A few weeks ago, Wells Fargo bank finally started issuing two flavors of co-branded Choice credit card (find non-affiliate application links here). As soon as I saw the announcement, I knew I would try to get Select version that has a $95 annual fee, waived with this offer. There are two reasons: higher initial sign-up bonus (90k points) and 30k points each year upon renewal.

IMO this is a very attractive offer as long as you have clear plans for the bonus. The main problem with Choice is the fact that you can only book hotels 100 days ahead of your stay. Believe it or not, this is actually an improvement since it used to be 30 days. Either way, I like to book lodging 11 months in advance, as soon as I get my airline tickets. But, you can’t have everything, so I’ll adjust.

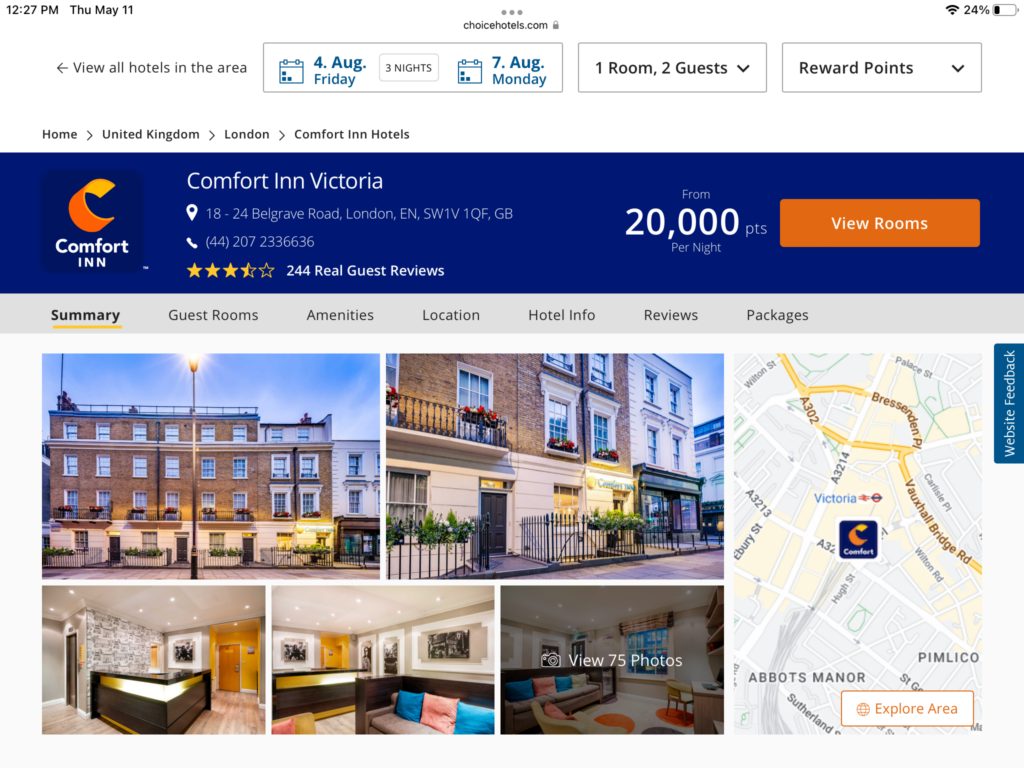

As far as my plans go, ideally, I would like to utilize points towards a 3-night stay in London next summer. There is a Comfort Inn there, located near Victoria station (a major transportation hub). The cost is a very reasonable (by London standards) 20k points per night/per room. We would need two rooms, so that would be 120k points total. The terms for the card say that 30k renewal points get deposited only a few days after your anniversary. So, if I timed it just right, I would have enough for the entire stay from just one credit card+$95 fee, 90-100 days before our trip. Not too shabby.

The cost is a very reasonable (by London standards) 20k points per night/per room. We would need two rooms, so that would be 120k points total. The terms for the card say that 30k renewal points get deposited only a few days after your anniversary. So, if I timed it just right, I would have enough for the entire stay from just one credit card+$95 fee, 90-100 days before our trip. Not too shabby.

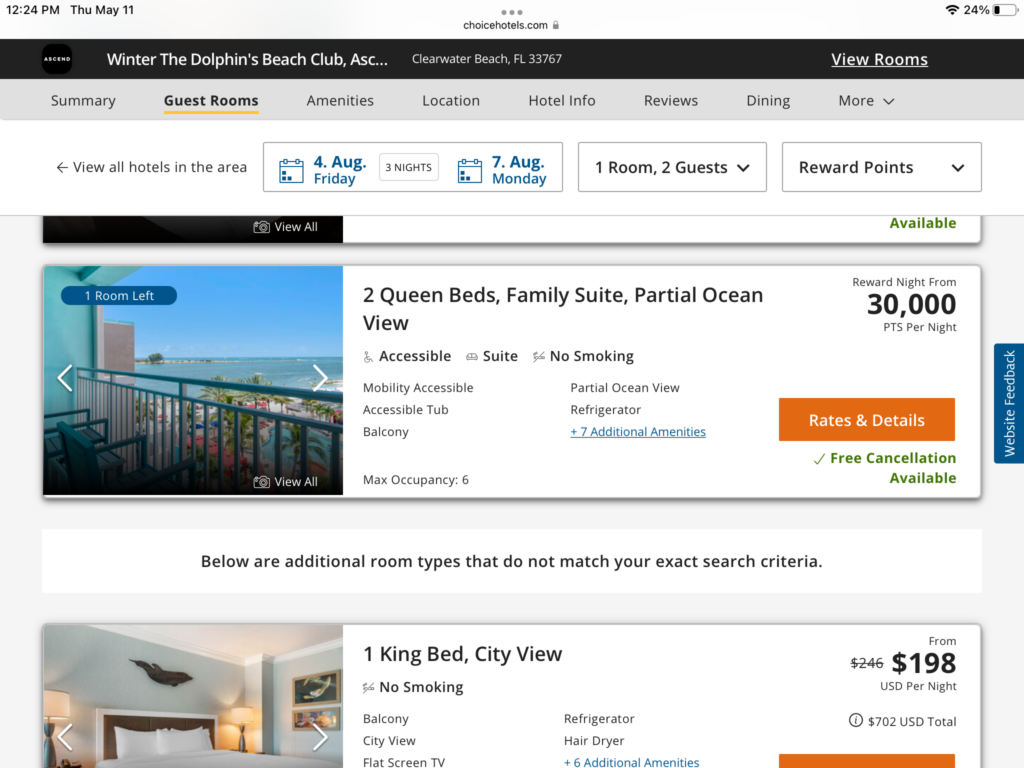

Of course, as I always say, when it comes to hotel points, it’s important to have Plan B and Plan C in mind. A lot can happen in a year, and Choice program could be completely gutted by next May. Fortunately, there is a nice beachfront hotel in Clearwater, only two hours from our house. It has a rather strange name: Winter the Dolphin’s Beach club, Ascend Collection

The rates start at 30k points per night, and you can sometimes snag a suite with a partial ocean view. It’s not a place I would go out of my way for, but if I have points to burn, why not. A weekend at the beach is always a win in my book.

Applying for the card

So, with that part out of the way, I went ahead and applied in my husband’s name. Aaand it went to pending status. I figured it would mean eventual rejection and that’s exactly what happened when I got the letter a few days ago. However, the reason for rejection was very strange. It said that my husband already had a Choice credit card. I know that old Choice Barclaycards are being converted to Wells Fargo, but we never had one. I think?

I tried to convince my husband to call and inquire, but he got super irritated, so I abandoned the idea. I went ahead and applied for this card in my name the following day…and got the same exact letter in the mail. This time I called and told the Wells Fargo rep that there was a mistake. She was friendly and said she would forward the info to the relevant department. By the end of the day I got an email telling me I was approved.

I told my husband about what happened, hoping he would volunteer to make a call on his behalf. That way we would have two Choice credit cards instead of one. No dice, he saw right through my manipulation. Interestingly enough, his credit wasn’t pulled, so no harm done. Perhaps it’s for the best, as I would rather not have $6k in minimum spending in 3 months. I could do it, but it would require me to get creative. And I’m kind of lazy. Plus, I would rather not acquire extra Choice points without a clear goal in mind.

Overall, I’m excited about this approval. Anything I can do to preserve savings when it comes to London stay is a good thing. This Comfort Inn doesn’t look fancy, and the rooms are tiny. Still, it’s been recently remodeled, has A/C and is conveniently located. What more can you ask for? I don’t really look for luxury when it comes to city hotels, since we are usually gone for most of the day. It’s a different story when it’s a resort that is a destination onto itself.

But more than anything, I still get excited by the possibility of leveraging miles and points for trips where I would otherwise pay cash. In London it would mean forking over at least $1,200 for three nights for my family of four, especially if we wanted to stay in a central location. Instead, I intend to use hotel points from just one sign-up bonus. Sure, there are no guarantees that everything will go as planned. But having a plan far in advance is often crucial when it comes to using points to your advantage.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

like at blog

Ahmm blog

blog is nice

blog is cntt

handsome blog

hott blog

outside blog

nice blog

Leana,

Did the sign up bonus points post quickly for you after meeting minimum spend? I completed minimum spend recently before 2nd statement closing. The bonus hasn’t posted yet, even though it’s been 5 days since statement closing.

@Mary B If I remember correctly, it did post within a few days. Maybe send a secure message?

I have been trying to get the select card and I have been put in pending status twice. The first time I applied, it was because I had the original choice card through Barclays. Got the “you can only have 1 choice account” letter and my credit was not pulled. So I cancelled my choice card and then a week later applied for the select card again…didnt get “you can only have 1 choice account” response but the application was put into pending and my credit still was not pulled. What is happening here? I’m super confused and don’t know why this specific card is so confused. Any tips?

@John I recommend you call them and see what’s going on. It’s likely that since you had a Barclays Choice card, you won’t be eligible for the bonus. I’ve seen some reports indicating it, but it’s possible you may get it anyway. Actually, I tried applying in my husbands name just a week ago, and this time he was instantly approved. Go figure! But he never had Barclays product.

Love it! You always make me smile when blogging about your husband’s annoyance with calling any c/c co about anything. I’m in the same boat. Sometimes, if I make the call, chat with the rep about how I handle all of our finances, then they get approval from him to talk to me about his application. I definitely weigh the benefit vs his annoyance with me. 😅 Of course, at any get together, he is bragging about how he flys up front because I’m so creative with c/c bonuses. 🙄

@Tricia It’s a delicate balance, that’s for sure! My husband absolutely hates making phone calls, so it’s something I do try to avoid if at all possible. Travel is kind of my thing, so telling him we will have a boatload of Choice points isn’t much of an incentive. Although, the other day he was talking to the CEO of his company who apparently loves to travel. Turns out we have visited a lot of the same places. So at the end of the conversation the CEO tells my husband: “You are an interesting guy!” To which my husband responds: “That’s all thanks to my wife.”

We’ll be in London in a couple weeks, our third try going as a family of five on 4 night, 2 rooms, central AirBnB, reluctantly pay about $1,200. Back in 2020 was going to be all Choice hotels, 2 rooms per night, about 8k each. Last year was supposed to be a combo of IHG and Choice hotels. My stash doesn’t even come close when I looked for this year. IHG is getting ridiculous on point and so does Choice. We lost an Ascent hotel in Colorado that used to be able to fit 8 people. It is harder across the board to use hotel Certificates. Sorry for endless ranting. Hope you can get accommodation that is reasonable.

@Agnes You can rant here anytime! 😉 I definitely hear you. Most hotel programs have greatly devalued points over the last few years. In part, it’s due to huge pent-up demand in travel. But mostly, it’s because they can. That’s why I try not to collect hotel points speculatively. Hyatt is one exception, but even there I only have 120k points at the moment. So far Hyatt has thankfully been announcing award chart changes well in advance. Due to their small footprint they can’t afford to be too aggressive in eliminating value. I still find value in hotel certificates, but agree that those are also becoming harder to use. I do recommend you look into Wyndham program for Vacasa stays where there is a tremendous value to be had for families. Right now their credit card offers are down, though.

Also a quick way to get Choices points is transfer Thank You Points. One Thank You = two Choice

Jim, very good point! Unfortunately, I have zero Thank You points at the moment and can’t seem to get approved for Premier card.