As many of our readers know, I accumulate most of my miles and points from introductory signup bonuses. There is no question that doing so has become much harder lately. For example, I can’t currently get approved for Chase cards due to 5/24 rule, and most of the time I get a popup when applying for Amex products telling me I’m not eligible for introductory offer.

But opportunities still exist, and saying that this hobby is dead is silly IMO. No doubt, the good old days are behind us, but if you are getting older, that’s normally true in general, not just when it comes to miles and points. For example, my mom has fond memories about living in the Soviet Union, and I have to remind her about long lines for basic goods and having to buy meat that was classified as “third-degree freshness.” As in, expired. It’s really her youth she misses.

Anyway, we would do well to adapt instead of moaning about good old days and getting bitter. You win some and you lose some. Speaking of…

Bad timing on my Sonesta credit card application

A few months ago Frequent Miler blog has reported on new Sonesta credit card with a 125k points bonus. I’ve never heard about Sonesta program, but was intrigued. After signing up for a free account and checking award rates for properties in popular locations, I was quite impressed. Getting a hotel in NYC or San Francisco for 25k points is a good deal, indeed.

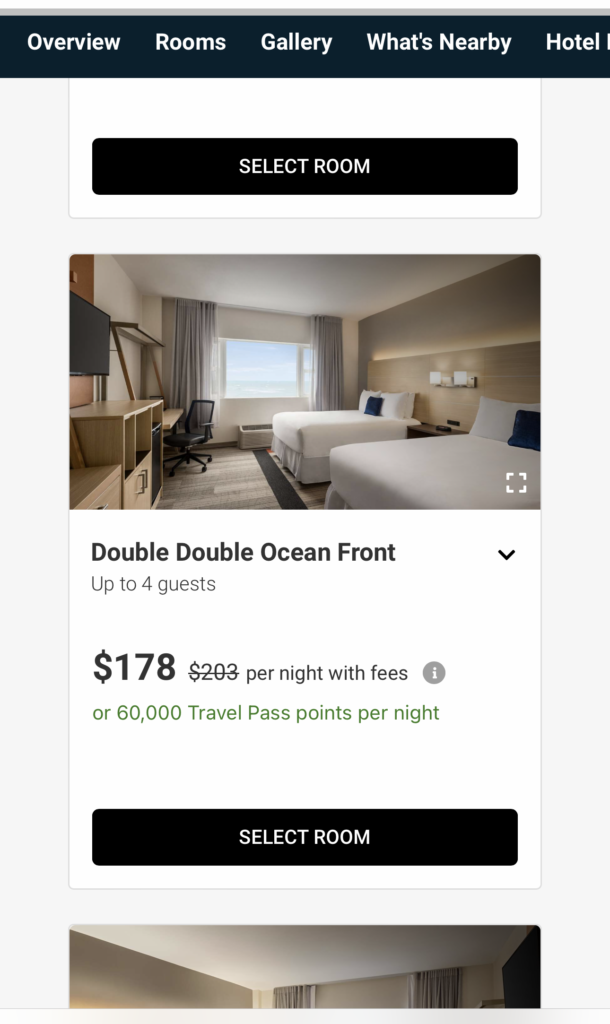

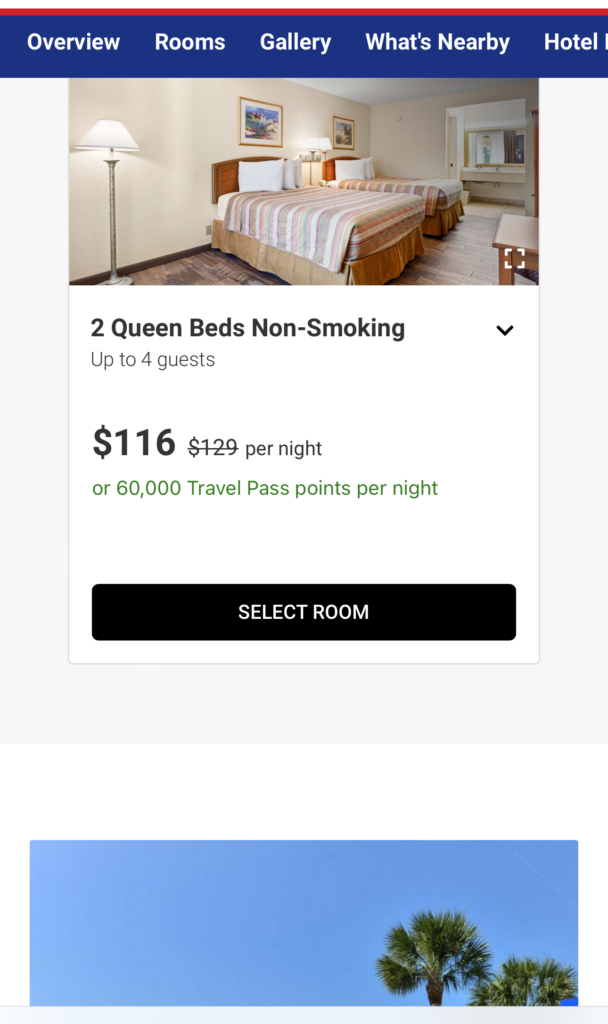

However, I wasn’t planning to go to either of those places in a near future, but could possibly utilize part of the bonus towards a hotel in Miami Beach next year. We will have to spend a night there after flight from Santiago, and staying in a room with an ocean view sure beats being by the airport. Plus, the price was very reasonable 22.5k points per night.

Well. I dragged my feet on applying, but finally pulled the trigger last month. Approved. That’s the good news. The bad news is that just last night I’ve noticed that all Sonesta properties now cost 60k points per night. It could be a glitch that will get resolved, but I really doubt that my desired property will still cost 22k points. It was clearly underpriced before.

What’s really odd is that all the other Sonesta hotels, even cheap ones, also cost 60k points per night.

Again, it may be a glitch, but it certainly doesn’t inspire a lot of confidence in the program. The timing really stinks because I should be getting my bonus in a few days, after the statement closes.

Will I lose sleep over it? Not really. Applying for a hotel card is always risky, and I knew that going in. Plus, Sonesta program doesn’t have an award chart, so they can pretty much do whatever they want without any repercussions. It certainly won’t build any goodwill, but it’s not like I would be a profitable customer for them anyway. So, no hard feelings.

I guess the moral of the story is “you snooze, you lose.” I should have applied for the card right away, since I knew I could put these points to good use. I’ve said before that many things in this hobby require a leap of faith.

Update: it appears it was a glitch after all, as award pricing is back to normal.

No luck with applying for Citi AAdvantage Platinum Select Mastercard

I’ve noticed on AA.com that the offer on this card is currently increased to 75k miles after spending $3,500 in 4 months, annual fee is waived. Non-affiliate application link

I’m eligible since I got my last bonus more than 48 months ago. AA currency can be quite valuable, especially if you can find business-class redemption to Asia, like I did. But even if you are only interested in domestic flights, AA program can offer cheap rates via miles.

I do believe that devaluation is coming, especially when it comes to premium partner redemptions. But for now, there are many good deals to be had as long as you are flexible on dates and destinations. Unfortunately, I got denied, which wasn’t really surprising.

I’ve tried applying for this product several times in the last year, all with the same outcome. But I’ll keep on trying. My husband should be eligible for new bonus next winter, and you better believe I’ll give it a shot. I don’t take credit card denials personally.

Success with new Expedia card applications

Not long ago, Wells Fargo introduced One Key cards (non-affiliate link). I went ahead and applied for the one with no annual fee and $400 in OneKey cash. There are a few reasons for that. First, the spending requirements are lower ($1k instead of $3k). Also, my theory was that it would be easier to get approved for “inferior” version.

And I was approved, and so was my husband. The reason I applied was so I could use these points towards a stay in Peru next year. The place I’m looking at has no chain hotels, so Expedia currency will be super useful, almost as good as cash in this case. I haven’t gotten a bonus on either card, but don’t foresee any issues.

Another minor win

This isn’t a new credit card application per se, but an easy opportunity to collect 10k Amex points. I saw a post on Milestomemories on this deal, and immediately took advantage of it. If all goes well, I should get 10k MR points after adding my daughter to my Amex Gold card and spending $2k in 6 months. Check this link to see if you are eligible.

I will likely use my Gold card to pay property taxes and some other bills. You can never have too many MR points, so I always try to take advantage of these types of deals.

Final thoughts

You may be surprised when I say this, but overall, I’m quite happy with the results. Yes, it would be nice to get approved for Citi AA card, and brutal Sonesta devaluation (a glitch?) is certainly a bummer. But at the end of the day, I should get $800 towards hotel expenses I planned to pay anyway. And 10k MR points will someday be used for another exciting adventure. Hopefully.

Sure, after decades of participating in the miles and points hobby my level of excitement over some credit card approvals is rather tame. It’s the same way I felt when my mom brought home meat classified as “third-degree freshness.”But hey, at least we got to eat real meat that day!

I would love to get some of these 100k UR points or 175k MR bonuses everybody seems to be getting approved for. But I’ll take what I can get. Plus, I still have a decent stash of points that I need to work my way through. So why get greedy and bitter? Forget the good old days and enjoy the present.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Cari Thank you very much for your kind words! We no longer make commission on Chase cards when you go through that link. Other issuers still pay us, though. We list our personal referral links for Chase on this page https://milesforfamily.com/apply-for-credit-cards/

But no worries, and thanks for thinking of us. It’s all very confusing, for sure.

I just applied for the Chase Ink preferred card. Luckily I am under 5/24 and was instant approved. I clicked your link that took me to travel freely site and I sure hope you get credit for it. I try to support the good sites when I can, and yours is definitly a great one! Thank you, Cari

@Nancy I hope it’s a glitch too! Otherwise, my timing really sucks. 😉

I really hope that Sonesta pricing is a glitch! Good call on the Hawaiian Airlines card. I might need to consider that one as well.

@Aleks Yes, the 80k Jet Blue offer was a good one. I would absolutely consider it if I didn’t already have 230k points to burn.

I’m seriously thinking about applying for Hawaiian 70k miles offer issued by Barclays, in anticipation of them being folded into Alaska Mileage Plan due to merger. It’s a speculative move that could pay off big time. And worst case scenario: I will have a good excuse to finally take my kids to Hawaii. Barclays applications have been a hit or miss for us, though I did get approved for Aviator card a few months ago. Maybe lightning will strike twice?!

Ugh, this Sonesta situation is super annoying, as I’m so close to getting my bonus. Oh well,if it’s not fixed, I’ll just use up the points at 60k level and be done with the program. I haven’t lost anything aside from credit inquiry and $2k in spending. Not the end of the world.

Good play!

I am also got interest in Sonesta card/program, lets see how that glitch develops. They might be doing some changes on the back-end, hence the 60K pricing glitch – hopefully temporarily. Although I only see partial value in the program with ~0.75cpp at majority of properties. Too bad they are mostly in US, otherwise might be more useful to me.

There were a good card offer from Barclay – JBlue Plus card with 80,000 miles offer after $1,000 in spend. I took advantage of this short-lived opportunity and glad I did. The value is typically over $1K after annual fee. Plus free bags.

Happy travels!