When I got approved for Amex Gold last month, I was genuinely shocked. I’ve been trying to get ahold of it for years, with no success up until now. Naturally, I was mainly interested in a signup bonus, as 90k Membership Rewards points is nothing to sneeze at.

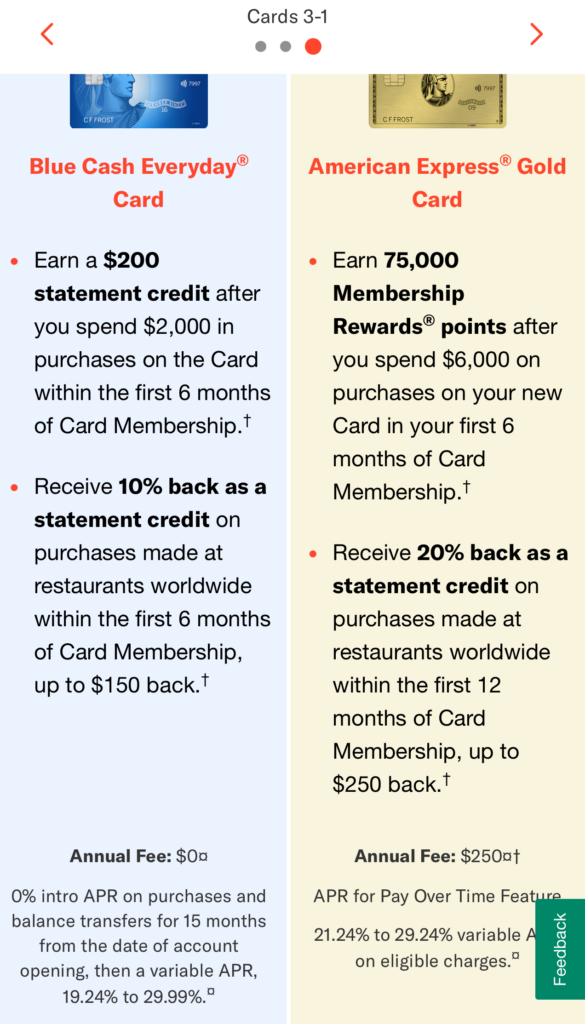

As far as I know, there are two offer flavors on this card. To the best of my knowledge, 90k offer+ 20% back on restaurants up to $50 is only available via referrals. I recommend doing a search on Google and I can guarantee you will come across a working link eventually. That’s the one I applied for.

The second offer is 75K points + 20% cash back on restaurants up to $250 (might be able to get $350 if doing incognito search). There is a working application link (does not pay us commission). I would say this bonus is comparable to 90K points offer and for some will even be superior.

It goes without saying that the initial bonus is worth paying the $250 annual fee (not waived). But what do you do when the first year is up?

Why I now consider Amex Gold superior to Amex Everyday Preferred

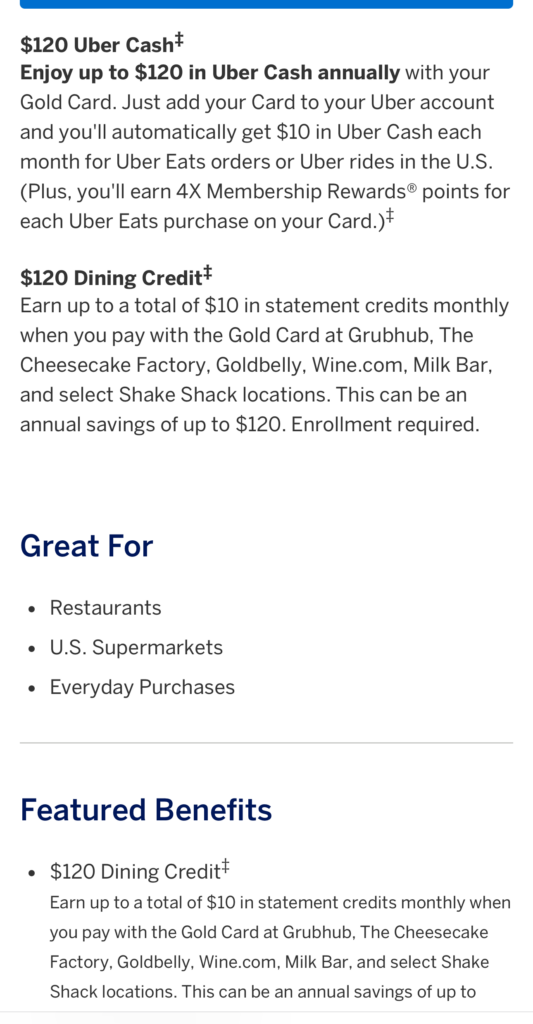

When Amex Gold initially came out, I did not feel it qualified to be in a “keeper” category, at least not when we are talking about regular families. How so? Well, despite the fact that it offers 4X points on groceries and dining, the $250 annual fee is quite steep. Yes, it offers dining credits that expire each month, but I felt it would be a nuisance to keep track of. Plus, at the time, Uber and Grubhub didn’t have any participating restaurants in our area.

But times have changed. We now have a ton of local restaurants on Uber app, and Grubhub has two (Pizza Hut and KFC). My son absolutely loves KFC, so we go there at least once a month. And prices via Grubhub and Uber are exactly the same as buying food in person (we only do pickup).

So, with a little diligence, it’s actually quite easy to get $240 in benefits each year. Obviously, I would never pay face value for credits that expire each month. But I would probably pay $200. So, just like that, the annual fee is reduced to $50, quite palatable for middle-class families.

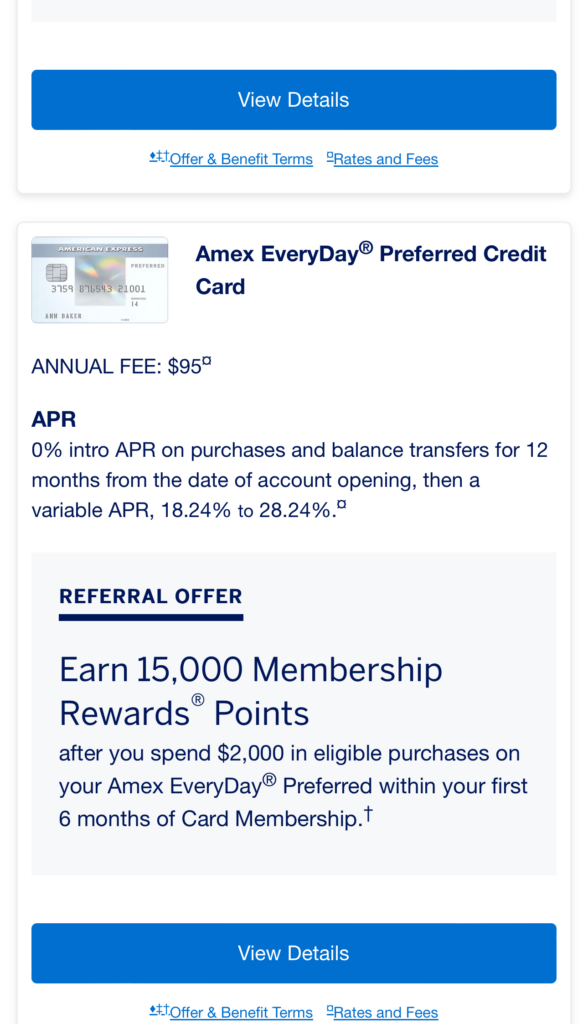

Now let’s compare Amex Gold to Amex Everyday Preferred. The biggest issue with the latter is the requirement to make at least 30 purchases each month before increased points payout kicks in. Yes, you can buy 30 $1 Amazon gift card reloads, but it’s a bit of a nuisance. Still, if you can get past it, you’l earn 4.5 points per dollar on groceries (on up to $6,000 each year), 3 points on gas and 1.5 points on everything else. All for $95 annual fee. It’s quite decent, especially if you prefer to collect flexible points via everyday spending.

Signup offers on this card are nothing to write home about, and I believe they currently hover around 15k points. On the other hand, you only have to spend $2k in 6 months, so the barrier to entry is quite low. Plus, you get 0% on purchases and balance transfers for 12 months.

Here is my referral link in case you want to apply.

Here is my referral link in case you want to apply.

It’s a solid card, no doubt, but I still prefer Amex Gold. Again, the main reason is the ability to easily maximize dining credits each year. The fact that it offers 4 points on dining is a big plus as well. Last but not least, not having to worry about making 30 purchases each month is a good thing.

Will I renew my Amex Gold?

I just might. I need to see what kind of offers I’ll be seeing on my Citi Shop My Way Rewards credit card a year from now. If they keep sending me lucrative deals, having Amex Gold will be pointless (pun intended). I won’t be using it if I can get 10% cash back on dining and groceries. I don’t do manufactured spending, and my normal expenses aren’t enough to maximize rewards on both cards.

If, however, the offers on Citi card dry up, I will absolutely consider renewing my Amex Gold. I do have access to discounted Kroger gift cards via AARP membership, but they have a limit of $250 each month. And my family spends closer to $600 on groceries. We also (unfortunately) spend quite a bit on dining, so getting 4 points per dollar would come in handy. I consider Membership Rewards the second most valuable currency right after Chase Ultimate Rewards.

Essentially, the card will cost me only $50 each year (once you factor in credits), which is not that bad. I’m not saying it’s a no-brainer, but IMO there are compelling reasons to hang on to it as long as you have use for Membership Rewards. What is a no-brainer is initially collecting 75k or 90K points with relatively minimal effort.

P.S. Readers, feel free to share your Amex Gold referral links in the comments, as long as you have one of the two offers I’ve mentioned earlier.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Chelsea This will depend if you regularly spend money in Dunkin Donuts. We do, so the $7 monthly credit alone would make up for the fee increase. We should be able to utilize $100 Resy credit, but that one is trickier since we live in a small town. It’s more of a no brainer for big city folks, like NYC and such. I will probably cancel or downgrade the card because I do like simplicity, and it’s just too many credits to juggle. Plus, I keep getting amazing targeted spending offers on my Citi Shop My Way card. So I doubt I will end up using my Gold card a whole lot. But I have 6 months to decide.

The annual fee is now $325. Do you think it’s still worth keeping after the first year? Thanks!

@Bobby V The link for Amex Gold does not pay me anything, it’s not a referral link. I’ve explicitly stated it in the post. The referral link I’ve included is for Amex Everyday Preferred, and only because it’s the best offer available (to my knowledge). I understand that there is a lot of distrust in this community, some of it for good reason. However, in the future, I recommend you read posts more carefully before making accusations and questioning someone’s integrity. I think it’s only fair and I’m sure that’s how you would also like to be treated. As far as which card is the best, it’s YMMV type situation. Like I said at the end of the post, Amex Gold can be a good “keeper” for some. I’m not sure I’ll renew it, but the value is there. I do agree that getting bonus points on gas would be nice.

The gold card isn’t better – you just saying that so ppl can click the link so you get bonus points – I have both the platinum and gold.. for gold to get better they need to add more categories like gas for example, also for the restaurant credit they need to add more places . Also you only get $240 in rewards out of the $250 you have to pay. For me in Jersey the $120 for restaurants is limited to a hand full of places that aren’t even near me.

@Christian I was shocked because up until now I’ve gotten a pop-up saying I don’t qualify for the bonus. I must have gotten it at least 10 times over the last few years. But I don’t give up easily!

Occasionally I get targeted offers from Amex ( like Delta and Hilton cards), but nothing MR-related. That’s why I was really surprised to get Amex Gold approval at last.

Interesting. You mention early on that you were shocked that your application was approved. You’re certainly no novice on credit cards. Any idea why Amex was so reluctant until now?

@PT Thanks for reading!

Yes, pickup is actually very easy and some places will even let you get it via drive-thru. You just need to switch to “pickup” in the app. More importantly, the prices tend to be the same, and there are occasional coupons that sweeten the deal. There is a nuisance factor, for sure, and you need to keep track of the expiring credits. But it’s not that hard, really.

Hi Leana,

I had no idea that you could pick up your own order if you use UberEats and GrubHub. I’ve always ignored those credits.

You teach me something new with each of your posts. I love your writing.