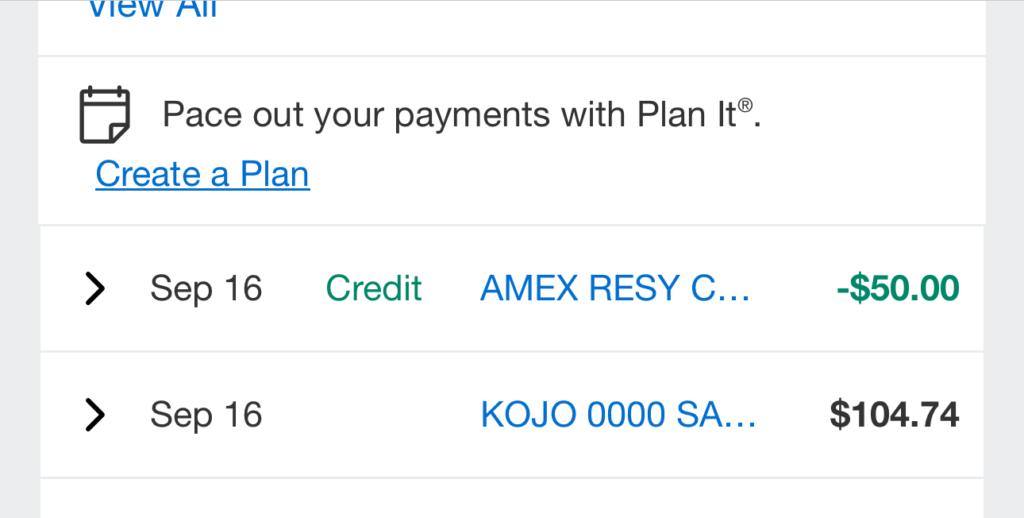

Our bill came up to $104 including tip, though $50 Amex credit certainly took the sting out of it. Plus, it was our anniversary dinner, so we didn’t mind splurging. If you ever find yourself in downtown Sarasota, this is a decent place to eat. We will be back, though I’ll be skipping appetizers next time.

We capped off our dinner by driving 10 minutes to the nearby Lido beach, in order to see sunset.

Not a bad deal for $64 total ($54 dinner+cost of gas). Thanks, Amex! You may have just saved a marriage. Who is gonna leave a gal and forego all these “free” dining credits?

Will I be renewing my Amex Gold?

I’m still on the fence, and will decide next May when my $325 renewal fee hits. I can’t cancel the card until then anyway, otherwise I would be risking losing my 90k points signup bonus. But I can request a refund via Amex chat in case I decide to get rid of the card. On paper, the changes are actually a net positive for my personal situation. There are quite a few relatively affordable Resy restaurants in Sarasota where I can take advantage of biannual credit, and it’s a nice excuse to see sunset at the beach.

Then again, it’s a nuisance to keep track of three credits per month, plus two additional credits per year. And it goes without saying that I would never pay face value for any of them. Let’s break them down separately:

1) Dunkin’ credit of $7 per month

I would maybe pay $70 per year for it total. This one is very useful, as my kids love Dunkin.

2) Uber (or Uber Eats) credit of $10 per month

I normally buy Uber gift cards at 20% off. After factoring in inconvenience, I would probably pay $90 for this $120 annual benefit.

3) Resy credit of $50 X 2

I wouldn’t pay more than $70 total for it, if that. I would view it as a $15 coupon of sorts, given twice per year. Too many restrictions and all the restaurants require driving an hour.

4) GrubHub credit of $10 per month

We only have a few restaurants that are listed on GrubHub, so this is the least valuable credit of all. Right now we use it for KFC, but if that chain stopped participating, I would struggle to use it. For that reason I would not pay more than $70 for it, if that.

Grand total: $300 in expected benefits per year

That means that the annual fee will effectively be $25 per year, which isn’t bad at all considering the fact that the card earns 4X points on dining and groceries. The problem for me, however, is that my Citi Shop Your Way credit card constantly comes out with unusually lucrative promos on those categories. A good problem to have, I know. If I won’t be using the Gold card to increase my MR stash, then what’s the point?

Plus, I like simplicity and the nuisance factor of clawing back the annul fee month by month has to be considered as well. I simply hate this sort of thing, to be honest. But like I said before, if you can collect the signup bonus, the card is totally worth having in the first year. You don’t have to decide right away whether it’s a keeper. If you sign up in the next few months, you should be able to take advantage of Resy credit three times before the renewal fee hits.

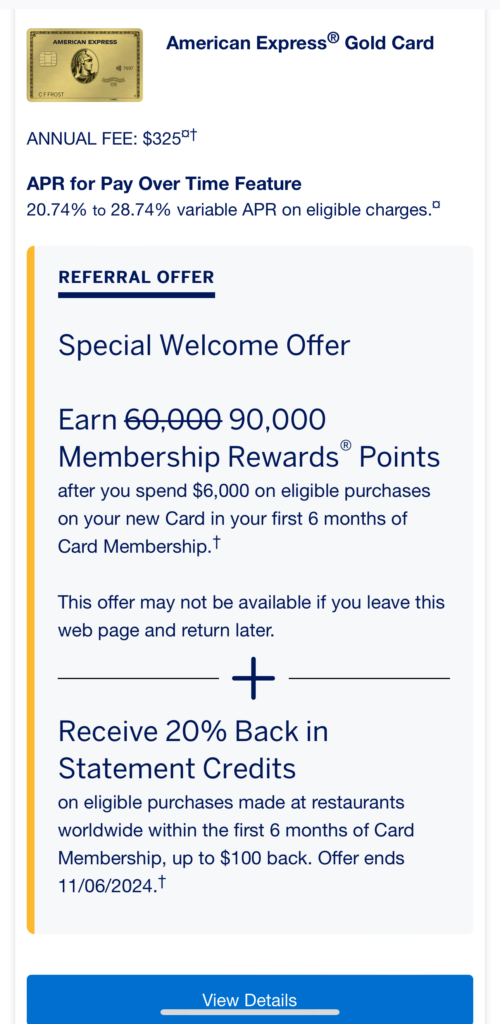

I was actually planning to leave a non-affiliate link offering 90k points+20% dining credits. But lo and behold, my personal link actually has this offer, but only when opened in certain browsers (Incognito and Firefox seem to work). Btw, you also need to use certain browsers in order to pull up the identical non-affiliate offer.

Update: it looks like there is a referral offer out there for 100k points, so I’ve removed my referral link. Obviously, I can fully recommend it since I applied for the card myself. It’s a no-brainer offer during the first year, and renewing the card can make sense as well. Emphasis on “can.”

Readers, do you plan to renew your Amex Gold?

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Nancy Great! Hope you enjoy it. Eating out is one of my weaknesses when it comes to spending money. Any excuse to go out is alright with me.

You’ve inspired me to try a Resy restaurant credit! We’ve got a few locations near our home, most notably a Tex-Mex restaurant that has a chocolate piñata dessert.

@NJ Riley The post is about Amex Gold that earns Membership Rewards. Sorry if I didn’t make it clear.

I have a Delta Sky Miles AMEX Gold card and it just renewed in August for “only” $150. When I first signed up close to 15 years ago, it was $99/year.

Wonder why yours is so much more?

@Christian You should absolutely take advantage of the Resy credit! Check this website for locations nearby, though I found the app to have more listings. https://resy.com/?date=2024-09-24&seats=2

You do have to opt into it through your Amex profile and (I think) you have to register your Gold card on Resy.com But that’s it, you just have to pay with Gold at an eligible location. We could have spent less at this restaurant, but got an appetizer, sushi set, meals and dessert. Went a bit overboard, but we like trying new foods and $50 credit was a good excuse.

I didn’t explore the Resy credits. I’m kind of inclined to close or downgrade my gold card but it would be nice to get this credit in the meantime.

@ ACinCLT Fair enough, and I’m glad the math works out for you.

Personally I think Amex is on the wrong path. While there are some consumers who enjoy spreadsheets like you, I doubt that most feel that way. All these tiny monthly credits are getting ridiculous, at least in my opinion. I know the goal is to condition folks to keep Amex cards top of the wallet, and maybe it works to an extent. But I think for most it’s a nuisance and annoyance, and makes them more likely to cancel rather than deal with the mental gymnastics.

I’m very careful when it comes to paying renewal fees. I do on some cards, but there has to be a clear path for at least breaking even or close to it. But we don’t have a lot of “fat” in our budget.

I have the Amex Platinum and Gold cards (along with the CSR) plus 10 or so hotel and airline cards. I know it is a pain at times keeping up with all the credits and getting value for them but I’m retired, sort of obsessive/compulsize and love spreadsheets so I have one with all my various credits and keep up with them. Personally I get more value from the Platinum and Gold than the AF on things I would spend anyway then get all the other benefits (Platinum -lounges, 5X airline MR points, International Airline Program, insurance, etc and Gold – mainly 4x food and groceries plus Amex offers on both). I don’t quite cover the CSR AF but the Sapphire Lounge, travel insurance and just having a card with 3X on all travel plus ability to transfer to Hyatt and United make it a keeper).

To each their own – personally I never “have to cover” the AF if I feel the overall benefits of the card work for me and I would never sign up for any card for the SUB, especially an Amex card, and cancel after 1 year. I plan to keep any card I get until my situation changes or I at least give them 3 years to see how it works out.

@Russ I’m kind of leaning towards canceling my Gold card as well. I haven’t wasted any monthly benefits yet, but it is a nuisance to keep track of them. I really value simplicity, and Amex cards are anything but simple these days. You have to be anal retentive to enjoy the current setup!

I do like the idea of earning 4x points on groceries and restaurants, at least in theory. But I doubt that it would amount to anything tangible via our everyday spending. For those dabbling in MS, I totally get the appeal.

I definitely think you should consider getting Aspire card for your wife due to 175k points bonus. Despite various devaluations, that stash of Hilton points can still get two nights at many nice properties. New SLH partnership is a very positive development, since it has added a bunch of unique hotels. Not sure if you’ve been to Costa Rica, but I can wholeheartedly recommend Rio Perdido and Tabacon resorts. I’ve reviewed both when SLH partnered with Hyatt, and you can find the associated posts by using search function.

Dumped my Gold card, too expensive and we use none of the benefits. I’ve been an AMEX cardholder since 1978, but the endless fee increases have driven me away. The new Platinum card restrictions on lounge access killed that for us too. I still have the Hilton Aspire card, but elite benefits are useless in the US, they are just not recognized. The food/beverage credit induces you to spend big in their restaurants and parking fees are outrageous (San Antonio-$50/night, The Wit in Chicago-$71/night PLUS $35 late checkout fee!) In Europe, it’s worthwhile: upgrades offered without asking, buffet breakfast, exec lounge, all clean and well stocked. Not sure if I’ll renew my Aspire card, but the new 175,000 point offer is tempting, my wife has not had the card yet. AMEX is a declining opportunity card and Cap 1 seems to have taken over the value part of the elite benefits field. Happy anniversary!!