About a month and a half ago, I had a good fortune of receiving a targeted offer on Amex Delta card in the mail. While most folks in this hobby make fun of this particular currency, I happen to value it highly. It comes down to expectations as well as recent change in my family’s circumstances. Since my SIL moved to north Detroit area last month, I expect that we will be going to Michigan at least once every two years (if not more) to visit her. And Delta happens to have the best coverage from Florida to Detroit.

I also hope to get about 1 CPM (cents per mile) from my Delta stash and use it exclusively for domestic economy flights. I don’t expect a scenario where Delta program will go below that number, at least not for foreseeable future. That’s why I was delighted to apply for 60k miles offer, since it should equal at least $600 in flight value. Currently you can get around 1.3 CPM, and closer to 1.5 CPM with 15% discount via its co-branded card. So, if you intend to pay cash for Delta flights, this is a return you simply can’t ignore.

Anyway, thanks to some unexpected expenses, I met the minimum spending and got the bonus a few days ago. This was truly perfect timing, since we need to book flights to Detroit for next April, with the idea of seeing a solar eclipse. Well, and visiting my SIL while we are at it!

Beginning of April is when most Florida snow birds go home to their northern “nests”, so tickets can be rather expensive, especially on weekends. That’s why I wasn’t surprised to see a price of over 25k miles per person for Tampa-Detroit flight. The 15% discount took it down to a bit over 21k miles. Still high, but doable. The timing of the flight was perfect, so I pulled the trigger towards 5 tickets (my MIL will be coming with us).

The return flight was much cheaper at 17k miles, and the 15% discount brought it down to 15k miles. I should mention that booking a roundtrip Delta ticket will often work out to be a cheaper option. However, in my case I wanted to stick to one-way flights. The biggest reason: a possibility of booking on Southwest once the new schedule is loaded.

Southwest had a non-stop Saturday flight from Tampa to Detroit this spring, so I’m cautiously optimistic that they will bring it back, since there is a lot of demand to/from Florida during that time of year. If the rate via points is much less than what Delta charges, I will probably rebook. Anyway, I didn’t have quite enough miles in my account for that return flight from Detroit to Tampa, and needed to transfer 21k Amex Membership Rewards.

Checking Virgin Atlantic at the last minute

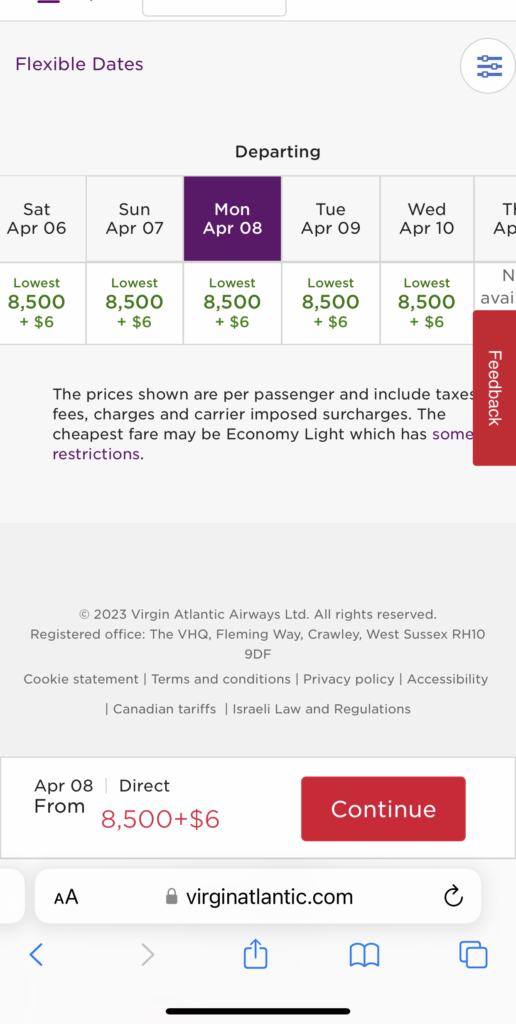

I was about to pull the trigger, but then decided to check Virgin Atlantic just in case. In my past experience, any time a domestic flight is priced over 12.5k miles on Delta.com, it’s not bookable via Virgin website. So I didn’t have much hope. But lo and behold, the same flight was running at 8.5k miles:

The price seems to be based on distance, since a bit longer Detroit-Fort Myers flight for the same date is running at 11.5k Virgin Atlantic miles. For Tampa even with a 15% discount, Delta pricing didn’t come close. But what about flexibility? Officially, Virgin Atlantic charges a $55 cancellation fee per person. However, according to multiple data points, the program works in a similar manner as British Airways Avios. In other words, you will only lose the taxes you pay, which for domestic US flights is only $6 per person.

But isn’t it better to use up miles and preserve flexible points?

Normally, that is my advice. However, in this case, we are talking 15k Delta miles vs. 8.5k flexible points per ticket. This is a trade I’m totally willing to make. After all, I accumulate flexible points for opportunities like this one. I should also add that at this time Chase is offering a 30% bonus on transfers to Virgin Atlantic. However, I don’t currently have a card that will allow me to perform this transfer. Sure, I could easily convert my Chase Freedom Unlimited to Sapphire Preferred, but it would require paying $95 annual fee.

Heads up! The 80k offer on CSP will end on May 25th. Click here for more details.

Update on May 23rd: looks like Amex has just started offering a 30% bonus on transfers to Virgin Atlantic.

So, reluctantly, I’ve decided to use my Capital One Venture X points as well as Amex MR points instead. Truth be told, I actually value my Chase UR stash more than the other two currencies, mostly due to access to Hyatt and United. Yes, you heard that right. Despite significant recent devaluation, United program still offers unique opportunities I can’t get elsewhere. Like paying 6k miles one-way for a fully refundable ticket from Warsaw to Budapest, which will hopefully help my relatives get approved for Hungarian visas.

I certainly don’t collect United miles via speculative transfers from Chase and don’t recommend you do it either. But just like Delta, the program can be extremely useful in specific circumstances. Speaking of Delta, you may wonder what’s the point of collecting these miles if I ended up using a partner program in the end. Well, I don’t have an unlimited supply of flexible points. In fact, I have very little left at the moment. Plus, many Delta flights are not bookable via Virgin Atlantic. It’s a hit-or-miss type situation. Either way, I’m confident we will put my leftover Delta miles to good use eventually, so I’m not worried.

I certainly wish I paid more attention to Virgin Atlantic program over the years, and would actively accumulate their miles via Bank of America co-branded credit card bonuses. But as they say, hindsight is 20/20. I focus on here and now.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I live in a Delta hub so virgin Atlantic is one I always check, usually before delta! They have devalued in the last few years which is a bummer but still have a lot of opportunities. I do wish they would bring back delta first class seats to Europe! But maybe delta isn’t releasing any inventory 🙁

@Tammie Yeah, Delta is just not releasing first class to partners anymore. I’ve seen this mentioned by quite a few bloggers. It’s still a good deal for international economy, as I’ve booked a flight from Tokyo Haneda to Seattle for 27.5k Virgin miles when Delta wanted 100k. It’s such an insane difference. I hope you find something worthwhile! It’s tough for hub captives, and airlines know it.

I agree with you 100% on Delta, for domestic flights anyway. I have consistently found a value of 1.2+cpp even during peak times. And now with the 15% rebate, I got 1.6cpp on a flight we just booked to the caribbean. While the points required was 20% higher than United, the routing and schedule was MUCH more preferable.

An aspect that I believe gets overlooked is the ease of acquiring those points. Yeah, that sounds backwards on the surface. But I can replenish my Delta miles a lot faster than I can United.

And, believe it or not, the Delta flight required 30% FEWER miles than AA.

@Projectx I totally believe you on Delta sometimes being much cheaper via miles compared to its competitors. We paid 15k miles per person for nonstop Seattle-Orlando flight when Alaska wanted 20k miles. Both flights leave around the same time, so no difference whatsoever.

Delta is awful for a lot of things, but it can be extremely useful for simple nonstop domestic flights where you just need to get from point A to a point B. It’s simply a tool that may or may not be useful for a specific route. But to call the whole program useless is simply not fair.