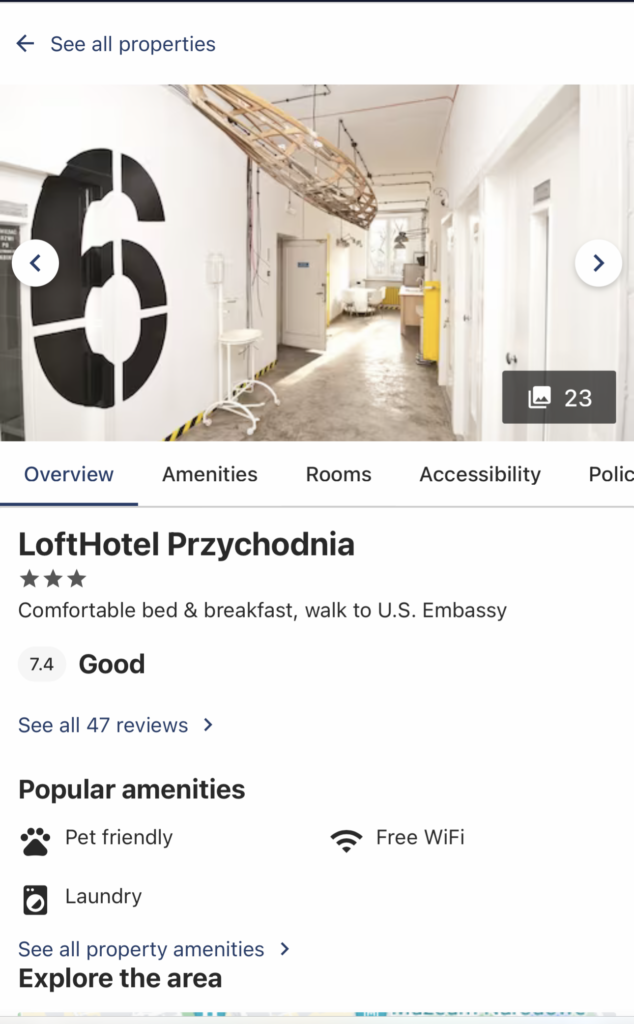

Have you always wanted to stay in a Warsaw hotel that used to be a dental clinic? How about using hospital IV stand to hang your clothes in the room? If you said Yes, the new Delta benefit can let you experience both and pay zero or very little out-of-pocket. Can’t beat that!

But let me back up for a minute. Last week Amex has refreshed its lineup of co-branded Delta credit cards. Normally, these types of enhancements don’t really get my attention. However, in this case I happen to be a proud owner of Delta SkyMiles Amex Gold card. Naturally, not so proud that I won’t cancel it in a few months.

Anyway, when I read that I can use $100 credit on prepaid hotels booked through Delta, I knew I had to take advantage of it somehow. We have a few stays coming up that are relatively set, like needing a hotel in NYC that would comfortably fit my family of four. Emphasis on “comfortably.” Forget about using this credit to your advantage if you have hotel points. Lowering the room rate from $600 to $500 per night is not why I participate in this hobby.

I started looking at other possibilities, and a perfect option presented itself. If my Belarus relatives get their Polish visas sorted out, they will need to spend one night in Warsaw in each direction before meeting us in Zakopane. I did book an apartment for about $110 per night via Lufthansa miles promotion (now dead), which would give us 3k miles. Certainly not a game-changer.

But it was the best deal relatively close to the Warsaw train station. However, the apartment doesn’t have A/C and only has one bathroom for five people. So, I figured that I might as well put Delta credit to good use and get them two rooms on the way back from Zakopane. I almost booked that “dental office” hotel I’ve mentioned earlier, but instead settled on cheap Ibis property closer to bus station.

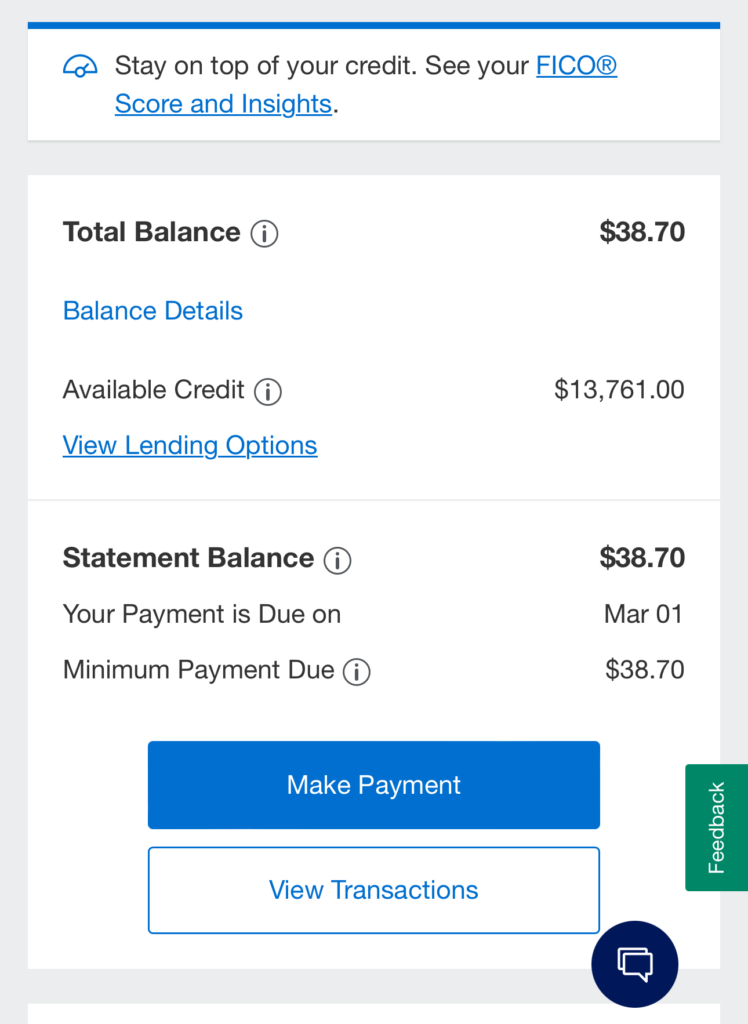

The total cost for two rooms was $138, quite cheap. The rate is 100% refundable, which is crucial to me since I don’t know if we will even be going to Poland. But I figured that the worst that will happen is Amex will keep the $100 out of the refund, so it’s not like I will lose anything. And perhaps I’ll end up with $138 check.

It took only three days to get the credit, so my total for both rooms is $38. No points redemption would ever come close.

So in my case this recent Amex enhancement worked out nicely, to say the least.

Should you apply for increased Delta offers?

It honestly depends. I’ve said many times that hatred for Delta SkyMiles in our hobby can be over the top at times. Sure, getting a good deal on premium class will be very tough, especially if you leave or land in the US. But there are niche deals to be had if you are flying between cities in Asia etc. Personally, I use Delta miles for roundtrip economy redemptions in US. That’s where you will usually get good deals. Not all the time and not on all routes. Flexibility is essential.

But a few months ago, I paid 21k Delta miles per person for roundtrip summer flight from Fort Myers to Detroit, thanks to 15% cardholder discount. Is it an earth-shattering deal? Of course not. But I don’t think anyone can say that there is zero value in this redemption. It would be ridiculous.

If you end up applying for Delta SkyMiles Amex Gold card (our affiliate link), the first year is waved and you will get 70k miles after spending $3k in the first 6 months. It’s certainly an easy win for someone who lives near Delta hub. If you’ve previously had this product, I recommend checking this non-affiliate link which may pull up targeted offers without “lifetime” language. That’s how I ended up with my current Gold card.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Talchinsky Yes, you have to book through this website while logged in https://www.travelextras-delta.com/Hotels#.

Make sure to use Delta credit card and you should see a $100 credit a few days later.

Hi Leana. Booking a hotel in a small town in NZ where points are not an option. Do I understand correctly that you have to book through Delta stays while logged in to Delta account and then use corresponding Delta Gold Personal card to trigger the $100? My mom has this card and so does my husband so I guess I need to login to mom’s Delta account and pay with mom’s Delta card for 1 night, and likewise with my husband’s Delta account and husband’s card for 2nd night?

@Aleks Yes, I totally agree that utilizing $50 hotel credit from CSP to your advantage can be tough, especially when traveling in the US. Hotel prices have gone up so much, that it can barely make a dent. Even a basic Hyatt Place will run you $150 with taxes. If it costs 8k Hyatt points (which I value at $100), I would rather go that route. In that case $50 credit is borderline worthless. There are situations where it could come in handy, but an occasional traveler like myself will have to put in effort to make it work. And I like to keep things simple.

As I’ve mentioned to Tom, Delta Gold card can certainly be worth renewing for some. I just don’t think that’s me.

@Tom It took only three days to get the $100 credit, which was a nice surprise. The terms say that it could take up to 60 days.

As far as whether Amex will claw it back in the event of cancellation, that I don’t know. I’m sure we will have data points on this one soon enough. Amex is certainly entitled to keep it, and I wouldn’t hold it against them. I fully intend to keep these reservations, but the visa situation with my relatives is out of my hands, unfortunately.

On renewing the card: could absolutely make sense if you have a large Delta miles balance, plan to check bags and can organically utilize the $100 hotel credit. I am almost out of Delta miles, and we rarely check bags. I also try to use hotel points whenever possible. So it just doesn’t make sense for me.

Thanks for pointing out this new Delta card feature. I’ve noticed that Amex increased annual fee to $150, but this hotel credit can be of some value to offset the increase. On the other hand, I found that Chase Preferred card $50 hotel credit (via Chase Travel portal) is very hard for me to put to any use. With cash prices being astonishingly high past 2 years in most locations, it’s a tough call to pay with Chase points (-credit) or cash for stays compared to point or FNC nights. $100 seems like a better deal from Amex, if prices in it’s booking portal are on par with normal cash rates.

And I agree with you that occasionally one can find a very good value using Delta miles, especially for flights in Americas. Plus a CC bonus of 15% refund is helpful for cardholders. With that in mind, one can find keeping Delta card beneficial, recovering the $150 fee and even gain more value.

Hi Leana,

I think you are the first person I know that has tried to use this credit. I see that you posted your statement balance. How quick did the $100 credit hit? I would guess that they charged you $138 to start and at some point gave you the $100 credit but wondering how quick that hits (obviously within your statement period for sure). I also wonder if you cancel that reservation in the future, whether amex is smart enough to take back the $100 credit they gave you. I would think so but who knows.

I, like you, am also thinking of cancelling this card (at least the one in my wife’s name). But this $100 credit brings the AF to $45 or $50 per year (I forget what they increased the AF to), and since the Delta card does have lifetime language for the bonus, it might be worth it to keep it since if she travels once by herself then the balance of the annual fee more than pays for baggage fees. But we have a few months to decide before we decide on that.

Thanks Leana

Tom