Now that’s a controversial take for you! As is the case with all families, it’s a matter of when and not if an unexpected emergency bill eventually comes our way. Unfortunately, we’ve had quite a few of those in the last six months. Both of our cars broke down and required thousands of dollars to fix. Then my son broke his arm, and a flood of medical bills came our way. I’m still dealing with the fallout, and will have a post on it at some point. Spoiler alert! Our health insurance system is broken beyond repair.

Anyway, a few weeks ago we got another “fun” surprise. Our septic drain field collapsed and needed to be replaced. The lowest estimate was $7,600, plus $400 for sod, so it would be a total of $8k. Ouch.

Speaking of sod, I’ve decided to save a few hundred bucks and lay it myself with the help of my lazy kids. Big mistake.

Paying this bill in full would mean completely draining the remainder of our emergency fund, leaving us with almost nothing to cover other unexpected bills that I’m sure are coming our way soon. Our dentist mentioned something about our son possibly needing braces, but I pretended I didn’t hear her.

After recovering from the initial shock, I started looking at ways I could minimize the pain. My initial thought was applying for Bilt credit card with the hope of getting 5X spending offer that many, including Nancy, seem to get. That would mean potentially getting 40k very valuable points as a consolation prize. I should mention that my husband and I have been getting rejections from most banks recently, and we are not eligible for many juicy sign-up bonuses floating around internets.

But I quickly tossed aside the idea of a Bilt card, and here is why. The 5X promo is only valid for five days after you get the card activated. So everything would have to happen right on schedule, and if you’ve dealt with contractors, you know that delays are part of a deal. I don’t know this person very well, and would not be comfortable prepaying the bill before the job was done. Spoiler alert! This was the right decision, as we experienced a delay of over two weeks from the original date given to us.

Back to drawing board I go. I did look at the cards I already have with the idea of at least maximizing the rewards, and decided to use Capital One Venture X. It earns 2X on everything, which isn’t bad. But the more I thought about it, the more it seemed prudent to take advantage of 0% promo on purchases for 12 months. Usually, I have at least a few credit cards that offer that option. But not this time.

Enter “My Chase Plan”

I’ve seen Chase advertise “pay over time” plan on their credit cards before, but didn’t pay much attention to it. I figured it was similar to Amex, which usually runs promos that give you 3-4 months to pay off certain bills with no interest. But I saw this Chase banner when I logged in to check one of my accounts, and clicked to see more details:

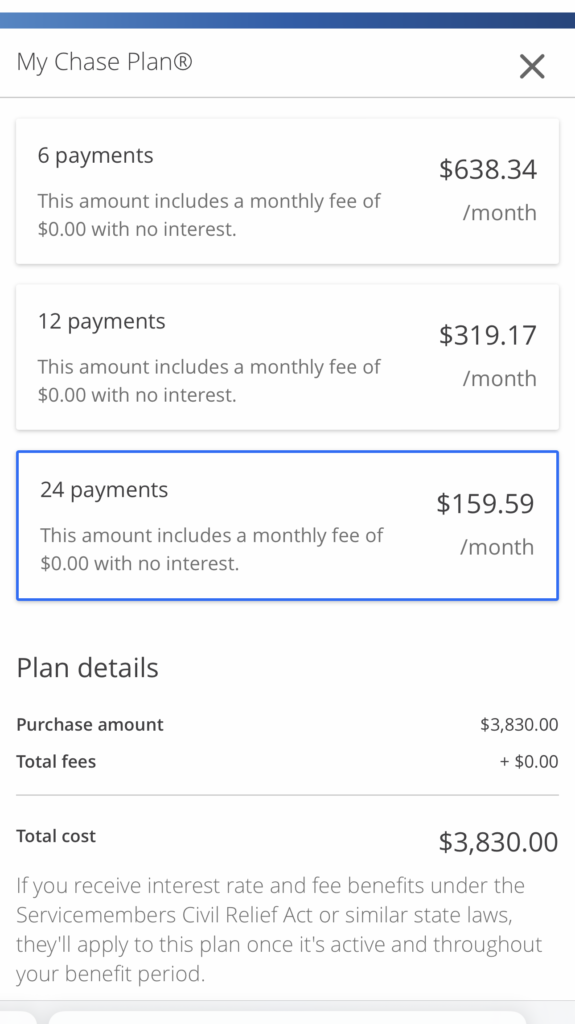

To my surprise, I found out that they offer plans for 24 months. As long as we charged the purchase by the end of March, I would pay no fees or interest. So, this is what I did. We had to put 50% down upfront for materials, and I used my husband’s Chase Freedom Unlimited. You still get points on purchases, so that meant getting 5,745 Chase Ultimate Rewards. But the real prize is the ability to pay it off with no interest over two years. And indeed, my plan worked like a charm.

It looks like you get no fees on your first plan per each credit card. That’s why I used my Chase World of Hyatt Visa for our final payment. It only earned us 1 point per dollar, but again, the real appeal was 0% interest. I could have used my Chase Freedom Flex, but would prefer to keep this bill separate since I use Freedom on a regular basis.

Since I like Hyatt program and don’t have a premium Chase card at the moment, I figured I won’t have a problem putting those 3,830 Hyatt points to good use. Chase Freedom Flex is actually one of my favorite credits cards due to earning 3X points on dining and rotating 5X categories (currently groceries). My personal referral link, thanks if you use it!

I’ve learned that you can change your payment preferences to “interest saving balance.” That way you won’t pay interest on new charges. It’s nice that monthly payments for our two Chase “pay over time” plans will be deducted automatically. This means that we will have an extra bill of $320 for the next two years, but it sure beats depleting our emergency fund. Plus, even if I had a lot of extra money, it would make sense to take advantage of this plan and keep it in a savings account earning 4-5% interest.

How this new development will affect travel and other plans

This was obviously not something we could have foreseen, and I’m not losing sleep over it. We were looking to get a low-interest loan for a gently used SUV in a near future, since our van has 199k miles. This plan will now have to wait until we are done paying off this new bill. Fortunately, our van still works (mostly) and if it ain’t broke, don’t fix it. I don’t have a problem driving a junker.

We also have tuition bills coming our way in a few years, and we already told our daughter that it will have to be a cheap local community college, so she can live with us. Fortunately, she wants to become an elementary school teacher, and going to a fancy university for this type of degree is downright wasteful IMO.

As far as travel goes, we are not canceling any of our existing plans. Fortunately, most are nonrefundable, so it’s an easy decision. And frankly, I probably would keep them anyway. I feel like we are still in a decent shape, since we have Roth IRA we can tap into without penalty if we need to. Also, there is an option to borrow from 401(k) and pay no interest. Obviously, I would prefer to avoid going either route, but if we have to, it’s not the end of the world.

Perhaps I am so nonchalant about it because I know it’s not he worst thing that can happen to a family. As my mom recently said, a “problem that can be fixed with money is a good problem to have.” Truth.

As far as travel plans next year, those will most definitely be lighter than usual. I hope to do an epic family road trip (dysfunction and all) out West next summer, but we will be using miles and hotel points to cover most of it. We also plan to visit some friends in New York state and hopefully see some fall colors while we are at it. Last but not least, I’m looking forward to going on a free-ish cruise with just my husband next spring. We likely won’t be doing any tours or paying for specialty dining. Fortunately, I have lots of experience traveling on a shoestring. Travel is a privilege, and I am not too good to stay in a basic $100 hotel room. And I hope I never will be.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Hah, that covers a lot of us! 🙂

@Audrey Thanks!

Oops, I meant “interest saving balance”, will change the wording now.

On my pay over time balance I have to choose “interest saving balance” and it adds the new charges to the plan installment. What’s “adjusted balance”?

Also, hang in there Leana!

@Russ Yes indeed! Ironically, my mom never had a lot of money and still doesn’t.

“problem that can be fixed with money is a good problem to have.” Truth.

Agree. 🙂

@Jennifer Will do. Thanks for the tip!

I’d recommend asking about this particular scholarship now. She will need volunteer or work hours and a certain GPA.

Nice post 🌹🌹

@Projectx Thanks! Sometimes when it rains, it pours. But we will manage, I’m sure.

Oof… that’s a rough stretch of big bills. Sorry to hear of all your headaches!

@Jennifer We will definitely look into scholarships when it gets closer to graduation. My daughter is in dual enrollment in a local college, so she should hopefully have an AA degree by the time she is done with high school. She was told by her guidance counselor that it may preclude her from qualifying for any future help since dual enrollment is sponsored by the state. But we will certainly look into all the possibilities.

I think you made the right choice. I used the Chase pay over time when two appliances broke at the same time. I didn’t want to go into our emergency fund either. It worked great. I chose a Chase card I don’t use often and was able to pay it off early.

Side note, you should definitely look into Florida Bright Futures Scholarship. My son is on track to have 100% tuition at any Florida state college. There is also one that pays 75%. It is a huge relief to know we won’t have to pay for tuition.