Recently I’ve wrapped up my three-part trip report on visiting Costa Rica with kids over Labor Day. In the introduction I’ve promised to do a deep dive into hidden $ costs of our adventure, and I’m not talking about out-of-pocket expenses, like food and sightseeing. This was a classic case of a “free” trip, where flights and hotels were covered entirely by miles and points. But was it really free? Let’s take a look.

1) Flights

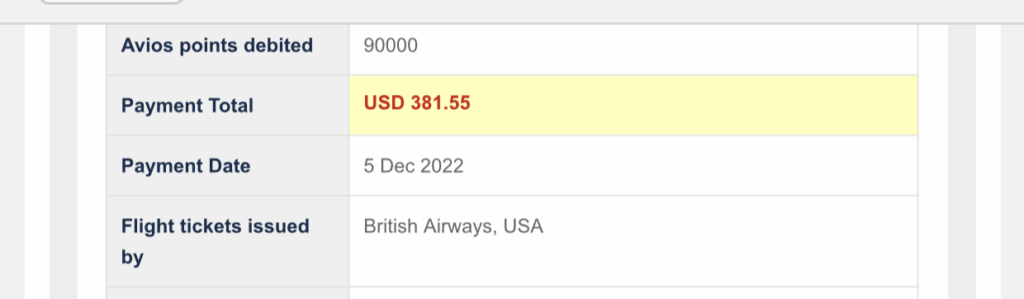

I used British Airways Avios points for five people, previously accumulated via transfer (40% bonus) from Amex Membership Rewards.

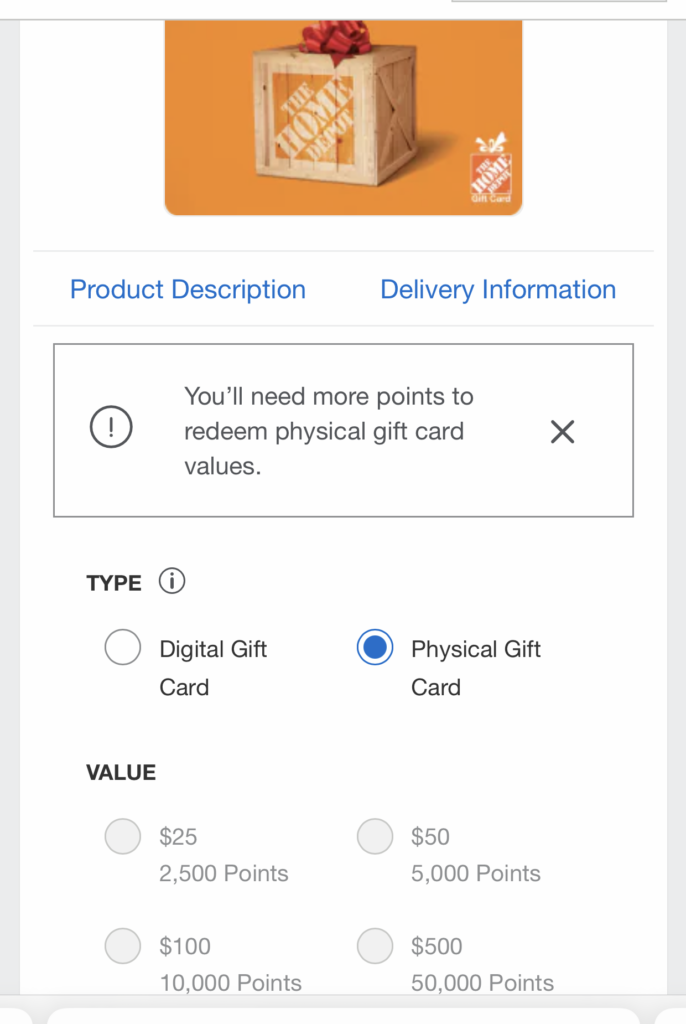

So far, the only real cost is $382, which is dirt cheap for five roundtrip tickets from Miami to Liberia. However, let’s not forget that I had to transfer around 65k MR points, which could have been redeemed towards $650 in Home Depot gift cards. Yes, I’m aware that you can cash out MR points at 1.1 cents apiece if you have a Schwab Platinum card. But let’s ignore that because most people (including me) don’t have access to it.

Of course, a $650 Home Depot gift card is not the same as cash. Still, it shouldn’t be too hard to sell it for $550 to a friend or relative. My SIL is currently doing renovations on a bathroom, and would gladly buy it for that price. Of course, you can also use it for a project on your own home.

Real cost of our five tickets: $932

2) Cost of hotels

On this trip we stayed at two resorts: Andaz Costa Rica at Papagayo Peninsula and Rio Perdido. We also spent one night (two rooms) at Hyatt Place Miami Airport West/Doral. I used a total of 126k Hyatt points, which I’ve accumulated via 1:1 transfer from Chase Ultimate Rewards. This one is pretty straightforward. I could have cashed out these points for $1,260 in statement credits.

Real cost of hotels: $1,260

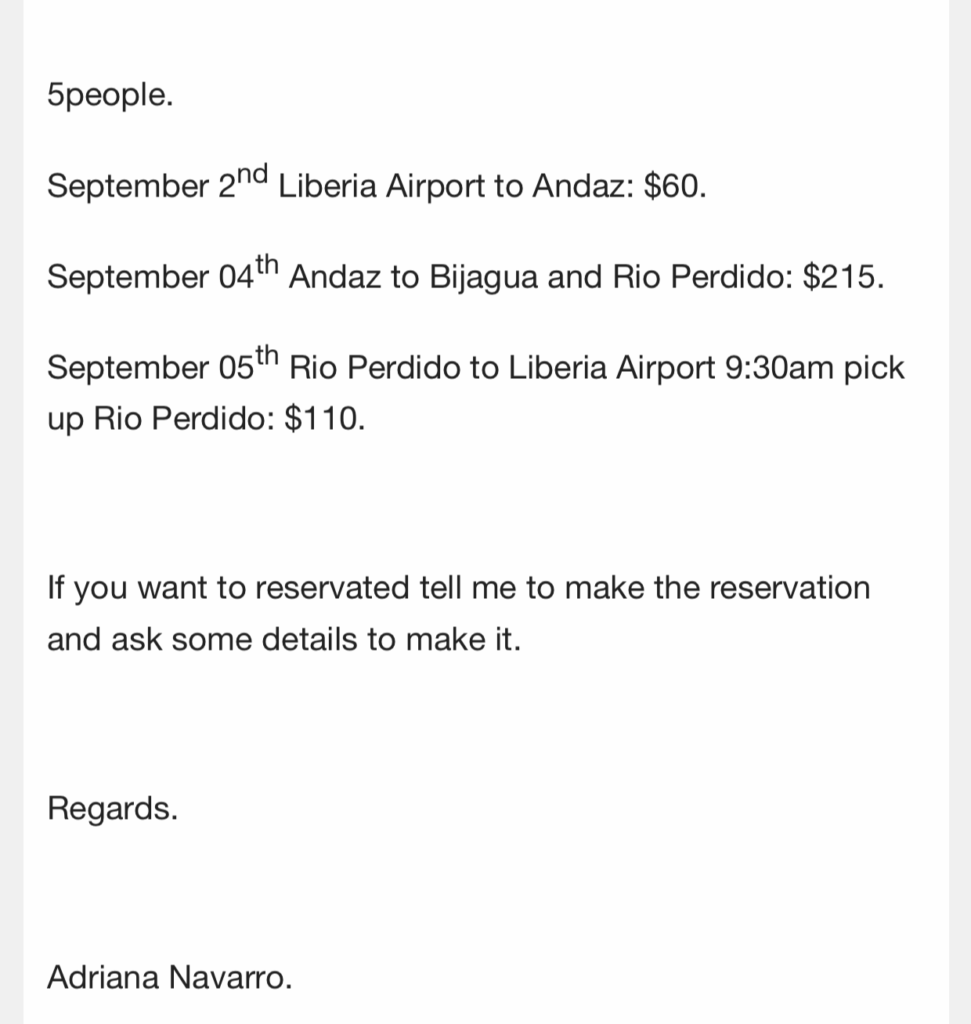

3) Transportation and parking costs

We chose to hire a local company rather than rent a van. The total came down to $385, and I left $65 in tips.

We also spent around $70 on gas for driving to/from Miami, plus $30 to leave our car in Hyatt parking lot. We also spent $80 on Uber for driving from Hyatt to Miami airport and back.

Transportation expenses total: $630

Grand total for everything: $2750

Wow, that’s a lot of money, especially for a “free” trip. And keep in mind, this is just a bare bones total, not taking into account the money you will spend on sightseeing, hotel tips, souvenirs and dining out. Now let’s see if we can figure out a rough per-hour cost of our vacation. We only had three nights in Costa Rica, and had to leave at 9:00 AM the last morning in order to catch our flight. So, we only had two and a half days there, really. I’m not counting the time spent sleeping, for obvious reasons.

Anyway, in reality, we probably had around 27 hours total to enjoy our time in Costa Rica. That works out to around $100 per hour. Again, the true cost is even higher since there are other incidental expenses. But I’m only focusing on non-negotiable costs here.

What’s the point of this masochistic exercise

Believe it or not, it’s not to discourage you from travel. Not at all. I was fully aware of the real and hidden costs of this trip, and booked it anyway. Which brings me to my main points.

1) Book the trips you actually want to take

Might as well, because you are paying for them. Sometimes a lot. That trip to Maldives? Not free. A trip to Disney World? You know the answer. I loved travel before I discovered miles and points. I would still be going places even if I had to pay cash. It just wouldn’t be to Andaz Costa Rica where rooms cost $650 per night in low season. And I probably would not be flying from Miami to Liberia, since those flights cost $800 per person. So, using just 18k Avios+$78 is a price I’m more than willing to pay.

2) Resist being penny-wise and pound-foolish

One of the reasons I’ve decided to go with the transfer company instead of renting a car is precisely because I knew our per-hour trip cost would be close to $100. I figured I would need to save at least $200 to make up for the inconvenience of dealing with a car rental. That’s because it would take us probably an hour to sign all the documents upon arrival and I would also need to leave for the airport an hour earlier.

I’ve determined that it would not be worth it because in the end we would maybe save $135 at most, even after factoring in tips. I’m not even taking into consideration the nuisance factor of driving in a foreign country. If you’ve read my post on transportation logistics in Japan, you will notice the same theme. We spent extra on Uber and private transfers in order to buy out precious time, as well as make it easier for my elderly MIL.

Final thoughts

Travel is expensive even when it’s “free”. This is especially true when you are flying a family of five to an international destination (high departure taxes) and only spend a few nights there. For some, the overall cost may be a deal breaker, and that’s OK. We all have different goals, and there is nothing wrong with redeeming points on low-category hotels and doing a road trip. Or just cashing out Chase UR points for a bathroom remodel. They are your points, spend them the way you want.

Going to Maldives is not a rite of passage in order to be considered a successful traveler. Neither is staying in Park Hyatt Vendome Paris or Park Hyatt Tokyo. Nothing wrong with those places, of course, but it’s not that big of a deal if you choose to skip them. We actually went to Paris last year and booked a non-chain hotel via AirBnB. And we loved it.

I was also perfectly happy staying in Comfort Inn Tokyo Roppongi, and would do so again. We did spend two nights in Park Hyatt Sydney in 2018 since we had uncapped Hyatt certificates, though I personally would not use points on it. But I respect that many folks feel differently, and am not here to rain on anyone’s parade.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

There is also the annual fee and interest for some. But the memories and experiences are priceless and that is something you cannot add a price tag to.

@Boonie Good point on the annual fee! I thought about adding it, but left it out in the end. I also realized that I forgot to add the cost of travel insurance. But the numbers are not critical here, but rather the concept of looking at the big picture. Like you said, you can’t put a price on memories. To me, travel is one of the best “investments” one can make.

An interesting take, but in my view a flawed analysis. Cost occurs upon acquisition of the points/miles, not when using the points/miles. At best, an analysis of the missed opportunity of cash-back earnings vs. points/miles earnings on the front end would reveal hidden cost. But to present “cost” as the options one has on redemption – cashing out to gift cards or cash back – versus travel – is (again my view) invalid. Even then, I view my travel – not having “paid” for airfare or branded hotel in 30+ years (with purposeful strategic exceptions) to be traveling “freely.” Spending on eating out, fuel, whatever, all of that is going to happen whether traveling or at home, costs do not evaporate when not traveling, perhaps they even increase b/c we sit at home, shop on line, and spend even more.

@DJG I hear you! Honestly, there are different ways to look at it. I totally get why you see your travel as “free”. If you haven’t discovered points, you wouldn’t have all these opportunities to earn them at a low cost via bonuses or MS. So, the acquisition cost is what truly matters. That’s fair. Plus, some currencies are harder to cash out than others. For example, I would have to be in a big financial bind to even consider redeeming my Amex MR points on gift cards. That’s just a poor value proposition (to me). That said, just because I wouldn’t consider it, doesn’t mean there is no hidden (and very real) cost to my decision. With Chase UR points it’s a bit different. Any time you are transferring them to a travel partner, you are effectively buying them for 1 cent apiece. If you had CSR during the height of Covid pandemic, the cost was closer to 1.5 cents since you could redeem them at that rate towards groceries. But that’s neither here nor there, since it was a limited time opportunity. Again, I’m not saying that it’s optimal way to use UR points, but the cost is very real indeed. IMO, it’s good to think about it before blindly transferring UR points to Hyatt for “free” hotel stays. At the very least, I ask myself if I would rather have cash because I’m not giving up some Monopoly money.

That said, I love flexible points and miles because they give me “permission” to travel. The incentive to redeem them towards trips is just too powerful at this stage of my life. We are still in decent health, and I love making memories with my kids. I feel good about using them on travel, and have no regrets.

I do agree with you on not including dining expenses and such when doing this type of analysis. That’s why I only focused on the basics in my post.

Loved the math and thoughts of renting a car. We have waited more than an hour several times just for our turn to get waited on at the car rental counter! This is not fun and makes my hubby really grumpy so let’s add in a grump factor as well. Car rental = time spent waiting in line + grumpy hubby + filling out documents+earleir arrival at airport for return + possible difficult to find drop off location VS Uber/taxi costs. You made a good point on this!! Love your articles and love the real world costs.

It annoys me to no end when I see blogs claiming “FREE” trips. Even my stays at an all inclusive cost me tips+airport transfers+airport parking+tax on flights+hotels before/after flights if early/late flights, and the “cash-out value” of the points for the flights and resorts. I had a friend comment about my points for an all-inclusive resort being “free” to me. I explained that I could have cashed out those points for $2,000.00 in cash to spend on something else. And that it takes me valuable time and some money to earn those points. I guess people who do not do this “hobby” have a hard time understanding. Anyways, I am rambling, thank you for another great article!

@Cari Thanks for your thoughtful comment! We always appreciate it when readers take the time to share their thoughts.

You make a lot of good points. This hobby can take up a lot of valuable time, and that’s something else to consider. It’s incredibly addictive, and there is a lot of pressure to keep up. And yes, the word “free” is definitely overused.

Also, constantly reading posts about redeeming a gazillion points to fly to Maldives for the weekend can seem like it’s the only right way to travel. Not that it’s wrong to go there, but it’s not something I ever felt the urge to do. And I still don’t! Though it’s fun to live vicariously through other people adventures. I’m genuinely happy for anyone who gets to achieve a special dream via miles and points. It’s all about doing things WE love, and I have to remind myself constantly not to take any of it for granted.

Thanx for sharing valuable content with us.

@Raunak Thanks for reading!

Great analysis of opportunity costs.

Loved the “hiring a driver” example.

Thanks, Sebastian! There is a danger of over-analyzing these things, but I would rather make rational travel decisions