For most regular families, grocery bill is their second highest expense each month, right after mortgage. So naturally, you want to ease the pain by getting the biggest discount you can, whether in the form of points or cash back. Of course, choosing the right store is also important. For example, I’m a big fan of ALDI. Unfortunately, we don’t have one in our town, and it’s not worth it for me to drive 40 minutes one-way just to save a few bucks. In general, I avoid places like Sam’s Club because you end up getting more than you need, which cancels out any discounts.

A few years ago I signed up for Kroger delivery, and I’m a big fan. I do have to pay $59 each year to get unlimited free deliveries, but to me it’s worth it. Plus, Kroger prices are quite reasonable. Not as good as ALDI, but close enough. And the convenience factor can’t be overstated. Here is how I’m maximizing savings on my Kroger grocery purchases.

AARP+SYWR credit card combo

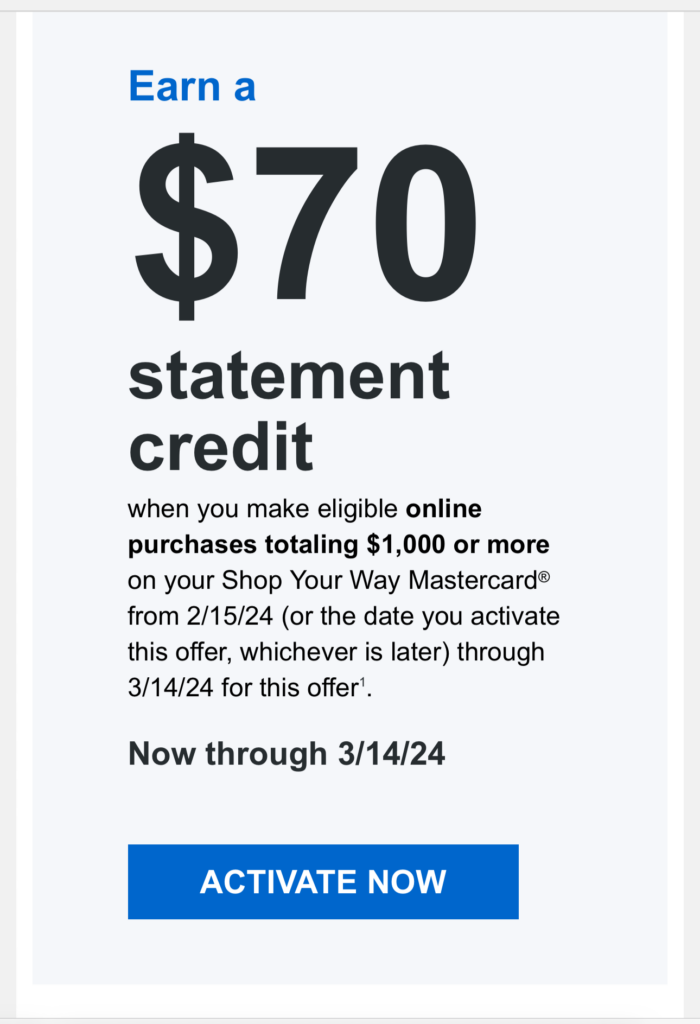

I’ve written about Citi Shop Your Way Rewards credit card a few times in the past year. The sign-up bonus is nothing to write home about, but the spending offers can be extremely lucrative. Unfortunately, I haven’t been getting a lot of cash back promos on groceries, gas and restaurants lately. However, Citi keeps sending me offers on online spending.

Here is the latest one:

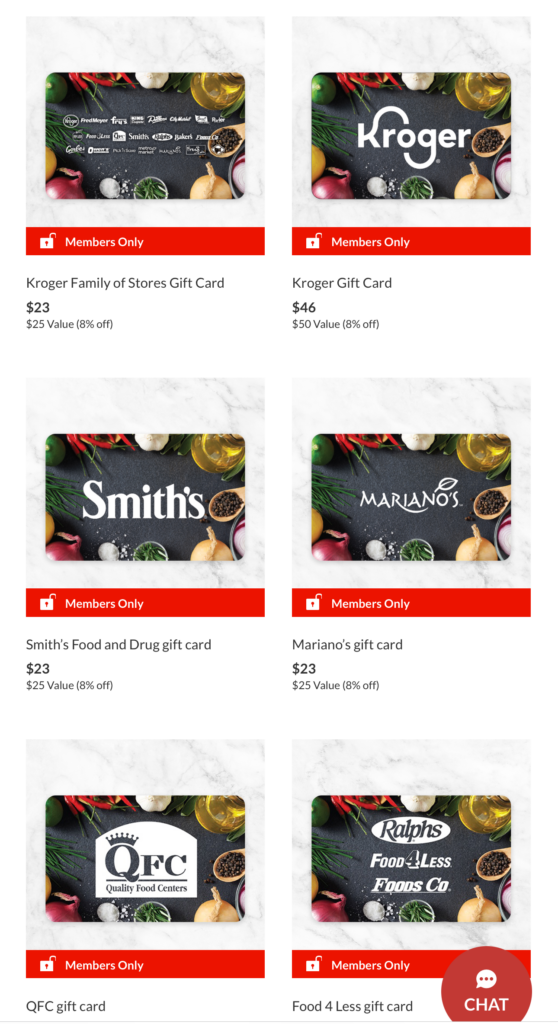

I spend quite a bit online anyway, and using the card for groceries purchased on Kroger.com helps me to get closer to the $1k threshold. But it gets better. I also have an AARP membership which allows me to purchase Kroger e-gift cards at 8% off.

Unfortunately, the highest denomination they have is $50 and AARP only allows you to buy 5 gift cards per month. Still, that’s $20 off something I need anyway, which adds up to $240 per year. AARP membership only costs me $16 yearly, and sometimes they have specials to decrease the rate further. And no, you don’t have to be 50 to join AARP. I’m not there…yet. If you take Citi promo into account, that means getting my Kroger purchases at 15% off, and I even earn an additional 1% via Citi rewards points on top of that. Hey, every little bit helps.

You can buy other grocery gift cards via AARP. For example, there are $100 Albertsons gift cards at 8% off, which is pretty good.

If you don’t like dealing with gift cards

There are still options for those who like to keep it simple. If you are working on minimum spending requirements, putting groceries on that particular card is almost always the right move. This is especially true if you are struggling to come up with enough organic spending. There is something to be said for keeping your life from becoming overly complicated.

Beyond that, here are a few credit cards we recommend:

1) Blue Cash Preferred from American Express

This card (our affiliate link) is the gold standard for those who prefer to earn cash back on groceries, at least in my opinion. You get 6% on grocery purchases on up to $6k per year, which is decent. That’s about how much my family spends, though we tend to eat out a lot (as in too much).

The card does come with a $95 annual fee, but you get a credit on Disney+, which would offset it for some folks. From terms: “Get a $7 monthly statement credit after using your enrolled Blue Cash Preferred® Card to spend $9.99 or more each month on a subscription to the Disney Bundle. Valid only at DisneyPlus.com, Hulu.com, or Plus.espn.com in the U.S.”

I actually have this card myself and am thinking about renewing it since my kids like Disney+.

2) American Express Gold Card

This card (non-affiliate link) has a $250 annual fee, but could be the right fit for some. It earns 4X Membership Rewards points on groceries on up to 25k in purchases each year. There are some monthly credits to offset the fee.

3) Amex Everyday Preferred credit card

This card (Leana’s personal referral link) is one of the best for earning Amex Membership Rewards. It earns 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x); 2x points at US gas stations; and 1x points on other purchases. When you use the card 30 or more times in a billing period, you get 50% more points. It is a bit tedious to keep track of this requirement, but it’s still a solid product, especially for grocery purchases. The annual fee is a relatively reasonable $95.

Readers, what strategies do you use to save money on groceries?

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@HML That’s pretty good! Can’t beat 10% off, no other card comes close.

I got an offer on my sywc for $20 credit on $200 in groceries every month for the whole year!

@Sara You don’t have to be 50 to get AARP card. I think it offers great value, especially if you can utilize their discounted gift cards. One perk I’ve forgotten about is 10% off on Carrabba’s bill, and you can still use discounted gift cards. I could have saved $13 the other day, but totally forgot about it.

@PT Yes, Chase Freedom is great and I’m using it on groceries this quarter on what’s left after I get 5 Kroger gift cards via AARP each month. Unfortunately, it usually only offers 5X points on groceries for few months each year, and even that is not guaranteed. That’s why I didn’t feel it’s appropriate to include it in this post, since it specifically focuses on groceries.

Leanna, great article – very useful, especially considering some of us are on the cusp of deciding to get AARP or not! LOL

GREAT idea! thanks for the tip, i have that card too but never know when they do the grocery card thing…

I use the Chase Freedom card for groceries during the quarter that they are 5x and buy the store gift cards then. I value UR points.

@Sam That’s a good one! Never got around to applying for this card due to measly signup bonus, but it’s a nice option for low spenders.

Citi Custom Cash – 5x Thank You points on up to $500 per month. No annual fee.