It’s the end of the world

As we know it,

And I feel fine…

Obviously, I’m quoting the famous lyrics from R.E.M song. Every few years I try to do a post with reflections on the current state of miles and points hobby. I think it’s good to take a step back and analyze the current trends. If you are relatively new to this hobby, you’ve probably noticed the prevailing “doom and gloom” feeling in our community lately. Is it justified? Yes and no. We’ll get to the “no” part later, but first let’s talk about the negative developments.

The truth is, most high-ROI redemptions I’ve written about just a few years ago are long gone, and airlines/hotel programs are constantly looking for ways to eliminate what’s left. Do bloggers like myself speed up this process? I have no doubt that we do. It’s a double-edged sword. Blogging is an efficient platform to condense information and make it easily digestible to the masses.

I personally have learned (at no cost) from blogs about deals that I never knew existed, and for that I am grateful. On the other hand, the more people redeem points towards one sweet-spot award, the more unsustainable the whole scheme becomes. Although, some deals have taken years to die. But my advice is: if you see something you are interested in, don’t put it off until next year. A year is an eternity in this hobby.

The last few months have been particularly brutal. Part of the reason is robust economy and record numbers of folks traveling. Most of them are paying cash, so there is little incentive for airlines and hotel programs to provide outsized value via miles and points. Eventually, there will be a recession and you will see more compelling deals. But not now.

A post mortem

Let’s take a quick look at some of the recent negative developments:

1) Devaluation of United Mileage Plus

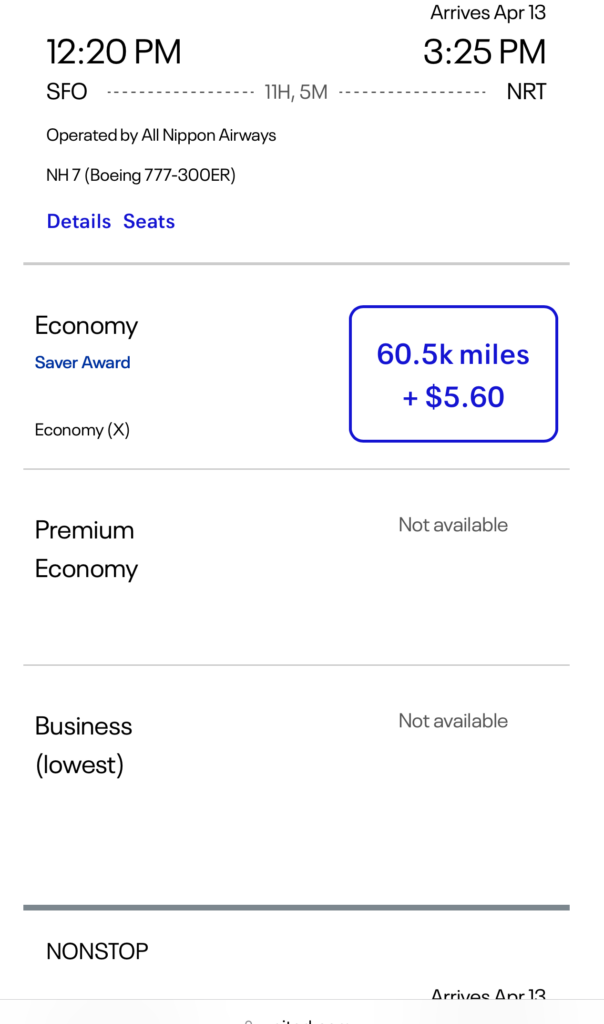

Many blogs have written about the increase in costs for business-class redemptions. I suppose that’s fair because that’s what most folks are interested in. However, what’s been ignored is how much the economy redemptions have gone up as well. For example, this award for San Francisco to Tokyo Narita used to cost just 35k miles a year ago.

I’ve also written about the fact that economy awards to Europe via United can cost as much as double compared to Lifemiles. Sure, all things being equal, I much prefer United Mileage Plus to Avianca. But is the former program twice as good? I don’t think so. I can’t believe I’m saying it, but I’ll take my chances with Lifemiles and hope for the best before I pay double.

It’s clear that United program is looking to become Delta-like. That’s fair enough, and I got a lot of value from Delta when flying within the United States. I don’t think the hatred towards Delta is fully justified, you just have to know how to use it. But here is the problem. Delta often offers decent deals in economy, and I don’t see the same trend when it comes to United. So, we now have expensive awards for domestic travel and they charge a fortune for international flights as well. Something’s gotta give, and I feel like United executives lack a clear vision. Time will tell.

2) Steady devaluation of Hyatt program

Folks in charge of Hyatt award program have clearly taken a “slowly boil a frog” approach when it comes to their currency. It’s very smart, but it’s also disrespectful to the members who invest a lot of time and money chasing after Globalist status. I believe it will backfire eventually. Many of their all-inclusive resorts have doubled in price via points, and Hyatt Residence properties were quietly moved from the main platform to Hyatt Homes and Hideaways Sure, you can still book them, but you will only get 1.1 cents per point.

And of course, the cherry on top is the recent integration of Mr and Mrs Smith platform. This really annoyed many Hyatt loyalists and I don’t blame them. Why didn’t Hyatt give heads up on dynamic pricing instead of touting this as some game-changer? Extremely disrespectful and shortsighted. In retrospect, the loss of SLH was a big deal after all.

Category adjustments have also been fairly brutal in the recent years, but at least Hyatt is somewhat justified there. The cash rates at many desirable places are out of sight these days, so using points is still advantageous. The fact that they have an award chart is obviously a plus, and makes Hyatt currency more stable compared to their peers. Then again, Hyatt can’t afford to cut too much due to their mediocre footprint. Still, I believe a move to revenue pricing will eventually come, though it will likely be a hybrid like Hilton.

3) Other no-notice devaluations

The biggest issue with miles and points is the lack of transparency. Programs have gotten into a bad habit of increasing pricing without any sort of warning. Just the other day I’ve noticed that Avios program has raised award rates on AA flights. I was looking at Miami-Lima route that used to cost 13k points a few months ago, and it’s now running at 16k. No warning was given, and Avios program supposedly has an award chart. It’s weird because LATAM flights still cost 13k Avios, but they charge an extra $40 in taxes, which negates any savings compared to AA.

This is just one example out of many. People put a lot of effort into collecting points towards a specific award, only to see the goal posts moved further and further away.

What you can do to protect yourself (and still have fun)

This is obviously not a one-size-fits-all advice. Our blog is geared towards regular families, so keep that in mind.

1) Collect only cash or flexible points via everyday spending

If you are a low-spender, you should not chase miles, hotel points or certificates, at least in my opinion. To be clear, I’m not talking about signup bonuses here, which we will discuss later. But if you put $2k-$3K on credit cards each month, you need to be strategic in your efforts. I’ve written about Citi Shop Your Way credit card, an obscure product that is tailor-made for middle-class families. Just recently I got $100 statement credit offer on $1000 in spending each month on groceries, gas and restaurants (for the rest of the year). And keep in mind, the card already gives an equivalent of 3%-5% cash back in those categories.

I also happen to have Amex Hilton Surpass card that gives a free uncapped hotel certificate after $15k in spending per calendar year. Out of all hotel certificates in this hobby, it’s definitely the most lucrative one. If I had higher spending level, I would consider it. But I don’t, so I won’t. I would much rather have cash from my weird Citi credit card. That “free” Hilton certificate would be very expensive if I chose it instead of pursuing the Citi offer.

In short, count your opportunity cost. If you prefer flexible points, that’s fine too. In that case, I would recommend Amex Gold or Amex Everyday Preferred for Membership Rewards points, and Chase Sapphire Preferred+ Chase Freedom Flex combo for Ultimate Rewards. Chase Sapphire Preferred (our affiliate link) currently has an increased bonus of 75K points, though you might be able to get 85K bonus if applying in Chase branch.

2) Have realistic expectations when it comes to miles and points, and be ready to pivot

People like to complain how X and Y award used to cost half of what it does now. This is 100% true, but what is often ignored is how signup bonuses have increased too. In the past you were lucky to find 90k points offer on Chase IHG credit card, yet now you can easily get 165k points or more. Redeeming points on overwater bungalow in Bora Bora is sadly no longer a good deal, but there is plenty of value left if you are diligent enough.

Good times!

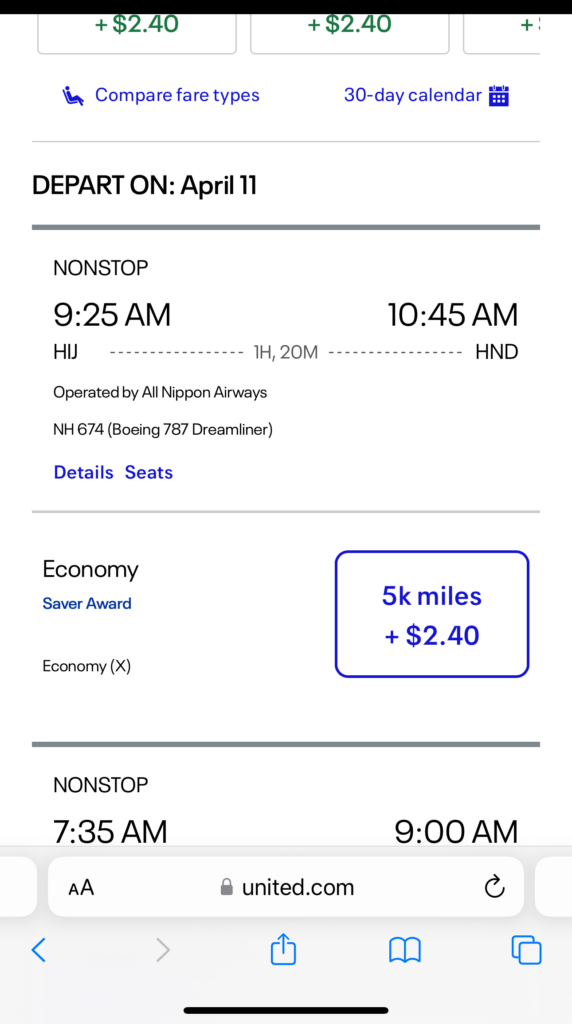

While United Mileage Plus program has been steadily going downhill, it does still have sweet spots, like ANA flights within Japan:

Since Japan rail pass has gone up in price, flying instead of taking a train has become more compelling. Most programs have unique mileage deals you can’t get anywhere else, so focus on those.

Plus, in this hobby, when one door closes, another one opens. For example, after breaking up with Hyatt, SLH will partner with Hilton in a near future. Reportedly, you will be able to use Hilton certificates on SLH properties, which is great news.

Due to this development, I might look into upgrading to Amex Hilton Aspire X 2 for me and my husband. I’ll have to see all the details first, but it could make sense to go this route for a special anniversary trip. Again, I’ll need to crunch the numbers. After all, we are talking $1,100 in annual fees for two cards, though Aspire comes with several valuable credits that mostly offset it.

As far as Hyatt program goes, there is still plenty of value left, at least for my family. One recent example: redeeming points on a suite in Hyatt Regency Coconut Point Resort and Spa. I don’t normally collect Hyatt currency via everyday spending unless there is a bonus offer, and currently only have 40K points in my account. Don’t invest more than you can afford to lose, especially when pursuing elite status.

Last but not least, don’t overvalue your miles. If you got them, use them. Everybody has to determine the acceptable CPM for themselves, for me it’s 1 cent as long as miles were obtained via signup bonus. And believe me, I practice what I preach. Be loyal to your bank account first. Always.

3) See this hobby for what it truly is

You may have seen the movie “School ties” starring Brendan Fraser, that focuses on anti-semitism in the America in the fifties. At the end of it, the main character tells the dean of his elite prep school: “You used me for football. I’ll use you to get into Harvard.” Not to say that the issue of anti-semitism can in any way be compared to our trials and tribulations in the miles and points hobby. But!

The truth is, airline and hotel programs use us to get lucrative contracts with major banks, who then market those currencies to consumers via sign-up bonuses. In turn, we try to get outsized value from miles and points, occasionally beating the programs at their own game. Everybody wins. Well, except the bank. It’s a transactional relationship, and I don’t think it pays to get emotional over this sort of thing.

To be sure, I’ve encountered very kind individuals working for Hyatt, United and other travel companies. Some have gone above and beyond to help my family, making a stressful situation a little less so. And it didn’t matter that I used points obtained from signup bonuses. But to the bean counters we are just a number cutting into company’s profits.

If you find yourself getting too upset, try to get out of the echo chamber of the miles and points community for awhile. Yes, when you read Twitter, Reddit and blog comments, it may seem like the latest devaluation is the worst thing happening in the world at the moment. It’s not.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Randy Southwest fills an important niche and they are good at it. I don’t use the program as often as I used to, but there are deals to be had. I paid 10k for nonstop flight from Tampa to Detroit when we flew to see solar eclipse last month. Excellent value, and our flight left on time. Can’t complain!

@Retired Gambler Totally agree that there is still value to be had, it’s just much harder these days. But such is life. We all knew that getting an overwater bungalow in Bora Bora for $49 per night (cost of renewal fee on old IHG card) wasn’t going to last. Although you had to really work for it and watch availability like a hawk.

It’s like complaining that gas no longer costs 49 cents per gallon. And yes, loyalty programs are really marketing companies, 100%.

Been flying Southwest for years and am a long-time A-list or A-list-preferred member with them. Use my miles all the time for paying for flights for my wife. The points are always valid and no blackouts. Seems like Southwest is still doing this right.

Get over it. These programs are marketing, not loyalty. If you ever believe otherwise you are deluding yourself. They owe you nothing. If you don’t like a program travel w someone else. I am lifetime elite on AA, DL and UA plus lifetime Marriott Titanium and Hilton Diamond. I run around $200,000 a year through my cards (retired now so no business travel spending), pay them off monthly and travel a lot. Have business class flights to Italy, from Greece (Emirates), to Taipei and back from Singapore (Singapore Airlines non-stop to JFK) planned in next 9 months all with points.

BTW I am fine with the cost of Emirates and Singapore awards (paid 87,000 for Athens-EWR on Emirates and 111,5000 for SIn-JFK). Sure they aren’t the 50,000-60,000 one way awards blogs promote but at least they are available unlike the vast majority of the cheaper saver fares (especially if code sharing)

Agree much has changed since I starting flying heavily (and originally joined the AA and DL programs) in the mid 80s. For those complaining about recent changes you would really miss things like 1000 minimum miles on every segment, frequent bonuses and very low, fixed rate award charts. Of course no credit cards then or SUBs so my 8,000,000 miles is mainly “butt in seat”.

There is still value. Just yesterday I transferred 223,000 membership rewards points to Singapore Air and booked 2 saver business class seats SIN-JFK. Yes 111,5000 a seat is high but an incredible product on a 17 1/2 hour flight so well worth it. If paid cash would be over $8800 so almost 4 cent a point. Booked DL Premium Select SEA-TPE for 66,300 (after 15% discount for having their credit card) for a ticket that was around $1000 so, again, good value.

I just try to get more than my personal value for points or miles. If less I just pay cash. No big deal – you adjust

@Nancy Thanks so much!

Great insight, Leana, especially the “See this hobby for what it is.”

@Projectx Oh, I don’t doubt it! I’m insulated from all the MS drama because I it’s not something I generally get involved in. But it’s prudent to have several liquidation avenues in mind so you don’t get stuck holding the “bag” (of prepaid cards).

Hope you find other opportunities soon.

Danny, Delta gets a lot of hate, but I still maintain that for domestic travel, they can’t be beat.

Oh, this game has become MUCH more difficult in the last few months. And the hits listed in this article are the least of my worries.

I won’t get into all of it here, but a lot of MS avenues have dried up, VGC MS is much more difficult than it’s ever been, Amex clawbacks and pop-up jail spreading faster than ever before, I could go on and on.

There are still opportunities, but it’s brutal out there right now.

@Michael Thanks! I was afraid that I came across as a cynical person in the post, which isn’t the case. I am grateful for all the travel memories this hobby has given my family over the years.

But I do think folks sometimes get too emotionally attached to miles, points and elite status. As a result, a devaluation can feel like a personal insult, which of course it’s not. It’s just business, and if you feel you are not valued as a customer, take your money and energy elsewhere.

I’ve been very happy with AA program over the last few years. I do think a significant devaluation is coming, at least when it comes to partner business awards. But that’s life, and like you said, other opportunities will present themselves.

@Adam Yes, totally true that there were many other devaluations recently. I’ve only highlighted a few, as the post was already too long by the time I got done with it. Individual miles are a fragile investment indeed, so it’s important to consider the possibility of devaluation before you get a chance to use them for that dream trip. But if you got the miles on the cheap (like a signup bonus), you will still come out ahead. It’s important to keep things in perspective. But making speculative transfers is a dicey proposition.

As far as banks losing out, I meant situations where a customer signs up for a card, collects the bonus and then cancels it before renewal. Banks absolutely make money on co-branded cards because most folks don’t feel like optimizing.

@Danny Thanks for your kind words! I love Jet Blue points and Delta miles. Well, “love” is probably too strong of a word, but we got a ton of value from both programs over the years. I paid only 7,500 Jet Blue points per person for a flight from Sarasota to JFK, which is excellent. I also paid 15k Delta miles for a flight from Seattle to Orlando when Alaska program wanted 22k miles. You are right that different families have different needs, so one person’s trash can be another person’s treasure. The key is flexibility and having access to different programs.

I hate to fawn; but, Leana, you are so good! Your logic and examples are solid. You give advice that a majority of people can follow. And you “SEE THIS HOBBY FOR WHAT IT TRULY IS.” I’m in Florida today, having flown our extended family of 6 here and back in AA Main Cabin Extra for well under 100k points. Can I do it again next year? who knows! but something will work.

@James You are absolutely correct. Banks are getting smarter in weeding out unprofitable customers. Actually, Shop My Way card has been the only Citi product I’ve been able to get over the last three years or so. Basically, they approve everyone with a pulse due to subprime nature of the card.

It will change when we hit a recession, but then we will have a different set of problems to deal with.

Other devaluations that happened in the very recent past:

1) ANA

2) Turkish Airlines

I was really happy to have made some bookings just a few weeks before this. Less happy about a refund I got due to a cancellation, after the devaluation – the refunded miles are worth a lot less now.

3) American Airlines

Indirect devaluation, IMO. Their international partners – Etihad, Qatar, British etc. – appear to be providing a lot fewer award seats to AA.

“The truth is, airline and hotel programs use us to get lucrative contracts with major banks, who then market those currencies to consumers via sign-up bonuses. In turn, we try to get outsized value from miles and points, occasionally beating the programs at their own game. Everybody wins. Well, except the bank”

About the last sentence – the bank loses money with a handful of expert players, who know how to take advantage of the system. Overall though the bank makes money for sure, or they’d stop doing this.

@Aleks This game has certainly become too nuanced and too frustrating for an average Joe. I get it.

I am a freak who enjoys optimizing, so it’s still fun. I like the thrill of the chase, and beating programs at their own game. But it can be time-consuming and I’d argue that many will do better going to the gym or learning a new skill. Or spending time with their family for a change! 😉

There is value to be had, but you have to be willing to do the work. From talking to most normal people, I’d say 99 out of 100 won’t have the patience and will bail after they don’t find awards to Hawaii at saver level over Christmas. And there is honestly nothing wrong with that. We all have limited time during the day.

Getting approved for cards has also gotten harder, no question. But I keep on trying and occasionally succeed.

This is why I love this blog! 🙂 I think everyone needs to evaluate why/how points and miles fits into their own needs, and just try to make the best use of it. There’s no right or wrong. And why should we expect travel companies and banks to want to be taken advantage of. They want to play the game just as much as we do. For my family of 4, we have to fly to Florida 2-3x a year via Delta or Jetblue, so those points are the most valuable to us, even if they are ridiculed in the travel blogging community. And whatever else we have left over is a bonus!

I agree with everything in this post and would like to add one more problem. That’s CC approvals more declines, I believe they are not looking for 800 credit scores and balances that are paid in full each.No profit in that profile. All my friends are 800 credit scores and we are all having a hard time getting approvals. This will change when they are flying planes that are half empty.

Very well thought and written about these touchy topics!

Me too, in the past year or so, have been noticing the downward tone in this blog community – addressing changes and devaluations of multiple travel mile/point programs. Yes – those changes are real, and mostly decrease value for the consumers, but on the other hand we had several increased sign-up bonuses to counter-balance (at least for those who can get approved for them 😉

Totally agree about United and Hyatt sour state of mind, they need to reconsider value proposition from selling miles to banks to serving loyalists by building up their brand values.

Hilton went on similar path, with cutting as much useful benefits as possible. On my call with Amex – cancelling my Aspire card – rep told that recent changes, like discontinuing Priority Pass and changing Hilton credits – are the work of Hilton folks. But nevertheless Amex jumped card fee to $550 and did not blink. I suspect they have tons of cancellations, just like mine. Hope they learn…

I also agree on the shady practice of hidden devaluations practiced by many airline loyalty programs. Customers collect their miles for travel in the future, so they should give at least 3 months warning for incoming changes on miles usage. If not for consumers – they wouldn’t be able to get billions from the banks for mileage programs at all. So it’s the consumers they should respect!

Overall it’s a game of corporate greed and “street-smart” people, which become streamlined with the bloggers, just like you mentioned. But it takes some discipline and many newcomers won’t hold for long in the game. Corporations aware of that: just look at the record profits at Emirates/Etihad/Singapore Airlines in the past 2 years – and those are the first to increase and limit their award charts!